PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910630

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910630

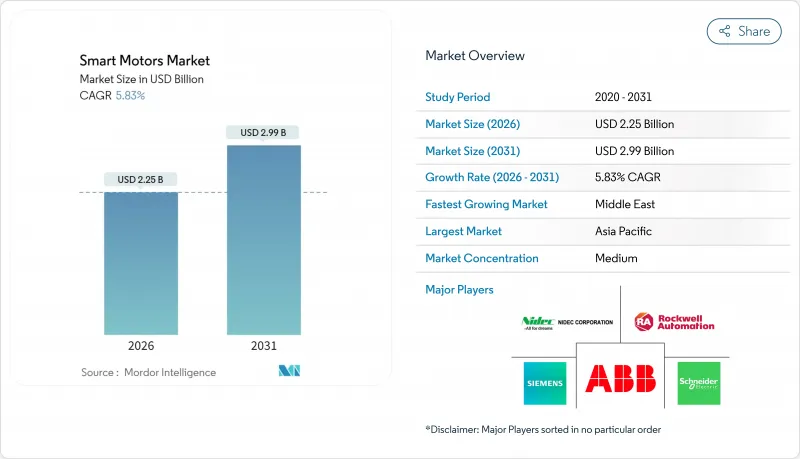

Smart Motors - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The smart motors market was valued at USD 2.13 billion in 2025 and estimated to grow from USD 2.25 billion in 2026 to reach USD 2.99 billion by 2031, at a CAGR of 5.83% during the forecast period (2026-2031).

The heightened convergence of edge artificial intelligence, advanced power electronics, and industrial automation platforms is accelerating adoption as manufacturers, commercial building owners, and infrastructure operators seek to reduce energy bills and enhance uptime. Demand is further driven by regulatory mandates on motor efficiency, growing interest in predictive maintenance, and the need to secure motor networks that now reside firmly within enterprise information-technology perimeters. While the technology remains moderately fragmented, the direction of competition is clear: vendors that can integrate control logic, edge analytics, and secure connectivity within compact housings are rapidly capturing market share. Opportunities are expanding in data center cooling, offshore wind systems, and autonomous mobile robotics, where compact, high-performance drives provide measurable productivity gains.

Global Smart Motors Market Trends and Insights

Convergence of Smart Motor Controls with Edge AI for On-Device Optimization

Edge AI is moving motor intelligence from centralized PLCs toward embedded microcontrollers that can execute inference locally. STMicroelectronics' STM32 family now integrates AI accelerators that cut response latency from milliseconds to microseconds. Texas Instruments' C2000 real-time devices run machine-learning models that flag bearing or winding failures up to 30 days before breakdown, allowing maintenance staff to schedule repairs without disrupting production. Renesas Electronics measured 15-20% efficiency improvements after loading adaptive torque algorithms onto motor drives serving robotic assembly cells. These gains are significant in applications such as pick-and-place robotics, where split-second motion profiles determine throughput. Edge processing also addresses data sovereignty rules by keeping operational data on-premises.

Mandates on Industrial Energy Efficiency Standards in Europe and China

The European Union's Regulation 2019/1781 raises the minimum standard for IE3 motors for most industrial applications and promotes IE4-IE5 in high-consumption settings, effectively drawing intelligent drives into compliance strategies. China's 14th Five-Year Plan targets a 13.5% cut in industrial energy intensity by 2025, naming smart motors as core enablers. IEC 60034-30-1 and IEC 60034-2-1 supply the classification and test methodology that manufacturers must satisfy. Industrial plants in metallurgy, cement, and chemicals-where motors absorb as much as 70% of electricity-are therefore reshuffling capital budgets toward high-efficiency, sensor-rich drives. Regulatory floors accelerate adoption because smart motors can log and report energy performance in real time, validating compliance audits.

Cybersecurity Vulnerabilities in Networked Motor Systems

Linking thousands of drives onto Ethernet networks expands the attack surface that adversaries can exploit. NIST warns that poorly segmented motor networks can allow lateral movement from a single drive to plant-wide control layers. ICS-CERT alerts from 2024 documented malware incidents in which compromised inverters caused speed excursions, damaging pumps and production batches. Real-time constraints complicate patching because drives cannot tolerate the communication latency associated with standard IT security tools. As a result, chemical, water, and power utilities often defer smart motor rollouts until vendors demonstrate drive-native security stacks certified under IEC 62443.

Other drivers and restraints analyzed in the detailed report include:

- Rapid Electrification of HVAC Systems in Commercial Buildings

- Increasing Adoption in Autonomous Mobile Robots and AGVs

- Fragmented Communication Protocol Ecosystem Limiting Interoperability

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Variable speed drives dominated the smart motors market with a 47.82% share in 2025, as they have long served as the principal link between motors and automation networks. Integrated motor-drive packages, however, are experiencing the fastest 6.85% CAGR because buyers value the ability to install a single, sealed unit that combines power electronics, controls, and sensors. The approach eliminates external cabinets and reduces wiring runs, resulting in a cleaner plant floor footprint that appeals to food, beverage, and pharmaceutical processors, particularly those subject to hygiene or safety audits that penalize exposed cable trays. Integrated drives also pass electromagnetic-compatibility tests more readily, saving weeks in design iterations.

Advances in silicon carbide and gallium nitride transistors, operating at higher switching frequencies and lower losses, now permit dense packaging that would have overheated just a few years ago. ABB's integrated solutions deliver 30-40% more power per liter than discrete counterparts while embedding vibration, temperature, and current sensors that stream analytics data to edge PCs. These diagnostics help maintenance teams transition from monthly route-based inspections to condition-based plans, trimming labor and preventing surprise failures. In retrofit environments, stand-alone inverters continue to sell steadily, while new greenfield projects increasingly default to integrated form factors because lifecycle economics favor them. As more factory automation vendors preload multi-protocol firmware onto integrated motors, users gain the flexibility to reconfigure communications through software updates rather than hardware swaps, further stimulating adoption.

The 1-10 kW tranche retained a 60.74% share of the smart motors market size in 2025, as mid-range machines-such as conveyors, mixers, and compressors-remain prevalent across both discrete and process industries. Motors in this band see rapid payback when energy savings compound across long duty cycles. Nonetheless, adoption momentum is strongest below 1 kW, where unit sales are expanding at a 7.02% CAGR. Laboratory automation, medical diagnostics, and pick-and-place feeders require ultra-compact drives that mix fine speed control with low acoustic noise and high positional accuracy. Here, fractional-horsepower smart motors replace simple shaded-pole or stepper designs, resulting in a dramatic increase in shipment volumes.

Integration trends mirror those in higher ratings but with heightened emphasis on power density. Texas Instruments demonstrates reference designs featuring a tiny C2000 microcontroller, gate drivers, and field-oriented control firmware, all housed within a palm-sized enclosure that can still manage three-phase currents. Below 1 kW drives also unlock broader building automation use cases, including fan-coil units, smart blinds, and micro-pumps in HVAC hydronic loops. Because distributed building devices number in the thousands, even small motors collectively move the market needle. Above-10 kW systems, in contrast, stay conservative; oil rigs and mines value ruggedness and proven performance over bleeding-edge controls, so upgrades follow longer refresh cycles.

The Smart Motors Market Report is Segmented by Component (Variable Speed Drive, Integrated Motor-Drive, and More), Power Rating (Below 1 KW, 1-10 KW, and More), Communication Protocol (Ethernet/IP, PROFINET, and More), Application (Industrial, Commercial, Automotive, and More), and Geography (North America, Europe, Asia-Pacific, Middle East and Africa, South America). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

The Asia Pacific region held 37.42% of global revenue in 2025, underscored by China's push to reduce industrial-energy intensity and India's Production Linked Incentive schemes, which channel subsidies toward advanced automation. Japanese robotic cell makers require servos with sub-millisecond jitter, fueling demand for high-performance smart drives, while South Korean shipyards integrate ruggedized motors to endure salt-laden atmospheres over 25-year lifecycles. Taiwan and mainland China, home to booming semiconductor foundries, add further pull for low-vibration, high-purity clean-room motors. Local supply chains shorten lead times, letting Asian OEMs undercut foreign rivals on pricing without sacrificing features.

The Middle East is the pacesetter with a 6.35% CAGR through 2031. Saudi Arabia's Vision 2030 plans channel billions into petrochemical, mining, and green-hydrogen projects, each specifying motor systems with advanced diagnostics to minimize maintenance trips to remote desert sites. United Arab Emirates mega-buildings adopt intelligent HVAC drives to comply with sustainability ratings. Offshore desalination plants along the Gulf rely on corrosion-resistant smart motors that flag bearing wear before catastrophic failures, protecting water output.

North America continues to upgrade legacy assets as reshoring trends bring new automated factories online. U.S. federal tax incentives for efficient motors complement California and New York building codes, which mandate the use of variable-speed drives in HVAC systems over certain horsepower thresholds. Cybersecurity stipulations under the NIST framework elevate demand for drives certified to IEC 62443-4-2. In Europe, Regulation 2019/1781 is in full effect, obliging even small workshops to swap out sub-IE3 motors. German automotive groups are early adopters of PROFINET-enabled smart drives to control and coordinate paint-shop conveyors and welding robots. Eastern Europe, with its lower labor costs, is emerging as a contract-manufacturing hub and a successive investment wave for smart motor suppliers.

- Siemens AG

- Schneider Electric SE

- ABB Ltd

- Rockwell Automation Inc.

- Nidec Corporation

- Safran Electrical and Power

- Nanotec Electronic GmbH and Co. KG

- Turntide Technologies Inc.

- Fuji Electric Co. Ltd

- Moog Inc.

- Dunkermotoren GmbH (Ametek Inc.)

- Shanghai Moons' Electric Co. Ltd

- WEG S.A.

- Yaskawa Electric Corporation

- Parker Hannifin Corporation

- SEW-Eurodrive GmbH and Co KG

- Brook Crompton Holdings Ltd

- Bonfiglioli Riduttori S.p.A.

- Emerson Electric Co.

- Applied Motion Products Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Convergence of Smart Motor Controls with Edge AI for On-Device Optimization

- 4.2.2 Mandates on Industrial Energy Efficiency Standards in Europe and China

- 4.2.3 Rapid Electrification of HVAC Systems in Commercial Buildings

- 4.2.4 Increasing Adoption in Autonomous Mobile Robots and AGVs

- 4.2.5 Rising Deployment in Offshore Wind Turbine Pitch and Yaw Systems

- 4.2.6 Declining Cost of Integrated Motor-Drive Packages Due to SiC/GaN Power Devices

- 4.3 Market Restraints

- 4.3.1 Cybersecurity Vulnerabilities in Networked Motor Systems

- 4.3.2 Fragmented Communication Protocol Ecosystem Limiting Interoperability

- 4.3.3 Prolonged Supply Chain Constraints for Power Electronics Components

- 4.3.4 Skills Gap in Condition-Based Maintenance Analytics

- 4.4 Industry Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Degree of Competition

- 4.8 Impact of Macroeconomic Factors

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Component

- 5.1.1 Variable Speed Drive

- 5.1.2 Motor

- 5.1.3 Integrated Motor-Drive

- 5.2 By Power Rating

- 5.2.1 Below 1 kW

- 5.2.2 1-10 kW

- 5.2.3 Above 10 kW

- 5.3 By Communication Protocol

- 5.3.1 Ethernet/IP

- 5.3.2 PROFINET

- 5.3.3 Modbus TCP

- 5.3.4 Other Communication Protocol

- 5.4 By Application

- 5.4.1 Industrial

- 5.4.1.1 Oil and Gas

- 5.4.1.2 Metal and Mining

- 5.4.1.3 Water and Wastewater

- 5.4.1.4 Food and Beverage

- 5.4.1.5 Chemicals

- 5.4.1.6 Other Industrial

- 5.4.2 Commercial

- 5.4.2.1 HVAC and Building Automation

- 5.4.2.2 Data Centers

- 5.4.2.3 Other Commercial

- 5.4.3 Automotive

- 5.4.4 Aerospace and Defense

- 5.4.1 Industrial

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Russia

- 5.5.2.5 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 South Korea

- 5.5.3.5 Australia

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle East and Africa

- 5.5.4.1 Middle East

- 5.5.4.1.1 Saudi Arabia

- 5.5.4.1.2 United Arab Emirates

- 5.5.4.1.3 Rest of Middle East

- 5.5.4.2 Africa

- 5.5.4.2.1 South Africa

- 5.5.4.2.2 Egypt

- 5.5.4.2.3 Rest of Africa

- 5.5.4.1 Middle East

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global Level Overview, Market Level Overview, Core Segments, Financials as Available, Strategic Information, Market Rank/Share for Key Companies, Products and Services, and Recent Developments)

- 6.3.1 Siemens AG

- 6.3.2 Schneider Electric SE

- 6.3.3 ABB Ltd

- 6.3.4 Rockwell Automation Inc.

- 6.3.5 Nidec Corporation

- 6.3.6 Safran Electrical and Power

- 6.3.7 Nanotec Electronic GmbH and Co. KG

- 6.3.8 Turntide Technologies Inc.

- 6.3.9 Fuji Electric Co. Ltd

- 6.3.10 Moog Inc.

- 6.3.11 Dunkermotoren GmbH (Ametek Inc.)

- 6.3.12 Shanghai Moons' Electric Co. Ltd

- 6.3.13 WEG S.A.

- 6.3.14 Yaskawa Electric Corporation

- 6.3.15 Parker Hannifin Corporation

- 6.3.16 SEW-Eurodrive GmbH and Co KG

- 6.3.17 Brook Crompton Holdings Ltd

- 6.3.18 Bonfiglioli Riduttori S.p.A.

- 6.3.19 Emerson Electric Co.

- 6.3.20 Applied Motion Products Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-Space and Unmet-Need Assessment