PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910624

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910624

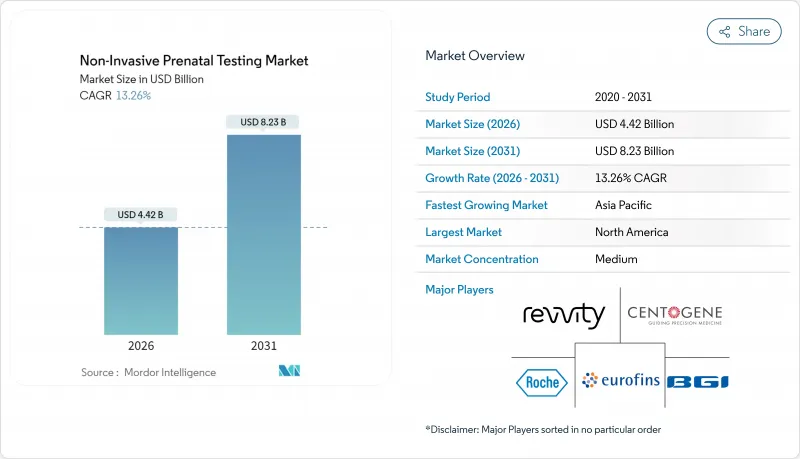

Non-Invasive Prenatal Testing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The non-invasive prenatal testing market was valued at USD 3.90 billion in 2025 and estimated to grow from USD 4.42 billion in 2026 to reach USD 8.23 billion by 2031, at a CAGR of 13.26% during the forecast period (2026-2031).

Broader clinical guidelines now recommend cell-free DNA screening for every pregnancy, while payer policies are easing prior-authorization hurdles, driving volume expansion across risk categories. Sequencing costs have plunged and automated workflows are cutting turnaround times, making tests more affordable for emerging markets. The FDA's 2024 final rule on laboratory-developed tests established transitional compliance that paradoxically accelerated adoption because large commercial laboratories moved quickly to standardize processes. At the same time, direct-to-consumer channels are expanding in parallel with physician referral networks, reflecting a growing willingness among expectant parents to pay out-of-pocket for early genetic insight.

Global Non-Invasive Prenatal Testing Market Trends and Insights

Rising Global Maternal Age Increasing Aneuploidy Prevalence

Advanced maternal age drives higher baseline risk for chromosomal abnormalities, causing prenatal screening volumes to rise steadily in developed economies. Universal guideline recommendations issued in 2024 removed the age-based risk threshold and repositioned cfDNA testing as first-line screening for every pregnancy. Hospitals are seeing fewer invasive procedures because expectant parents opt for a blood test that carries no miscarriage risk, opening a predictable revenue stream for laboratories. Large cohort studies confirm that test sensitivity remains consistent across age groups even though positive predictive value shifts upward with age. Payers find the economics attractive because earlier detection lowers lifetime treatment costs, and laboratories leverage the reliable volume to negotiate bulk reagent pricing.

Shift From Invasive Procedures to cfDNA Screening for Safety

Amniocentesis and chorionic villus sampling both carry tangible miscarriage risk, causing anxiety that makes non-invasive alternatives appealing. Clinical audits show cfDNA adoption cuts invasive procedure volumes by up to 80%, yet diagnostic confirmation remains available when results indicate a high likelihood of abnormality. Obstetricians note lower medicolegal exposure, while insurers see fewer claims related to procedure-linked complications. The blood-based approach enables rapid retesting if initial samples are inadequate, improving the patient experience. Importantly, safety advantages resonate in average-risk pregnancies where historical cost-benefit analyses favored no testing at all.

Ethical & Regulatory Concerns on Incidental Findings / Sex Selection

India's PCPNDT Act criminalizes fetal sex disclosure, forcing providers to redesign reports for local compliance. Policymakers worry that expanding panels could reveal non-paternity or maternal cancer, raising consent complexities. The Early IDENTIFY trial showed that half of non-reportable cases masked maternal malignancies, sparking debate on duty-to-warn obligations. Bioethics councils recommend incremental test roll-outs with enhanced counseling, yet region-specific restrictions slow commercial timelines. Vendors must therefore navigate a patchwork of disclosure rules that limit cross-border scale economies.

Other drivers and restraints analyzed in the detailed report include:

- Falling Sequencing Costs & Automation Lowering Test Prices

- Expansion of Reimbursement to Average-Risk Pregnancies

- Limited Lab Infrastructure & Bioinformatics Expertise in Emerging Markets

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

In 2025, next-generation sequencing commanded 60.87% of non-invasive prenatal testing market share, cementing its reputation for analytical breadth and scalability. Rolling-circle amplification, however, is accelerating at a 15.08% CAGR, its ambient-temperature workflow suiting resource-constrained settings. The non-invasive prenatal testing market size for NGS-based assays is projected to grow steadily as laboratories leverage legacy platforms to handle rising test complexity. Meanwhile, simpler chemistries unlock new customer segments that lack capital budgets for high-end sequencers.

Digital PCR and CRISPR-enabled assays are entering pilot programs, aiming for tighter fetal-fraction quantification and improved specificity. Regulatory tightening may initially advantage entrenched NGS vendors whose systems already meet quality benchmarks, yet disruptive pricing from RCA or isothermal methodologies could pivot purchasing decisions as emerging-market volumes scale.

Whole-genome cfDNA tests held 49.11% of the non-invasive prenatal testing market size in 2025, favored for their comprehensive chromosomal coverage. Microdeletion panels are registering a brisk 14.32% CAGR, benefitting from ongoing evidence that broader variant detection adds clinical value in select cases. Aneuploidy-only assays remain popular where payers reimburse a limited menu, but their relative share is edging downward as guidelines evolve.

Bundled monogenic and carrier-status screens could redraw market boundaries by merging reproductive planning with prenatal surveillance. Yet reimbursement remains the gating factor; without payer endorsement, self-pay economics will cap near-term adoption despite rising consumer curiosity.

The 10-12-week window claimed 69.05% share in 2025 as first-trimester screening became standard obstetric protocol. Laboratories often pre-schedule draws during routine ultrasound visits, ensuring logistical efficiency and high patient adherence. Tests performed after 24 weeks, although a small base, are growing 16.34% annually thanks to late-pregnancy management needs such as unexplained anomalies on third-trimester scans.

Clinicians prefer early results for decision-making latitude, but late-stage applications offer reassurance in complex pregnancies where earlier screening was missed or inconclusive. Vendors are refining assays to remain sensitive despite declining fetal fraction as gestation advances, thereby broadening addressable volume.

The Non-Invasive Prenatal Testing Market Report is Segmented by Technology (Next-Generation Sequencing, and More), Test Type (Aneuploidy Screening, and More), Gestation Window (10-12 Weeks, and More), Sample Type (Maternal Plasma CfDNA, and More), Component (Instruments, and More), End User (Hospitals, and More), Distribution Channel, Application, and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America retained 44.78% revenue share in 2025 thanks to payer alignment, established lab networks, and strong professional-society support. The April 2025 removal of prior authorization by a leading national insurer underscores momentum toward frictionless access. Canada's province-by-province funding continues to cause uptake disparity, yet national volume grows as private pay fills public-sector gaps. Mexico's private hospitals are onboarding local sequencing capacity, although reimbursement remains limited to out-of-pocket segments.

Europe reflects a mosaic of policy models that balance ethics with universal healthcare aims. The United Kingdom's National Health Service deploys cfDNA as a contingent second-tier screen, while Germany and France reimburse first-line testing for defined indications. Italy and Spain are expanding region-level pilots to full coverage. Continental emphasis on genetic counseling and consent creates robust support infrastructure, albeit at higher per-test administrative cost.

Asia-Pacific is the growth front runner at 16.18% CAGR. China's government-backed genomics clusters and large birth cohort sustain scale economies that lower per-test pricing. Japan's multi-center demonstration project validated clinical performance, catalyzing private insurer uptake. India's dual-regulation landscape-modern lab hubs in metros versus PCPNDT limitations on sex disclosure-creates uneven regional adoption. Australia operates on an out-of-pocket model averaging AUD 500-800 (USD 330-530), although policy reviews are underway to integrate tests into Medicare Benefits Schedule.

- Illumina

- Natera

- F. Hoffmann-La Roche Ltd (Ariosa)

- BGI Genomics Co. Ltd

- Laboratory Corp of America Holdings

- Eurofins

- Revvity, Inc.

- Thermo Fisher Scientific

- Agilent Technologies

- QIAGEN

- Invitae

- Myriad Women's Health Inc.

- Centogene

- MedGenome Labs

- GenePlanet d.o.o.

- Genetron Health

- Berry Genomics

- Ravgen Inc.

- Bionano Genomics, Inc.

- ARUP Laboratories

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Global Maternal Age Increasing Aneuploidy Prevalence

- 4.2.2 Shift From Invasive Procedures to cfDNA Screening for Safety

- 4.2.3 Falling Sequencing Costs & Automation Lowering Test Prices

- 4.2.4 Expansion of Reimbursement to Average-Risk Pregnancies

- 4.2.5 First-Trimester Guideline Endorsement by Obstetric Societies

- 4.2.6 Bundled Carrier + Prenatal Genetic Panel Adoption

- 4.3 Market Restraints

- 4.3.1 Ethical & Regulatory Concerns on Incidental Findings / Sex Selection

- 4.3.2 Limited Lab Infrastructure & Bioinformatics Expertise in Emerging Markets

- 4.3.3 Accuracy Challenges in Twin and IVF Pregnancies Reducing Clinician Confidence

- 4.3.4 Uncertain Clinical Utility of Microdeletion Screening for Payers

- 4.4 Value Chain Analysis

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitutes

- 4.6.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Technology

- 5.1.1 Next-Generation Sequencing (NGS)

- 5.1.2 Rolling-Circle Amplification

- 5.1.3 Microarray

- 5.1.4 Real-Time PCR

- 5.1.5 Other Technologies

- 5.2 By Test Type

- 5.2.1 Aneuploidy Screening

- 5.2.2 Microdeletion / Microduplication Screening

- 5.2.3 Whole-Genome cfDNA Screening

- 5.2.4 Rh-D Genotyping

- 5.2.5 Monogenic Disease Testing

- 5.3 By Gestation Window

- 5.3.1 10-12 Weeks

- 5.3.2 13-24 Weeks

- 5.3.3 Greater Than 24 Weeks

- 5.4 By Sample Type

- 5.4.1 Maternal Plasma cfDNA

- 5.4.2 Circulating Trophoblastic Cells

- 5.5 By Component

- 5.5.1 Instruments

- 5.5.2 Kits & Reagents

- 5.5.3 Services

- 5.6 By End User

- 5.6.1 Hospitals & Birthing Centers

- 5.6.2 Diagnostic Laboratories

- 5.6.3 IVF & Fertility Clinics

- 5.6.4 Research Institutes

- 5.7 By Distribution Channel

- 5.7.1 Physician-Referral

- 5.7.2 Direct-to-Consumer (DTC)

- 5.8 By Application

- 5.8.1 Down Syndrome (Trisomy 21)

- 5.8.2 Edwards Syndrome (Trisomy 18)

- 5.8.3 Patau Syndrome (Trisomy 13)

- 5.8.4 Turner Syndrome

- 5.8.5 Other Chromosomal Abnormalities

- 5.9 Geography

- 5.9.1 North America

- 5.9.1.1 United States

- 5.9.1.2 Canada

- 5.9.1.3 Mexico

- 5.9.2 Europe

- 5.9.2.1 Germany

- 5.9.2.2 United Kingdom

- 5.9.2.3 France

- 5.9.2.4 Italy

- 5.9.2.5 Spain

- 5.9.2.6 Rest of Europe

- 5.9.3 Asia-Pacific

- 5.9.3.1 China

- 5.9.3.2 Japan

- 5.9.3.3 India

- 5.9.3.4 Australia

- 5.9.3.5 South Korea

- 5.9.3.6 Rest of Asia-Pacific

- 5.9.4 Middle East and Africa

- 5.9.4.1 GCC

- 5.9.4.2 South Africa

- 5.9.4.3 Rest of Middle East and Africa

- 5.9.5 South America

- 5.9.5.1 Brazil

- 5.9.5.2 Argentina

- 5.9.5.3 Rest of South America

- 5.9.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and analysis of Recent Developments)

- 6.3.1 Illumina Inc.

- 6.3.2 Natera Inc.

- 6.3.3 F. Hoffmann-La Roche Ltd (Ariosa)

- 6.3.4 BGI Genomics Co. Ltd

- 6.3.5 Laboratory Corp of America Holdings

- 6.3.6 Eurofins Scientific SE

- 6.3.7 Revvity, Inc.

- 6.3.8 Thermo Fisher Scientific Inc.

- 6.3.9 Agilent Technologies Inc.

- 6.3.10 Qiagen N.V.

- 6.3.11 Invitae Corporation

- 6.3.12 Myriad Women's Health Inc.

- 6.3.13 Centogene N.V.

- 6.3.14 MedGenome Labs Ltd

- 6.3.15 GenePlanet d.o.o.

- 6.3.16 Genetron Health

- 6.3.17 Berry Genomics

- 6.3.18 Ravgen Inc.

- 6.3.19 Bionano Genomics, Inc.

- 6.3.20 Arup Laboratories

7 Market Opportunities & Future Outlook

- 7.1 White-Space & Unmet-Need Assessment