PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910532

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910532

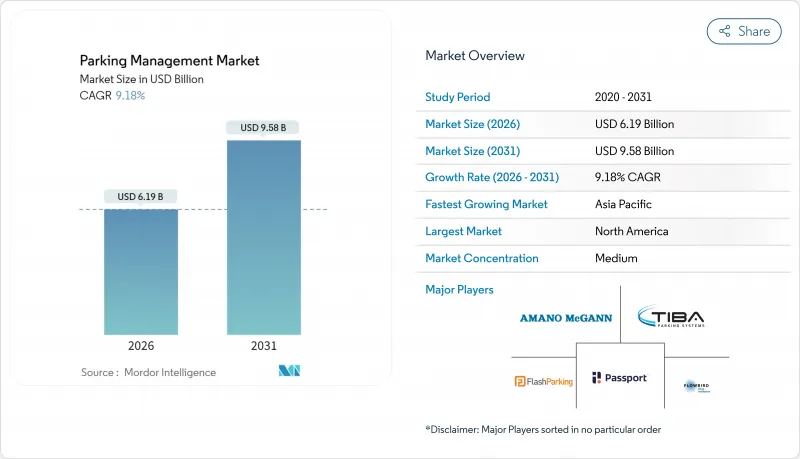

Parking Management - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The parking management market was valued at USD 5.67 billion in 2025 and estimated to grow from USD 6.19 billion in 2026 to reach USD 9.58 billion by 2031, at a CAGR of 9.18% during the forecast period (2026-2031).

Urban densification, dedicated smart-city funding, and the migration toward data-rich, cloud-based platforms are reshaping how cities, airports, and private operators monetize and regulate curb space. Municipal digitization mandates in North America, national smart-city programs in Asia Pacific, and evolving EU sustainability targets collectively fuel demand for integrated solutions that pair license-plate recognition, dynamic pricing, and mobility-as-a-service (MaaS) capabilities. Hardware remains the largest revenue contributor, yet the fastest value creation now comes from analytics and managed services that turn occupancy data into operational intelligence. Competitive dynamics are shifting as infrastructure incumbents defend installed bases while AI-native entrants aggregate multi-site portfolios, often through high-profile acquisitions.

Global Parking Management Market Trends and Insights

Urban Traffic Congestion Mitigation

Dynamic curb management programs demonstrate how parking can reduce vehicle circling and greenhouse-gas emissions. San Francisco's SF Park recalibrates rates every six weeks to maintain 85% occupancy, producing documented 30% reductions in search traffic within pilot zones. Similar sensor-based deployments in Portland and Hoboken showcase transferable playbooks for mid-sized cities that lack the resources for bespoke research. Municipal agencies now position parking APIs alongside transit feeds, allowing navigation apps to direct drivers to the lowest-cost bay in real time. The approach reframes parking fees from static taxes to behavior-modifying levers that re-balance peak-hour loads. Emerging congestion-pricing proposals in Los Angeles and Singapore further elevate the role of parking data as an enforcement backbone.

Smart-City Funding for Intelligent Transport Systems

Dedicated federal and supra-national grants are lowering adoption risk for cash-strapped municipalities. In the United States, the Federal Highway Administration earmarked USD 2.3 billion through 2026 for 5G-enabled roadway and parking systems, with disbursements contingent on open-architecture and cybersecurity compliance. European cities tap into Horizon Europe funds to pilot curb-side EV-charging combined with automated parking guidance. Long-cycle capital unlocks multi-agency projects that fuse parking occupancy, traffic-signal timing, and public-transit arrival data into a single urban-mobility dashboard. Because eligibility criteria require interoperability, vendors that support standardized APIs gain a structural advantage when bids are scored.

Cyber-Security and Data-Privacy Vulnerabilities

Mandatory migration to PCI-DSS 4.0 after April 2024 exposed security gaps at facilities still running decade-old controllers. Breaches of license-plate databases in California and the Netherlands amplified public scrutiny, prompting regulators to widen audit scopes to include anonymization protocols. Large platforms responded by embedding zero-trust architectures and partnering with specialist security firms, but smaller garages struggle to fund continual penetration testing. EU proposals to classify curb-management data as "high-risk AI processing" may add algorithmic-transparency requirements that further stretch compliance budgets.

