PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910634

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910634

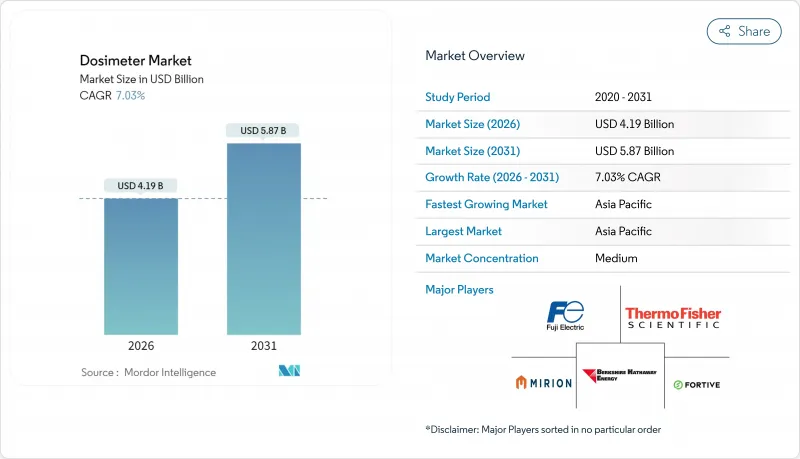

Dosimeter - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The dosimeter market was valued at USD 3.91 billion in 2025 and estimated to grow from USD 4.19 billion in 2026 to reach USD 5.87 billion by 2031, at a CAGR of 7.03% during the forecast period (2026-2031).

Recent revenue expansion is closely tied to stricter radiation-safety regulations, the roll-out of small modular reactors, and rapid innovation in connected electronic personal dosimeters (EPDs) that stream dose data in real time. Health-care providers are purchasing higher volumes of eye-lens monitors after international regulators slashed permissible annual exposure limits, while industrial non-destructive-testing (NDT) crews are upgrading to wireless badges that simplify multi-site compliance documentation. Suppliers are also layering artificial-intelligence analytics onto existing hardware so safety teams can predict cumulative exposure trends and automate reporting. Asia-Pacific's nuclear build-out, coupled with its fast-growing diagnostic-imaging sector, positions the region as the largest and fastest-advancing demand center for dosimetry solutions. Meanwhile, moderate market fragmentation persists because leading manufacturers continue to acquire niche technology firms, expand regional service bureaus, and offer subscription-based data platforms that lock in long-term customers.

Global Dosimeter Market Trends and Insights

Heightened Oncology Imaging and Radiotherapy Volumes

Growing demand for precision radiotherapy and high-throughput diagnostic imaging is swelling the population of radiation workers who need continuous monitoring. Modern linear accelerators emit higher-energy stray neutrons, prompting facilities to add bubble detectors and semiconductor badges that capture mixed-field exposure. Proton-therapy centers are early adopters of multi-site microdosimeters that map dose distributions inside complex radiation fields. Hospitals are also layering AI dashboards onto badge data so managers can forecast cumulative exposure and rotate staff before limits are reached. The result is a clear shift from quarterly film badges to real-time EPDs that integrate with hospital information systems, ensuring compliance with tightened occupational limits.

Expansion of Nuclear-Power Capacity (SMRs and Life-Extension Projects)

Dozens of Asia-Pacific utilities have approved small modular reactors that require a denser network of dosimeters per installed megawatt than conventional units. Life-extension programs in aging fleets add further demand by replacing legacy film badges with wireless EPDs capable of centralized dose logging. Vendors such as Mirion have released SMR-specific monitoring suites and report double-digit revenue gains from the segment. The industry's ALARA culture calls for even finer measurement granularity, encouraging utilities to purchase high-sensitivity semiconductor detectors for low-level gamma fields.

Calibration-Source Shortages and Isotope Supply Chain Shocks

Chronic shortages of molybdenum-99, cesium-137, and cobalt-60 disrupt calibration schedules and force service bureaus to extend certification cycles, undermining confidence in badge accuracy. Emerging markets suffer most because they rely on imported sources and have limited domestic irradiation facilities. Some labs experiment with alternative photon sources, but regulatory bodies are slow to approve new methods, lengthening qualification timelines and slowing badge procurement.

Other drivers and restraints analyzed in the detailed report include:

- Tightening Eye-Lens Dose Limits and Real-Time Compliance Audits

- Industrial Radiography Digitization (Pipe-Weld QC, 5G Infra Build-Out)

- Persistent Accuracy Gaps for Low-Energy Neutron Fields

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Electronic Personal Dosimeters captured 38.72% dosimeter market share in 2025 and are forecast to expand at a 8.75% CAGR as facilities pivot toward instant exposure feedback. The segment benefits from wireless connectivity, GPS tagging, and AI analytics that warn users when cumulative dose trends accelerate. Thermoluminescent Dosimeters still appeal to price-sensitive programs seeking proven accuracy, while Optically Stimulated Luminescence gains niche traction where faster readout is critical. Film badges persist in some developing regions, but their share continues to shrink as regulatory bodies favor systems that support rapid audit cycles. Hybrid Direct Ion Storage devices now bridge passive longevity with electronic readout ease, smoothing migration paths for operators cautious of full-scale EPD deployment.

EPD vendors are integrating environmental sensors that record temperature, humidity, and air pressure so safety officers can correlate exposure with changing work conditions. Larger industrial sites deploy thousands of units tied into cloud dashboards that visualize dose distribution across departments. As firmware updates add new sensor modalities, mid-cycle replacement rates lengthen, but software-as-a-service contracts keep revenue recurring, reinforcing vendor lock-in.

Passive monitoring accounted for 52.10% of the dosimeter market size in 2025, thanks to entrenched regulatory acceptance, yet active systems are growing faster at an 8.52% CAGR. Hospitals rolling out high-dose interventional cardiology suites want audible alarms and real-time dose dashboards, pushing procurement toward active badges. Nuclear utilities favor active systems for outage work where job times are compressed and exposure rates fluctuate sharply. Service providers bundle cloud-based analytics that automate limit tracking, reducing administrative load on radiation-safety officers.

Passive badges remain popular in large-scale screening programs because they are inexpensive, lightweight, and require minimal user training. In lower-income regions, government health agencies still distribute passive film badges to clinics, though donor-funded pilot projects now introduce optically stimulated luminescence readers to accelerate result turnaround. Vendors that offer compatible ecosystems spanning both passive and active technologies position themselves well to capture the full lifecycle of customer upgrades.

The Dosimeter Market Report is Segmented by Product Type (Electronic Personal Dosimeter, Thermoluminescent Dosimeter, and More), Application (Active, and Passive), End-User Industry (Healthcare, Oil and Gas, Mining and Metals, and More), Detection Technology (Semiconductor, Scintillator-Based, and More), and Geography (North America, South America, Europe, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific led the dosimeter market with 28.45% share in 2025 and is accelerating at a 8.63% CAGR as China, India, and Southeast Asian countries greenlight new reactors and expand radiotherapy capacity. China's nuclear construction pipeline, coupled with large-scale isotope-production facilities, secures steady badge demand across utility and pharmaceutical segments. Japan's post-Fukushima retrofits prioritize digital dose tracking, while Malaysia and the Philippines embrace SMRs, each requiring dense personal-dosimetry networks around modular sites.

North America retains a substantial installed base of legacy reactors and nationwide medical imaging fleets. The U.S. Nuclear Regulatory Commission's focus on real-time worker monitoring drives hospitals to swap quarterly badge programs for live EPD dashboards. Canada's CANDU refurbishments and uranium mining operations procure neutron-capable detectors, whereas Mexico's industrial-radiography contractors expand their badge subscriptions to meet national occupational-health mandates.

Europe witnesses incremental uptake as reactor life-extension projects roll out dosimeter upgrades and decommissioning teams outfit technicians dismantling shuttered German plants. The United Kingdom's advanced-reactor pilots integrate next-generation semiconductor detectors from project inception. GDPR constraints influence product design, pushing suppliers to certify data-encryption modules and offer on-premises servers. Eastern European states exploring SMR options establish locally hosted dosimetry service bureaus, further propelling regional sales.

- Mirion Technologies Inc.

- LANDAUER (Berkshire Hathaway Energy)

- Thermo Fisher Scientific Inc.

- Fuji Electric Co., Ltd.

- Fortive Corp. (Fluke Biomedical)

- ATOMTEX JSC

- Polimaster Ltd.

- Ludlum Measurements Inc.

- Panasonic Industrial Devices

- Arrow-Tech Inc.

- SE International Inc.

- Automess Automation & Measurement GmbH

- Radiation Detection Company Inc.

- Unfors RaySafe AB

- ECOTEST Group Ukraine

- Dosimetrics GmbH

- Kromek Group PLC

- Electronic & Engineering Co. (I) P. Ltd.

- Bubble Technology Industries Inc.

- Qingdao TLead International Co. Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Heightened oncology imaging and radiotherapy volumes

- 4.2.2 Expansion of nuclear-power capacity (SMRs and life-extension projects)

- 4.2.3 Tightening eye-lens dose limits and real-time compliance audits

- 4.2.4 Industrial radiography digitization (pipe-weld QC, 5-G infra build-out)

- 4.2.5 AI-enabled dose-analytics platforms bundled with EPD hardware

- 4.2.6 Rising emerging-market biodosimetry labs for emergency surge response

- 4.3 Market Restraints

- 4.3.1 Calibration-source shortages and isotope supply chain shocks

- 4.3.2 Persistent accuracy gaps for low-energy neutron fields

- 4.3.3 Data-integration cyber-security liabilities

- 4.3.4 End-user fatigue from badge-processing subscription costs

- 4.4 Industry Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Product Type

- 5.1.1 Electronic Personal Dosimeter (EPD)

- 5.1.2 Thermoluminescent Dosimeter (TLD)

- 5.1.3 Optically Stimulated Luminescence (OSL)

- 5.1.4 Film Badge

- 5.1.5 Direct Ion Storage and DIS-OSL

- 5.2 By Application

- 5.2.1 Active

- 5.2.2 Passive

- 5.3 By End-user Industry

- 5.3.1 Healthcare

- 5.3.2 Nuclear Power and Fuel Cycle

- 5.3.3 Oil and Gas

- 5.3.4 Mining and Metals

- 5.3.5 Industrial NDT / Manufacturing

- 5.3.6 Defence and Security

- 5.4 By Detection Technology

- 5.4.1 Semiconductor (Si, SiC, PIN)

- 5.4.2 Scintillator-based

- 5.4.3 Gas-filled GM / Proportional

- 5.4.4 Solid-State Passive (LiF, Al2O3, BeO)

- 5.4.5 Bubble / Superheated-Drop

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Russia

- 5.5.3.7 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 India

- 5.5.4.4 South Korea

- 5.5.4.5 South-East Asia

- 5.5.4.6 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 Saudi Arabia

- 5.5.5.1.2 United Arab Emirates

- 5.5.5.1.3 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Egypt

- 5.5.5.2.3 Rest of Africa

- 5.5.5.1 Middle East

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Mirion Technologies Inc.

- 6.4.2 LANDAUER (Berkshire Hathaway Energy)

- 6.4.3 Thermo Fisher Scientific Inc.

- 6.4.4 Fuji Electric Co., Ltd.

- 6.4.5 Fortive Corp. (Fluke Biomedical)

- 6.4.6 ATOMTEX JSC

- 6.4.7 Polimaster Ltd.

- 6.4.8 Ludlum Measurements Inc.

- 6.4.9 Panasonic Industrial Devices

- 6.4.10 Arrow-Tech Inc.

- 6.4.11 SE International Inc.

- 6.4.12 Automess Automation & Measurement GmbH

- 6.4.13 Radiation Detection Company Inc.

- 6.4.14 Unfors RaySafe AB

- 6.4.15 ECOTEST Group Ukraine

- 6.4.16 Dosimetrics GmbH

- 6.4.17 Kromek Group PLC

- 6.4.18 Electronic & Engineering Co. (I) P. Ltd.

- 6.4.19 Bubble Technology Industries Inc.

- 6.4.20 Qingdao TLead International Co. Ltd.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment