PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910607

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910607

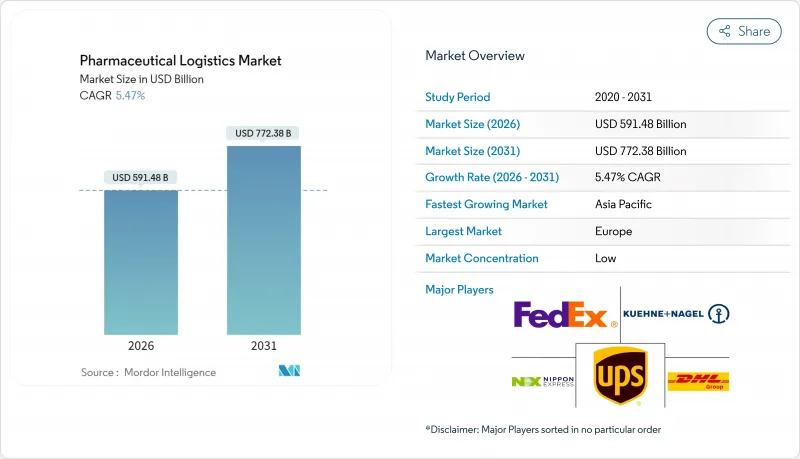

Pharmaceutical Logistics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Pharmaceutical Logistics Market was valued at USD 560.81 billion in 2025 and estimated to grow from USD 591.48 billion in 2026 to reach USD 772.38 billion by 2031, at a CAGR of 5.47% during the forecast period (2026-2031).

Robust growth stems from biologics proliferation, rigorous serialization mandates, and the pivot toward direct-to-patient delivery models that require precision distribution capacities. Strong capital spending by global integrators, sustained e-pharmacy adoption, and expanding temperature-controlled infrastructure continue to intensify competition while enlarging addressable demand for end-to-end, compliant supply-chain solutions. Technology deployment-particularly IoT sensors, blockchain traceability, and AI-driven network optimization-has accelerated as stakeholders guard against temperature excursions and counterfeit risk. At the same time, sustainability commitments are redirecting capacity toward intermodal and ocean transportation to curb emissions, opening new service niches for specialty providers. Price pressures linked to cold-chain energy costs and multi-jurisdictional compliance remain headwinds, yet they also spur investment in low-carbon packaging, regionalized inventories, and alternative fuels that ultimately expand the pharmaceutical logistics market.

Global Pharmaceutical Logistics Market Trends and Insights

Expansion of Online Pharmacies

Nearly half of consumers now prefer ordering medicines online, compelling carriers to engineer door-step delivery networks that secure 2 °C-8 °C conditions for sensitive products. Providers in Asia-Pacific leverage digital payments and telehealth platforms to scale ambient and refrigerated parcel services, while U.S. integrators enhance last-mile visibility through IoT-enabled pack-out solutions. Regulators have responded by extending serialization and track-and-trace to the single-unit level, raising compliance hurdles but also differentiating operators that offer real-time temperature and location data. As e-pharmacy volumes climb, network redesign toward micro-fulfillment hubs tightens lead-times, improving medication adherence and fueling incremental demand across the pharmaceutical logistics market.

Rising OTC-Medicine Demand & Chronic-Disease Burden

OTC formulations carry less-stringent handling rules than prescription drugs, enabling blended transport lanes that cut storage costs for integrated distributors. However, the rising prevalence of diabetes and cardiovascular disease forces continual replenishment cycles that intensify throughput requirements for time-critical inventory. Logistics partners exploit automation, such as robotic pick-and-pack and smart blister packaging, to combine OTC and chronic-care medications within unified flows that reduce dwell time. Hybrid models improve asset utilization and sustain profitability within the pharmaceutical logistics market while enhancing service quality for pharmacies and clinics.

High Cost of Temperature-Controlled Distribution

Cold-chain failures cost drug makers an estimated USD 35 billion each year, reflecting write-offs, repackaging, and penalty shipments. Passive packaging with phase-change materials can extend protection to 96 hours but often doubles per-parcel expenses, placing strain on emerging-market programs where funding is scarce. The need for redundant monitoring equipment and qualified staff compounds overhead, limiting profit margins for smaller carriers within the pharmaceutical logistics market. Innovation in low-carbon refrigerants and reusable totes aims to reduce cost per shipment, yet wide deployment remains constrained by initial capital outlay.

Other drivers and restraints analyzed in the detailed report include:

- Acceleration of Biologics & Vaccine Cold-Chain Needs

- Outsourcing Surge to 3PL/4PL Specialists

- Complex & Divergent Global Compliance Standards

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Transportation generated 51.40% of 2025 revenue, illustrating that physical movement remains the backbone of the pharmaceutical logistics market. Road freight captures regional flows, particularly across Europe and North America, while air freight underpins long-haul biologics replenishment with next-day service guarantees. Ocean lanes gain relevance as shippers pursue sustainable options, leveraging GDP-compliant reefer containers to curb emissions.

Value-added services, growing at a 4.42% CAGR, include labeling, secondary packaging, order kitting, and serialization consulting that relieve manufacturers of non-core tasks. Demand rises fastest in Asia-Pacific, where contract manufacturers seek single-source partners to handle regulatory printing in multiple languages. As data integrity rules tighten, certified relabeling and tamper-evident pack-outs transform from optional extras into procurement prerequisites, driving incremental margin across the pharmaceutical logistics market.

The Pharmaceutical Logistics Market Report is Segmented by Service Type (Transportation, Warehousing & Storage, and Value-Added Services & Others), Mode of Operation (Cold-Chain Logistics and Non-Cold-Chain Logistics), Product Type (Prescription Drugs, OTC Drugs, Biologics & Biosimilars, and More), Geography (North America, South America, Europe, Asia-Pacific, and, More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Europe maintained a 31.70% revenue share in 2025, underpinned by harmonized GDP enforcement, dense road networks, and large-scale manufacturing clusters in Germany, Switzerland, and Ireland. Investment in cross-border rail-air corridors supports modal shifts that lower emissions without compromising lead times. The pharmaceutical logistics market size in Europe benefits from continual capacity additions such as Cold Chain Technologies' new Netherlands hub, which augments regional PCM production and reduces transit risk.

North America remains a powerhouse thanks to DSCSA-driven serialization maturity and sustained public-sector funding for pandemic preparedness. DHL allocated 50% of its EUR 2 billion (USD 2.08 billion) plan to U.S. and Canadian facilities, integrating solar-powered warehouses and LNG trucks that curb emissions while preserving service standards. Combined with FedEx's USD 440 million expansion of healthcare distribution centers, the region continues to redefine best practices around data visibility and sustainability.

Asia-Pacific is expected to post the fastest growth at 5.02% CAGR from 2026 to 2031, buoyed by increased production out of China and India, widening insurance coverage, and e-pharmacy proliferation. Governments incentivize cold-chain upgrades, as evidenced by India's 2025 tax rebates on GDP-compliant warehousing equipment. Regional carriers deploy rail-truck sea-air solutions along the China-Europe corridor, trimming cost and cutting transit emissions. Middle East & Africa trail in infrastructure, yet Gulf Cooperation Council localization programs spur warehouse investment, securing future pharmaceutical logistics market expansion.

- Deutsche Post DHL

- Kuehne + Nagel

- UPS

- FedEx

- Nippon Express

- World Courier

- SF Express

- CEVA Logistics

- DSV

- Kerry Logistics

- C.H. Robinson

- Lineage Logistics

- United States Cold Storage

- Americold Logistics

- Nichirei Logistics Group

- Kloosterboer

- NewCold Advanced Cold Logistics

- VersaCold Logistics Services

- Rhenus Logistics

- Cencora

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Expansion of online pharmacies

- 4.2.2 Rising OTC-medicine demand & chronic-disease burden

- 4.2.3 Acceleration of biologics & vaccine cold-chain needs

- 4.2.4 Outsourcing surge to 3PL/4PL specialists

- 4.2.5 Mandatory end-to-end IoT / blockchain track-and-trace

- 4.2.6 Net-zero logistics investments driving infrastructure renewal

- 4.3 Market Restraints

- 4.3.1 High cost of temperature-controlled distribution

- 4.3.2 Complex & divergent global compliance standards

- 4.3.3 Shortage of advanced phase-change packaging materials

- 4.3.4 Last-mile biologic delivery bottlenecks in emerging markets

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

- 4.8 Impact of COVID-19 & Geo-Political Events

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Service Type

- 5.1.1 Transportation

- 5.1.1.1 Road Freight

- 5.1.1.2 Air Freight

- 5.1.1.3 Sea Freight

- 5.1.1.4 Rail Freight

- 5.1.2 Warehousing & Storage

- 5.1.3 Value-added Services and Others

- 5.1.1 Transportation

- 5.2 By Mode of Operation

- 5.2.1 Cold-Chain Logistics

- 5.2.2 Non-Cold-Chain Logistics

- 5.3 By Product Type

- 5.3.1 Prescription Drugs

- 5.3.2 OTC Drugs

- 5.3.3 Biologics & Biosimilars

- 5.3.4 Vaccines & Blood Products

- 5.3.5 Clinical Trail Materials

- 5.3.6 Cell & Gene Therapies

- 5.3.7 Medical Devices & Diagnostics

- 5.3.8 Veterinary Medicine

- 5.3.9 Others

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 South America

- 5.4.2.1 Brazil

- 5.4.2.2 Peru

- 5.4.2.3 Chile

- 5.4.2.4 Argentina

- 5.4.2.5 Rest of South America

- 5.4.3 Asia-Pacific

- 5.4.3.1 India

- 5.4.3.2 China

- 5.4.3.3 Japan

- 5.4.3.4 Australia

- 5.4.3.5 South Korea

- 5.4.3.6 South East Asia (Singapore, Malaysia, Thailand, Indonesia, Vietnam, and Philippines)

- 5.4.3.7 Rest of Asia-Pacific

- 5.4.4 Europe

- 5.4.4.1 United Kingdom

- 5.4.4.2 Germany

- 5.4.4.3 France

- 5.4.4.4 Spain

- 5.4.4.5 Italy

- 5.4.4.6 BENELUX (Belgium, Netherlands, and Luxembourg)

- 5.4.4.7 NORDICS (Denmark, Finland, Iceland, Norway, and Sweden)

- 5.4.4.8 Rest of Europe

- 5.4.5 Middle East and Africa

- 5.4.5.1 United Arab of Emirates

- 5.4.5.2 Saudi Arabia

- 5.4.5.3 South Africa

- 5.4.5.4 Nigeria

- 5.4.5.5 Rest of Middle East And Africa

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials, Strategic Info, Market Rank/Share, Products & Services, Recent Developments)

- 6.4.1 Deutsche Post DHL

- 6.4.2 Kuehne + Nagel

- 6.4.3 UPS

- 6.4.4 FedEx

- 6.4.5 Nippon Express

- 6.4.6 World Courier

- 6.4.7 SF Express

- 6.4.8 CEVA Logistics

- 6.4.9 DSV

- 6.4.10 Kerry Logistics

- 6.4.11 C.H. Robinson

- 6.4.12 Lineage Logistics

- 6.4.13 United States Cold Storage

- 6.4.14 Americold Logistics

- 6.4.15 Nichirei Logistics Group

- 6.4.16 Kloosterboer

- 6.4.17 NewCold Advanced Cold Logistics

- 6.4.18 VersaCold Logistics Services

- 6.4.19 Rhenus Logistics

- 6.4.20 Cencora

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment