PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910543

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910543

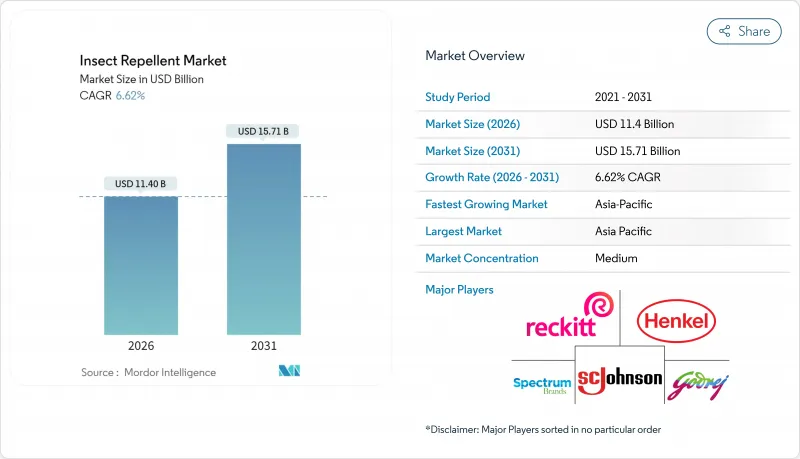

Insect Repellent - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

Insect repellent market size in 2026 is estimated at USD 11.4 billion, growing from 2025 value of USD 10.69 billion with 2031 projections showing USD 15.71 billion, growing at 6.62% CAGR over 2026-2031.

This growth trajectory is largely driven by escalating global apprehensions regarding vector-borne diseases, a burgeoning outdoor lifestyle, and ongoing innovations in delivery systems that enhance both protection and user convenience. The European Commission highlights Haiti and Brazil as the foremost nations at risk of vector-borne diseases in Latin America and the Caribbean. In 2025, these countries registered index scores of 8.9 and 8.8, respectively, for diseases like the Zika virus and Dengue fever. While Asia-Pacific continues to dominate as the primary regional hub, North America and Europe are witnessing a surge in demand, spurred by climate change's expansion of mosquito habitats. Although natural active ingredients and spatial formats are gaining popularity, traditional offerings like N, N-diethyl-meta-toluamide (DEET) and pyrethroids maintain their edge due to established efficacy and regulatory acceptance. Players in the market are focusing on research and development investments, seasonal promotions, and bolstering e-commerce presence, navigating the delicate balance between price sensitivity and the trend towards premiumization.

Global Insect Repellent Market Trends and Insights

Rise in Vector-borne Diseases

Vector-borne diseases are on the rise worldwide. The World Health Organization (WHO) highlighted in its September 2024 factsheet that over 700,000 deaths occur annually due to diseases spread by mosquitoes, ticks, and other arthropods. Climate change is pushing vector habitats further north, bringing malaria and dengue threats to temperate regions that were once safe. According to the Centers for Disease Control and Prevention, in 2024, more than 13 million cases of dengue were reported in North, Central, and South America and the Caribbean. Dengue transmission in these areas remains high in 2025. This surge has led to a heightened demand for repellents in these newly at-risk areas. Furthermore, pyrethroid resistance in malaria vectors is now a global concern, affecting over 80% of monitored sites. This resistance is steering consumers towards alternative active ingredients and spurring innovation in new formulations. In response to these challenges, government health agencies are amplifying their recommendations for personal protective measures. Notably, the CDC has highlighted DEET, picaridin, and IR3535 as top choices for effective protection against disease vectors.

Increasing Outdoor Recreational Activities

In the wake of pandemic-induced lifestyle changes, outdoor recreation saw a notable uptick in participation. For example, the Outdoor Foundation reported that in 2024, over 63.4 million individuals in the U.S. engaged in hiking activities at least once. This marks the highest participation rate since 2010, showcasing a growth of approximately 31 percentage points over the past 15 years. As consumers increasingly incorporate pest protection into their recreational gear, sales in adventure tourism and outdoor sports equipment have seen a direct correlation with the growth of the repellent market. This trend isn't limited to traditional activities like camping and hiking; it now encompasses outdoor dining, festivals, and the use of urban green spaces, expanding the market's reach beyond just wilderness enthusiasts. Moreover, professional outdoor workers from sectors like construction, agriculture, and landscaping, often overlooked, are significantly boosting the demand for commercial-grade repellents.

Competition from Alternative Protection Methods

Alternative protection technologies are increasingly encroaching on the traditional repellent market. Products like permethrin-treated clothing, bed nets, and electronic devices are drawing consumer interest, even as evidence of their efficacy remains mixed. Systematic reviews indicate that electronic mosquito repellents fail to offer measurable protection against mosquito landings. Yet, consumers continue to adopt them, swayed by their perceived convenience and the allure of being chemical-free. While permethrin-treated clothing boasts a longer protection duration than topical repellents, this advantage poses a substitution risk in the market, especially for outdoor professionals and military users. In residential settings, integrated pest management strategies, merging environmental tweaks, biological controls, and physical barriers, are diminishing the dependence on personal repellent products. Furthermore, the rise of smartphone apps touting ultrasonic repellent features, despite scientific evidence debunking their effectiveness, underscores a consumer trend: a willingness to explore alternative technologies, potentially postponing the shift away from traditional products.

Other drivers and restraints analyzed in the detailed report include:

- Growing Pet Ownership

- Shifting Consumer Preferences Towards Natural Products

- Consumer Health Concerns Over Chemicals

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

In 2025, sprays and aerosols command the market with a 45.72% share, capitalizing on their convenience, portability, and instant application appeal to a wide range of consumers. Meanwhile, liquid vaporizers are the fastest-growing segment, boasting a 7.32% CAGR through 2031. This surge is fueled by tech advancements in spatial protection and a consumer shift towards hands-free, continuous coverage. While coils hold their ground in price-sensitive markets, despite concerns over combustion byproducts, mats strike a balance between traditional coils and modern liquid systems. Bait products, tailored for integrated pest management, face growth challenges due to regulatory hurdles and complex applications.

Liquid vaporizers are reaping the rewards of patent innovations, especially in controlled-release mechanisms and volatile pyrethroid formulations. Notably, in July 2024, Godrej Consumer Products unveiled 'Renofluthrin', India's inaugural indigenous mosquito repellent molecule, tailored for liquid vaporizers. These advanced formulations promise 12-hour protection per cartridge, ensuring a steady release of active ingredients. This innovation meets consumer demands for prolonged efficacy, reducing the need for frequent reapplications. Emerging categories like wearable devices and electronic dispensers are weaving repellent delivery into everyday products, but their market presence is still modest, awaiting validation of efficacy and a drop in costs.

In 2025, conventional insect repellents command an 82.10% market share, bolstered by decades of proven efficacy, regulatory endorsements, and a well-established manufacturing base for DEET, picaridin, and pyrethroid formulations. Meanwhile, natural insect repellents are on a growth trajectory, boasting an 8.05% CAGR through 2031. This surge is fueled by a rising consumer health consciousness and regulatory backing for botanical active ingredients, such as oil of lemon eucalyptus and various essential oil blends. The disparity in growth rates underscores a shift in consumer priorities: many now prefer shorter protection durations if it means enhanced safety and environmental sustainability.

Research underscores the efficacy of natural ingredients. For instance, PMD (para-menthane-3,8-diol) matches DEET's performance against major vector species, provided it's used in the right concentrations. Furthermore, advancements like nano-emulsion technologies bolster the stability and bioavailability of botanical ingredients. This innovation addresses the traditional challenges of plant-based repellents, such as swift degradation and variable efficacy. While there's a growing acceptance of premium pricing for natural products, hinting at potential margin expansions, challenges in sourcing botanical ingredients could temper swift market share growth.

The Insect Repellent Market is Segmented by Product Type (Bait, Coils, Sprays/Aerosols, Mats, Liquid Vaporizer, and More), by Ingredient Type (Natural Insect Repellent and Conventional Insect Repellent), by End User (Adults and Kids/Children), by Distribution Channel (Supermarkets/Hypermarkets, Convenience Stores, Online Retail Stores, and More), and by Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

In 2025, the Asia-Pacific region accounted for 49.10% of global revenue, and the region also registers the strongest regional CAGR at 9.15% during the period to 2031, primarily driven by the ongoing public health focus on dengue and malaria. Government-led awareness initiatives, bolstered by mass media campaigns, have significantly increased the adoption of repellents. A testament to local research and development capabilities, India's Goodknight Flash, featuring Renofluthrin, not only cuts down on import costs but also fortifies supply resilience. With rising disposable incomes, urban households are upgrading from traditional coils to liquid vaporizers, further expanding the regional insect repellent market.

North America, while trailing, boasts substantial figures, largely due to outdoor recreational activities and the spread of insect-borne diseases. In 2024, retail sales in the U.S. reached an impressive USD 376.9 million. The region's strong preference for botanical ingredients allows for premium pricing and higher margins for innovators. Additionally, climate change has lengthened the mosquito season in northern states, leading to a more consistent monthly demand for insect repellents, rather than the previously sharp summer peak.

Europe's growth is tempered by stringent chemical regulations, pushing the industry towards natural formulations that align with eco-toxicology standards. Germany and France are at the forefront, championing sustainability certifications and driving the adoption of recyclable packaging.

In the Middle East and Africa, donor-funded initiatives are bolstering distribution in malaria-prone areas, making repellents more accessible to lower-income communities.

Meanwhile, Latin America's urban sprawl into tropical regions is increasing contact with disease vectors, prompting a surge in diverse product offerings and investments in localized manufacturing.

- S.C. Johnson & Son Inc.

- Reckitt Benckiser Group PLC

- Spectrum Brands Holdings Inc.

- Godrej Consumer Products Ltd.

- Dabur India Ltd.

- Henkel AG & Co. KGaA

- Newell Brands Inc.

- Enesis Group

- Quantum Health

- Jyothy Labs Limited

- Sawyer Products Inc.

- Avon Products Inc.

- Tender Corporation (Natrapel)

- Kao Corporation

- The Coleman Company, Inc.

- Merck KGaA (IR3535)

- 3M

- Coleman (Repel brand)

- Wondercide Inc.

- Sawyer Products, Inc.

- Enesis Group

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rise in Vector-borne Diseases

- 4.2.2 Increasing Outdoor Recreational Activities

- 4.2.3 Growing Pet Ownership

- 4.2.4 Shifting Consumer Preferences Towards Natural Products

- 4.2.5 Rapid Technological Advancements Driving Innovation

- 4.2.6 Government and Public Health Campaigns

- 4.3 Market Restraints

- 4.3.1 Competition from Alternative Protection Methods

- 4.3.2 Consumer Health Concerns Over Chemicals

- 4.3.3 Insecticide Resistance

- 4.3.4 Availability of Counterfeit Products

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS

- 5.1 By Product Type

- 5.1.1 Bait

- 5.1.2 Coils

- 5.1.3 Sprays/Aerosols

- 5.1.4 Mats

- 5.1.5 Liquid Vaporizer

- 5.1.6 Other Product Types

- 5.2 By Ingredient Type

- 5.2.1 Natural Insect Repellent

- 5.2.2 Conventional Insect Repellent

- 5.3 By End User

- 5.3.1 Adults

- 5.3.2 Kids/Children

- 5.4 By Distribution Channel

- 5.4.1 Supermarkets/Hypermarkets

- 5.4.2 Convenience Stores

- 5.4.3 Online Retail Stores

- 5.4.4 Other Distribution Channels

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.1.4 Rest of North America

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Colombia

- 5.5.2.4 Chile

- 5.5.2.5 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 United Kingdom

- 5.5.3.2 Germany

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Russia

- 5.5.3.7 Sweden

- 5.5.3.8 Belgium

- 5.5.3.9 Poland

- 5.5.3.10 Netherlands

- 5.5.3.11 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 India

- 5.5.4.4 Thailand

- 5.5.4.5 Singapore

- 5.5.4.6 Indonesia

- 5.5.4.7 South Korea

- 5.5.4.8 Australia

- 5.5.4.9 New Zealand

- 5.5.4.10 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 United Arab Emirates

- 5.5.5.2 South Africa

- 5.5.5.3 Saudi Arabia

- 5.5.5.4 Nigeria

- 5.5.5.5 Egypt

- 5.5.5.6 Morocco

- 5.5.5.7 Turkey

- 5.5.5.8 Rest of Middle East and Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 S.C. Johnson & Son Inc.

- 6.4.2 Reckitt Benckiser Group PLC

- 6.4.3 Spectrum Brands Holdings Inc.

- 6.4.4 Godrej Consumer Products Ltd.

- 6.4.5 Dabur India Ltd.

- 6.4.6 Henkel AG & Co. KGaA

- 6.4.7 Newell Brands Inc.

- 6.4.8 Enesis Group

- 6.4.9 Quantum Health

- 6.4.10 Jyothy Labs Limited

- 6.4.11 Sawyer Products Inc.

- 6.4.12 Avon Products Inc.

- 6.4.13 Tender Corporation (Natrapel)

- 6.4.14 Kao Corporation

- 6.4.15 The Coleman Company, Inc.

- 6.4.16 Merck KGaA (IR3535)

- 6.4.17 3M

- 6.4.18 Coleman (Repel brand)

- 6.4.19 Wondercide Inc.

- 6.4.20 Sawyer Products, Inc.

- 6.4.21 Enesis Group

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK