PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910524

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910524

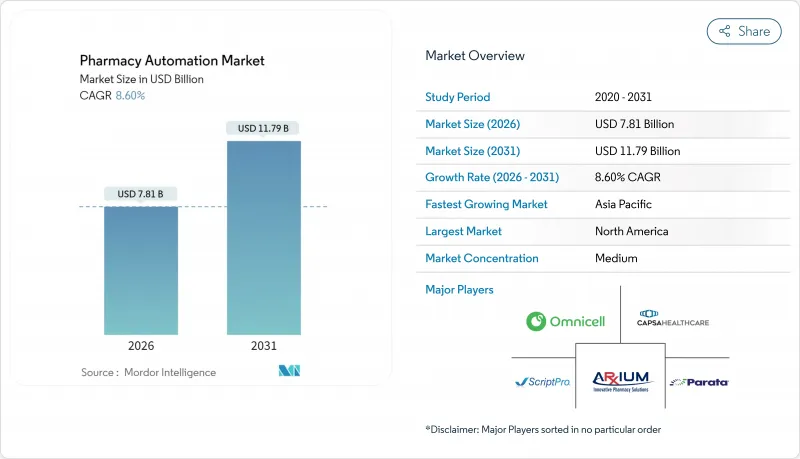

Pharmacy Automation - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The pharmacy automation market is expected to grow from USD 7.19 billion in 2025 to USD 7.81 billion in 2026 and is forecast to reach USD 11.79 billion by 2031 at 8.6% CAGR over 2026-2031.

Rising prescription volumes, chronic-disease prevalence, an aging population, and persistent labor shortages all converge to elevate demand for automated dispensing, compounding, and inventory management. New sterile-compounding rules under USP 797, effective November 2023, are pushing health systems toward robotic solutions that safeguard both staff and patients. Competitive intensity is rising because traditional medical-device firms and niche automation specialists now court the same hospital, retail, and mail-order buyers. Consolidation illustrated by BD's September 2024 acquisition of Parata Systems signals a race for scale and end-to-end capability. Artificial intelligence (AI) embedded in robotics transforms raw dispensing hardware into data-driven assets that reduce error rates, automate pharmacy labor, and manage the growing share of specialty drugs, which accounted for over 80% of 2023 U.S. approvals.

Global Pharmacy Automation Market Trends and Insights

Growing Prescription Volume and Medication Throughput

Global prescription counts continue to grow, and many hospital pharmacies now process thousands of orders daily. High-density robotic storage such as Swisslog's PillPick holds more than 50,000 unit doses and eliminates multiple human touches in the dispensing chain, keeping pace with volume spikes. Central-fill programs layer additional scale; CoverMyMeds' Central Fill-as-a-Service platform can trim cost-per-script by 30% while shrinking on-site labor. These technologies also deliver the digital logs required under USP 797 for traceability, ensuring compliance while throughput climbs.

Expanding Geriatric Population and Chronic Disease Burden

Adults aged 65 and older represent a fast-growing cohort that often manages five or more prescriptions. Long-term-care (LTC) pharmacies adopt automation to pouch-package timed doses, reducing errors and boosting adherence. FrameworkLTC reports that workflow robotics now redirect staff hours toward immunizations and point-of-care testing, broadening revenue streams while supporting chronic-care plans. The U.S. Drug Supply Chain Security Act also accelerates barcode-based tracking, making automated verification indispensable in LTC settings.

High Initial Capital Investment and Maintenance Costs

Up-front outlays for robotics, installation, and software stretch pharmacy budgets. Pay-per-script financing models such as CoverMyMeds' CFaaS remove the capital hurdle by converting costs into operating expenses. Independent outlets adopt compact robots like Qx-Dextron, which posts payback in under one year and draws less than 1 kWh per day, keeping utility costs minimal. Still, many robots installed around 2010 are hitting end-of-life, forcing operators to budget for replacement cycles.

Other drivers and restraints analyzed in the detailed report include:

- Heightened Patient Safety and Error-Reduction Mandates

- Shift Toward Centralized Fill and Hub Pharmacies

- Workflow Disruption and Staff-Training Barriers

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Automated medication dispensing systems retained a 47.07% pharmacy automation market share in 2025 thanks to unit-dose storage, bar-code checks, and secure drawers that integrate with electronic health records. Robotic sterile-compounding platforms recorded the highest 10.28% CAGR forecast to 2031 as institutions automate hazardous-drug preparation to comply with tightening USP 797 thresholds. The pharmacy automation market size for robotic compounding is expected to climb steadily as AI vision and gravimetric checks mitigate contamination risk.

Automated packaging and labeling solutions slash technician time by half, while automated tablet counters bring sub-minute cycle times to community outlets. Storage-and-retrieval modules use vertical carousels to compress square footage, and analytic dashboards surface demand patterns that inform formulary rationalization. Pharmacist workflow software now embeds AI that proposes par levels and flags slow-moving items, linking operational data to clinical decision support.

Hospital environments processed most of the 2025 medication volume and accounted for 61.94% of pharmacy automation market share, propelled by emergencies, chronic-care onboarding, and acute-care needs. Systems such as BD's Pyxis MedStation ES supply closed-loop dispensing and real-time inventory telemetry that reduce on-ward retrieval trips. Central pharmacy dispensing hubs attached to large academic centers further expand capacity and consistency.

Mail-order and ePharmacy operators deliver the strongest 11.29% CAGR outlook. Amazon Pharmacy bundles same-day delivery with price-transparency applications, while CVS Health's digital prescription-management tools lock in chronic-therapy refills. High-bay automated warehouses, like the Tote-to-Person system at Dr. Max in Prague, pre-sort thousands of orders per hour and feed robotic packing stations. Retail chains continue to retrofit point-of-sale locations with compact counters and pick-to-light shelving that keep wait times under two minutes.

The Pharmacy Automation Market Report is Segmented by Product (Automated Medication Dispensing Systems, and More), End User (Hospital Pharmacies, and More), Deployment Model (Centralised Automation Hubs, and More), and Pharmacy Size (>500 Beds / >250 Stores, and More), and Geography (North America, Europe, Asia-Pacific, Middle East & Africa, South America). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America's 41.12% revenue share rests on mature EHR connectivity, payer pressures to cut errors, and FDA programs such as the Advanced Manufacturing Technologies designation that accelerate approval of automated processes. Large health systems funnel capital into sterile-compounding robotics following USP 797 revisions, and Canadian provinces now subsidize automation investments to address pharmacist shortages.

Asia-Pacific charts the highest 9.39% CAGR as India, China, and South Korea sprint toward hospital and supply-chain digitization. ISPE notes that cross-border manufacturing partnerships anchor capital inflows for automated filling and inspection lines. Chinese pilots using AI demand-forecasting and vendor-managed inventory registered double-digit lifts in stock-turn ratios. Indonesia and Vietnam rely on regional regulatory alignment via the Pharmaceutical Inspection Co-operation Scheme, easing foreign vendor entry and standardizing QA.

The EU lags North America in raw dollars yet benefits from regulatory certainty. The EU AI Act, live since August 2024, stipulates risk tiers for medical AI, giving hospitals the legal clarity to deploy compounding robots, cloud analytics, and AI safety checks in pharmacy workflows. Remote communities across the Nordics and Iberia adopt decentralized cabinets operated via telepharmacy, extending medication access while staying compliant with stringent data-privacy statutes.

- Accu-Chart Plus Healthcare Systems

- ARxIUM

- Baxter

- Capsa Healthcare

- BD (Becton, Dickinson & Co.)

- Grifols (LogiFill)

- ICU Medical (IntelliMix)

- Innotech Espana (Rowa)

- Mckesson

- NewIcon Oy

- Omnicell

- Oracle Health (Cerner Rx)

- Parata Systems

- Pearson Medical Technologies

- RxSafe

- ScriptPro

- Swisslog Healthcare

- Talyst Systems (Swisslog)

- TouchPoint Medical

- Yuyama Co. Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing Prescription Volume and Medication Throughput

- 4.2.2 Expanding Geriatric Population and Chronic Disease Burden

- 4.2.3 Heightened Patient Safety and Error-Reduction Mandates

- 4.2.4 Shift Toward Centralized Fill and Hub Pharmacies

- 4.2.5 Integration of Artificial Intelligence for Inventory Optimization

- 4.2.6 Surge in Specialty Drug Dispensing Complexity

- 4.3 Market Restraints

- 4.3.1 High Initial Capital Investment And Maintenance Costs

- 4.3.2 Workflow Disruption And Staff Training Barriers

- 4.3.3 Data Security And Privacy Concerns In Connected Systems

- 4.3.4 Regulatory Ambiguity For Robotic Sterile Compounding

- 4.4 Regulatory Landscape

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitutes

- 4.5.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Product

- 5.1.1 Automated Medication Dispensing Systems

- 5.1.2 Automated Packaging & Labeling Systems

- 5.1.3 Automated Table-top Tablet Counters

- 5.1.4 Automated Storage & Retrieval Systems

- 5.1.5 Robotic Sterile Compounding Systems

- 5.1.6 Pharmacist Workflow & Analytics Software

- 5.2 By End User

- 5.2.1 Hospital Pharmacies (In-patient, Out-patient)

- 5.2.2 Retail & Chain Pharmacies

- 5.2.3 Mail-order / ePharmacies

- 5.2.4 Long-term-care & Specialty Pharmacies

- 5.3 By Deployment Model

- 5.3.1 Centralised Automation Hubs

- 5.3.2 Decentralised Point-of-Care Units

- 5.4 By Pharmacy Size

- 5.4.1 >500 beds / >250 stores

- 5.4.2 100-499 beds / 50-249 stores

- 5.4.3 <100 beds / Independent stores

- 5.5 Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 Australia

- 5.5.3.5 South Korea

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle East & Africa

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of Middle East & Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and analysis of Recent Developments)

- 6.3.1 Accu-Chart Plus Healthcare Systems

- 6.3.2 ARxIUM

- 6.3.3 Baxter International Inc.

- 6.3.4 Capsa Healthcare

- 6.3.5 BD (Becton, Dickinson & Co.)

- 6.3.6 Grifols (LogiFill)

- 6.3.7 ICU Medical (IntelliMix)

- 6.3.8 Innotech Espana (Rowa)

- 6.3.9 McKesson Corporation

- 6.3.10 NewIcon Oy

- 6.3.11 Omnicell Inc.

- 6.3.12 Oracle Health (Cerner Rx)

- 6.3.13 Parata Systems LLC

- 6.3.14 Pearson Medical Technologies

- 6.3.15 RxSafe LLC

- 6.3.16 ScriptPro LLC

- 6.3.17 Swisslog Healthcare

- 6.3.18 Talyst Systems (Swisslog)

- 6.3.19 TouchPoint Medical

- 6.3.20 Yuyama Co. Ltd.

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment