PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910602

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910602

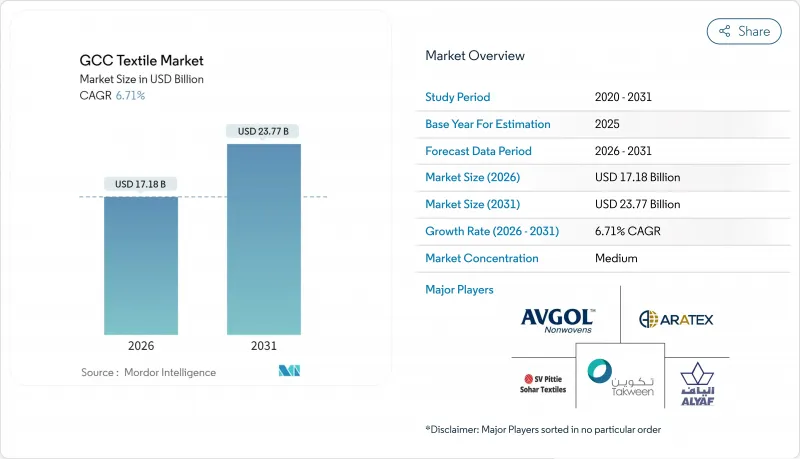

GCC Textile - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The GCC Textiles Market is expected to grow from USD 16.10 billion in 2025 to USD 17.18 billion in 2026 and is forecast to reach USD 23.77 billion by 2031 at 6.71% CAGR over 2026-2031.

Expanding discretionary incomes, government-backed industrial localization programs, and the region's youthful demographics are reinforcing demand across apparel, technical, and home textile categories. Large-scale infrastructure projects continue to stimulate consumption of geotextiles and construction fabrics, while policy incentives under Vision initiatives are drawing foreign and domestic investors into local manufacturing. E-commerce gains, spearheaded by digitally savvy consumers, are shortening fashion cycles and heightening the need for agile production. Growing sustainability mandates and circular-economy targets are also shaping product development and sourcing decisions within the GCC textiles market.

GCC Textile Market Trends and Insights

GCC Industrial-Diversification Incentives (Vision Programs)

National transformation agendas are channeling capital and policy support toward non-oil manufacturing. Saudi Arabia's Vision 2030 industrial strategy offers subsidized land, streamlined licensing, and preferential financing for textiles firms that localize production in economic cities. The UAE's Operation 300bn and Qatar's National Vision 2030 echo this blueprint, coordinating funding for technology adoption, workforce upskilling, and public-private partnerships. By backstopping capex and easing regulatory friction, these programs bolster investor confidence and accelerate the deployment of advanced weaving, knitting, and non-woven lines. Over the long term, such initiatives are expected to lift value-added output, reduce reliance on imports, and expand the GCC textiles market's export footprint.

E-Commerce-Driven Fast-Fashion Demand

Digital channels are reshaping go-to-market strategies across the GCC textiles market. Omni-channel leaders such as Landmark Group report that online sales already account for one-fifth of total turnover, supported by a USD 350 million automated distribution hub in Jebel Ali that handles more than 20,000 packages daily. Seamless payment systems, same-day delivery options, and mobile-first interfaces are raising customer expectations for speed and variety. Smaller garment makers now access cross-border buyers without heavy brick-and-mortar investment, multiplying competitive intensity. Rapid replenishment cycles require near-shoring of certain product lines, spurring interest in localized cut-make-trim operations across UAE free zones and industrial parks in Saudi Arabia.

Raw-Material Price Volatility (Cotton, Synthetics)

Cotton prices remain vulnerable to weather disruptions and shifting acreage, with the USDA forecasting tighter ending stocks versus consumption in 2025. Spot quotes above historical norms amplify working-capital needs for GCC textile mills that import nearly all natural fiber inputs. Synthetics show similar swings when oil or feedstock costs spike. Currency fluctuations and freight surcharges further complicate procurement planning. Manufacturers hedge through diversified sourcing and inventory buffers, yet sudden surges compress margins and force price renegotiations with buyers. Persistent volatility, therefore, weighs on profitability and can slow capacity expansion decisions across the GCC textiles market.

Other drivers and restraints analyzed in the detailed report include:

- Growing Fashion-Conscious Youth Population

- Mega-Project Demand for Technical & Geotextiles

- Intense Import Competition from Low-Cost Asian Suppliers

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Fashion and apparel generated 58.35% of the GCC textiles market size in 2025 on the back of retail network expansion and brand diversification. Department stores and malls in Riyadh, Jeddah, Dubai, and Doha widened their assortment to capture youth and expatriate spending. International labels increasingly adopt franchise or joint-venture formats that require localized supply of trims, labels, and select garment ranges. Digital retailers deploy data analytics to forecast trends, prompting contract manufacturers to shorten batch runs and adopt modular production. Meanwhile, industrial and technical textiles are projected to clock the fastest 8.02% CAGR through 2031 as mega-projects demand geotextiles, filtration media, and flame-retardant fabrics. Local suppliers that secure compliance certifications gain a first-mover advantage, and partnerships with engineering firms unlock bundled project bids.

Rising health-and-wellness awareness is lifting sales of medical textiles, including disposable gowns and wound-care dressings, though volumes remain modest relative to apparel. Home textiles such as bed linens and curtains benefit from residential real-estate developments and hospitality refurbishments ahead of high-profile events. Automotive textiles gain from seat-fabric and airbag applications as regional assembly ventures scale. Altogether, the widening application mix lessens revenue seasonality and supports resilience in the GCC textiles market.

The GCC Textiles Market Report is Segmented by Application (Fashion & Apparel, Industrial/Technical Textiles, and More), by Raw Material (Natural Fibers, Synthetic Fibers, and More), by Process/Technology (Woven, Knitted, Non-Woven, and More), and Geography (Saudi Arabia, UAE, Qatar, Kuwait, Oman and Bahrain). Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Alyaf Industrial Co. Ltd.

- SV Pittie Sohar Textiles

- Takween Advanced Industries

- Aratex Group

- Avgol Middle East

- Saudi German Nonwovens

- FPC Coated Technical Textiles

- Millennium Fashions Industries

- Lomar Collection

- Threads Group LLC

- Atraco Group

- Creative Clothing Co.

- Amin Textile Factory

- Baroque Garments

- Al Borj Machinery LLC

- Unirab & Polvara Spinning Weaving & Silk

- Misr Amreya

- AMCO Apparel Mfg. Co.

- Kabale Textiles

- New Global Cotton Textile LLC

- Fabricon International

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing fashion-conscious youth population

- 4.2.2 E-commerce-driven fast-fashion demand

- 4.2.3 GCC industrial-diversification incentives (Vision programmes)

- 4.2.4 Mega-project demand for technical & geo-textiles

- 4.2.5 Hub-and-re-export advantage via UAE free-zones

- 4.2.6 Circular-economy & recycling mandates

- 4.3 Market Restraints

- 4.3.1 Raw-material price volatility (cotton, synthetics)

- 4.3.2 Intense import competition from low-cost Asian suppliers

- 4.3.3 Skilled-workforce shortages in manufacturing

- 4.3.4 SASO-/Saber-related compliance costs

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Industry Attractiveness - Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts(Values, In USD Billion)

- 5.1 By Application

- 5.1.1 Fashion & Apparel

- 5.1.2 Industrial/Technical Textiles

- 5.1.3 Household & Home Textiles

- 5.1.4 Medical & Healthcare Textiles

- 5.1.5 Automotive & Transport Textiles

- 5.1.6 Others (Protective, Sports Textiles, etc.)

- 5.2 By Raw Material

- 5.2.1 Natural Fibers

- 5.2.1.1 Cotton

- 5.2.1.2 Wool

- 5.2.1.3 Silk

- 5.2.2 Synthetic Fibers

- 5.2.2.1 Polyester

- 5.2.2.2 Nylon

- 5.2.2.3 Rayon / Viscose

- 5.2.2.4 Acrylic

- 5.2.2.5 Polypropylene

- 5.2.3 Recycled Fibers

- 5.2.4 Others (Speciality High-Performance Fibers (Aramid, Carbon, UHMWPE))

- 5.2.1 Natural Fibers

- 5.3 By Process / Technology

- 5.3.1 Woven

- 5.3.2 Knitted

- 5.3.3 Non-woven

- 5.3.3.1 Spunlaid (Spunbond / Melt-blown)

- 5.3.3.2 Dry-laid Hydro-entangled

- 5.3.3.3 Wet-Laid

- 5.3.3.4 Needle-punched

- 5.3.4 3-D Weaving & Spacer Fabrics

- 5.4 By Geography

- 5.4.1 Saudi Arabia

- 5.4.2 United Arab Emirates

- 5.4.3 Qatar

- 5.4.4 Kuwait

- 5.4.5 Oman

- 5.4.6 Bahrain

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Products & Services, and Recent Developments)

- 6.4.1 Alyaf Industrial Co. Ltd.

- 6.4.2 SV Pittie Sohar Textiles

- 6.4.3 Takween Advanced Industries

- 6.4.4 Aratex Group

- 6.4.5 Avgol Middle East

- 6.4.6 Saudi German Nonwovens

- 6.4.7 FPC Coated Technical Textiles

- 6.4.8 Millennium Fashions Industries

- 6.4.9 Lomar Collection

- 6.4.10 Threads Group LLC

- 6.4.11 Atraco Group

- 6.4.12 Creative Clothing Co.

- 6.4.13 Amin Textile Factory

- 6.4.14 Baroque Garments

- 6.4.15 Al Borj Machinery LLC

- 6.4.16 Unirab & Polvara Spinning Weaving & Silk

- 6.4.17 Misr Amreya

- 6.4.18 AMCO Apparel Mfg. Co.

- 6.4.19 Kabale Textiles

- 6.4.20 New Global Cotton Textile LLC

- 6.4.21 Fabricon International

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment