PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910595

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910595

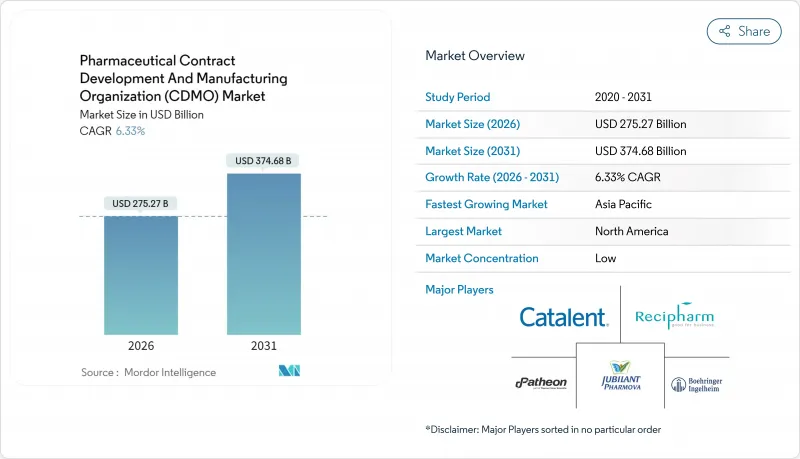

Pharmaceutical Contract Development And Manufacturing Organization (CDMO) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Pharmaceutical contract development and manufacturing organization (CDMO) market is expected to grow from USD 258.88 billion in 2025 to USD 275.27 billion in 2026 and is forecast to reach USD 374.68 billion by 2031 at 6.33% CAGR over 2026-2031.

Robust outsourcing demand for complex biologics, the rise of high-potency APIs (HPAPIs), and artificial-intelligence-enabled-enabled process-development platforms underpin this trajectory. Peptide-based GLP-1 therapies, expanding vaccine programs, and sustained investment in digitally connected plants further amplify the need for specialist partners able to absorb capital and regulatory risks. North American innovators continue to anchor high-value biologics and gene-therapy work, while Asia-Pacific cost advantages accelerate capacity expansion. Consolidation-typified by Novo Holdings' USD 16.5 billion purchase of Catalent-signals a decisive shift toward end-to-end providers that combine development, scale-up, and commercial production.

Global Pharmaceutical Contract Development And Manufacturing Organization (CDMO) Market Trends and Insights

Increasing Outsourcing Volume by Large Pharmaceutical Companies

Escalating R&D costs and pipeline complexity drive pharmaceutical majors to off-load non-core manufacturing. Asset-light models free capital for discovery while leveraging CDMO expertise to maintain global supply continuity. Lonza's USD 1.2 billion Vacaville site purchase from Roche underpins this transition, adding 330,000 L of biologics capacity to support blockbuster antibody demand. Outsourcing is most intense for sterile biologics and gene-editing therapies, where regulatory rigor and technical barriers heighten the value of specialist partners.

Surge in Biologics and Complex-Molecule Pipelines

Biological entities now dominate new-drug filings, propelled by antibody-drug conjugates, mRNA vaccines, and cell-based therapeutics. Samsung Biologics secured USD 1.4 billion in new 2024 contracts and is expanding antibody-drug-conjugate suites, illustrating spiraling demand for cGMP biologics supply . Biologics' stringent cold-chain, contamination-control, and analytics requirements solidify a preference for full-scope CDMOs with proven regulatory track records.

Stringent Multi-Region Regulatory Requirements

Divergent dossiers and rolling updates such as the European Medicines Agency's new fee rules raise compliance budgets and prolong variation lead times EMA. CDMOs must operate duplicate quality-management systems and align data-integrity protocols across FDA, EMA, and PMDA audits, challenging smaller entrants.

Other drivers and restraints analyzed in the detailed report include:

- Cost and Speed Advantage of Manufacturing in Emerging Markets

- Consolidation Toward One-Stop CDMOs

- High Capex for Sterile Biologics Suites

For complete list of drivers and restraints, kindly check the Table Of Contents.

Geography Analysis

North America retained 37.95% revenue share in 2025, buoyed by premier biologics programs, FDA Orphan-Drug incentives, and a deep venture-capital pool. The United States sustains premium pricing as cGMP compliance costs and stringent data-integrity audits elevate barriers to entry. Canada benefits from free-trade access and skilled resources, whereas Mexico lures secondary packaging and regional solid-oral projects. Thermo Fisher's USD 4.1 billion filtration-business acquisition reinforces North American vertical-integration strategies.Asia-Pacific logs the fastest 7.18% CAGR through 2031. China and South Korea bankroll mega-plants for mAbs and oligonucleotides, though geopolitical risk nudges US sponsors toward India and Southeast Asia. The Pharmaceutical contract development and manufacturing organization (CDMO) market size in India alone could surpass USD 22 billion by 2035, aided by PLI incentives and harmonized quality standards.Samsung Biologics' fourth plant, topping 600,000 L, cements Incheon as the world's largest single-site biologics hub. Australia leverages expedited regulatory pathways for early-phase oncology and cell-therapy trials.

Europe presents steady expansion anchored in quality leadership. Germany's continuous-manufacturing clusters and the United Kingdom's advanced-therapy corridor offset Brexit friction through mutual-recognition waivers. The EMA's updated variation fees raise short-term compliance costs but assure global sponsors of consistent review rigor. Eastern Europe gains traction as an overflow destination for solid-oral generics and secondary packaging. Sustainability regulations incentivize solvent-recovery units and low-energy lyophilization, driving process innovation.

- Thermo Fisher Scientific Inc. (Patheon)

- Lonza Group

- Catalent Inc.

- Samsung Biologics Co. Ltd.

- WuXi AppTec Inc.

- Recipharm AB

- Jubilant Pharmova Ltd.

- Boehringer Ingelheim Group

- Pfizer CentreOne

- Aenova Holding GmbH

- Fujifilm Diosynth Biotechnologies

- Baxter BioPharma Solutions

- Corden Pharma GmbH

- AbbVie Contract Manufacturing

- Cambrex Corporation

- Syneos Health Inc.

- IQVIA Holdings Inc.

- Labcorp Drug Development

- PAREXEL International Corporation

- ICON PLC

- Charles River Laboratories International Inc.

- Eurofins Scientific SE

- SGS Life Science Services SA

- CMIC Holdings Co. Ltd

- Novotech Pty Ltd

- Hangzhou Tigermed Consulting Co. Ltd

- Samsung Bioepis Co. Ltd

- Tesa Labtec GmbH (TESA SE)

- Tapemark

- Famar SA

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing outsourcing volume by large pharmaceutical companies

- 4.2.2 Surge in biologics and complex-molecule pipelines

- 4.2.3 Cost- and speed-advantage of manufacturing in emerging markets

- 4.2.4 Consolidation toward end-to-end one-stop CDMOs

- 4.2.5 AI-enabled rapid process-development platforms

- 4.2.6 GLP-1 and peptide HPAPI capacity build-outs

- 4.3 Market Restraints

- 4.3.1 Stringent multi-region regulatory requirements

- 4.3.2 Capacity-utilization and lead-time risk

- 4.3.3 High capex for sterile biologics suites

- 4.3.4 Scarcity of skilled aseptic-manufacturing talent

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.6.1 Dosage-formulation technologies

- 4.6.2 3D printing applications in OSD

- 4.6.3 Continuous-manufacturing adoption

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

- 4.8 Investment and Funding Landscape

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Service Type

- 5.1.1 API Manufacturing

- 5.1.1.1 Small Molecule

- 5.1.1.2 Large Molecule

- 5.1.1.3 High-Potency (HPAPI)

- 5.1.2 FDF Development and Manufacturing

- 5.1.2.1 Solid Dose

- 5.1.2.2 Liquid Dose

- 5.1.2.3 Injectable Dose

- 5.1.3 Secondary Packaging

- 5.1.1 API Manufacturing

- 5.2 By Molecule Type

- 5.2.1 Small Molecule

- 5.2.2 Large Molecule (Biologics and Biosimilars)

- 5.2.3 High-Potency APIs

- 5.3 By Dosage Form

- 5.3.1 Solid Oral

- 5.3.2 Sterile Injectables

- 5.3.3 Topicals and Transdermals

- 5.3.4 Specialty/Novel (e.g., ODT, Long-acting)

- 5.4 By Therapeutic Area

- 5.4.1 Oncology

- 5.4.2 Metabolic and Endocrine

- 5.4.3 Cardiovascular

- 5.4.4 CNS and Psychiatry

- 5.4.5 Infectious Diseases and Vaccines

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Russia

- 5.5.2.7 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 India

- 5.5.3.3 Japan

- 5.5.3.4 South Korea

- 5.5.3.5 Australia and New Zealand

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle East and Africa

- 5.5.4.1 Middle East

- 5.5.4.1.1 United Arab Emirates

- 5.5.4.1.2 Saudi Arabia

- 5.5.4.1.3 Turkey

- 5.5.4.1.4 Rest of Middle East

- 5.5.4.2 Africa

- 5.5.4.2.1 South Africa

- 5.5.4.2.2 Nigeria

- 5.5.4.2.3 Egypt

- 5.5.4.2.4 Rest of Africa

- 5.5.4.1 Middle East

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Thermo Fisher Scientific Inc. (Patheon)

- 6.4.2 Lonza Group

- 6.4.3 Catalent Inc.

- 6.4.4 Samsung Biologics Co. Ltd.

- 6.4.5 WuXi AppTec Inc.

- 6.4.6 Recipharm AB

- 6.4.7 Jubilant Pharmova Ltd.

- 6.4.8 Boehringer Ingelheim Group

- 6.4.9 Pfizer CentreOne

- 6.4.10 Aenova Holding GmbH

- 6.4.11 Fujifilm Diosynth Biotechnologies

- 6.4.12 Baxter BioPharma Solutions

- 6.4.13 Corden Pharma GmbH

- 6.4.14 AbbVie Contract Manufacturing

- 6.4.15 Cambrex Corporation

- 6.4.16 Syneos Health Inc.

- 6.4.17 IQVIA Holdings Inc.

- 6.4.18 Labcorp Drug Development

- 6.4.19 PAREXEL International Corporation

- 6.4.20 ICON PLC

- 6.4.21 Charles River Laboratories International Inc.

- 6.4.22 Eurofins Scientific SE

- 6.4.23 SGS Life Science Services SA

- 6.4.24 CMIC Holdings Co. Ltd

- 6.4.25 Novotech Pty Ltd

- 6.4.26 Hangzhou Tigermed Consulting Co. Ltd

- 6.4.27 Samsung Bioepis Co. Ltd

- 6.4.28 Tesa Labtec GmbH (TESA SE)

- 6.4.29 Tapemark

- 6.4.30 Famar SA

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment