PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910577

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910577

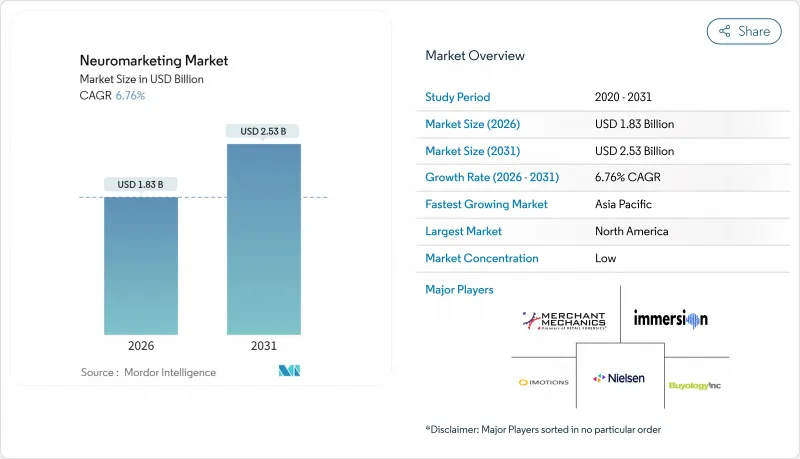

Neuromarketing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

Neuromarketing market size in 2026 is estimated at USD 1.83 billion, growing from 2025 value of USD 1.71 billion with 2031 projections showing USD 2.53 billion, growing at 6.76% CAGR over 2026-2031.

Expansion is fueled by the proven ability of electroencephalography-machine learning systems to predict purchase intent with 87.1% accuracy, the rise of immersive extended-reality testing environments, and the widening gap between privacy regulations and traditional consumer-insight tools. Global brands view neuromarketing platforms as infrastructure for campaign pre-testing, audience segmentation, and user-experience optimization, while investors support new ventures that bridge hardware miniaturization with cloud analytics. Strict data-protection laws, notably California SB 1223 and the European Union's GDPR, compel vendors to embed privacy-preserving design principles that add compliance costs yet create durable competitive advantages. Consolidation is underway as larger technology companies acquire specialist firms to embed neural measurement across wider marketing-technology stacks.

Global Neuromarketing Market Trends and Insights

Increasing Need for Advanced Marketing Tools

Brand marketers face fragmented digital journeys that weaken click-through and conversion metrics as proxies for engagement. EEG-based systems integrated with machine learning provide real-time readouts of cognitive load, emotional arousal, and motivational intent that correlate directly with sales lift. A landmark study reported 87.1% purchase-prediction accuracy against 64% for surveys, validating the shift toward neurobiological measurement. Consumer goods firms that deploy these tools achieve faster creative iteration, reduced media wastage, and higher return on advertising spend. Heightened competition inside crowded online marketplaces further elevates demand for deeper behavioral insight.

AI-Powered Predictive Attention Analytics Adoption

Neuromarketing vendors embed convolutional neural networks and gradient-boosting models to forecast attention patterns before campaigns launch. Training on large multi-modal datasets enables cross-cultural segmentation that distinguishes subtle emotional cues among demographic cohorts. Functional near-infrared spectroscopy studies reveal gender-specific prefrontal activation during mixed-culture adverts, allowing brands to tailor messaging by neurobiological fit. Forecasting extends beyond single creatives to long-term brand-equity trajectories, guiding budget allocation and portfolio strategy. Companies that integrate these predictive engines into media-planning workflows compress insights cycles from weeks to hours.

High Capital Cost of Gold-Standard Neuroimaging (fMRI)

Installing an fMRI suite can exceed USD 3 million, with recurrent maintenance topping USD 200,000 each year. Such spending is feasible for large pharmaceutical firms but unattainable for most agencies and start-ups. The capital hurdle entrenches a two-tier structure in which resource-rich organizations access high-resolution data while others rely on lower-cost EEG or eye-tracking alternatives. Portable fNIRS devices deliver roughly 75% of fMRI precision at 10% of its cost, but they cannot yet fully replicate whole-brain mapping. This constraint limits large-scale adoption and slows methodological innovation.

Other drivers and restraints analyzed in the detailed report include:

- Rising Demand for Privacy-Compliant, Opt-In Consumer Insights

- Integration of Neuromarketing with Immersive XR Platforms

- Fragmented Regulatory Landscape and Data-Privacy Constraints

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Retail and consumer brands captured 37.12% neuromarketing market share during 2025, driven by high-volume campaign testing across fast-moving consumer goods. Healthcare and pharma applications, however, are advancing at a 7.12% CAGR, the fastest among end users. The neuromarketing market size for healthcare communications will benefit from neuroscience-based content that improves patient adherence and clinical-trial engagement. Pharmaceutical marketers employ digital biomarkers to monitor cognitive side effects in real time, while hospital networks test user-experience flows of telehealth portals to reduce friction and missed appointments.

Banks and insurers integrate neural feedback into onboarding journeys that shorten form-completion times and lower abandonment. Market-research agencies embed biometric panels within traditional survey infrastructures to boost predictive validity. Academic institutions expand brain-computer-interface labs through public-private grants, particularly in Asia Pacific where governments fund translational neuroscience. Automotive and entertainment firms explore in-vehicle emotion monitoring and storyboarding optimization, rounding out a diversified end-user landscape that strengthens demand resilience.

Electroencephalography held 40.28% revenue in 2025 thanks to well-established research protocols and shrinking sensor costs. Functional near-infrared spectroscopy is growing 7.35% annually, narrowing the gap by offering mobile, fiber-less caps that map prefrontal blood oxygenation while users browse physical aisles or virtual storefronts. The neuromarketing market size for fNIRS solutions will expand as headset manufacturers embed optical diodes inside mixed-reality devices. Eye-tracking modules benefit from integration into smart glasses that assess driver distraction and retail shelf gaze.

Functional magnetic resonance imaging remains indispensable for high-resolution studies of subconscious brand associations, even as budget pressures favor lighter modalities. Wearable biometrics that combine galvanic skin response with photoplethysmography enable continuous emotion tracking during day-long consumer safaris. Emerging brain-sensing earbuds and neuromorphic sensors sit at the frontier, promising hands-free passive data streams that could reshape methodological norms once reliability thresholds are met.

The Neuromarketing Market Report is Segmented by End Users (BFSI, Retail and Consumer Brands, Market Research Agencies, Scientific Institutions, and More), Technology (EEG, Eye Tracking, Biometrics, Facial Coding, FNIRS, and More), Offering (Hardware, Software, and Services), Application (Advertising and Media Testing, Product and Packaging Design, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America commanded 41.20% neuromarketing market share in 2025, reflecting deep venture-capital pools, academic brain-science clusters, and clear privacy guidance. United States funding for neurotechnology reached USD 2.3 billion across 129 deals that year, catalyzing breakthrough sensor designs and AI pipelines. Canada supplements with public grants that encourage cross-border consortia, while Mexico's consumer-goods companies adopt budget-friendly eye-tracking as digital advertising sophistication rises. Acquisition activity, such as Apple's USD 22 million purchase of Datakalab, underscores the region's appetite for embedded neural-analysis capability.

Asia Pacific is growing at a 7.83% CAGR through 2031 and will narrow the regional revenue gap as China, India, Japan, and South Korea integrate neuromarketing into omnichannel retail, gaming, and automotive experiences. Government research grants in China support neuro-AI startups that partner with global brands, while India's direct-to-consumer platforms deploy EEG headbands in usability labs. Cultural norms that emphasize group harmony amplify the impact of social-cognition metrics, motivating local agencies to customize study protocols that capture collectivist cues. Japan's electronics giants and South Korea's entertainment groups pioneer immersive XR laboratories that fuse fNIRS with haptic feedback to refine product launches.

Europe maintains healthy demand anchored by Germany's automotive heritage, France's luxury-goods creativity, and the United Kingdom's media-agency innovation. Stringent GDPR enforcement propels edge-analytics and federated-learning solutions that limit personal-data transfer, positioning European vendors as global benchmarks for ethical neuromarketing. Academic networks such as the Human Brain Project spin off instrumentation advances that flow into commercial offerings. Privacy-focused reputation attracts multinational brands facing rising consumer skepticism, turning compliance sophistication into a revenue catalyst. Long-run opportunities also emerge in South America, the Middle East, and Africa as digital infrastructure accelerates and multinational retailers localize omnichannel strategies.

- The Nielsen Company LLC

- Neurons Inc.

- Immersion Neuroscience Inc.

- NVISO SA

- Cadwell Industries Inc.

- Compumedics Limited

- Merchant Mechanics Inc.

- Neural Sense (Pty) Ltd

- SR Labs SRL

- Synetiq Ltd.

- Mindspeller BV

- MindMetriks LLC

- Uniphore Technologies Inc.

- Tobii AB

- iMotions A/S

- Bitbrain Technologies SL

- Emotiv Inc.

- Shimmer Research Ltd.

- Myndlift Ltd.

- Blackbox Biometrics LLC

- Innerscope Research Inc.

- Eye Square GmbH

- HCL Technologies Limited (Neuromarketing Practice)

- Spark Neuro Inc.

- Affectiva Inc.

- Sensory Logic Inc.

- Neurotrend LLC

- SalesBrain LLC

- NeuroVision Marketing LLC

- Neuro-Insight Pty Ltd

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Need for Advanced Marketing Tools

- 4.2.2 Proliferation of Smartphone-Based Real-Time Experience Tracking

- 4.2.3 AI-Powered Predictive Attention Analytics Adoption

- 4.2.4 Rising Demand for Privacy-Compliant, Opt-In Consumer Insights

- 4.2.5 Integration of Neuromarketing with Immersive XR Platforms

- 4.2.6 Growing Venture Funding in Neurotechnology Start-Ups

- 4.3 Market Restraints

- 4.3.1 High Capital Cost of Gold-Standard Neuroimaging (fMRI)

- 4.3.2 Fragmented Regulatory Landscape and Data Privacy Constraints

- 4.3.3 Shortage of Multidisciplinary Talent

- 4.3.4 Consumer Skepticism over Subconscious Manipulation

- 4.4 Industry Ecosystem Analysis

- 4.5 Regulatory Landscape

- 4.6 Impact of Macroeconomic Factors

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By End Users

- 5.1.1 Banking, Financial Services and Insurance

- 5.1.2 Retail and Consumer Brands

- 5.1.3 Market Research Agencies

- 5.1.4 Scientific Institutions

- 5.1.5 Healthcare and Pharma

- 5.1.6 Other End Users

- 5.2 By Technology

- 5.2.1 Electroencephalography (EEG)

- 5.2.2 Functional Magnetic Resonance Imaging (fMRI)

- 5.2.3 Eye Tracking

- 5.2.4 Biometrics (GSR, Heart Rate)

- 5.2.5 Facial Coding / Emotion AI

- 5.2.6 Functional Near-Infrared Spectroscopy (fNIRS)

- 5.2.7 Other Technologies

- 5.3 By Offering

- 5.3.1 Hardware / Devices

- 5.3.2 Software / Platforms

- 5.3.3 Services

- 5.4 By Application

- 5.4.1 Advertising and Media Testing

- 5.4.2 Product and Packaging Design

- 5.4.3 User Experience and Digital Analytics

- 5.4.4 Retail and In-Store Analytics

- 5.4.5 Pricing Research

- 5.4.6 Political and Social Campaign Testing

- 5.4.7 Other Applications

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 France

- 5.5.3.3 United Kingdom

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Russia

- 5.5.3.7 Rest of Europe

- 5.5.4 Asia Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 India

- 5.5.4.4 South Korea

- 5.5.4.5 Australia and New Zealand

- 5.5.4.6 Rest of Asia Pacific

- 5.5.5 Middle East

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 United Arab Emirates

- 5.5.5.3 Turkey

- 5.5.5.4 Rest of Middle East

- 5.5.6 Africa

- 5.5.6.1 South Africa

- 5.5.6.2 Egypt

- 5.5.6.3 Nigeria

- 5.5.6.4 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 The Nielsen Company LLC

- 6.4.2 Neurons Inc.

- 6.4.3 Immersion Neuroscience Inc.

- 6.4.4 NVISO SA

- 6.4.5 Cadwell Industries Inc.

- 6.4.6 Compumedics Limited

- 6.4.7 Merchant Mechanics Inc.

- 6.4.8 Neural Sense (Pty) Ltd

- 6.4.9 SR Labs SRL

- 6.4.10 Synetiq Ltd.

- 6.4.11 Mindspeller BV

- 6.4.12 MindMetriks LLC

- 6.4.13 Uniphore Technologies Inc.

- 6.4.14 Tobii AB

- 6.4.15 iMotions A/S

- 6.4.16 Bitbrain Technologies SL

- 6.4.17 Emotiv Inc.

- 6.4.18 Shimmer Research Ltd.

- 6.4.19 Myndlift Ltd.

- 6.4.20 Blackbox Biometrics LLC

- 6.4.21 Innerscope Research Inc.

- 6.4.22 Eye Square GmbH

- 6.4.23 HCL Technologies Limited (Neuromarketing Practice)

- 6.4.24 Spark Neuro Inc.

- 6.4.25 Affectiva Inc.

- 6.4.26 Sensory Logic Inc.

- 6.4.27 Neurotrend LLC

- 6.4.28 SalesBrain LLC

- 6.4.29 NeuroVision Marketing LLC

- 6.4.30 Neuro-Insight Pty Ltd

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-Space and Unmet-Need Assessment