PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910516

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910516

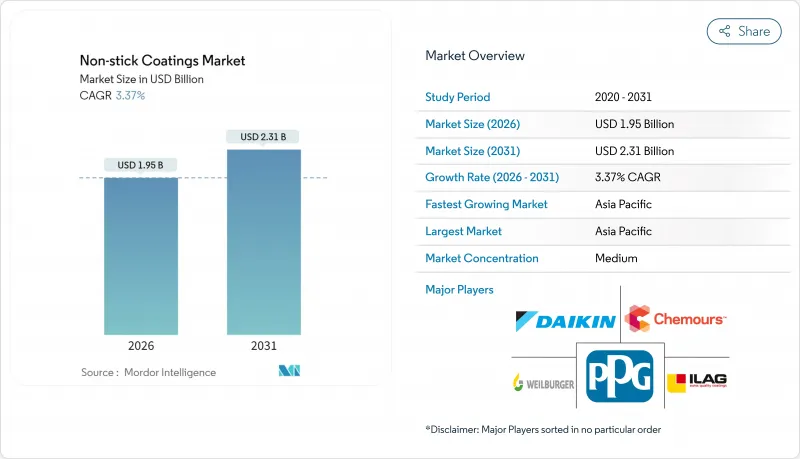

Non-stick Coatings - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Non-stick Coatings Market is expected to grow from USD 1.89 billion in 2025 to USD 1.95 billion in 2026 and is forecast to reach USD 2.31 billion by 2031 at 3.37% CAGR over 2026-2031.

This expansion reflects steady demand from cookware, food-processing, and advanced electronics alongside the ongoing shift toward PFAS-free chemistries. Supply chains remain vulnerable to fluctuations in fluorspar costs, yet producers with diversified raw-material portfolios hold a competitive edge. Product innovation centers on ceramic and hybrid systems that meet regulatory mandates without compromising release performance, while regional momentum in the Asia-Pacific sustains volume growth despite moderating sales in North America and Europe. Rising automation in manufacturing and sustained household preference for low-oil cooking sustain long-term consumption across industrial and consumer verticals.

Global Non-stick Coatings Market Trends and Insights

Rising Household Demand for Non-Stick Cookware

Urban living patterns and increasingly busy lifestyles have sustained consumer preference for cookware that minimizes oil use and simplifies cleaning. Kitchenware brands are increasingly advertising certifications that guarantee PFOA-free surfaces, and retailers are highlighting such labels to build trust. Mid-tier and premium products now dominate online sales channels in China and Southeast Asia, where e-commerce discounts shorten replacement cycles. Large-scale producers capitalize on this shift by launching multi-layer ceramic finishes that rival PTFE in abrasion resistance. Certification to FDA 21 CFR 175.300 and equivalent EU frameworks has become a core marketing feature for imported offerings. With disposable incomes rising and modular kitchens proliferating, the non-stick coatings market enjoys a stable consumer base that absorbs upgraded product lines.

Industrial Machinery and Food-Processing Uptake

Manufacturers of bakeware, packaging rollers, and industrial mixers specify advanced coatings to meet hygiene mandates and reduce downtime. PPG's September 2024 investment in Malaysia added five production lines dedicated to waterborne and solvent-borne systems tailored for bakery trays and energy components. Equipment integrators favor smooth, easy-clean surfaces that endure caustic wash cycles and thermal shocks, which lowers sanitation costs across large plants. In oil and gas valves, low-friction fluoropolymer films cut torque and prevent corrosion under sour-gas conditions. Governments that legislate stricter food-safety audits indirectly stimulate demand for compliant surfaces, benefiting suppliers with global technical support. The long replacement interval for industrial parts locks in recurrent coating purchases and underpins price stability across this segment.

PFAS Regulatory Clamp-Down

Mandatory disclosure and outright bans on legacy PFAS generate immediate production gaps. 3M recorded a 20% decline in PFAS volumes during 2023 and will exit all fluorochemical manufacturing by the end of 2025, booking a USD 800 million pre-tax charge tied to asset write-downs. Chemours faces multi-jurisdictional litigation that diverts capital away from new PTFE capacity, slowing the supply of high-purity grades. Downstream blenders absorb higher compliance costs as they redesign formulations and requalify them under NSF and EFSA food-contact standards. Small contract coaters struggle to fund new ovens and fume-capture systems required under evolving Clean Air Act rules. Collectively, these disruptions reduce short-term volumes in the non-stick coatings market until alternative chemistries are scaled.

Other drivers and restraints analyzed in the detailed report include:

- Regulation-Driven Shift to PFOA-Free Ceramics

- Electronics and Medical Device Adoption

- Fluorspar-Supply Price Shocks

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Fluoropolymers held 41.32% non-stick coatings market share in 2025, underscoring their supremacy in thermal stability and release longevity. The non-stick coatings market size for fluoropolymers outstripped USD-denominated growth in rival chemistries even as regulatory headwinds intensified. PTFE variants free of PFOA now dominate reorder volumes, thanks to their proven compatibility with existing application equipment. Daikin and Chemours capitalize on this reliance by offering low-VOC dispersions and powder grades engineered for electrostatic spray. In contrast, ceramic finishes post the fastest 3.62% CAGR to 2031 because they bypass PFAS scrutiny and appeal to health-conscious consumers. Commercial roll-outs employ sol-gel routes reinforced with nano-zirconia or titania to curb brittleness. Silicone coatings occupy a narrower niche serving bakeware and medical devices, where flexibility and biocompatibility trump extreme release. Although hybrid organic-inorganic systems currently account for a small slice of the market, they promise a convergence of stain resistance and impact toughness that could realign market shares after 2028.

Second-generation fluoropolymers purpose-built for semiconductor carriers maintain premium pricing, cushioning suppliers from cookware cyclicality. Conversely, capacity rationalization by 3M removes a sizeable volume and prompts downstream formulators to dual-source critical grades. Tier-two Asian compounds secure share gains by signing multi-year supply deals with appliance OEMs seeking stable coating lines. ISO 14001 certification emerges as a credential when end buyers audit sustainability claims, nudging suppliers to invest in waste-heat recovery and solvent capture. Overall, the interplay of regulatory pressure and application-centric performance sustains a dual-speed trajectory in this segment, with ceramics accelerating yet fluoropolymers defending entrenched industrial roles.

The Non-Stick Coatings Market Report is Segmented by Type (Fluoropolymer, Ceramic, Silicone, and Other Types), by Application (Cookware, Food Processing, Fabrics and Carpets, Medical, Electrical and Electronics, Industry Machinery, Automotive, and Other Applications), and by Geography (Asia-Pacific, North America, Europe, South America, and Middle-East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific accounted for 49.62% of 2025 revenue and is projected to advance at a 3.53% CAGR, reinforcing its primacy in the non-stick coatings market. Capacity additions in China's Zhejiang and Guangdong clusters shorten lead times for cookware OEMs, while tax incentives draw new spray-line investments to Vietnam and Indonesia. India's urban middle class is embracing premium pans sold via flash-sale portals, although regulatory oversight on imported PTFE will tighten under pending BIS standards. Japan leverages advanced robotics and semiconductor equipment demand to sustain high-purity coating imports, offsetting slower household replacement cycles.

North America ranks second by value but confronts the most disruptive PFAS legislation. State-level bans accelerate ceramic R&D, and US coaters invest in capture-destroy exhaust systems to secure EPA approvals. Mexico benefits from near-shoring by US appliance brands, lifting regional powder demand for stovetop grates and bakeware sheets. Europe continues to migrate away from long-chain PFAS under REACH, with Germany championing water-based dispersions and France encouraging sol-gel start-ups through green economy grants. Eastern European plants attract cookware assembly operations that source coatings locally to sidestep shipping costs.

Smaller yet dynamic opportunities emerge in the Middle East and Africa, where hospitality expansion spurs commercial-kitchen upgrades. South American processors of poultry and confectionery adopt FDA-compliant films to meet export audits, driving localized toll-coating ventures in Brazil. Geographic diversification thus cushions suppliers from any single regulatory or macro-economic shock, although logistics disruptions in the Red Sea trade lane remain a watchpoint.

- 3M

- AGC Chemicals

- Cavero Coatings

- DAIKIN INDUSTRIES, Ltd.

- Endura Coatings

- ILAG - Industrielack AG

- Metal Coatings

- Metallic Bonds Ltd

- PPG Industries, Inc.

- Rhenotherm Kunststoffbeschichtungs GmbH

- Showa Denko K.K.

- Solvay

- The Chemours Company

- Weilburger

- Zhejiang Pfluon Technology Co., Ltd

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising household demand for non-stick cookware

- 4.2.2 Industrial machinery and food-processing uptake

- 4.2.3 Regulation-driven shift to PFOA-free ceramics

- 4.2.4 Electronics and medical device adoption

- 4.2.5 Water-based low-VOC fluoropolymer dispersions

- 4.3 Market Restraints

- 4.3.1 PFAS regulatory clamp-down

- 4.3.2 Micro-plastic health perception

- 4.3.3 Fluorspar-supply price shocks

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size & Growth Forecasts (Value)

- 5.1 By Type

- 5.1.1 Fluoropolymer

- 5.1.2 Ceramic

- 5.1.3 Silicone

- 5.1.4 Other Types

- 5.2 By Application

- 5.2.1 Cookware

- 5.2.2 Food Processing

- 5.2.3 Fabrics and Carpets

- 5.2.4 Medical

- 5.2.5 Electrical and Electronics

- 5.2.6 Industry Machinery

- 5.2.7 Automotive

- 5.2.8 Other Applications

- 5.3 By Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 ASEAN Countries

- 5.3.1.6 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Spain

- 5.3.3.6 Nordic

- 5.3.3.7 Russia

- 5.3.3.8 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Colombia

- 5.3.4.4 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 Turkey

- 5.3.5.3 UAE

- 5.3.5.4 South Africa

- 5.3.5.5 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 3M

- 6.4.2 AGC Chemicals

- 6.4.3 Cavero Coatings

- 6.4.4 DAIKIN INDUSTRIES, Ltd.

- 6.4.5 Endura Coatings

- 6.4.6 ILAG - Industrielack AG

- 6.4.7 Metal Coatings

- 6.4.8 Metallic Bonds Ltd

- 6.4.9 PPG Industries, Inc.

- 6.4.10 Rhenotherm Kunststoffbeschichtungs GmbH

- 6.4.11 Showa Denko K.K.

- 6.4.12 Solvay

- 6.4.13 The Chemours Company

- 6.4.14 Weilburger

- 6.4.15 Zhejiang Pfluon Technology Co., Ltd

7 Market Opportunities & Future Outlook

- 7.1 White-space and Unmet-need Assessment