Other drivers and restraints analyzed in the detailed report include:

- Cloud-Native Parking-as-a-Service Adoption

- Mobile Payment and Digital Ticketing Penetration

- High CAPEX and Legacy-System Integration Complexity

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The parking management market size for on-premise systems reached USD 3.29 billion in 2025, translating into a 58.02% revenue share. Operators value on-premise control for mission-critical gateways where sub-basement cellular signals remain unreliable. Even so, cloud-native offerings are expanding at an 11.12% CAGR as metropolitan Wi-Fi and private-LTE backbones mature. Cross-site dashboards allow portfolio owners to adjust tariffs globally with a single rule set, and automated disaster-recovery protocols minimize downtime risk.

Cloud adoption strengthens recurring-revenue visibility for vendors and stabilizes cash flows for asset owners via subscription OPEX rather than lumpy CAPEX. Because software patches roll out centrally, vulnerability windows shrink, aligning with PCI-DSS 4.0 audit cycles. Cloud architectures also simplify MaaS integrations, letting third-party apps conduct tokenized reservations without exposing garage networks. As a result, the parking management market sees a progressive blending of hybrid deployments where local gateways cache transactions but sync to cloud analytics.

Off-street facilities generated USD 3.49 billion in revenue in 2025, underpinned by stable demand at airports, hospitals, and multi-tenant retail complexes. This accounted for 61.57% of the parking management market share. Yet on-street deployments show superior expansion, rising at an 11.28% CAGR on the back of digital curb-management ordinances in cities such as Birmingham and Guelph.

The on-street advance reflects a policy pivot that treats curb space as a multimodal asset. Real-time dashboards dispatch enforcement patrols only when sensors flag overstays, cutting overtime costs by 18%. Contactless meters and pay-by-plate apps lower cash-handling security risks, while variable rates raise turnover, boosting surrounding retail footfall. Vendors that offer integrated citation workflows and open-data feeds gain mindshare among planners seeking end-to-end transparency.

The Parking Management Market Report is Segmented by Deployment Model (On-Premises and Cloud-Based), Parking Site (Off-Street, On-Street), Solution Component (Hardware, Software Platform, Services), End-User Vertical (Municipal and Government, Commercial Off-Street Operators, and More), Technology (Sensor-Based, Camera/LPR-based, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America retained 38.96% of global revenue in 2025, reflecting mature digitization mandates and early adoption of dynamic pricing. Municipalities leverage open-data policies that compel vendors to expose occupancy APIs, spurring third-party innovation in navigation and curb-delivery routing. PCI-DSS 4.0 enforcement and California Consumer Privacy Act amendments drive demand for tamper-resistant architectures. Operators deploy AI vision to remove gates, cutting average ingress times by 40% and elevating user satisfaction scores.

Asia Pacific follows a different trajectory, posting the fastest regional CAGR at 9.78%. Rapid urbanization in China, Japan, and South Korea creates acute land-use pressures, making efficient curb allocation a policy imperative. National smart-city blueprints fund sensor grids and 5G backbones that lower latency for cloud guidance. Automakers integrate Parkopedia feeds into dashboards, and QR payments embedded in super-apps normalize contactless parking even in tier-three cities. The region's consumer tech literacy accelerates adoption curves, compressing time-to-scale for pilot solutions.

Europe balances data-privacy rigor with sustainability objectives. Revised GDPR cross-border transfer clauses in 2025 require data-localization or approved contractual mechanisms, leading many operators to choose regional cloud zones. EU Green Deal legislation links curb policy to modal-shift targets, incentivizing spaces reserved for micro-mobility docks and EV charging. Dynamic-pricing pilots in Stockholm and Madrid tie tariffs to emission classes, nudging fleets toward cleaner vehicles. While market growth is moderate, regulatory clarity supports vendor investment certainty.

South America and the Middle East and Africa remain emergent but increasingly visible in expansion roadmaps. Sao Paulo integrates parking sensors with flood-alert networks to reroute traffic during monsoon events, while Dubai positions smart-parking concessions as part of a "paperless government" strategy. Although project counts are lower, greenfield builds allow leapfrogging directly to cloud architectures without legacy constraints.

- Amano McGann Inc.

- Conduent Transportation Solutions Inc.

- SKIDATA GmbH

- Flowbird Group SAS

- TIBA Parking Systems (FAAC SpA)

- FlashParking Inc.

- Passport Labs Inc.

- Q-Free ASA

- Siemens AG (Intelligent Traffic Systems)

- Bosch Security and Safety Systems (Robert Bosch GmbH)

- Indigo Park Services UK Ltd.

- LAZ Parking Ltd. LLC

- Cleverciti Systems GmbH

- IPS Group Inc.

- ParkMobile LLC

- EasyPark Group AB

- SenSen Networks Ltd.

- Parkopedia Ltd.

- Streetline Inc.

- ParkHelp Technologies S.L.

- ParkPlus Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Urban traffic congestion mitigation

- 4.2.2 Smart-city funding for intelligent transport systems

- 4.2.3 Cloud-native parking-as-a-service adoption

- 4.2.4 Mobile payment and digital ticketing penetration

- 4.2.5 MaaS-driven dynamic curb-pricing integration

- 4.2.6 Real-estate REIT monetisation of parking assets

- 4.3 Market Restraints

- 4.3.1 Cyber-security and data-privacy vulnerabilities

- 4.3.2 High CAPEX and legacy-system integration complexity

- 4.3.3 Equity backlash against dynamic pricing

- 4.3.4 Lack of interoperability standards (vendor lock-in)

- 4.4 Regulatory Landscape

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitutes

- 4.6.5 Competitive Rivalry

- 4.7 Impact of Macroeconomic Factors on the Market

- 4.8 Investment Analysis

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Deployment Model

- 5.1.1 On-premises

- 5.1.2 Cloud-based

- 5.2 By Parking Site

- 5.2.1 Off-street

- 5.2.2 On-street

- 5.3 By Solution Component

- 5.3.1 Hardware (Meters, Sensors, Cameras, LPR, Kiosks)

- 5.3.2 Software Platform

- 5.3.3 Services (Installation, Managed, Consulting)

- 5.4 By End-User Vertical

- 5.4.1 Municipal and Government

- 5.4.2 Commercial Off-street Operators

- 5.4.3 Transit and Airports

- 5.4.4 Hospitality and Retail

- 5.4.5 Healthcare and Universities

- 5.4.6 Other End-User Verticals

- 5.5 By Technology

- 5.5.1 Sensor-based (ultrasonic, magnetometer)

- 5.5.2 Camera / LPR-based

- 5.5.3 Mobile-app and Bluetooth

- 5.5.4 RFID and NFC

- 5.6 Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 Europe

- 5.6.2.1 United Kingdom

- 5.6.2.2 Germany

- 5.6.2.3 France

- 5.6.2.4 Italy

- 5.6.2.5 Rest of Europe

- 5.6.3 Asia Pacific

- 5.6.3.1 China

- 5.6.3.2 India

- 5.6.3.3 Japan

- 5.6.3.4 South Korea

- 5.6.3.5 Rest of Asia Pacific

- 5.6.4 South America

- 5.6.4.1 Brazil

- 5.6.4.2 Argentina

- 5.6.4.3 Rest of South America

- 5.6.5 Middle East and Africa

- 5.6.5.1 Middle East

- 5.6.5.1.1 United Arab Emirates

- 5.6.5.1.2 Saudi Arabia

- 5.6.5.1.3 Turkey

- 5.6.5.1.4 Rest of Middle East

- 5.6.5.2 Africa

- 5.6.5.2.1 South Africa

- 5.6.5.2.2 Egypt

- 5.6.5.2.3 Rest of Africa

- 5.6.5.1 Middle East

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Amano McGann Inc.

- 6.4.2 Conduent Transportation Solutions Inc.

- 6.4.3 SKIDATA GmbH

- 6.4.4 Flowbird Group SAS

- 6.4.5 TIBA Parking Systems (FAAC SpA)

- 6.4.6 FlashParking Inc.

- 6.4.7 Passport Labs Inc.

- 6.4.8 Q-Free ASA

- 6.4.9 Siemens AG (Intelligent Traffic Systems)

- 6.4.10 Bosch Security and Safety Systems (Robert Bosch GmbH)

- 6.4.11 Indigo Park Services UK Ltd.

- 6.4.12 LAZ Parking Ltd. LLC

- 6.4.13 Cleverciti Systems GmbH

- 6.4.14 IPS Group Inc.

- 6.4.15 ParkMobile LLC

- 6.4.16 EasyPark Group AB

- 6.4.17 SenSen Networks Ltd.

- 6.4.18 Parkopedia Ltd.

- 6.4.19 Streetline Inc.

- 6.4.20 ParkHelp Technologies S.L.

- 6.4.21 ParkPlus Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment