PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910539

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910539

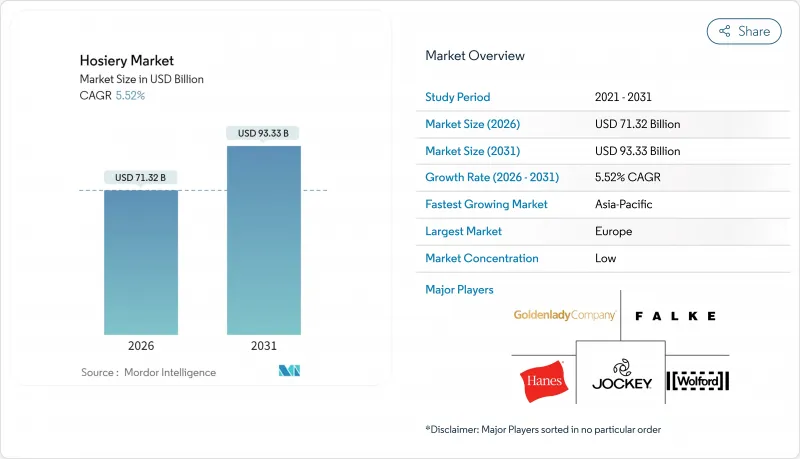

Hosiery - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Hosiery Market was valued at USD 67.59 billion in 2025 and estimated to grow from USD 71.32 billion in 2026 to reach USD 93.33 billion by 2031, at a CAGR of 5.52% during the forecast period (2026-2031).

This surge in global hosiery demand is attributed to a confluence of factors: shifting fashion trends, heightened awareness of health and wellness, notable technological strides, and the burgeoning realm of global e-commerce. Central to this demand is the athleisure trend, steering consumers towards comfy leggings and high-tech performance socks, ideal for both workouts and casual outings. Furthermore, with a growing and aging global populace and rising obesity rates, there's an intensified demand for specialized medical and plus-size compression hosiery. These products play a crucial role in managing circulatory issues and enhancing blood flow. Highlighting this concern, StatCan reported that in 2024, approximately 34.3% of Canadian adults were overweight, with another 30.8% classified as obese. Notably, Canadian men exhibited a higher likelihood of being overweight compared to women. Simultaneously, a rising consumer focus on sustainability is prompting manufacturers to pivot towards eco-friendly materials. Innovations like recycled nylon and organic cotton are not just trends; they're attracting a more environmentally conscious clientele. Recent product launches underscore these evolving trends. For example, in December 2024, the eco-centric brand Swedish Stockings, in partnership with influencer Camille Charriere, unveiled a chic collection of sustainable tights.

Global Hosiery Market Trends and Insights

Growth of Athleisure and Hybrid Lifestyles

The athleisure revolution is reshaping how consumers approach hosiery, with a growing preference for products that transition effortlessly from workouts to professional settings. A November 2024 survey by Japan's Ministry of Education, Culture, Sports, Science and Technology revealed that 62.1% of respondents engaged in walking for exercise. In March 2025, HanesBrands launched "Hanes Moves," showcasing features like anti-chafe solutions and moisture-wicking technologies across men's, women's, and children's lines, underscoring the trend. This evolution isn't limited to traditional activewear; compression socks are now popular among health-conscious consumers who value their performance benefits in everyday wear. As fashion and function merge, premium pricing becomes viable, with consumers leaning towards versatility and technical performance over mere aesthetics. Highlighting this shift, LYCRA Company's trend forecast for 2025-2026 spotlights "Gorpcore," underscoring the demand for outdoor-performance attributes, such as moisture-wicking and durability, in daily hosiery.

Technological Innovation in Materials and Production

Material science breakthroughs are driving product differentiation and enhancing manufacturing efficiency, with smart textiles emerging as the next frontier in hosiery innovation. Research from MIT and Cambridge showcases the integration of conductive yarns and pressure sensors into knit textiles, paving the way for real-time health monitoring through compression socks and other smart hosiery applications. Meanwhile, the University of Minnesota has developed dynamically controlled compression garments using shape memory alloys, marking a significant shift toward responsive textile technologies. Innovations in production, such as 3D knitting technologies, not only reduce waste but also facilitate mass customization. Additionally, advancements in fiber spinning are yielding more sustainable and functional materials. A notable example of textile innovation translating into tangible health benefits is the integration of infrared technology in performance socks. This was highlighted by Hologenix's CELLIANT partnership with Cadense in September 2024, emphasizing improvements in circulation and cellular oxygenation.

Volatile Raw Material Prices

Fluctuations in raw material costs are exerting pressure on margins and introducing uncertainty into the supply chain. Adding to these challenges, container shipping rates have been volatile. Notably, routes from Asia to the US East Coast saw a staggering 165% surge, compelling companies to either absorb these costs, rethink their sourcing strategies, or hold more inventory. Starting in April 2025, East China will see a new production of 1.83 million tonnes per year in polyester filament yarn capacity. While this could ease some supply pressures, it also hints at ongoing market volatility. Ethical concerns in the cotton supply chain, especially allegations of forced labor in key producing areas, complicate sourcing for manufacturers. They face added compliance costs and risks of regulatory penalties, especially under laws like the Uyghur Forced Labor Prevention Act. Highlighting the significance of these challenges, the Office of the Economic Adviser noted that in the financial year 2023, India's Wholesale Price Index for cotton yarn peaked at INR 149.4, marking a decade-high.

Other drivers and restraints analyzed in the detailed report include:

- Sustainability and Ethical Consumerism

- Fusion of Fashion and Functionality

- Counterfeit and Low-Quality Products

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

In 2025, socks dominate the market with a commanding 66.54% share, underscoring their widespread appeal across various demographics and use cases. Meanwhile, tights and pantyhose are on a growth trajectory, boasting a 6.74% CAGR through 2031, fueled by the rising popularity of premium and sustainable options. The sock segment's supremacy can be attributed to its responsiveness to athleisure trends, where features once deemed premium, like moisture-wicking and compression, are now standard expectations. Body stockings, though niche, are carving out a larger presence, thanks to their integration with shapewear and the body-positive fashion movement championing diverse sizing.

Knee-highs and hold-ups strike a balance, catering to both fashion and functionality, especially in professional settings where full hosiery might be overkill. Addressing age-old challenges in this realm, LYCRA's MADE TO FIT YOU technology boasts impressive consumer wear test results: a staggering 85% reduction in red marks and a 70% preference for enhanced fit and comfort. While hosiery accessories claim the smallest market share, their growth is notable, especially in tandem with premium product adoption. This trend highlights consumers' willingness to invest in complementary items, not just to prolong garment life but also to boost performance. The intersection of fashion and medical needs is spurring innovation across all product categories, with advancements like compression technology and smart textile integration birthing new subcategories within established segments.

In 2025, women command a 67.10% market share, driven by diverse product needs in fashion, professional, and wellness applications. Meanwhile, the men's segment is witnessing the fastest growth, boasting a 6.87% CAGR, fueled by the rise of gender-neutral trends and heightened performance awareness. As men increasingly turn to compression socks for athletic and health benefits, the traditional gender divide in hosiery consumption blurs. This shift is bolstered by clinical evidence highlighting the benefits of improved circulation and recovery. Parents, now more attuned to foot health and comfort, are opting for children's hosiery that boasts technical features like moisture management and antimicrobial treatments.

Brands are embracing gender-neutral design principles, crafting unisex sizing systems and colorways that resonate across demographics. The surge in the men's segment mirrors a cultural pivot towards self-care and wellness. Compression socks, especially, are gaining traction among fitness enthusiasts and professionals who often find themselves on their feet or traveling. Meanwhile, the women's segment is innovating with a focus on inclusive sizing and sustainable materials, aligning with the growing demands for body-positive fashion and environmental stewardship. In the kids' segment, there's a noticeable shift towards prioritizing foot health and comfort, with parents valuing technical features over mere aesthetics. This evolution opens doors for premium positioning in a market traditionally sensitive to price.

The Hosiery Market is Segmented by Product Type (Body Stockings, Socks, Knee-Highs and Hold-Ups, Tights and Pantyhose, and Hosiery Accessories), End-User (Women, Men, and Kids), Price Range (Mass and Premium), Distribution Channel (Supermarkets/Hypermarkets, Specialty Stores, Online Retail Stores, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Europe commands a 40.02% market share, driven by its premium brand legacy and consumers who prioritize fit and sustainability. While demand remains robust, rising OEKO-TEX fees and mandates like the Digital Product Passport are inflating operational costs, moderating the region's CAGR. Germany, France, Italy, and Spain, grappling with heightened counterfeit risks, underscore the necessity of authentication. Meanwhile, circular-economy laws are nudging European mills towards recycled nylon and certified organic cotton, stabilizing price points.

Asia Pacific is on a rapid ascent, charting a 7.47% CAGR, bolstered by an influx of 1.83 million tons of new polyester filament capacity set to debut in East China come April 2025. Illustrating this momentum, Vietnam's Far Eastern Polytex is expanding with a USD 1.54 billion investment, and India's Sanathan Textiles has inaugurated a plant worth INR 726 crore as of July 2023. As urban wages rise, so does discretionary spending, further amplified by the RCEP's easing of export challenges. While environmental regulations grow stringent, they come with a silver lining: supportive incentive schemes that mitigate compliance costs.

North America charts a steady course with mid-single-digit growth, propelled by performance innovations and sourcing laws that champion transparency. The Uyghur Forced Labor Prevention Act is not just a regulatory hurdle; it's steering investments towards traceability and favoring vetted mills. In the U.S., a surge in smart textile research and development is catalyzing premium product adoption. Meanwhile, Canada is witnessing a spike in demand for recycled yarn socks, especially in wellness chains. Together, these trends solidify North America's role as a resilient player in the hosiery market, even in the face of raw-material price fluctuations.

- Hanesbrands Inc.

- Golden Lady Company S.p.A.

- Wolford AG

- Falke KGaA

- Jockey International Inc.

- CSP International Fashion Group

- Spanx Inc.

- SKIMS

- Heist Studios

- Renfro Brands (Burlington)

- Calzedonia Group

- Adidas AG (Hosiery)

- Nike Inc. (Hosiery)

- Bombas

- Lululemon Athletica (Hosiery)

- Puma SE (Socks)

- Under Armour Inc. (Hosiery)

- G-III Apparel Group (Donna Karan)

- Iconix Brand Group

- Carolina Hosiery Mill Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growth of Athleisure and Hybrid Lifestyles

- 4.2.2 Technological Innovation in Materials and Production

- 4.2.3 Sustainability and ethical consumerism

- 4.2.4 Fusion of Fashion and Functionality

- 4.2.5 Inclusive sizing and gender-neutral trends

- 4.2.6 Demand for Smart and High-Performance Fabrics

- 4.3 Market Restraints

- 4.3.1 Volatile raw material prices

- 4.3.2 Counterfeit and low-quality products

- 4.3.3 Intense market competition

- 4.3.4 Sustainability challenges and costs

- 4.4 Consumer Behaviour Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Product Type

- 5.1.1 Body Stockings

- 5.1.2 Socks

- 5.1.3 Knee-highs and Hold-ups

- 5.1.4 Tights and Pantyhose

- 5.1.5 Hosiery accessories

- 5.2 By End-User

- 5.2.1 Women

- 5.2.2 Men

- 5.2.3 Kids

- 5.3 By Price Range

- 5.3.1 Mass

- 5.3.2 Premium

- 5.4 By Distribution Channel

- 5.4.1 Supermarkets/Hypermarkets

- 5.4.2 Specialty Stores

- 5.4.3 Online Retail Stores

- 5.4.4 Other Distribution Channels

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.1.4 Rest of North America

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Colombia

- 5.5.2.4 Chile

- 5.5.2.5 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 United Kingdom

- 5.5.3.2 Germany

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Russia

- 5.5.3.7 Sweden

- 5.5.3.8 Belgium

- 5.5.3.9 Poland

- 5.5.3.10 Netherlands

- 5.5.3.11 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 India

- 5.5.4.4 Thailand

- 5.5.4.5 Singapore

- 5.5.4.6 Indonesia

- 5.5.4.7 South Korea

- 5.5.4.8 Australia

- 5.5.4.9 New Zealand

- 5.5.4.10 Rest of Asia Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 United Arab Emirates

- 5.5.5.2 South Africa

- 5.5.5.3 Saudi Arabia

- 5.5.5.4 Nigeria

- 5.5.5.5 Egypt

- 5.5.5.6 Morocco

- 5.5.5.7 Turkey

- 5.5.5.8 Rest of Middle East and Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Hanesbrands Inc.

- 6.4.2 Golden Lady Company S.p.A.

- 6.4.3 Wolford AG

- 6.4.4 Falke KGaA

- 6.4.5 Jockey International Inc.

- 6.4.6 CSP International Fashion Group

- 6.4.7 Spanx Inc.

- 6.4.8 SKIMS

- 6.4.9 Heist Studios

- 6.4.10 Renfro Brands (Burlington)

- 6.4.11 Calzedonia Group

- 6.4.12 Adidas AG (Hosiery)

- 6.4.13 Nike Inc. (Hosiery)

- 6.4.14 Bombas

- 6.4.15 Lululemon Athletica (Hosiery)

- 6.4.16 Puma SE (Socks)

- 6.4.17 Under Armour Inc. (Hosiery)

- 6.4.18 G-III Apparel Group (Donna Karan)

- 6.4.19 Iconix Brand Group

- 6.4.20 Carolina Hosiery Mill Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK