PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910593

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910593

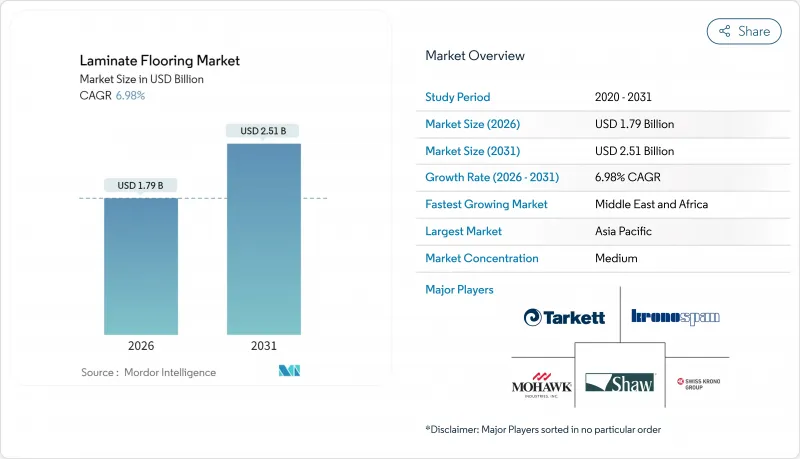

Laminate Flooring - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Laminate Flooring Market was valued at USD 1.67 billion in 2025 and estimated to grow from USD 1.79 billion in 2026 to reach USD 2.51 billion by 2031, at a CAGR of 6.98% during the forecast period (2026-2031).

Momentum stems from post-pandemic home renovation, accelerating urban housing starts in Asia-Pacific, and stricter formaldehyde regulations that spur safer formulations. Technology is widening end-use possibilities through water-resistant cores and click-lock systems that cut installation labor, a key advantage over hardwood and ceramic tile alternatives. Competition is intensifying as luxury vinyl players invest in capacity, yet laminate retains a compelling cost profile while replicating natural textures more convincingly than before. Margins remain sensitive to HDF and MDF input prices, but vertical integration among leading mills partially offsets volatility.

Global Laminate Flooring Market Trends and Insights

Surge in Residential Renovation Activities Post-COVID

Global lockdowns reoriented consumer spending toward home upgrades, causing a sharp rise in flooring replacements that persists even as economies reopen. Houzz's 2024 survey showed 67% of homeowners undertook major flooring projects, and laminate won share by combining low install cost with realistic wood visuals. Renovation projects dominate mature markets because aging housing stock requires refreshes more frequently than new builds, boosting volumes in the United States, Canada, Germany, and Japan. Remote work trends keep the spotlight on home offices, directing demand toward durable surfaces that resist chair scuffs and coffee spills better than carpet. DIY chains reported elevated flooring sales throughout 2024, and Home Depot confirmed continuing strength into early 2025. Manufacturers responded with simplified click-systems that allow weekend installation without professional crews, reinforcing laminate's renovation appeal.

Cost Competitiveness Versus Hardwood Flooring

Laminate's installed cost runs roughly 50% below hardwood, a spread that widens when lumber prices spike, prompting thrifty buyers to switch materials during volatile periods. Engineered overlays eliminate the need for refinishing, lowering lifetime expense and positioning laminate as a value-engineered solution for rental properties and first-time homeowners. Recent texturing advances replicate hand-scraped oak or hickory finishes convincingly, reducing the aesthetic compromise that once deterred premium buyers. Builders increasingly use laminate in model homes to control budgets without sacrificing curb appeal, and this practice cascades to buyer upgrades once a project scales. Retailers highlight the value gap in marketing messages, amplifying consumer awareness of price advantages. The economic appeal extends to emerging markets where purchasing power remains constrained, fuelling adoption in India, Indonesia, and Brazil.

Volatility in HDF/MDF Raw-Material Prices

Fibreboard accounts for roughly 65% of laminate production cost, so swings in woodchip and resin inputs quickly erode margins during supply shocks. German indices showed 15-20% HDF inflation during 2024, compelling mills to execute multiple price hikes that strained distributor relationships. Smaller converters lacking captive panel mills faced greater pressure, occasionally exiting unprofitable contracts. Energy price fluctuations magnify the risk because fiberboard production is heat-intensive, tying costs to natural gas and electricity tariffs. Compliance with CARB Phase 2 and EU limits on formaldehyde content adds resin complexity and cost that cannot always be passed downstream. Manufacturers hedge through multi-year fiber contracts and in-house resin facilities, but such strategies require capital that many regional players lack.

Other drivers and restraints analyzed in the detailed report include:

- Rapid Urbanization & Housing Demand in Asia-Pacific

- Technological Advances in Water-Resistant Laminates

- Growing Popularity of Luxury Vinyl Tiles (LVT)

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

HDF-based planks commanded 63.61% of laminate flooring market share in 2025 due to superior density that resists indentation during daily traffic. MDF alternatives, however, are increasing at a 7.11% CAGR, capitalizing on lighter weight that eases handling for DIY installers. The laminate flooring market size for MDF substrates is projected to expand from USD 0.65 billion in 2026 to USD 0.92 billion by 2031 as improved emboss-in-register technology delivers highly realistic textures. Suppliers position HDF products at premium price points while MDF lines target value channels, enabling portfolio segmentation without cannibalization. Innovations in moisture-resistant additives blur the historical performance gap, encouraging specifiers to accept MDF in moderate-duty commercial jobs. Panel producers integrate recycled wood fibers to meet carbon goals, yet mechanical properties still meet EN 13329 wear ratings. Sector rivalry is expected to intensify as Asian mills scale MDF output, lowering unit cost and amplifying price competition globally.

Demand dynamics vary regionally, with North America continuing to favor high-density cores for resilience against seasonal humidity swings, while Europe leans toward MDF's sustainability narrative. Marketing campaigns highlight acoustic improvements possible through lower-density boards paired with underlay, a feature attracting multifamily developers seeking noise mitigation. Trade tariffs on Chinese HDF push importers to diversify sourcing from Vietnam and Brazil, inadvertently boosting MDF acceptance where availability proves steadier. Brands such as Kronospan and Swiss Krono showcase hybrid constructions that gradient density across the plank, merging HDF surface durability with MDF affordability. Future innovation may explore bio-based resins to further cut emissions without sacrificing performance. Buyers will ultimately balance price, stability, and perceived quality when selecting substrate types.

The Laminate Flooring Market Report is Segmented by Product Type (High-Density Fiberboard, Medium-Density Fiberboard), Application (Residential, Commercial), Construction (New Construction, Renovation/Replacement), and Geography (North America, South America, Europe, Asia-Pacific, Middle East & Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific commanded 37.95% of global revenue in 2025 on the back of large-scale residential construction in China and India, and the region is projected to post a 6.55% CAGR through 2031. Chinese urban renewal continues, with county-level cities redeveloping obsolete housing blocks that require cost-effective interiors like laminate. India's PMAY-Urban scheme subsidizes low-income flats that specify laminate to balance the budget with consumer expectations for wood aesthetics. Southeast Asian markets, including Vietnam and the Philippines, witness rising middle-class consumption, driving organized retail of flooring products and increasing brand awareness. Regulatory diversity across the region necessitates tailored emission compliance, prompting global manufacturers to set up localized testing labs.

Middle East & Africa, though smaller today, is the fastest-growing territory at 6.82% CAGR as megaprojects proliferate in Saudi Arabia, Egypt, and the Gulf Cooperation Council. Developers prioritize speed and cost certainty; laminate delivers both attributes alongside visuals suited to modern architectural themes. Import dependency remains high, so distributors stock broader SKU assortments to limit lead-time risk amid shipping volatility. Currency swings can destabilize landed cost, encouraging regional production; Kronospan's feasibility study for a Middle East panel plant illustrates this pivot. Consumer education is underway as retailers host installation workshops to familiarize contractors with click-lock techniques suitable for local labor pools. North America grows at a steady 5.05% CAGR, propelled by persistent home improvement and a backlog of office conversions sparked by hybrid work arrangements. U.S. tariffs on Chinese panels raise domestic production volumes, and Mohawk's USD 87 million expansion in North Carolina exemplifies reshoring trends.

European demand advances despite construction downturns in France and Germany, as robust DIY cultures and energy-retrofit incentives fuel flooring upgrades. EU circular-economy directives elevate interest in products with verified recyclability, encouraging mills to adopt bio-based binders and take-back programs. Anti-dumping duties on Chinese plywood indirectly shield regional laminate mills by reducing price competition from alternative wood panels. Eastern European countries, notably Poland and Romania, emerge as export hubs due to competitive labor costs and central logistics. South America trails with 3.95% CAGR amid economic volatility, yet Brazil's Minha Casa Minha Vida social-housing initiative adds baseline volume for cost-efficient laminate. Currency depreciation elevates import costs, stimulating local production by firms such as Duratex.

- Mohawk Industries

- Tarkett S.A.

- Shaw Industries Group Inc.

- Kronospan Holdings Ltd.

- Swiss Krono Group

- Armstrong Flooring, Inc.

- Mannington Mills, Inc.

- BerryAlloc NV

- Egger Group

- Classen Group

- Kaindl Flooring GmbH

- Faus Group

- Pergo (Unilin)

- Alsafloor

- Beaulieu International Group

- Nature Home Holding Co.

- Der International

- Formica Group

- Quick-Step Flooring

- Milliken & Company

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surge in residential renovation activities post-COVID

- 4.2.2 Cost competitiveness versus hardwood flooring

- 4.2.3 Rapid urbanization & housing demand in APAC

- 4.2.4 Technological advances in water-resistant laminates

- 4.2.5 Rise of DIY e-commerce flooring kits

- 4.2.6 EU circular-economy certifications for public projects

- 4.3 Market Restraints

- 4.3.1 Volatility in HDF/MDF raw-material prices

- 4.3.2 Growing popularity of luxury vinyl tiles (LVT)

- 4.3.3 Stricter formaldehyde-emission regulations

- 4.3.4 Resin-additive supply-chain disruptions

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Industry Rivalry

5 Market Size & Growth Forecasts

- 5.1 By Product Type

- 5.1.1 High-Density Fiberboard Laminated Flooring

- 5.1.2 Medium-Density Fiberboard Laminated Flooring

- 5.2 By Application

- 5.2.1 Residential

- 5.2.2 Commercial

- 5.3 By Construction

- 5.3.1 New Construction

- 5.3.2 Renovation / Replacement

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 South America

- 5.4.2.1 Brazil

- 5.4.2.2 Argentina

- 5.4.2.3 Peru

- 5.4.2.4 Chile

- 5.4.2.5 Rest of South America

- 5.4.3 Europe

- 5.4.3.1 United Kingdom

- 5.4.3.2 Germany

- 5.4.3.3 France

- 5.4.3.4 Spain

- 5.4.3.5 Italy

- 5.4.3.6 BENELUX (Belgium, Netherlands, Luxembourg)

- 5.4.3.7 NORDICS (Denmark, Finland, Iceland, Norway, Sweden)

- 5.4.3.8 Rest of Europe

- 5.4.4 Asia-Pacific

- 5.4.4.1 China

- 5.4.4.2 India

- 5.4.4.3 Japan

- 5.4.4.4 South Korea

- 5.4.4.5 Australia

- 5.4.4.6 South-East Asia (Singapore, Malaysia, Thailand, Indonesia, Vietnam, Philippines)

- 5.4.4.7 Rest of Asia-Pacific

- 5.4.5 Middle East & Africa

- 5.4.5.1 United Arab Emirates

- 5.4.5.2 Saudi Arabia

- 5.4.5.3 South Africa

- 5.4.5.4 Nigeria

- 5.4.5.5 Rest of Middle East & Africa

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products & Services, Recent Developments)

- 6.4.1 Mohawk Industries

- 6.4.2 Tarkett S.A.

- 6.4.3 Shaw Industries Group Inc.

- 6.4.4 Kronospan Holdings Ltd.

- 6.4.5 Swiss Krono Group

- 6.4.6 Armstrong Flooring, Inc.

- 6.4.7 Mannington Mills, Inc.

- 6.4.8 BerryAlloc NV

- 6.4.9 Egger Group

- 6.4.10 Classen Group

- 6.4.11 Kaindl Flooring GmbH

- 6.4.12 Faus Group

- 6.4.13 Pergo (Unilin)

- 6.4.14 Alsafloor

- 6.4.15 Beaulieu International Group

- 6.4.16 Nature Home Holding Co.

- 6.4.17 Der International

- 6.4.18 Formica Group

- 6.4.19 Quick-Step Flooring

- 6.4.20 Milliken & Company

7 Market Opportunities & Future Outlook

- 7.1 Bio-based zero-VOC laminate formulations

- 7.2 Rental-oriented modular click-lock panels