PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910643

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910643

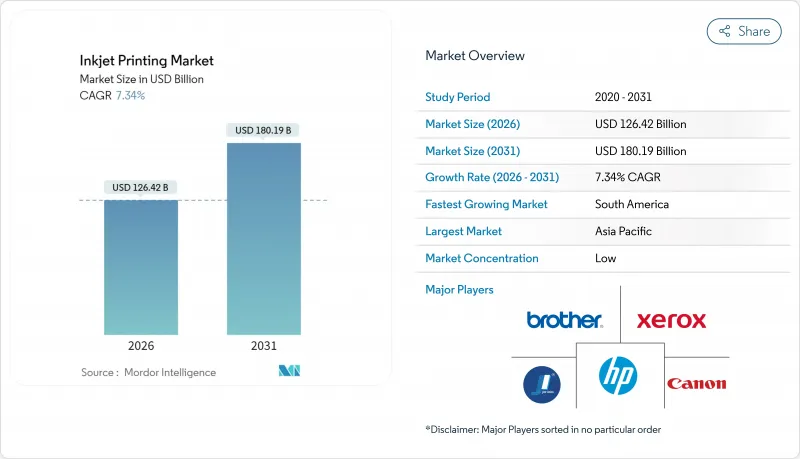

Inkjet Printing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The inkjet printing market was valued at USD 117.77 billion in 2025 and estimated to grow from USD 126.42 billion in 2026 to reach USD 180.19 billion by 2031, at a CAGR of 7.34% during the forecast period (2026-2031).

Current momentum rests on three pillars: rising demand for data-rich packaging, the fashion sector's pivot to on-demand textile output, and regulatory pressure that favors water-based chemistries. Vendors are shifting from hardware-centric propositions toward connected, service-rich ecosystems that lower the total cost of ownership and support mass customization. Consolidation among printhead innovators, coupled with region-specific incentives for localized production, is reshaping competitive dynamics while opening white-space opportunities in direct-to-shape, functional electronics, and decor applications. The inkjet printing market continues to thrive by translating these structural forces into scalable, digitally enabled workflows that replace analog systems across packaging, publishing, textile, and industrial verticals.

Global Inkjet Printing Market Trends and Insights

Data-driven Packaging Demand from FMCG and Food Sectors

Stringent traceability mandates and anti-counterfeiting initiatives are pushing brand owners toward real-time, variable data capabilities that only the inkjet printing market can scale efficiently. Graphic Packaging International's deployment of imprinting technology embeds batch-level serialization while maintaining line speeds, proving that high-resolution thermal inkjet can coexist with high-throughput environments. MapleJet's modular coding systems further illustrate how inline integration minimizes downtime and ensures regulatory compliance on recyclable films. Collaborations such as SUDPACK-LEIBINGER extend this approach to mono-material packaging, demonstrating how compliant inks combined with recyclable substrates future-proof operations under forthcoming EU targets. Across markets, the ability to embed QR codes and dynamic design elements is transforming packaging from a passive container to an interactive brand asset, locking in sustained demand for innovative inkjet platforms.

Proliferation of Short-run, On-demand Publishing

Average first-print runs continue to contract as publishers align inventory with volatile consumer demand. Nielsen BookScan data show double-digit drops in initial orders, prompting adoption of sheetfed and web inkjet devices that deliver offset-like economics at runs below 1,000 copies. Canon's new B2 device prints 8,700 sheets per hour, reducing breakeven points and enabling "gap" printing strategies that bridge supply during social-media-driven sales spikes. HP's digital production platforms reinforce this shift by automating job sequencing and finishing, trimming labor costs, and integrating cloud-based analytics. As publishers pivot to micro-batch replenishment and personalized editions, the inkjet printing market stands out as the only technology able to monetize these emerging workflows without inflating warehousing costs.

Accelerating Shift of Ad-spend into Digital Channels

The ongoing transition of marketing budgets to programmatic platforms limits addressable volumes for commercial print. Agencies favor click-through metrics and real-time attribution, challenging print service providers that were once reliant on high-volume flyers and catalogs. In response, firms reposition toward high-impact direct mail and transpromo pieces that leverage data-driven personalization. By coupling unique QR codes with loyalty programs, printers preserve relevance and capture premium margins, yet overall volume shrinkage remains a drag on the inkjet printing market's legacy commercial segment.

Other drivers and restraints analyzed in the detailed report include:

- Growth of Industrial Decor and Direct-to-shape Printing

- Advent of Single-pass, High-speed Inkjet Presses

- Persistent Cap-ex Premium over Legacy Flexo/Screen Lines

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Drop-on-Demand (DoD) platforms delivered 45.88% of 2025 revenue, underscoring their versatility across substrates and the high image fidelity clients require. Despite leadership, DoD growth decelerates as Continuous Inkjet's 9.10% CAGR appeals to packaging lines seeking uninterrupted, high-velocity coding. The inkjet printing market size attributable to Continuous Inkjet is projected to surpass USD 33.6 billion by 2031, indicating that speed now carries equal weight with quality for many converters. DoD vendors respond by integrating recirculation heads and AI-assisted droplet control to push speeds past 80 m/min without sacrificing 1,200 dpi resolution.

Investment decisions increasingly revolve around SKU complexity and downtime tolerance. Food and beverage lines that manage hundreds of batch codes daily gravitate toward Continuous technology, while decor and photographic segments remain DoD strongholds due to grayscale modulation advantages. Hybrid architectures that blend DoD pre-coats with Continuous varnish layers illustrate the convergence path ahead for the inkjet printing market.

Aqueous formulations held 34.22% share in 2025, benefiting from low VOC profiles and broad paper compatibility. Regulatory headwinds expedite adoption, yet they also elevate Latex chemistries that combine water-based carriers with polymer particles to deliver exterior durability. Latex's 10.78% CAGR could lift its slice of the inkjet printing market to nearly one-quarter by 2031. High-capacity bulk tanks and odor-free operation position Latex for in-store signage and decor, segments historically served by solvent inks.

Solvent-based lines persist where extreme adhesion or chemical resistance prevails, but even automotive fixtures now pilot UV-LED and Latex alternatives. Mimaki's CMR-free UV inks and HP's Latex R-series underscore an accelerating R&D cycle focused on sustainability without durability trade-offs. As regulators harden thresholds, the inkjet printing industry is pivoting toward chemistries that embed compliance into their value proposition rather than treating it as a retrofit.

The Inkjet Printing Market Report is Segmented by Printing Technology (Drop-On-Demand, Continuous Inkjet, and More), Ink Type (Aqueous, Solvent, UV-Curable, and More), Component (Printers, Ink Cartridges and Bulk Inks, and More), Application (Books and Publishing, Advertising, and More), Substrate (Paper and Paperboard, Plastic Films and Foils, and More), and Geography (North America, and More). Market Forecasts in Value (USD).

Geography Analysis

Asia-Pacific's dominance reflects unparalleled synergy between volume-oriented Chinese converters and high-precision Japanese head manufacturers. Investments in automation and AI-enabled presses proliferate across textile hubs from Guangdong to Tamil Nadu, reinforcing regional leadership. South Korea leverages its electronics ecosystem to pilot functional inkjet lines for OLED and PCB fabrication, widening the technology pool that feeds the inkjet printing market.

South America's acceleration hinges on policy-driven localization that shields converters from import tariffs while fostering job creation. Fiscal incentives help smaller plants upgrade to digital lines, especially in food packaging, where demand for traceability and shorter lead times aligns with inkjet capabilities. Supply chain disruptions in 2024 illustrated the strategic value of domestic print capacity, spurring cap-ex through 2031.

North America and Western Europe continue to shape technological trajectories via R&D clusters and stringent environmental norms. The German Printing Ink Ordinance and REACH expansions catalyze rapid migration to low-VOC chemistries, setting de facto global benchmarks. In the Middle East and Africa, rising e-commerce elevates label and flexible-packaging demand, yet infrastructure gaps temper scale. Nonetheless, pilot projects in Gulf states demonstrate high-speed single-pass lines for beverage coding, hinting at future momentum in the inkjet printing market.

- HP Inc.

- Canon Inc.

- Seiko Epson Corp.

- Brother Industries Ltd.

- Ricoh Company Ltd.

- Xerox Holdings Corp.

- Fujifilm Holdings Corp.

- Konica Minolta Inc.

- Kyocera Corp.

- Lexmark International

- Durst Group AG

- Mimaki Engineering Co. Ltd.

- Roland DG Corp.

- Hitachi Industrial Equipment Systems

- Videojet Technologies Inc.

- Domino Printing Sciences

- Inkjet Inc.

- Jet Inks Pvt Ltd.

- King Printing Co. Ltd.

- Electronics For Imaging (EFI)

- Nazdar Ink Technologies

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Data-driven packaging demand from FMCG and food sectors

- 4.2.2 Proliferation of short-run, on-demand publishing

- 4.2.3 Growth of industrial decor and direct-to-shape printing

- 4.2.4 Advent of single-pass, high-speed inkjet presses

- 4.2.5 IoT-enabled predictive maintenance lowering TCO

- 4.2.6 Adoption of water-based inks to meet stricter VOC caps

- 4.3 Market Restraints

- 4.3.1 Accelerating shift of ad-spend into digital channels

- 4.3.2 Persistent cap-ex premium over legacy flexo/screen lines

- 4.3.3 Widening patent thicket around print-head designs

- 4.3.4 Raw-material price volatility for specialty pigments

- 4.4 Industry Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Impact of the Macroeconomic Factors on the Market

5 MARKET SIZE AND GROWTH FORECASTS (VALUES)

- 5.1 By Printing Technology

- 5.1.1 Drop-on-Demand Inkjet

- 5.1.2 Continuous Inkjet

- 5.1.3 Other Printing Technologies

- 5.2 By Ink Type

- 5.2.1 Aqueous

- 5.2.2 Solvent-based

- 5.2.3 UV-curable

- 5.2.4 Latex

- 5.2.5 Dye-Sublimation

- 5.2.6 Other Ink Type

- 5.3 By Component

- 5.3.1 Printers

- 5.3.2 Ink Cartridges and Bulk Inks

- 5.3.3 Print-heads

- 5.3.4 Software and Services

- 5.4 By Application

- 5.4.1 Books and Publishing

- 5.4.2 Commercial Print

- 5.4.3 Advertising

- 5.4.4 Transactional

- 5.4.5 Labels

- 5.4.6 Packaging

- 5.4.7 Textile Printing

- 5.4.8 Electronics and PCB Printing

- 5.4.9 Other Applications

- 5.5 By Substrate Material

- 5.5.1 Paper and Paperboard

- 5.5.2 Plastic Films and Foils

- 5.5.3 Textile

- 5.5.4 Metal

- 5.5.5 Glass and Ceramics

- 5.5.6 Other Substrate Material

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 Europe

- 5.6.2.1 Germany

- 5.6.2.2 United Kingdom

- 5.6.2.3 France

- 5.6.2.4 Italy

- 5.6.2.5 Spain

- 5.6.2.6 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 China

- 5.6.3.2 Japan

- 5.6.3.3 India

- 5.6.3.4 South Korea

- 5.6.3.5 Australia

- 5.6.3.6 Singapore

- 5.6.3.7 Rest of Asia-Pacific

- 5.6.4 Middle East and Africa

- 5.6.4.1 Middle East

- 5.6.4.1.1 Saudi Arabia

- 5.6.4.1.2 United Arab Emirates

- 5.6.4.1.3 Turkey

- 5.6.4.1.4 Rest of Middle East

- 5.6.4.2 Africa

- 5.6.4.2.1 South Africa

- 5.6.4.2.2 Nigeria

- 5.6.4.2.3 Egypt

- 5.6.4.2.4 Rest of Africa

- 5.6.4.1 Middle East

- 5.6.5 South America

- 5.6.5.1 Brazil

- 5.6.5.2 Argentina

- 5.6.5.3 Rest of South America

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 HP Inc.

- 6.4.2 Canon Inc.

- 6.4.3 Seiko Epson Corp.

- 6.4.4 Brother Industries Ltd.

- 6.4.5 Ricoh Company Ltd.

- 6.4.6 Xerox Holdings Corp.

- 6.4.7 Fujifilm Holdings Corp.

- 6.4.8 Konica Minolta Inc.

- 6.4.9 Kyocera Corp.

- 6.4.10 Lexmark International

- 6.4.11 Durst Group AG

- 6.4.12 Mimaki Engineering Co. Ltd.

- 6.4.13 Roland DG Corp.

- 6.4.14 Hitachi Industrial Equipment Systems

- 6.4.15 Videojet Technologies Inc.

- 6.4.16 Domino Printing Sciences

- 6.4.17 Inkjet Inc.

- 6.4.18 Jet Inks Pvt Ltd.

- 6.4.19 King Printing Co. Ltd.

- 6.4.20 Electronics For Imaging (EFI)

- 6.4.21 Nazdar Ink Technologies

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment