PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910534

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910534

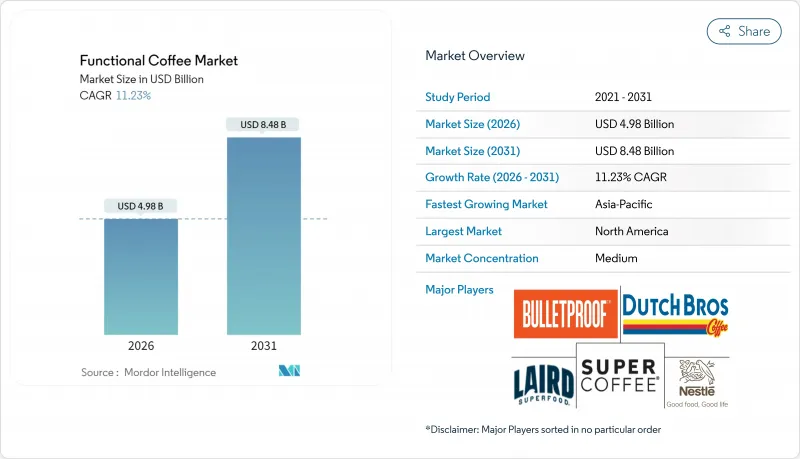

Functional Coffee - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The global functional coffee market was valued at USD 4.48 billion in 2025 and estimated to grow from USD 4.98 billion in 2026 to reach USD 8.48 billion by 2031, at a CAGR of 11.23% during the forecast period (2026-2031).

The market expansion is driven by increasing consumer preference for beverages that provide health benefits beyond traditional caffeine effects. Ready-to-drink formats dominated with 68.88% market share in 2024 and are projected to maintain the highest growth rate at 12.53% CAGR through 2030. Consumer demand focuses on beverages that combine energy, cognitive support, immunity benefits, and clean-label ingredients in a single product. Manufacturers are incorporating adaptogens, nootropics, and probiotics alongside caffeine to create distinctive products. Ready-to-drink (RTD) products remain significant due to their precise dosing, portability, and extended shelf life, while single-serve pods gain momentum in the home segment as sustainable designs transition from development to commercial production.

Global Functional Coffee Market Trends and Insights

Increasing Popularity of Adaptogens and Nootropics in Coffee Formulations

Adaptogenic ingredients such as ashwagandha, reishi mushrooms, and lion's mane are increasingly being incorporated into coffee formulations, driven by growing consumer interest in health and wellness. These ingredients are known for their potential to reduce stress, improve focus, and enhance overall cognitive function, making them appealing additions to functional beverages. The partnership between RYZE Superfoods and Calm highlights this trend, emphasizing products designed to provide cognitive benefits and sustained energy. This collaboration underscores the industry's growing focus on functional beverages that align with consumer wellness preferences, as more consumers seek products that support mental clarity and balanced energy levels. Similarly, Clevr's functional coffee brand has expanded its retail distribution to Target stores, featuring Fair Trade coffee blends infused with reishi and ashwagandha. This move reflects the broader acceptance of adaptogenic ingredients in mainstream markets, as consumers increasingly prioritize functional benefits in their daily routines. The nootropic beverage market is witnessing significant growth, driven by demand from gaming communities and professionals seeking cognitive enhancement through coffee-based products. These beverages cater to a growing demographic looking for convenient and effective ways to boost mental performance and productivity.

Expansion of Product Innovation Incorporating Botanicals, Probiotics, and Superfoods

Coffee product innovation reflects key advancements driven by changing consumer preferences and industry requirements. The integration of probiotics has introduced functional beverages that cater to the increasing focus on digestive health and overall wellness. These beverages not only provide the benefits of coffee but also support gut health, making them a dual-purpose option for consumers. Additionally, the market has expanded to include protein-enriched coffee formulations and mushroom coffee varieties, designed to appeal to health-conscious consumers seeking added nutritional benefits beyond traditional coffee. Protein-enriched coffee offers an energy boost combined with muscle recovery benefits, while mushroom coffee is gaining popularity for its potential adaptogenic properties and immune support. In terms of cultivation, the use of botanical pesticides enhances soil fertility while maintaining crop quality, promoting sustainable farming practices. These practices not only ensure long-term agricultural productivity but also align with the increasing consumer demand for environmentally friendly products. The functional beverages market is experiencing strong growth, highlighting substantial potential for health-focused coffee products that align with current wellness trends and consumer priorities.

