PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910547

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910547

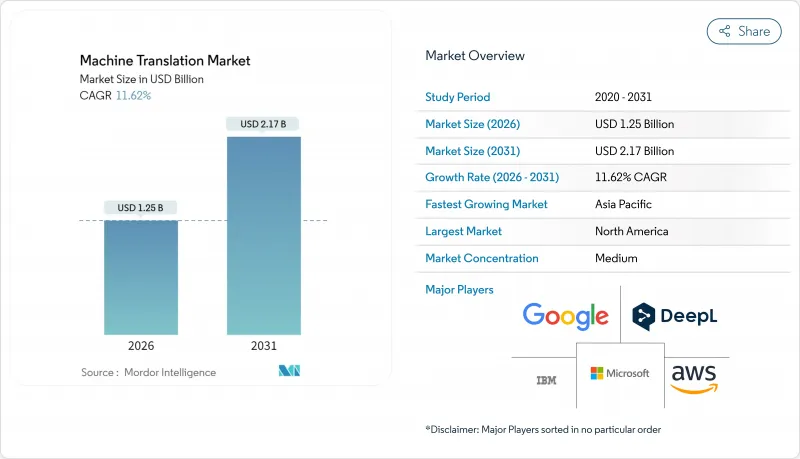

Machine Translation - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Machine Translation market is expected to grow from USD 1.12 billion in 2025 to USD 1.25 billion in 2026 and is forecast to reach USD 2.17 billion by 2031 at 11.62% CAGR over 2026-2031.

Adoption accelerates as enterprises pivot from rule-based tools toward transformer-based neural models that boost BLEU scores, cut post-editing workloads, and integrate easily with cloud content workflows. Heightened digitization mandates, stringent multilingual compliance rules, and the ability of vendors to embed MT APIs into e-commerce, CRM, and mobile platforms expand procurement budgets across sectors. Accurate, domain-tuned neural engines now serve as brand-experience safeguards, especially where mistranslations jeopardize safety or legal standing. Competition increasingly revolves around demonstrable accuracy gains in regulated verticals such as healthcare and automotive, where even minor errors invite penalties under device and vehicle guidelines.

Global Machine Translation Market Trends and Insights

Growing Demand for Content Localization

Enterprises now require simultaneous, context-aware adaptation across websites, apps, chatbots, and social media rather than isolated page translations. Neural engines trained on brand-specific corpora safeguard tone and terminology, reducing editorial loops and time-to-market. Shopify merchants illustrate the shift by deploying LangShop to localize product descriptions, prices, and checkout flows in minutes . Hybrid workflows combine rule-based glossaries with neural suggestions, balancing speed with consistency and underpinning the 14.23% CAGR for Hybrid and Adaptive MT. Localization also underpins customer-experience metrics, as native-language content directly lifts conversion rates and reduces support tickets. As companies seek unified experience management, translation moves from a back-office task to a board-level KPI.

Transformer-Based MT Breakthroughs

Transformer architectures allow models to weigh entire sentence context simultaneously, eliminating the word-by-word bottlenecks of statistical engines. Tencent's Hunyuan-MT-7B secured top scores at WMT 2025 with just 7 billion parameters, proving that efficiency and accuracy can coexist . Apple's iOS 26 delivers on-device live translation across 12 language pairs, removing latency and privacy hurdles tied to cloud calls . These advances unlock real-time subtitling, video dubbing, and voice assistants that juggle conversational turns without resetting context. The resulting user acceptance reinforces enterprise willingness to finance frequent model updates, widening the addressable machine translation market.

Persistent Accuracy Gaps in Low-Resource Languages

Hundreds of African and Southeast Asian languages lack large digital corpora, causing BLEU scores to fall below commercial thresholds and forcing costly human validation. Transfer-learning strategies improve quality incrementally, yet remain compute-heavy and capital-intensive. Healthcare providers hesitate to rely on automated output that could misstate dosage instructions, limiting uptake where linguistic diversity is greatest. These disparities shrink the immediate machine translation market in emerging economies and slow global revenue realization for vendors.

Other drivers and restraints analyzed in the detailed report include:

- Expansion of Cross-Border E-Commerce Platforms

- Need for Cost-Efficient, High-Speed Translation

- Rising Energy Costs of Large-Scale Model Training

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Neural Machine Translation held 48.21% of the machine translation market share in 2025 as transformer models slashed post-editing labor across technical manuals and customer chats. Hybrid and Adaptive MT's 13.65% CAGR arises from blending neural fluency with rule-based glossary locking, a crucial feature for regulated sectors that cannot tolerate terminology drift. Statistical MT persists in high-volume settings where low latency trumps premium accuracy, while rule-based engines anchor legacy workflows in defense and aeronautics. The segment spotlight now falls on refining attention mechanisms that deliver top-tier BLEU while halving GPU inference time. Vendors differentiate via domain-specific data curation, offering medical, legal, and automotive packs that ship with pretrained terminology. As the race narrows to incremental accuracy wins, consistent quality across obscure language pairs becomes a key buying criterion, enlarging the total machine translation market.

Transformer-centered R&D dominates patent filings, yet light-weight sequence-to-sequence setups remain popular for edge devices. Tencent's Hunyuan-MT-7B and other medium-parameter models demonstrate that compute-efficient networks can rival massive architectures at a fraction of training cost. Moving forward, vendors devote capital to continual-learning pipelines that update engines with minimal downtime. Such agility matters when product catalogs pivot weekly and legal statutes refresh quarterly, requiring rapid glossary updates without retraining from scratch. These technical evolutions maintain investor appetite, reinforcing long-term growth prospects for the entire machine translation industry.

The Machine Translation Market Report is Segmented by Technology (Statistical Machine Translation, Rule-Based Machine Translation, and More), Deployment (On-Premise, Cloud-Based), End-User Vertical (Automotive and Mobility, Military and Defense, Healthcare and Life-Sciences, IT and Telecom, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America's machine translation market size leadership stems from enterprise SaaS penetration and a supportive VC ecosystem that rewarded DeepL with a multi-billion-dollar valuation after showcasing measurable BLEU gains in legal texts. Stringent HIPAA and financial-privacy rules drive on-prem demand, yet public-cloud adoption rises as AWS, Azure, and Google secure FedRAMP and SOC 2 certifications. The region also hosts the majority of MT patent filings, underscoring innovation centrality.

Asia Pacific's growth pace reflects sovereign AI funding, 5G rollout, and manufacturing digital twins that depend on real-time localization. Tencent and Baidu secure provincial grants for model pretraining, ensuring their engines meet content-filtering regulations while delivering competitive accuracy. Japanese automakers run bilingual infotainment in production vehicles, and South Korean electronics brands bundle live-chat MT inside warranty apps, reinforcing demand.

Europe occupies the middle ground where regulatory rigor meets expansive language portfolios. The EU AI Act imposes transparency on high-risk MT applications, spurring demand for explainable architectures that log decision paths. Germany's export-driven manufacturers localize technical documents into dozens of languages to meet after-sales service obligations. Nordic media firms experiment with real-time dubbing to broaden streaming reach, reflecting cultural preferences for subtitled over dubbed content.

- Google LLC

- Microsoft Corporation

- Amazon Web Services Inc.

- DeepL GmbH

- IBM Corporation

- Meta Platforms Inc.

- Baidu Inc.

- Tencent Cloud Computing (Beijing) Co. Ltd.

- RWS Holdings PLC

- SYSTRAN International Co. Ltd.

- Lionbridge Technologies Inc.

- Welocalize Inc.

- Smartling Inc.

- AppTek LLC

- Lingotek Inc.

- PROMT Ltd.

- Yandex NV

- Cloudwords Inc.

- Omniscien Technologies Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing demand for content localization

- 4.2.2 Need for cost-efficient, high-speed translation

- 4.2.3 Expansion of cross-border e-commerce platforms

- 4.2.4 Transformer-based MT breakthroughs

- 4.2.5 Mandatory multilingual compliance under EU AI Act

- 4.2.6 Real-time in-game voice translation uptake

- 4.3 Market Restraints

- 4.3.1 Persistent accuracy gaps in low-resource languages

- 4.3.2 Free/open-source MT engines commoditizing pricing

- 4.3.3 Sovereign data-privacy regulations (China, EU)

- 4.3.4 Rising energy costs of large-scale model training

- 4.4 Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Impact Macroeconomic Factors on the Market

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Technology

- 5.1.1 Statistical Machine Translation (SMT)

- 5.1.2 Rule-based Machine Translation (RBMT)

- 5.1.3 Neural Machine Translation (NMT)

- 5.1.3.1 Sequence-to-Sequence NMT

- 5.1.3.2 Transformer-based NMT

- 5.1.4 Hybrid and Adaptive MT

- 5.1.5 Other Technologies

- 5.2 By Deployment

- 5.2.1 On-premise

- 5.2.2 Cloud-based

- 5.3 By End-user Vertical

- 5.3.1 Automotive and Mobility

- 5.3.2 Military and Defense

- 5.3.3 Healthcare and Life-sciences

- 5.3.4 IT and Telecom

- 5.3.5 E-commerce and Retail

- 5.3.6 Media and Entertainment

- 5.3.7 BFSI

- 5.3.8 Government and Public Sector

- 5.3.9 Education and E-learning

- 5.3.10 Other End-user Verticals

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 South America

- 5.4.2.1 Brazil

- 5.4.2.2 Argentina

- 5.4.2.3 Rest of South America

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 France

- 5.4.3.3 United Kingdom

- 5.4.3.4 Russia

- 5.4.3.5 Rest of Europe

- 5.4.4 Asia Pacific

- 5.4.4.1 China

- 5.4.4.2 Japan

- 5.4.4.3 India

- 5.4.4.4 South Korea

- 5.4.4.5 Rest of Asia Pacific

- 5.4.5 Middle East

- 5.4.5.1 United Arab Emirates

- 5.4.5.2 Saudi Arabia

- 5.4.5.3 Turkey

- 5.4.5.4 Rest of the Middle East

- 5.4.6 Africa

- 5.4.6.1 South Africa

- 5.4.6.2 Nigeria

- 5.4.6.3 Rest of Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, Recent Developments)

- 6.4.1 Google LLC

- 6.4.2 Microsoft Corporation

- 6.4.3 Amazon Web Services Inc.

- 6.4.4 DeepL GmbH

- 6.4.5 IBM Corporation

- 6.4.6 Meta Platforms Inc.

- 6.4.7 Baidu Inc.

- 6.4.8 Tencent Cloud Computing (Beijing) Co. Ltd.

- 6.4.9 RWS Holdings PLC

- 6.4.10 SYSTRAN International Co. Ltd.

- 6.4.11 Lionbridge Technologies Inc.

- 6.4.12 Welocalize Inc.

- 6.4.13 Smartling Inc.

- 6.4.14 AppTek LLC

- 6.4.15 Lingotek Inc.

- 6.4.16 PROMT Ltd.

- 6.4.17 Yandex NV

- 6.4.18 Cloudwords Inc.

- 6.4.19 Omniscien Technologies Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment