PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910616

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910616

Indonesia Automation And Control System - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

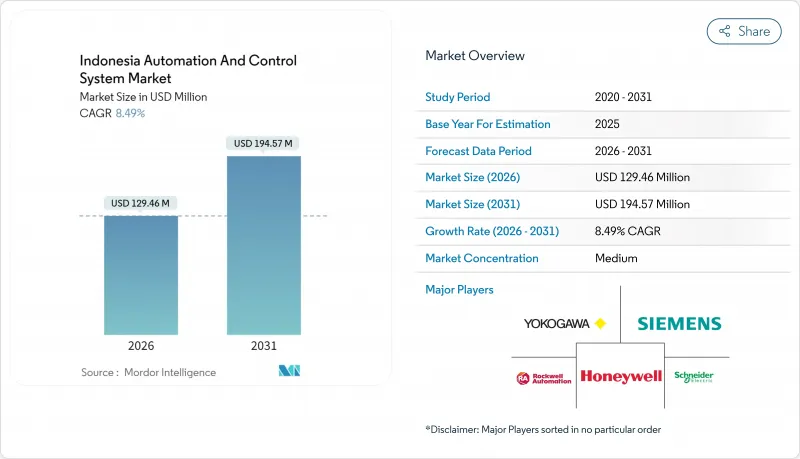

The Indonesia automation and control system market was valued at USD 119.34 billion in 2025 and estimated to grow from USD 129.46 billion in 2026 to reach USD 194.57 billion by 2031, at a CAGR of 8.49% during the forecast period (2026-2031).

The expansion reflects Jakarta's drive to position the country as Southeast Asia's manufacturing hub, the convergence of digital infrastructure with industrial capacity additions, and regulatory tailwinds that favour energy-efficient production. Government programs such as Making Indonesia 4.0, sizable power-sector capital expenditures, surging electric-vehicle investments, and relaxed local-content thresholds are opening procurement channels for global vendors even as domestic integrators scale up. Multinational suppliers are differentiating on predictive-maintenance software, cyber-secure architectures, and cloud-enabled platforms, while local service firms gain traction through cost-competitive integration and lifecycle support. These dynamics place the Indonesia automation and control system market at the center of a broader industrial modernization agenda that also improves energy security and export competitiveness.

Indonesia Automation And Control System Market Trends and Insights

Flourishing Power-Sector Capacity Additions

Massive generation and grid projects valued at IDR 51 trillion (USD 3.2 billion) are scaling demand for supervisory control and distributed control systems that coordinate renewable and thermal assets. State utility PLN is retrofitting excitation systems and deploying SCADA across hydro and coal plants to stabilize frequency as renewable penetration rises. The July 2024 decision to lower local-content rules below 30% widened the supplier pool and prompted multinationals to partner with Indonesian fabricators to meet sourcing quotas. Yokogawa's water-treatment SCADA in Bali and multiple PLN excitation retrofits in South Kalimantan illustrate the steady pipeline that supports the Indonesia automation and control system market.

Evolution of Wireless Sensor Networks and Protocols

5G rollout combined with lower-cost sensors is allowing factories to link conveyors, compressors, and HVAC systems without rewiring. PT Astra Daihatsu Motor cut fan energy use by 20% after connecting PLC-controlled motors to a wireless edge device, saving 122.66 kWh annually and avoiding 10.67 tCO2 emissions. Manufacturers now stage analytics at the edge for real-time alarms while offloading pattern discovery to cloud dashboards, a configuration well suited to Indonesia's archipelagic geography.

High Upfront CAPEX for Brown-Field Retrofits

Older cement, steel, and petrochemical complexes must rewire control loops and train operators before installing advanced DCS. PT Rainbow Tubulars Manufacture is investing IDR 300 billion (USD 18.9 million) to modernize seamless pipelines, revealing the cash requirements that deter midsize firms from similar upgrades. Integration surprises between analog I/O and modern Ethernet-based systems often inflate budgets and extend shutdown windows.

Other drivers and restraints analyzed in the detailed report include:

- Domestic Making Indonesia 4.0 Incentives

- Mandatory Energy-Efficiency Standards

- Skills Gap in Advanced Automation Engineering

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

In 2025, PLCs generated 26.66% of revenue, confirming their ubiquity in packaging, material-handling, and batch-process lines. That domination secures a resilient base for the Indonesia automation and control system market size at the plant-floor level. However, Industrial Robotics is set to grow at a 9.74% CAGR through 2031, amplified by new automotive paint shops and electronics surface-mount lines that need micron-level repeatability. SCADA platforms gain steady orders from power utilities interested in distributed asset visualization, while DCS penetrates chemical and F&B plants where recipe integrity is mission-critical. HMI design is shifting toward capacitive touch and mobile mirroring, allowing supervisors to view KPIs from remote stations, an essential feature across Indonesia's dispersed archipelago.

The safety-system niche is widening as insurers and regulators insist on SIL-3 emergency-shutdown loops, boosting demand for triple-modular-redundant PLCs and flame-scanner arrays. Efficiency mandates are pushing a shift from IE1 to IE3 motors, and the pairing of these units with variable-speed drives slashes energy bills and unlocks data for performance dashboards. Together, these trends underscore how hardware modernization and software orchestration are converging, reinforcing both the scale and the depth of the Indonesia automation and control system market.

Hardware produced 61.12% of 2025 sales, encompassing controllers, sensors, actuators, and secure switches that underpin every automation architecture. Much of the capital spending in the Indonesia automation and control system market flows first into this stack as line builders outfit new capacities across automotive, EV, and FMCG verticals. Software demand is maturing from basic HMI to advanced analytics, historian integration, and anomaly detection, though it still trails hardware in total receipts.

Services will expand at a 9.48% CAGR through 2031 because manufacturers are outsourcing system integration, network re-engineering, and predictive-maintenance programs to specialists like PT Dycom Engineering, which reported USD 5.8 million revenue in 2025. Lifecycle contracts that bundle spares, firmware, cybersecurity patching, and operator training are particularly attractive to firms lacking deep in-house engineering benches. As installed bases age, the Indonesia automation and control system market share for service firms is poised to rise, diversifying revenue toward more recurring streams.

The Indonesia Automation and Control System Market Report is Segmented by Product (PLC, SCADA, DCS, HMI, Safety Systems, Industrial Robotics, Electric Motors, and Drives), Component (Hardware, Software, and Services), Deployment Mode (On-Premise, and Cloud/IIoT-Edge), End-User Industry (Oil and Gas, Power Generation, Chemical and Petrochemical, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Yokogawa Electric Corporation

- Siemens AG

- Honeywell International Inc.

- Rockwell Automation Inc.

- Schneider Electric SE

- ABB Ltd.

- Emerson Electric Co.

- PT FANUC Indonesia

- Mitsubishi Electric Corporation

- Omron Corporation

- Delta Electronics Inc.

- Beckhoff Automation GmbH and Co. KG

- Advantech Co. Ltd.

- Bosch Rexroth AG

- Schneider Toshiba Inverter (STI)

- Fuji Electric Co. Ltd.

- Panasonic Industry Co. Ltd.

- Lenze SE

- Hitachi Industrial Equipment Systems Co. Ltd.

- Yokogawa Indonesia PT

- PT Omron Manufacturing of Indonesia

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Flourishing power-sector capacity additions

- 4.2.2 Evolution of wireless sensor networks and protocols

- 4.2.3 Domestic "Making Indonesia 4.0" incentives

- 4.2.4 Mandatory energy-efficiency standards for industry

- 4.2.5 Surge in EV and battery manufacturing investments

- 4.2.6 AI-enabled predictive-maintenance demand

- 4.3 Market Restraints

- 4.3.1 High upfront CAPEX for brown-field retrofits

- 4.3.2 Skills gap in advanced automation engineering

- 4.3.3 Volatile commodity pricing impacting OandG, mining

- 4.3.4 Cyber-security concerns in OT networks

- 4.4 Industry Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Product

- 5.1.1 Programmable Logic Controller (PLC)

- 5.1.2 Supervisory Control and Data Acquisition (SCADA)

- 5.1.3 Distributed Control System (DCS)

- 5.1.4 Human-Machine Interface (HMI)

- 5.1.5 Safety Systems

- 5.1.6 Industrial Robotics

- 5.1.7 Electric Motors (AC, DC, EC, Servo, Stepper)

- 5.1.8 Drives (AC, DC, Servo)

- 5.2 By Component

- 5.2.1 Hardware

- 5.2.2 Software

- 5.2.3 Services

- 5.3 By Deployment Mode

- 5.3.1 On-premise

- 5.3.2 Cloud / IIoT-Edge

- 5.4 By End-User Industry

- 5.4.1 Oil and Gas

- 5.4.2 Power Generation

- 5.4.3 Chemical and Petrochemical

- 5.4.4 Food and Beverage

- 5.4.5 Metals and Mining

- 5.4.6 Water and Wastewater

- 5.4.7 Other End-User Industries

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Yokogawa Electric Corporation

- 6.4.2 Siemens AG

- 6.4.3 Honeywell International Inc.

- 6.4.4 Rockwell Automation Inc.

- 6.4.5 Schneider Electric SE

- 6.4.6 ABB Ltd.

- 6.4.7 Emerson Electric Co.

- 6.4.8 PT FANUC Indonesia

- 6.4.9 Mitsubishi Electric Corporation

- 6.4.10 Omron Corporation

- 6.4.11 Delta Electronics Inc.

- 6.4.12 Beckhoff Automation GmbH and Co. KG

- 6.4.13 Advantech Co. Ltd.

- 6.4.14 Bosch Rexroth AG

- 6.4.15 Schneider Toshiba Inverter (STI)

- 6.4.16 Fuji Electric Co. Ltd.

- 6.4.17 Panasonic Industry Co. Ltd.

- 6.4.18 Lenze SE

- 6.4.19 Hitachi Industrial Equipment Systems Co. Ltd.

- 6.4.20 Yokogawa Indonesia PT

- 6.4.21 PT Omron Manufacturing of Indonesia

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment