PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910622

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910622

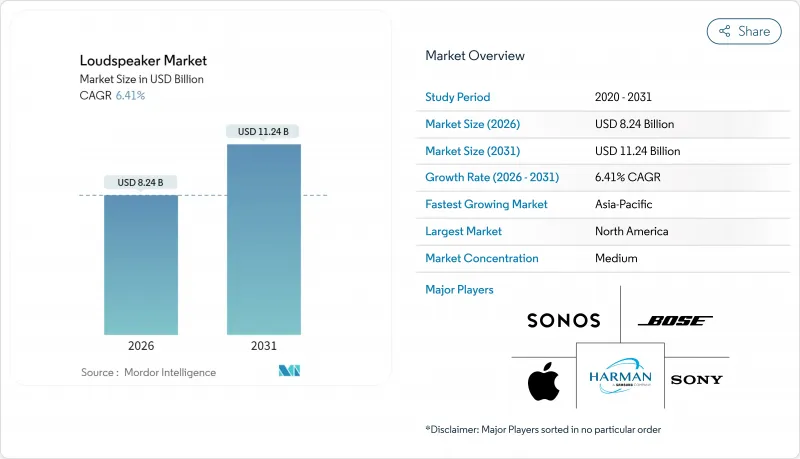

Loudspeaker - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

loudspeaker market size in 2026 is estimated at USD 8.24 billion, growing from 2025 value of USD 7.74 billion with 2031 projections showing USD 11.24 billion, growing at 6.41% CAGR over 2026-2031.

Rising consumer preference for wireless multi-room audio, the acceleration of automotive infotainment programs and expanding demand for immersive home-theater sound are sustaining growth momentum. Rapid penetration of Bluetooth LE Audio and Auracast broadcast technology is widening use cases from portable speakers to stadium installations. Active driver architectures with integrated amplification continue to displace passive designs as buyers favor simpler setup and embedded digital signal processing. At the same time, supply-chain exposure in digital signal processors and amplifier ICs remains a critical operational risk, pushing manufacturers to diversify sourcing and pursue vertical integration strategies.

Global Loudspeaker Market Trends and Insights

Growing Demand for Wireless Multi-Room Speakers

Bluetooth LE Audio's LC3 codec halves power consumption while sustaining CD-quality output, allowing synchronized playback across unlimited devices. Auracast broadcast further supports one-to-many streaming without device pairing, enabling gyms, airports, and retail spaces to deliver shared audio feeds seamlessly. Marshall's Emberton III showcases this shift with LE-Audio readiness and 32-hour battery life. Consumer surveys indicate that 45% of users now operate outdoor smart speakers, up 32% from 2023, validating sustained demand for wireless installations.

Rising Adoption in Automotive Infotainment Systems

Dolby Atmos has moved from luxury trims to standard packages, as evidenced by Cadillac's entire 2026 EV line-up. HARMAN's recognition as General Motors' 2024 Supplier of the Year demonstrates OEM commitment to branded audio collaboration. Texas Instruments' AM275x-Q1 microcontrollers and TAS6754-Q1 amplifiers embed spatial audio and active noise cancellation across multiple price points. These advances coincide with forecasts that infotainment software will become the second-largest automotive software segment by 2030.

Stringent RF-Emission Regulations and Spectrum Crowding

FCC Part 15 caps radiated emissions at 150 μV/m for 88-216 MHz bands and 200 μV/m for 216-960 MHz, limiting permissible power output and effective range for wireless speakers. Congestion in the 2.4 GHz ISM band intensifies as Wi-Fi 6, Bluetooth, and IoT devices compete for bandwidth, elevating packet loss and audio dropouts in dense urban environments. CE marking in Europe imposes electromagnetic-compatibility testing that can extend development cycles by six months, raising barriers for smaller entrants. As the installed base of wireless devices expands, multi-room systems must deploy dynamic channel management to avoid interference, adding cost and complexity.

Other drivers and restraints analyzed in the detailed report include:

- Growth in Home Theater and Gaming Consumption

- Advances in Bluetooth LE Audio (LC3)

- Semiconductor Supply-Chain Volatility for DSP and Amp ICs

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Soundbars captured 36.12% of 2025 revenues, equivalent to roughly one-third of the loudspeaker market size, as streamlined installation and integrated immersive processing appeal to apartment dwellers. Samsung maintains the largest brand presence by packaging Eclipsa Audio in its 2025 portfolio, raising competitive pressure on Dolby-exclusive ecosystems. The segment benefits from consumer migration toward large-screen televisions and gaming consoles that depend on external speakers for cinematic sound. Continuously declining prices expand penetration into mid-income households, while premium SKUs differentiate on Dolby Atmos, Wi-Fi streaming, and AI room calibration.

Outdoor speakers constitute the quickest-expanding niche at an 8.18% CAGR, pushed by restaurant patios, theme parks and backyard entertainment upgrades. IP55-rated Bose Professional 802 Series V models illustrate the commercial opportunity in all-weather reinforcement. Corrosion-resistant aluminum grilles and high-efficiency Class-D amps lower maintenance costs for venue operators, supporting adoption in humid and maritime climates. Within residential settings, battery-powered, multi-room capable outdoor units extend seamless music playback beyond indoor spaces, further amplifying demand.

Wireless connections held 66.10% of the loudspeaker market share in 2025 as Bluetooth and Wi-Fi overcame historical latency concerns through LC3, aptX Adaptive, and proprietary mesh protocols. The loudspeaker market size for wireless solutions is poised to expand fastest, aided by the Auracast broadcast that unlocks one-to-many use cases in public venues. Manufacturers integrate Bluetooth 5.4 to gain slot availability for higher data throughput, while dual-band 2.4 / 5 GHz Wi-Fi enables high-resolution, multi-room playback without range compromises.

Hard-wired interfaces remain relevant in studio monitoring and touring sound where deterministic latency is vital, yet their proportion continues to contract. Professional installations compensate with hybrid architectures, running local audio over balanced XLR and distributing networked audio via Dante or AVB, merging the reliability of copper with the flexibility of Ethernet. Regulatory caps on transmit power in outdoor environments temper some expansion, but antenna-design improvements and beamforming algorithms help maintain link stability.

The Global Loudspeaker Market Report is Segmented by Product Type (Soundbar, Subwoofer, In-Wall, and More), Connectivity Technology (Wired, Wireless), Driver Type (Active, Passive), Application (Communication, Home Entertainment, and More), End-User (Residential, Commercial and Institutional, Automotive OEM), and Geography (North America, South America, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America generated 32.54% of 2025 revenue, driven by early adoption of immersive formats and high per-capita expenditure on consumer electronics. Clear FCC compliance pathways encourage rapid time-to-market for wireless lines, although emission ceilings restrict transmit power in outdoor stadium systems. Robust upgrade cycles are evident as 45% of Sonos sales come from returning customers, illustrating brand loyalty in a mature replacement market.

Asia-Pacific exhibits the fastest trajectory with a 6.96% CAGR through 2031, propelled by infotainment penetration across China, India, and Southeast Asia. Expanded manufacturing capacity and ODM specialization deliver cost advantages that accelerate domestic uptake, particularly in portable Bluetooth speakers. HARMAN India forecasts infotainment as the second-largest regional software market by 2030, underscoring strategic importance for supplier localization.

Europe balances stringent CE certification protocols with rising consumer interest in sustainable materials and power efficiency. Established brands leverage comprehensive compliance labs to shorten approval timelines, marginalizing smaller entrants. Wireless outdoor deployments face channel-planning challenges in densely populated urban centers, pushing integrators toward multi-band and beamforming solutions to ensure link reliability.

- Amazon.com, Inc.

- Alphabet Inc. (Google LLC)

- Apple Inc.

- Bose Corporation

- Bowers & Wilkins (Sound United LLC)

- Cerwin Vega LLC

- Dynaudio A/S

- Harman International Industries, Inc.

- KEF Audio

- Klipsch Group, Inc.

- Koninklijke Philips N.V.

- Lenovo Group Limited

- LG Electronics Inc.

- Panasonic Holdings Corporation

- Pioneer & Onkyo Corporation

- Samsung Electronics Co., Ltd.

- Sennheiser electronic GmbH & Co. KG

- Sonos, Inc.

- Sony Group Corporation

- Sound United LLC (Denon, Polk Audio)

- Xiaomi Corporation

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing demand for wireless multi-room speakers

- 4.2.2 Rising adoption in automotive infotainment systems

- 4.2.3 Growth in home theatre and gaming consumption

- 4.2.4 Advances in Bluetooth LE Audio (LC3) enabling low-latency hi-fi streaming

- 4.2.5 Integration of AI-based sound calibration and voice assistants

- 4.2.6 Expansion of immersive audio standards across OTT platforms

- 4.3 Market Restraints

- 4.3.1 Stringent RF-emission regulations and spectrum crowding

- 4.3.2 Health concerns over high-decibel exposure in children

- 4.3.3 Margin pressure from commoditisation and Asian ODM supply

- 4.3.4 Semiconductor supply-chain volatility for DSP and amp ICs

- 4.4 Industry Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Investment Analysis

- 4.9 Impact of Macroeconomic Factors on the Market

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Product Type

- 5.1.1 Soundbar

- 5.1.2 Subwoofer

- 5.1.3 In-wall

- 5.1.4 Floor-standing / Tower

- 5.1.5 Bookshelf / Satellite

- 5.1.6 Outdoor

- 5.1.7 Other Product Types

- 5.2 By Connectivity Technology

- 5.2.1 Wired

- 5.2.2 Wireless

- 5.2.2.1 Bluetooth

- 5.2.2.2 Wi-Fi / Multi-room

- 5.2.2.3 Zigbee / Z-Wave / Thread

- 5.3 By Driver Type

- 5.3.1 Active (Powered)

- 5.3.2 Passive

- 5.4 By Application

- 5.4.1 Communication

- 5.4.2 Home Entertainment

- 5.4.3 Automotive

- 5.4.4 Events and Outdoor Entertainment

- 5.4.5 Commercial Sound Reinforcement

- 5.5 By End-user

- 5.5.1 Residential

- 5.5.2 Commercial and Institutional

- 5.5.3 Automotive OEM

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Argentina

- 5.6.2.3 Rest of South America

- 5.6.3 Europe

- 5.6.3.1 Germany

- 5.6.3.2 United Kingdom

- 5.6.3.3 France

- 5.6.3.4 Italy

- 5.6.3.5 Rest of Europe

- 5.6.4 Asia-Pacific

- 5.6.4.1 China

- 5.6.4.2 Japan

- 5.6.4.3 South Korea

- 5.6.4.4 India

- 5.6.4.5 Rest of Asia-Pacific

- 5.6.5 Middle East

- 5.6.5.1 Saudi Arabia

- 5.6.5.2 United Arab Emirates

- 5.6.5.3 Rest of Middle East

- 5.6.6 Africa

- 5.6.6.1 South Africa

- 5.6.6.2 Rest of Africa

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Amazon.com, Inc.

- 6.4.2 Alphabet Inc. (Google LLC)

- 6.4.3 Apple Inc.

- 6.4.4 Bose Corporation

- 6.4.5 Bowers & Wilkins (Sound United LLC)

- 6.4.6 Cerwin Vega LLC

- 6.4.7 Dynaudio A/S

- 6.4.8 Harman International Industries, Inc.

- 6.4.9 KEF Audio

- 6.4.10 Klipsch Group, Inc.

- 6.4.11 Koninklijke Philips N.V.

- 6.4.12 Lenovo Group Limited

- 6.4.13 LG Electronics Inc.

- 6.4.14 Panasonic Holdings Corporation

- 6.4.15 Pioneer & Onkyo Corporation

- 6.4.16 Samsung Electronics Co., Ltd.

- 6.4.17 Sennheiser electronic GmbH & Co. KG

- 6.4.18 Sonos, Inc.

- 6.4.19 Sony Group Corporation

- 6.4.20 Sound United LLC (Denon, Polk Audio)

- 6.4.21 Xiaomi Corporation

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment