PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910583

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910583

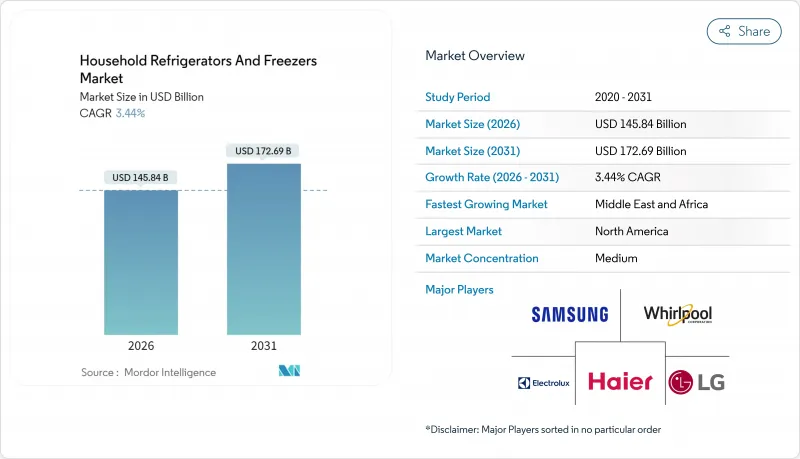

Household Refrigerators And Freezers - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The household refrigerators and freezers market size in 2026 is estimated at USD 145.84 billion, growing from 2025 value of USD 140.99 billion with 2031 projections showing USD 172.69 billion, growing at 3.44% CAGR over 2026-2031.

Energy-efficiency mandates in North America and the European Union, the rapid phase-out of high-GWP refrigerants, and steady urbanization across emerging Asia together underpin this moderate yet durable expansion. Rising demand for smart-connected models, wider adoption of natural refrigerants such as R600a and R290, and ongoing kitchen renovation cycles in mature economies further stimulate premium product uptake. At the same time, semiconductor shortages continue to lengthen production lead times, while elevated electricity tariffs in several developing countries temper replacement cycles. Leading manufacturers are therefore doubling down on in-house component sourcing, building regional factories to shorten supply chains, and intensifying R&D outlays targeting AI-driven food-management functions. These dynamics collectively sustain innovation while supporting incremental value growth throughout the household refrigerators and freezers market.

Global Household Refrigerators And Freezers Market Trends and Insights

Energy-Efficiency Regulations

Mandatory efficiency upgrades are accelerating replacement cycles across mature economies. The U.S. Department of Energy has finalized refrigerator standards taking effect in 2029 and 2030, demanding double-digit percentage cuts in annual energy use. In parallel, the EU's revised F-Gas Regulation bans fluorinated refrigerants in domestic units from January 2026, prompting full conversion to isobutane or propane systems. Leading OEMs have already transitioned to natural gases; GE Appliances finished a multiyear R600a roll-out during 2024, citing 10% efficiency gains and zero ozone-depletion potential. Complementary labelling schemes such as ENERGY STAR now spotlight refrigerant type, nudging consumers toward low-GWP alternatives.

Rising Disposable Income in Emerging Asia

Emerging Asian markets demonstrate robust first-time purchase demand driven by middle-class expansion and urbanization trends. India's refrigerant market, closely tied to appliance penetration, is forecast to grow 6-8% CAGR over the next five years as adoption of low-GWP refrigerants increases alongside appliance ownership. China's government trade-in subsidy program for eight home appliance categories, expanded in January 2025, directly benefits major manufacturers like Haier, which holds an estimated 40-50% share in the domestic refrigeration segment. The region's demand patterns favor larger-capacity units and multi-door configurations, with Chinese consumers increasingly selecting embedded (built-in) designs that command average prices 1.4x conventional models. Regulatory compliance adds complexity, as India's ratification of the Kigali Amendment in 2021 initiated HFC phase-down requirements in 2024, creating opportunities for suppliers like Refex Industries, which supplied 1,370 MT of refrigerants in FY24-25 with partnerships including LG and Voltas.

Semiconductor Supply Volatility

Persistent chip shortages extend refrigerator led times to upward of six months for high-end brands. Thermador notes that every major category, including side-by-side units, remains constrained owing to power-management IC and microcontroller gaps. The impact extends beyond premium brands, as semiconductors and electronic components are integral to modern refrigeration systems' energy efficiency and smart features. India's air conditioning market, which shares component supply chains with refrigeration, faces component shortages that may increase unit prices by USD 18-24 (Rs 1,500-2,000) (4-5%), with compressor shortages and BIS certification delays adding USD 12 -14.50 (Rs 1,000-1,200) per unit. Chinese manufacturers are responding through supply chain diversification, with Haier expanding to 143 global manufacturing centers and Midea operating over 40 major production bases to mitigate logistics and trade risks.

Other drivers and restraints analyzed in the detailed report include:

- Urban Housing Growth & Kitchen Renovations

- Omnichannel Retail Expansion

- High Electricity Tariffs

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Top-freezer units accounted for 42.79% of the household refrigerators and freezers market share in 2025, anchoring sales through their price advantage and compact footprint. Yet the French-door sub-segment is forecast to register the highest 8.37% CAGR through 2031 as consumers gravitate toward spacious interiors, wide shelves, and advanced climate zones. Samsung's 2025 Bespoke AI French-door portfolio integrates hybrid compressor-Peltier cooling and Food Recognition Vision software, a combination that elevates perceived value while meeting forthcoming energy benchmarks. Side-by-side configurations remain popular in North America for their balanced fresh-to-frozen ratio, whereas bottom-freezer models gain traction among wellness-focused buyers prioritizing eye-level produce access. Innovation now targets wall-thickness reduction; Whirlpool's SlimTech vacuum insulation trims cabinet walls by 66% and boosts interior volume by 25%, directly addressing urban space constraints. Growing demand for integrated kitchens further favors multi-door units that blend seamlessly with cabinetry, broadening premium opportunities within the household refrigerators and freezers market.

Second-tier trends include connectivity adoption and antimicrobial interiors. LG's door-in-door "knock" panels let users preview contents, cutting cold-air loss and lowering annual consumption, while built-in UV-C modules promise odor and germ suppression. Chinese retail analytics show that multi-door styles surpassed 58% online share in 2024H1, reinforcing a global pivot toward compartmentalized layouts. Manufacturers are therefore segmenting lines by lifestyle themes, family, wellness, and urban loft to command higher margins. These multifaceted design shifts collectively underpin the French-door segment's outsize contribution to household refrigerators and freezers market size expansion through 2031.

The Household Refrigerators and Freezers Market Report is Segmented by Type (Top-Freezer Refrigerators, Bottom-Freezer Refrigerators, Side-By-Side Refrigerators, French Door Refrigerators), Capacity (Less Than 300 Litres, 300 - 500 Litres, Greater Than 500 Litres), Distribution Channel (Multi-Branded Stores, and Other), and Geography (North America and Other). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America led revenue with a 31.05% household refrigerators and freezers market share in 2025, sustained by near-saturated ownership, brisk replacement cycles, and demand for smart features. Samsung and LG both prioritized the U.S.-built-in segment, leveraging Dacor and Signature Kitchen Suite, respectively, to secure builder partnerships and achieve double-digit premium growth. GE Appliances committed USD 3 billion through 2029 to expand fridge output across 11 domestic plants, underlining continued reshoring momentum. Although the region's 3.74% CAGR trails global averages, steady price-mix gains keep it the largest profit pool in the household refrigerators and freezers market. APAC delivers the fastest 6.32% CAGR, propelled by urbanization, first-time purchasing, and local manufacturing investments. China shipped 4.48 billion home appliances in 2024, up 20.8% year-on-year, reflecting export diversification and domestic subsidy schemes. India's appliances segment, still at low per-capita penetration, benefits from an expanding middle class even as component shortages nudge prices higher. Regional regulations favor natural refrigerants; India's Kigali-based HFC phase-down fosters uptake of R290 in mid-capacity models, reinforcing climate alignment.

Europe faces moderate growth at a 2.84% CAGR amid challenging economic conditions and regulatory transitions that increase compliance costs while driving innovation. The EU F-gas Regulation's January 2026 prohibition on fluorinated greenhouse gases in domestic refrigerators creates immediate transition pressure, though manufacturers like BSH have invested heavily in compliance, including a new refrigeration factory in Mexico and enhanced R&D spending approaching €850 million (USD 918 million). European industry associations emphasize competitiveness challenges from fragmented regulations, high electricity costs 2-3x US levels, and supply chain concentration for critical materials. The Middle East & Africa region exhibits the fastest forecast growth at 6.87% CAGR, supported by strategic investments like Sharp's USD 30 million joint venture in Egypt and Haier's 26.8% revenue growth in the region, driven by localized production and products adapted to unreliable power infrastructure.

- Whirlpool Corp.

- Haier Smart Home Co.

- LG Electronics Inc.

- Samsung Electronics Co.

- Electrolux AB

- Panasonic Corp.

- Bosch-Siemens Hausgerate GmbH

- Midea Group

- Hisense Co.

- Hitachi Global Life Solutions

- GE Appliances (Haier)

- Liebherr-Hausgerate

- Sub-Zero Group

- Arcelik A.S. (Beko, Grundig)

- Godrej Appliances

- Sharp Corp.

- TCL Technology

- P.C. Richard & Son (private label)

- Glen Dimplex (Home Appliances)

- SMEs & Local Players (collective)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Mainstream Energy-efficiency Regulations

- 4.2.2 Rising Disposable Income in Emerging Asia

- 4.2.3 Urban Housing Growth & Kitchen Renovations

- 4.2.4 Omnichannel Retail Expansion

- 4.2.5 Under-the-Radar Carbon-Neutral Refrigerant Adoption

- 4.2.6 AI-Enabled Predictive Maintenance for Compressors

- 4.3 Market Restraints

- 4.3.1 Supply-Chain Volatility for Semiconductors

- 4.3.2 High Electricity Tariffs in Developing Nations

- 4.3.3 Rare-Earth Magnet Price Shocks

- 4.3.4 Growing Second-Hand Appliance Market Online

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Bargaining Power of Buyers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 Market Size & Growth Forecasts

- 5.1 By Type

- 5.1.1 Top-freezer Refrigerators

- 5.1.2 Bottom-freezer Refrigerators

- 5.1.3 Side-by-Side Refrigerators

- 5.1.4 French Door Refrigerators

- 5.2 By Capacity

- 5.2.1 Less than 300 Litres

- 5.2.2 300 - 500 Liters

- 5.2.3 Greater than 500 Liters

- 5.3 By Distribution Channel

- 5.3.1 Multi-branded Stores

- 5.3.2 Specialty Stores

- 5.3.3 Online

- 5.3.4 Other Distribution Channels

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 South America

- 5.4.2.1 Brazil

- 5.4.2.2 Peru

- 5.4.2.3 Chile

- 5.4.2.4 Argentina

- 5.4.2.5 Rest of South America

- 5.4.3 Europe

- 5.4.3.1 United Kingdom

- 5.4.3.2 Germany

- 5.4.3.3 France

- 5.4.3.4 Spain

- 5.4.3.5 Italy

- 5.4.3.6 BENELUX (Belgium, Netherlands, Luxembourg)

- 5.4.3.7 NORDICS (Denmark, Finland, Iceland, Norway, Sweden)

- 5.4.3.8 Rest of Europe

- 5.4.4 APAC

- 5.4.4.1 China

- 5.4.4.2 India

- 5.4.4.3 Japan

- 5.4.4.4 South Korea

- 5.4.4.5 Australia

- 5.4.4.6 South-East Asia (Singapore, Malaysia, Thailand, Indonesia, Vietnam, Philippines)

- 5.4.4.7 Rest of Asia-Pacific

- 5.4.5 Middle East & Africa

- 5.4.5.1 United Arab Emirates

- 5.4.5.2 Saudi Arabia

- 5.4.5.3 South Africa

- 5.4.5.4 Nigeria

- 5.4.5.5 Rest of Middle East & Africa

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 Whirlpool Corp.

- 6.4.2 Haier Smart Home Co.

- 6.4.3 LG Electronics Inc.

- 6.4.4 Samsung Electronics Co.

- 6.4.5 Electrolux AB

- 6.4.6 Panasonic Corp.

- 6.4.7 Bosch-Siemens Hausgerate GmbH

- 6.4.8 Midea Group

- 6.4.9 Hisense Co.

- 6.4.10 Hitachi Global Life Solutions

- 6.4.11 GE Appliances (Haier)

- 6.4.12 Liebherr-Hausgerate

- 6.4.13 Sub-Zero Group

- 6.4.14 Arcelik A.S. (Beko, Grundig)

- 6.4.15 Godrej Appliances

- 6.4.16 Sharp Corp.

- 6.4.17 TCL Technology

- 6.4.18 P.C. Richard & Son (private label)

- 6.4.19 Glen Dimplex (Home Appliances)

- 6.4.20 SMEs & Local Players (collective)

7 Market Opportunities & Future Outlook

- 7.1 Connected-Home Interoperability Platforms

- 7.2 Circular-Economy Certified Refurbishment Programs