PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910589

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910589

Europe Online Travel - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

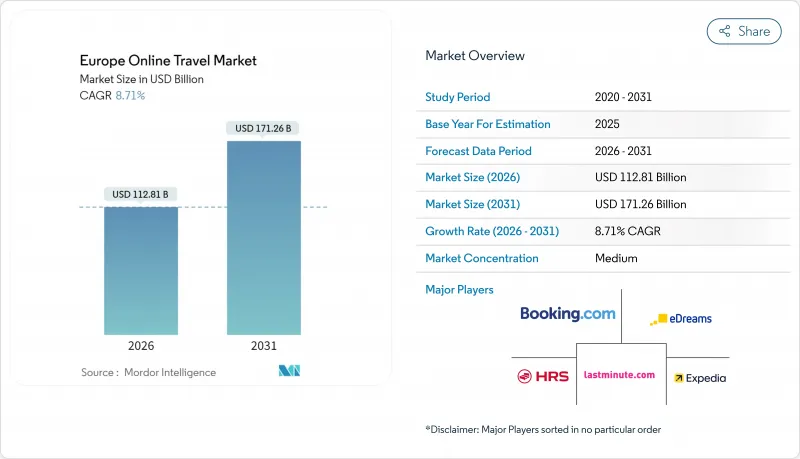

The Europe online travel market was valued at USD 103.78 billion in 2025 and estimated to grow from USD 112.81 billion in 2026 to reach USD 171.26 billion by 2031, at a CAGR of 8.71% during the forecast period (2026-2031).

This expansion is powered by post-pandemic rebound in intra-European and long-haul tourism, intensifying mobile-first booking behaviours, and regulatory catalysts such as the forthcoming EU Digital Identity Wallet that promises one-click authentication across borders. Heightened airline adoption of New Distribution Capability (NDC) protocols is redistributing pricing power toward carriers, while generative-AI trip-planning tools funnel search intent directly into bookable inventory, shortening the booking funnel for both consumers and suppliers. Competitive dynamics remain moderate because the top five companies hold just 48.9% of revenue, leaving ample space for differentiated entrants specializing in sustainable travel, multimodal transport, and hyper-localized experiences. Meanwhile, spiralling traffic-acquisition costs driven by the Digital Markets Act force leading OTAs to rethink marketing mixes, emphasizing loyalty ecosystems and subscription programs over purely search-driven growth. Taken together, these macro forces establish a resilient demand base for the Europe online travel market despite regulatory headwinds and intensifying supplier-direct campaigns.

Europe Online Travel Market Trends and Insights

Post-pandemic tourism rebound

France welcomed more than 100 million international visitors in 2024, surpassing pre-crisis highs and setting a benchmark for the Europe online travel market. Spain followed suit with 94 million foreign arrivals, a surge that lifted travel receipts and fueled online booking demand, particularly for higher-yield long-haul segments originating in North America. UK-bound inbound tourism reached record spending levels, reinforcing demand for dynamic packaging services that combine flights, hotels, and rail. Long-haul markets such as China demonstrated 40% growth in nights spent in France, signalling renewed appetite for European itineraries despite revenue remaining below 2019 benchmarks. Business travel remains subdued, but hybrid leisure-business (bleisure) itineraries are rising, causing suppliers to revamp loyalty programs around extended-stay rewards. The rebound underscores a structural pivot toward flexible digital channels as travelers prioritize real-time availability over traditional agency visits.

Mobile booking penetration

Mobile devices manage a growing share of transactions as European consumers integrate digital wallets and contactless payments into everyday life. Nordic countries, where mobile wallet usage exceeds 75%, illustrate how seamless payments accelerate app conversion rates. Booking Holdings reported double-digit mobile booking growth after deploying micro-personalization features that adjust inventory display to user context. Rail-first app Trainline now accounts for most European rail bookings, demonstrating how frictionless mobile UX can unlock highly fragmented transport markets. App-first challenger Omio launched Flex across continental markets, allowing travelers to change itineraries post-purchase, reinforcing the appeal of mobile-centric flexibility. Payment-method diversity from Apple Pay in Germany to Bizum in Spain compels platforms to localize checkout, driving further investment into payment orchestration middleware.

Digital Markets Act costs

The Digital Markets Act designates major OTAs as "gatekeepers," subjecting them to new self-preferencing and data-sharing rules that diminish organic search visibility and raise paid marketing costs . Booking.com's removal of rate-parity clauses exemplifies shifts hitting commission models and net margins. Meta-search engines like Skyscanner gain short-term advantage because diversified traffic sources dilute dependence on Google. Yet compliance complexity may entrench larger incumbents that can absorb additional legal and technical overhead, raising barriers for smaller rivals. Across Europe, class-action litigation against OTA pricing practices intensifies, adding incremental risk. Higher CAC pressures force OTAs to deepen loyalty programs, invest in brand media, and experiment with membership plans to stabilize repeat bookings.

Other drivers and restraints analyzed in the detailed report include:

- EU Digital Identity Wallet

- Generative-AI trip-planning bots

- Supplier-direct campaigns

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Transportation ranked first with 29.78% Europe online travel market share in 2025 as rail, aviation, and intercity bus operators scaled API connectivity and dynamic pricing engines. Vacation packages, although smaller, are predicted to deliver a 11.86% CAGR, signalling consumer appetite for curated, hassle-free experiences that bundle mobility with lodging and activities. The Europe online travel market size for transportation continues to benefit from continent-wide rail liberalization and highway toll digitization that unlock real-time inventory for third-party platforms. Meanwhile, the package segment attracts funding for software-defined tour operators able to compose flights, hotels, and experiences in milliseconds. Suppliers capitalize on this growth by integrating channel-agnostic APIs, enabling OTAs to sell dynamically priced packages complete with flexible cancellation policies. Overall, service-type diversification mitigates risk against cyclicality in any single travel vertical and encourages cross-sell strategies that boost contribution margins. Over the forecast window, experiences and ancillaries are expected to lift share within "Other Service Types," leveraging hotel concierges equipped with in-destination activity platforms like Turneo.

The transportation segment's primacy reflects Europe's dense multimodal infrastructure, but vacation packages' superior growth trajectory points to rising demand for convenience amid complex itineraries. Consumers increasingly value one-stop shopping that simplifies visa checks, seat assignments, and travel insurance, propelling conversion rates on OTA "packages tabs." Airlines partner with rail operators through initiatives like Eurostar's SkyTeam membership to extend network breadth without fleet expansion, thus supporting seamless ground-air itineraries. API-first property managers such as limehome expand across secondary cities, supplying inventory that feeds into dynamic packages and increasing geographic coverage for non-urban tourism. Technology vendors upgrade orchestration layers to assemble multi-sector bookings in real time, lowering package creation time from minutes to milliseconds. Consequently, platforms that master automated bundling gain a defensible moat as they cut complexity for both traveler and supplier. These shifts collectively reinforce the package category's rapid expansion in the Europe online travel market.

The Europe Online Travel Market Report is Segmented by Service Type (Transportation, Travel Accommodation, Vacation Packages, Other Service Types), Booking Type (Online Travel Agencies, Direct Travel Suppliers), Platform (Desktop, Mobile), and Geography (United Kingdom, Germany, France, Spain, Italy, BENELUX, NORDICS, Rest of Europe). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Booking Holdings Inc.

- Expedia Group Inc.

- Trip.com Group Ltd.

- eDreams ODIGEO

- lastminute.com Group

- TUI Group

- Airbnb Inc.

- Trivago N.V.

- Trainline PLC

- Flix SE (FlixBus/FlixTrain)

- Hostelworld Group PLC

- Skyscanner Ltd.

- Ryanair Holdings PLC

- easyJet PLC

- Deutsche Lufthansa AG

- Eurostar Group

- HRS Group

- Amadeus IT Group SA

- Sabre Corp.

- Travelport Worldwide Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Table of Contents - Europe Online Travel Market

2 Introduction

- 2.1 Study Assumptions & Market Definition

- 2.2 Scope of the Study

3 Research Methodology

4 Executive Summary

5 Market Landscape

- 5.1 Market Overview

- 5.2 Market Drivers

- 5.2.1 Post-pandemic rebound in intra-European and long-haul tourism

- 5.2.2 Surge in mobile booking penetration and in-app payment adoption

- 5.2.3 EU Digital Identity Wallet enabling one-click checkout

- 5.2.4 Generative-AI trip-planning bots shifting intent directly into bookings

- 5.2.5 Liberalised high-speed rail & multimodal ticketing APIs widen online transport inventory

- 5.2.6 Lifestyle & hybrid hotel formats using API-first distribution

- 5.3 Market Restraints

- 5.3.1 EU Digital Markets Act (DMA) raises traffic-acquisition costs for OTAs

- 5.3.2 Supplier-direct campaigns compress OTA commission margins

- 5.3.3 NDC fragmentation increases integration & servicing costs

- 5.3.4 Stricter carbon-reporting rules dampen discretionary air travel

- 5.4 Value / Supply-Chain Analysis

- 5.5 Regulatory Landscape

- 5.6 Technological Outlook

- 5.7 Porter's Five Forces

- 5.7.1 Threat of New Entrants

- 5.7.2 Bargaining Power of Suppliers

- 5.7.3 Bargaining Power of Buyers

- 5.7.4 Threat of Substitutes

- 5.7.5 Industry Rivalry

6 Market Size & Growth Forecasts

- 6.1 By Service Type

- 6.1.1 Transportation

- 6.1.2 Travel Accommodation

- 6.1.3 Vacation Packages

- 6.1.4 Other Service Types

- 6.2 By Booking Type

- 6.2.1 Online Travel Agencies

- 6.2.2 Direct Travel Suppliers

- 6.3 By Platform

- 6.3.1 Desktop

- 6.3.2 Mobile

- 6.4 By Geography

- 6.4.1 United Kingdom

- 6.4.2 Germany

- 6.4.3 France

- 6.4.4 Spain

- 6.4.5 Italy

- 6.4.6 BENELUX (Belgium, Netherlands, Luxembourg)

- 6.4.7 NORDICS (Denmark, Finland, Iceland, Norway, Sweden)

- 6.4.8 Rest of Europe

7 Competitive Landscape

- 7.1 Market Concentration

- 7.2 Strategic Moves

- 7.3 Market Share Analysis

- 7.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 7.4.1 Booking Holdings Inc.

- 7.4.2 Expedia Group Inc.

- 7.4.3 Trip.com Group Ltd.

- 7.4.4 eDreams ODIGEO

- 7.4.5 lastminute.com Group

- 7.4.6 TUI Group

- 7.4.7 Airbnb Inc.

- 7.4.8 Trivago N.V.

- 7.4.9 Trainline PLC

- 7.4.10 Flix SE (FlixBus/FlixTrain)

- 7.4.11 Hostelworld Group PLC

- 7.4.12 Skyscanner Ltd.

- 7.4.13 Ryanair Holdings PLC

- 7.4.14 easyJet PLC

- 7.4.15 Deutsche Lufthansa AG

- 7.4.16 Eurostar Group

- 7.4.17 HRS Group

- 7.4.18 Amadeus IT Group SA

- 7.4.19 Sabre Corp.

- 7.4.20 Travelport Worldwide Ltd.

8 Market Opportunities & Future Outlook

- 8.1 Rise of EU Digital Identity-enabled frictionless cross-border bookings

- 8.2 Hyper-personalised dynamic packaging via Gen-AI boosts ancillary revenue