Stringent Regulatory Frameworks on Health Claims and Functional Ingredients

The U.S. Food and Drug Administration (FDA) maintains strict oversight of caffeine through the Federal Food, Drug, and Cosmetic Act, designating it as a food additive with Generally Recognized as Safe (GRAS) status. For adults, the FDA has established a daily consumption limit of approximately 400 mg . The regulatory body implements heightened monitoring and mandatory adverse event reporting protocols for energy-based products to ensure consumer safety. Companies developing functional coffee products must navigate a complex landscape of regulatory requirements, particularly regarding structure/function claims. These claims require robust scientific substantiation and must be carefully worded to avoid any implications of disease treatment, which would trigger more stringent drug regulations. The implementation of new caffeine limits in 2025 across the United States and European Union markets will necessitate significant adjustments to product formulations and increase compliance-related expenses for manufacturers. The European Food Safety Authority (EFSA) offers more flexibility in permissible health claims compared to the FDA's conservative approach to disease risk reduction claims, creating strategic opportunities for companies operating in multiple markets. For botanical ingredients, manufacturers must complete comprehensive safety evaluations and adhere to established food additive regulatory frameworks. The classification distinction between liquid dietary supplements and conventional beverages significantly impacts how companies approach their product labeling and develop their marketing strategies.

Other drivers and restraints analyzed in the detailed report include:

- Rising Penetration of Ready-to-Drink (RTD) Functional Coffee Products

- Consumer Preference for Clean-Label and Natural Ingredient Products

- High Production Costs Associated with Functional Ingredient Integration

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The ready-to-drink coffee segment demonstrates market dominance, capturing 68.35% of the market share in 2025. This segment is experiencing robust growth momentum, with projections indicating a CAGR of 12.18% through 2031. The expansion is primarily attributed to rapid urbanization patterns and evolving consumer preferences for beverages that offer both portability and functional benefits. RTD coffee products excel in delivering precise measurements of functional ingredients through advanced shelf-stable systems, effectively preserving bioactive compounds while eliminating the need for consumer expertise in preparation.

In the broader coffee market landscape, instant coffee maintains its significant position through efficient manufacturing processes and extended product longevity, particularly resonating in markets where price sensitivity influences purchasing decisions more than premium positioning. The ground and whole bean segments continue to attract dedicated coffee enthusiasts seeking personalized functional experiences. These segments have evolved as specialty roasters incorporate innovative elements, such as adaptogenic blends and superfood infusions, into conventional brewing methodologies, meeting the growing consumer demand for customizable coffee experiences.

The Global Functional Coffee Market Report is Segmented by Product Type (Whole Bean, Ground Coffee, Instant Coffee, Ready-To-Drink Coffee, Coffee Pods and Capsules), Functional Claims (Energy Focus, Weight Management, Mental Focus/Cognitive, Gut Health and More) Distribution Channel (On-Trade and Off-Trade); and Geography (North America, Europe, Asia-Pacific, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

The North American market holds a commanding position with a 68.60% market share in 2025, establishing itself as the industry leader. This dominance is built on strong consumer trust in functional ingredients and a well-developed premium coffee culture. In the United States, specialty coffee has become a significant part of retail consumption. According to the National Coffee Association of the USA, 46% of American adults consumed specialty coffee in 2024 . Companies in the region benefit from supportive regulations that enable health claim validations, as seen in the United States, where Bulletproof successfully expanded from niche biohacker communities to mainstream consumers. The market's strength is further reinforced by the seamless business operations between Canada, the United States, and Mexico, supported by efficient supply chains and aligned consumer health preferences.

The Asia-Pacific market is experiencing remarkable growth at 13.08% CAGR, making it the fastest-growing region. Business opportunities are expanding rapidly in markets like India and Vietnam, where increasing consumer purchasing power directly correlates with higher coffee consumption. The market has shown particular adaptability in China, where traditional tea culture has influenced innovative coffee products. Indonesia's business landscape has evolved significantly, with coffee establishments becoming essential commercial and social centers. While companies face varying regulatory requirements across countries, these differences create opportunities for market-specific product innovations.

The European market continues to perform steadily, supported by well-structured functional food regulations and health-conscious consumers. Business potential remains largely untapped in South America and Middle East and Africa, where increasing urbanization and rising consumer income levels are creating new market opportunities. These regions demonstrate promising business prospects as consumer awareness grows alongside improving economic conditions.

- Nestle S.A.

- Dutch Bros Inc.

- Bulletproof 360 Inc.

- Laird Superfood Inc.

- Super Coffee

- JDE Peet's

- Keurig Dr Pepper Inc.

- Bulletproof 360 Inc.

- VitaCup Inc.

- Four Sigmatic Oy

- Clevr Blends

- GoodBrew LLC

- Windmill Health Products

- LDN Noots Ltd.

- PepsiCo Inc. (Propel Immune Coffee)

- Starbucks Corporation (Functional RTD lines)

- Danone S.A. (Mizone Coffee+)

- Tchibo GmbH

- Lavazza Group

- RYZE Superfoods

- Mud/Wtr Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing popularity of adaptogens and nootropics in coffee formulations

- 4.2.2 Expansion of product innovation incorporating botanicals, probiotics, and superfoods

- 4.2.3 Rising penetration of ready-to-drink (RTD) functional coffee products

- 4.2.4 Consumer preference for clean-label and natural ingredient products

- 4.2.5 Advancements in extraction and infusion technologies for precise formulation

- 4.2.6 Growing awareness of benefits of antioxidants and anti-inflammatory ingredients

- 4.3 Market Restraints

- 4.3.1 Stringent regulatory frameworks on health claims and functional ingredients

- 4.3.2 Complex supply chains and challenges sourcing specialty ingredients

- 4.3.3 High production costs associated with functional ingredient integration

- 4.3.4 Limited consumer awareness in emerging markets about functional coffee benefits

- 4.4 Supply Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Porter's Five Forces

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Product Type

- 5.1.1 Whole Bean

- 5.1.2 Ground Bean

- 5.1.3 Instant Coffee

- 5.1.4 Ready-to-Drink Coffee

- 5.1.5 Coffee Pods and Capsules

- 5.2 By Functional Claims

- 5.2.1 Energy Focus

- 5.2.2 Weight Management

- 5.2.3 Mental Focus/Cognitive

- 5.2.4 Gut Health

- 5.2.5 Immunity Boost

- 5.2.6 Beauty and Skin Health

- 5.2.7 Others

- 5.3 By Distribution Channel

- 5.3.1 On-Trade

- 5.3.2 Off-Trade

- 5.3.2.1 Supermarkets/Hypermarkets

- 5.3.2.2 Convenience Stores

- 5.3.2.3 Online Retail Stores

- 5.3.2.4 Other Distribution Channels

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.1.4 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 Italy

- 5.4.2.4 France

- 5.4.2.5 Spain

- 5.4.2.6 Netherlands

- 5.4.2.7 Poland

- 5.4.2.8 Belgium

- 5.4.2.9 Sweden

- 5.4.2.10 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 India

- 5.4.3.3 Japan

- 5.4.3.4 Australia

- 5.4.3.5 Indonesia

- 5.4.3.6 South Korea

- 5.4.3.7 Thailand

- 5.4.3.8 Singapore

- 5.4.3.9 Rest of Asia-Pacific

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Colombia

- 5.4.4.4 Chile

- 5.4.4.5 Peru

- 5.4.4.6 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 South Africa

- 5.4.5.2 Saudi Arabia

- 5.4.5.3 United Arab Emirates

- 5.4.5.4 Nigeria

- 5.4.5.5 Egypt

- 5.4.5.6 Morocco

- 5.4.5.7 Turkey

- 5.4.5.8 Rest of Middle East and Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials (if available), Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Nestle S.A.

- 6.4.2 Dutch Bros Inc.

- 6.4.3 Bulletproof 360 Inc.

- 6.4.4 Laird Superfood Inc.

- 6.4.5 Super Coffee

- 6.4.6 JDE Peet's

- 6.4.7 Keurig Dr Pepper Inc.

- 6.4.8 Bulletproof 360 Inc.

- 6.4.9 VitaCup Inc.

- 6.4.10 Four Sigmatic Oy

- 6.4.11 Clevr Blends

- 6.4.12 GoodBrew LLC

- 6.4.13 Windmill Health Products

- 6.4.14 LDN Noots Ltd.

- 6.4.15 PepsiCo Inc. (Propel Immune Coffee)

- 6.4.16 Starbucks Corporation (Functional RTD lines)

- 6.4.17 Danone S.A. (Mizone Coffee+)

- 6.4.18 Tchibo GmbH

- 6.4.19 Lavazza Group

- 6.4.20 RYZE Superfoods

- 6.4.21 Mud/Wtr Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK