PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910514

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910514

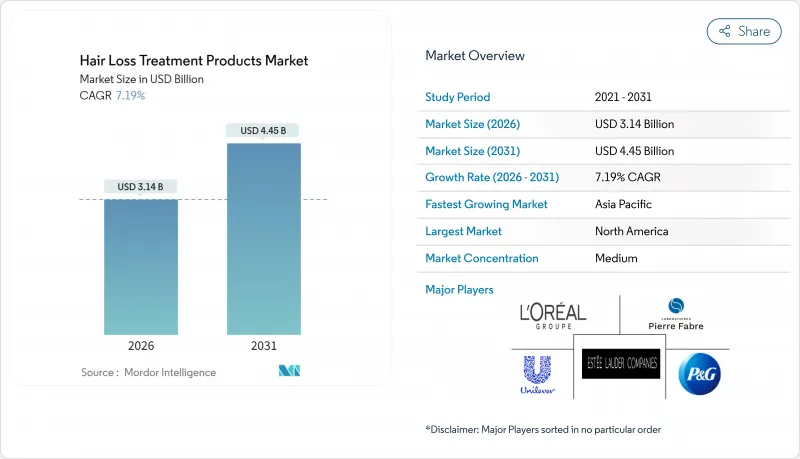

Hair Loss Treatment Products - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

Hair Loss Treatment Products Market size in 2026 is estimated at USD 3.14 billion, growing from 2025 value of USD 2.93 billion with 2031 projections showing USD 4.45 billion, growing at 7.19% CAGR over 2026-2031.

This expansion reflects a confluence of demographic pressures and technological breakthroughs that are reshaping treatment paradigms across consumer segments. The FDA's approval of deuruxolitinib (Leqselvi) in July 2024 for severe alopecia areata marked a pivotal regulatory milestone, signaling heightened institutional confidence in advanced therapeutic approaches. North America commands early-mover advantage, yet Asia-Pacific's youthful population, digital engagement, and innovation capacity underpin its status as the fastest-growing regional cluster. Competitive intensity is moderate; established consumer-health majors coexist alongside venture-backed biotech start-ups that deploy highly targeted delivery systems and personalized regimens. Growth opportunities increasingly concentrate around omnichannel distribution, combination therapy kits, and premium serums that promise visible results within 90 days.

Global Hair Loss Treatment Products Market Trends and Insights

Aging Population

Demographic transitions across developed markets are fundamentally altering treatment demand patterns, with individuals aged 50+ representing the fastest-growing consumer segment. According to MedlinePlus.gov, Androgenetic alopecia, commonly recognized as male pattern baldness in men and female pattern hair loss in women, is a prevalent cause of hair loss for both genders. The aging population's higher disposable income and healthcare spending propensity drives premium product adoption, particularly in North America where consumers aged 55+ account for 40% of hair loss treatment expenditure. Recent studies indicate that age-related hormonal changes accelerate hair follicle miniaturization, creating demand for targeted therapeutic interventions beyond traditional cosmetic approaches. This demographic shift coincides with increased longevity expectations, extending the treatment duration and lifetime customer value for manufacturers.

Scientific and Technological Advancements

Biotechnology breakthroughs are revolutionizing treatment efficacy through precision delivery mechanisms and regenerative approaches. Nanotechnology platforms enable targeted follicular penetration, with recent clinical trials demonstrating 3x improved bioavailability compared to conventional topical formulations. The development of siRNA therapeutics targeting specific hair loss pathways represents a paradigm shift from symptom management to root cause intervention. Pelage Pharmaceuticals' PP405, currently in Phase 2a trials, exemplifies this approach by activating dormant hair follicle stem cells through novel signaling pathways. Advanced delivery systems, including microneedle patches loaded with growth factors and exosome-based treatments, are demonstrating measurable improvements in hair density and thickness metrics. These technological advances are supported by increased patent filings, with South Korea leading at significant share of global hair loss treatment patents in 2024, reflecting intensive R&D investment across the value chain.

Prevalence of Counterfeit and Unsafe Products

Market proliferation of unregulated formulations undermines consumer confidence and creates safety concerns that constrain legitimate market growth. Counterfeit products, particularly prevalent in online marketplaces, often contain undisclosed active ingredients or harmful substances that can cause adverse reactions. Regulatory agencies report increasing seizures of fake hair loss treatments, with the FDA issuing multiple warnings about unapproved products containing prescription-strength ingredients without proper labeling. The challenge is particularly acute in emerging markets where regulatory oversight may be limited and price sensitivity drives consumers toward unverified alternatives. Consumer education initiatives and enhanced supply chain verification are becoming critical for maintaining market integrity and protecting brand reputation across legitimate manufacturers.

Other drivers and restraints analyzed in the detailed report include:

- Influence of Social Media and Beauty Influencers

- Non-invasive Alternatives Gaining Traction

- Regulatory Hurdles and Approval Delays

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Shampoo and conditioner products command 87.65% market share in 2025, reflecting their role as entry-level treatments and daily-use convenience for consumers seeking hair health maintenance. This dominance stems from established distribution networks, consumer familiarity, and integration into existing hair care routines without requiring behavioral changes. However, serums represent the fastest-growing segment at 8.02% CAGR through 2031, driven by targeted therapeutic formulations and premium positioning that appeals to treatment-focused consumers. The serum category benefits from advanced delivery technologies, including nanotechnology platforms and bioactive compounds that demonstrate measurable efficacy improvements over traditional formulations.

Other product categories, encompassing oils, gummies, and tablets, maintain steady growth trajectories supported by consumer preference for diverse treatment modalities and combination therapy approaches. The FDA's oversight of dietary supplements through the Dietary Supplement Health and Education Act provides regulatory framework for oral formulations, while topical oils benefit from natural ingredient trends and minimal processing appeals. Recent product launches, including Orthomol Hair Solution's introduction in German pharmacies with Baicapil complex, demonstrate continued innovation across traditional product categories. Manufacturing advances in encapsulation technology and sustained-release formulations are enhancing product efficacy across all categories, with impact on oral supplements and specialized topical treatments.

Female consumers represent 70.45% market share in 2025 and demonstrate the highest growth potential at 9.12% CAGR through 2031, reflecting evolving beauty standards and reduced stigma around hair loss treatment seeking. Social media influence plays a particularly strong role in female segment expansion, with beauty influencers normalizing hair loss discussions and promoting preventive care approaches. The female segment benefits from broader product variety, including cosmetically elegant formulations and multi-benefit products that address hair health alongside other beauty concerns. Clinical research indicates that female pattern hair loss affects in most of the women by age 50, creating substantial addressable market expansion as awareness increases.

Male consumers maintain significant market presence despite lower growth rates, with established treatment patterns and higher acceptance of pharmaceutical interventions. The male segment demonstrates stronger preference for clinically proven treatments, including FDA-approved medications and device-based therapies. Recent trends indicate increasing male adoption of comprehensive hair care routines, influenced by social media content and changing grooming standards. User-generated content on platforms like TikTok and Instagram is driving male engagement with hair loss topics, creating opportunities for brands to expand their male-focused product lines and marketing approaches.

The Hair Loss Treatment Products Market is Segmented by Product Type (Shampoo and Conditioner, Serum, Other Product Type), Gender (Female and Male), Category (Topical and Oral), Distribution Channel (Supermarkets/Hypermarkets, Health and Beauty Stores, Online Retail, Other Distribution Channel), and Geography (North America, Europe, Asia-Pacific, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America commands 35.62% market share in 2025, supported by advanced healthcare infrastructure, high disposable income, and established treatment acceptance patterns. The region benefits from robust regulatory frameworks that ensure product safety while facilitating innovation, with the FDA's approval pathways supporting both pharmaceutical and device-based treatments. Recent regulatory developments, including the FDA's approval of deuruxolitinib for alopecia areata, demonstrate continued innovation in prescription treatments. Consumer awareness levels remain high, supported by healthcare professional education and direct-to-consumer marketing that normalizes treatment seeking behavior.

Asia-Pacific emerges as the fastest-growing region at 8.78% CAGR through 2031, driven by rising disposable income, increasing aesthetic awareness, and expanding healthcare access. The region demonstrates strength in technology adoption, with South Korea leading global patent filings at a significanr share of hair loss treatment innovations in 2024. Consumer preferences in Asia-Pacific markets favor natural ingredients and traditional medicine integration, creating opportunities for products that combine modern technology with botanical actives. China and India represent the largest growth opportunities within the region, supported by urbanization trends and evolving beauty standards that prioritize hair health and appearance.

Europe maintains steady growth supported by established healthcare systems and regulatory harmonization through the European Medicines Agency. The region demonstrates strong preference for clinically validated treatments and sustainable product formulations, with increasing demand for environmentally conscious packaging and ingredient sourcing. South America and Middle East and Africa represent emerging opportunities with growing middle-class populations and increasing healthcare spending, though market development remains constrained by economic factors and limited distribution infrastructure in some areas.

- The Procter & Gamble Company

- L'Oreal S.A.

- Unilever

- Pierre Fabre Laboratories

- Estee Lauder Inc

- Freedom Laser Therapy

- Cipla Ltd.

- Dr. Reddy's Laboratories

- Sun Pharmaceutical Industries

- Merck & Co., Inc.

- Shiseido Company Limited

- Himalaya Wellness Company

- Natura & Co

- Taisho Pharmaceutical Holdings

- Capillus LLC

- Theradome Inc.

- iRestore

- Aclaris Therapeutics

- Fagron NV

- iGrow/Apira Science

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Aging Population

- 4.2.2 Scientific and Technological Advancements

- 4.2.3 Influence of Social Media and Beauty Influencers

- 4.2.4 Non-invasive Alternatives Gaining Traction

- 4.2.5 Heightened Aesthetic Awareness

- 4.2.6 Expansion of Modern Retail and E-commerce

- 4.3 Market Restraints

- 4.3.1 Prevalence of Counterfeit and Unsafe Products

- 4.3.2 Regulatory Hurdles and Approval Delays

- 4.3.3 Potential Side Effects

- 4.3.4 Variable Product Effectiveness

- 4.4 Consumer Behaviour Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Advancement

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Product Type

- 5.1.1 Shampoo and Conditioner

- 5.1.2 Serums

- 5.1.3 Others

- 5.2 By Gender

- 5.2.1 Male

- 5.2.2 Female

- 5.3 By Category

- 5.3.1 Topical

- 5.3.2 Oral

- 5.4 By Distribution Channel

- 5.4.1 Supermarkets/Hypermarkets

- 5.4.2 Health and Beauty Stores

- 5.4.3 Online Retail Stores

- 5.4.4 Other Distribution Channels

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.1.4 Rest of North America

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 Italy

- 5.5.2.4 France

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 India

- 5.5.3.3 Japan

- 5.5.3.4 Australia

- 5.5.3.5 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 South Africa

- 5.5.5.2 Saudi Arabia

- 5.5.5.3 United Arab Emirates

- 5.5.5.4 Rest of Middle East and Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 The Procter & Gamble Company

- 6.4.2 L'Oreal S.A.

- 6.4.3 Unilever

- 6.4.4 Pierre Fabre Laboratories

- 6.4.5 Estee Lauder Inc

- 6.4.6 Freedom Laser Therapy

- 6.4.7 Cipla Ltd.

- 6.4.8 Dr. Reddy's Laboratories

- 6.4.9 Sun Pharmaceutical Industries

- 6.4.10 Merck & Co., Inc.

- 6.4.11 Shiseido Company Limited

- 6.4.12 Himalaya Wellness Company

- 6.4.13 Natura & Co

- 6.4.14 Taisho Pharmaceutical Holdings

- 6.4.15 Capillus LLC

- 6.4.16 Theradome Inc.

- 6.4.17 iRestore

- 6.4.18 Aclaris Therapeutics

- 6.4.19 Fagron NV

- 6.4.20 iGrow/Apira Science

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK