PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910551

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910551

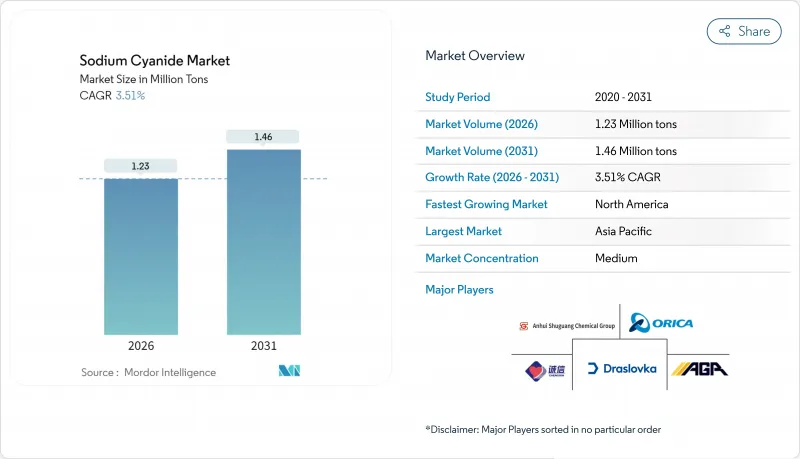

Sodium Cyanide - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Sodium Cyanide market is expected to grow from 1.19 Million tons in 2025 to 1.23 Million tons in 2026 and is forecast to reach 1.46 Million tons by 2031 at 3.51% CAGR over 2026-2031.

Mature demand in traditional gold-mining jurisdictions co-exists with fresh momentum from low-grade ore projects, tighter environmental codes, and modular on-site production technologies that lower logistics risk. Operators in North America and Asia-Pacific continue to recalibrate procurement toward solid briquettes for remote heap-leach sites, while liquid solutions gain favor at automated mills where just-in-time delivery trims inventory costs. Market leaders strengthen vertical integration through acquisitions that expand capacity and regional reach, and research pipelines push alternative lixiviants from pilot scale toward commercial feasibility. Collectively, these forces reinforce the sodium cyanide market's long-term relevance even as regulatory scrutiny and freight premiums apply counterweights to volume growth.

Global Sodium Cyanide Market Trends and Insights

Boom in Low-Grade Gold Mining Requiring Higher NaCN Loadings

Declining ore grades at flagship operations such as Nevada Gold Mines and Newmont's Tanami asset now demand cyanide additions that are 30-40% above historical norms, a shift that lifts average reagent intensity even where gold output stays flat. Modern heap-leach pads handle ore below 1 g/t Au, using extended residence times to secure economic recoveries, and every incremental percentage point drop in head grade translates into a disproportionate rise in sodium cyanide consumption. Similar patterns play out in West African oxide belts and Siberia's refractory lodes, adding steady tonnage demand even as greenfield discoveries slow. Engineering teams continue to optimize pH, oxygen levels, and solid-liquid ratios, yet chemistry fundamentals still tether gold dissolution rates to cyanide concentration. These realities together underpin a structural, not cyclical, pull on the global sodium cyanide market.

Rising Heap-Leach Projects in Africa and Central Asia

From Kazakhstan's RG Gold circuit to Nordgold's Bissa-Bouly complex, developers in under-explored regions are standardizing heap-leach flowsheets that rely on consistent sodium cyanide dosing. Many deposits host oxidized ores that dissolve readily under cyanide leach, enabling capital-lite builds over short schedules. Proximity to regional NaCN producers is improving as rail corridors and dry ports open across Central Asia, trimming freight surcharges and strengthening margins. Institutional lenders now require International Cyanide Management Code (ICMC) compliance as a condition of finance, pushing operators to lock in supply contracts with vendors capable of delivering code-certified product. Consequently, sodium cyanide market participants with distribution hubs in Kazakhstan, Uzbekistan, and the Sahel stand to capture an outsized share of incremental volumes over the decade.

Toxicity and Tightening ICMC Compliance Audits

ICMC auditors raised the bar in 2024 by mandating real-time telemetry on cyanide transport, storage, and consumption, adding 15-25% to annual compliance budgets for mid-tier miners. A high-profile spill in the United Kingdom that resulted in 90 kg of fish mortality sharpened public scrutiny and triggered insurance premium hikes for cyanide handlers. Stringent European Union and U.S. Occupational Safety and Health Administration (OSHA) limits on airborne HCN now compel enclosed handling systems and personal protective equipment upgrades. These factors collectively temper volume growth, especially for junior miners with constrained capital.

Other drivers and restraints analyzed in the detailed report include:

- Increasing Adoption of Cyanide Sparging Systems in APAC Mines

- Recovery of Silver-Bearing Tailings in Latin America

- High Marine Freight Premiums for Hazardous Cargoes

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Solid sodium cyanide accounted for 60.72% of 2025 shipments, a position underpinned by the format's lower spill risk, longer shelf life, and simplified ICMC documentation ORICA.COM. Large heap-leach operations use briquettes to stage-gate dissolution, thereby regulating the cyanide concentration profile over 60-90 day leach cycles. Solid product handling also permits bulk ISO-tank or 1 ton IBC deliveries, aligning with strict chain-of-custody protocols.

Conversely, the liquids sub-segment is poised for 3.72% CAGR, closing in on 583,000 t by 2031. Competitive intensity intensifies around packaging and micro-logistics, with service differentiation shifting from mere tonnage to end-to-end safety, telemetry, and reagent stewardship. Delivered as 30-32% solution, liquids sync with "milk-run" logistics, improving working capital and enabling precise chem-feed ratios. Together these trends preserve the solid segment's command while elevating liquids as the growth spotlight, reinforcing the sodium cyanide market's dual-format architecture.

The Sodium Cyanide Report is Segmented by Product Form (Solid and Liquid Solution), End-User Industry (Mining, Chemicals, and Other End-User Industries), and Geography (Asia-Pacific, North America, Europe, South America, and Middle-East and Africa). The Market Forecasts are Provided in Terms of Volume (Tons).

Geography Analysis

Asia-Pacific held 29.95% revenue share in 2025 on the strength of China's cyanide synthesis park in Hebei, Australia's world-class gold camps, and Indonesia's emergent heap projects. However, regional growth cools to a mid-3% pace as tighter environmental norms and alternative lixiviant pilots moderate fresh demand. Conversely, North America's sodium cyanide market is expected to post 3.98% CAGR, underwritten by the Nevada Gold Mines joint venture, renewed exploration in the Abitibi greenstone belt, and modular on-site synth capacity adds in Mexico. South America's pipeline of tailings re-treatments in Peru and Chile nudges regional reagent needs upward, while Central Asian tonnage climbs off a small base as Kazakhstan and Uzbekistan open new oxide developments. Europe remains a steady yet small consumer, with industrial users in Germany and France dominating offtake. Africa and the Middle East together account for a modest share but deliver outsized growth where greenfield deposits intersect infrastructure upgrades.

- Anhui Shuguang Chemical Group

- Australian Gold Reagents Pty Ltd

- Changsha Hekang Chemical Co. Ltd

- CSBP (Wesfarmers Chemicals, Energy & Fertilisers)

- CyPlus GmbH

- Draslovka

- Hebei Chengxin Group Co. Ltd

- JINCHENG HONGSHENG CHEMICAL CO. LTD

- Orica Limited

- Taekwang Industrial Co. Ltd

- Tongsuh Petrochemical Corp. Ltd (Asahi Kasei Corporation)

- Unigel

- Ynnovate Sanzheng (Yingkou) Fine Chemicals Co. Ltd

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Boom in low-grade gold mining requiring higher NaCN loadings

- 4.2.2 Rising heap-leach projects in Africa and Central Asia

- 4.2.3 Growth of on-site modular NaCN plants lowering logistics cost

- 4.2.4 Increasing adoption of cyanide sparging systems in APAC mines

- 4.2.5 Recovery of silver-bearing tailings in Latin America

- 4.3 Market Restraints

- 4.3.1 Toxicity and tightening ICMC compliance audits

- 4.3.2 Pilot-scale switch to glycine/thiosulphate lixiviants

- 4.3.3 High marine freight premiums for hazardous cargoes

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Competitive Rivalry

5 Market Size and Growth Forecasts (Value)

- 5.1 By Product Form

- 5.1.1 Solid (Briquettes/Powder)

- 5.1.2 Liquid Solution

- 5.2 By End-user Industry

- 5.2.1 Mining

- 5.2.2 Chemicals

- 5.2.3 Other End-User Industries

- 5.3 By Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 Australia and New Zealand

- 5.3.1.3 Indonesia

- 5.3.1.4 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Russia

- 5.3.3.2 CIS (ex-Russia)

- 5.3.3.3 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Peru

- 5.3.4.3 Argentina

- 5.3.4.4 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Ghana

- 5.3.5.2 Sudan

- 5.3.5.3 South Africa

- 5.3.5.4 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share (%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Anhui Shuguang Chemical Group

- 6.4.2 Australian Gold Reagents Pty Ltd

- 6.4.3 Changsha Hekang Chemical Co. Ltd

- 6.4.4 CSBP (Wesfarmers Chemicals, Energy & Fertilisers)

- 6.4.5 CyPlus GmbH

- 6.4.6 Draslovka

- 6.4.7 Hebei Chengxin Group Co. Ltd

- 6.4.8 JINCHENG HONGSHENG CHEMICAL CO. LTD

- 6.4.9 Orica Limited

- 6.4.10 Taekwang Industrial Co. Ltd

- 6.4.11 Tongsuh Petrochemical Corp. Ltd (Asahi Kasei Corporation)

- 6.4.12 Unigel

- 6.4.13 Ynnovate Sanzheng (Yingkou) Fine Chemicals Co. Ltd

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment