PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910647

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910647

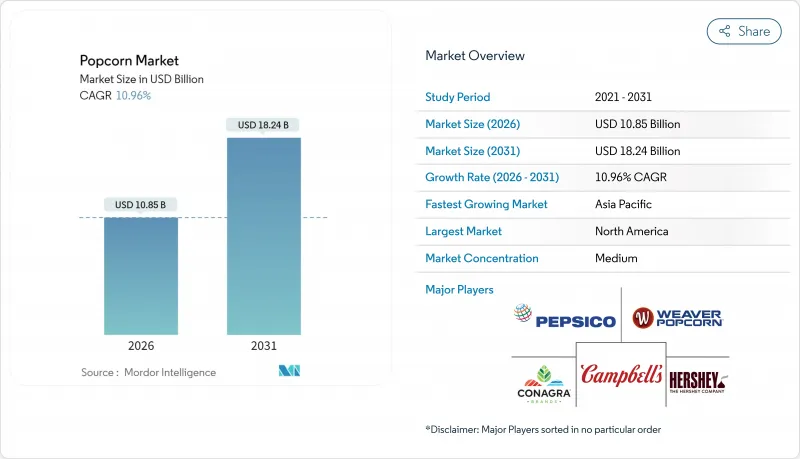

Popcorn - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

In 2025, the popcorn market was valued at USD 9.78 billion. The popcorn market is expected to grow from USD 9.78 billion in 2025 to USD 10.85 billion in 2026 and is forecast to reach USD 18.24 billion by 2031 at 10.96% CAGR over 2026-2031.

This growth is buoyed by trends like premiumization, strategic entertainment partnerships, and plant-level automation, ensuring consistent quality across a diverse flavor range. Investors are keenly eyeing this trajectory, with major food conglomerates snapping up niche assets for broader reach and a vertically integrated supply chain. North America leads in revenue, but the Asia Pacific is witnessing the swiftest demand surge, suggesting a strategy that marries scale with regional nuances. As consumers increasingly gravitate towards organic and clean-label products, established brands are responding by diversifying their offerings, introducing premium formulations that promise better margins. The International Food Information Council reported that in 2023, about 29% of U.S. consumers regularly purchased food and beverages for their "clean ingredients" labels.

Global Popcorn Market Trends and Insights

Innovations in Flavor and Product Types

Flavor innovation has become a pivotal strategy for differentiation, with manufacturers increasingly turning to co-branding partnerships to capture consumer interest and command premium prices. In October 2024, Starco Brands introduced a Garlic Butter flavor for its Winona Popcorn Spray. This move underscores a focused approach to product development, ensuring even coverage of kernels through an air-powered application. Notably, the product emphasizes health-conscious attributes, boasting non-GMO and gluten-free formulations. The pandemic acted as a catalyst for collaborative flavor innovations. For instance, Smartfood teamed up with Cap'n Crunch to create a Crunch Berries popcorn mix, while Frito-Lay expanded its Cheetos Popcorn line with Flamin' Hot variants. Such moves highlight how established snack brands are using popcorn as a canvas for flavor exploration. These innovations not only cater to the consumer's craving for unique taste experiences but also empower manufacturers to set premium prices, especially when positioned as limited editions with broad appeal.

Environmental Sustainability and Packaging Innovation

Regulatory pressures and heightened environmental awareness among consumers have spurred rapid advancements in sustainable packaging within the popcorn industry. Bad Monkey Popcorn has pioneered the world's first heatable, 100% compostable wood-fiber bag for pre-popped popcorn. Meanwhile, Braskem America has introduced WENEW, a bio-circular polypropylene sourced from used cooking oil, marking a significant step in reducing fossil fuel reliance for snack packaging. The European Union's Packaging and Packaging Waste Regulation (EU 2025/40), set to take effect in August 2026, imposes sustainable design mandates and binding reuse targets, signaling a shift in packaging strategies throughout the popcorn supply chain. In response, manufacturers are pivoting towards recyclable solutions. Notably, KYSU is set to debut airtight, reusable paper cans crafted from 100% recycled materials in October 2024, aiming to combat plastic pollution without compromising product freshness or visual appeal.

Fluctuations in Raw Material Prices

Popcorn manufacturers grapple with persistent corn price volatility. USDA projects corn prices stabilizing at around USD 4.35 per bushel by 2025. The World Bank reported that in 2024, maize averaged USD 191 nominal per metric ton. While forecasts hint at a return to historical price norms, uncertainties in trade policies, such as reciprocal tariffs and retaliatory measures, amplify price risks. An analysis from the University of Illinois warns the industry might endure a multi-year lower-price phase, echoing patterns from 1985-1992 and 1998-2005. However, this trend could be swiftly upended by supply shocks, be it from weather anomalies or geopolitical tensions. Manufacturers lacking hedging capabilities feel the pinch during price surges, facing margin compression. In contrast, those boasting integrated supply chains or long-term contracts enjoy a competitive edge amidst the volatility.

Other drivers and restraints analyzed in the detailed report include:

- Growth of At-Home Entertainment and Streaming Services

- Strategic Marketing and Collaborations

- Intense Competition from Alternative Snacks

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

In 2025, Ready-to-Eat (RTE) popcorn commands a dominant 56.78% market share, riding the wave of convenience trends and impulse buying that favor grab-and-go formats. Meanwhile, microwave popcorn is on a resurgence, boasting a robust 12.45% CAGR through 2031. This growth is fueled by the rising trend of at-home entertainment and packaging innovations that tackle past concerns over chemical additives. The revival of the microwave segment underscores manufacturers' commitment to addressing these concerns. A case in point is Coop Denmark's reintroduction of microwave popcorn, now packaged in Liven's cellulose-based bags. These bags not only sidestep PFAS worries but also ensure fat impermeability. While unpopped kernels cater to niche markets like bulk foodservice and artisanal producers, they grapple with competition from automated systems that lean towards processed formats.

Product type segmentation highlights varied consumption trends across demographics and occasions. RTE popcorn, with its strategic placement in bustling retail spots and portion-controlled packaging, dominates impulse buys. In contrast, microwave popcorn is favored for planned home entertainment consumption. Automation in manufacturing is increasingly skewed towards RTE production, emphasizing consistent quality and packaging efficiency. Facilities like Bratney's turnkey operation boast an impressive 99.9% perfect product rate, thanks to their integrated processing and packaging systems. The competitive landscape is witnessing a wave of consolidation, with major brands snapping up specialized manufacturing capabilities. A prime example is Hershey's acquisition of Weaver Popcorn facilities in October 2023, a move aimed at bolstering the SkinnyPop brand and tightening supply chain control.

In 2025, conventional popcorn dominates the market with an 85.20% share, bolstered by established supply chains and cost advantages that facilitate competitive pricing in mass-market channels. Meanwhile, organic popcorn is making waves, growing at a robust 13.55% CAGR. This surge underscores consumers' readiness to pay a premium for health and environmental benefits. Such growth mirrors the broader clean-label movement, which emphasizes natural ingredients and transparent sourcing over mere cost-cutting. Highlighting this trend, the International Federation of Organic Agriculture Movements reported that in 2023, per capita organic food consumption in the EU-27 hit a decade-high at approximately EUR 104.

However, the organic segment's growth isn't without challenges. Specialized corn varieties demand unique farming methods and dedicated processing facilities to uphold certification standards. This premium positioning allows organic brands to set higher prices, with some artisanal producers reaping margins 2-3 times that of conventional counterparts, thanks to direct-to-consumer sales and niche retail collaborations. Furthermore, regulatory frameworks, like the USDA National Organic Program standards, not only bolster consumer trust in organic certification but also erect barriers. These barriers shield established organic brands from conventional players eyeing the premium market, especially those unwilling to heavily invest in certified supply chains.

The Global Popcorn Market is Segmented by Product Type (Microwave Popcorn, Ready-To-Eat Popcorn, and More), Nature (Organic and Conventional), Flavor Profile (Salted/Traditional, Caramel, and More), Packaging Type (Single-Serve, Multi-Serve, and More), Distribution Channel (Supermarkets/Hypermarkets, Convenience Stores, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

In 2025, North America held a dominant 32.10% share of the popcorn market, bolstered by a deep-rooted snacking culture and elevated per-capita consumption rates. The U.S. leverages integrated farm-to-factory corridors, reducing raw-material delays and swiftly rotating SKUs for seasonal events. Canada boosts regional growth with efficient cross-border distribution, while Mexico broadens its market presence with value-centric pack sizes, catering to the expansion of modern trade. Recent manufacturing investments, like Weaver Popcorn's upgraded plant in Indiana (May 2024), underscore the region's long-term confidence, enhancing packaging capabilities for premium offerings.

Asia Pacific is set to lead with the highest absolute volume growth, projected at a 12.25% CAGR through 2031. China's burgeoning cinema scene and a middle class willing to splurge on snacks are paving the way for both mainstream and premium popcorn offerings. Flavors like Sichuan peppercorn are striking a chord with local tastes. While popcorn's presence in India's snack repertoire is modest, the growth trajectory is promising; 4700BC's ambitious revenue targets hint at the potential for scaling with broader distribution. Meanwhile, Japan and South Korea are increasingly favoring packaging innovations that cater to convenience store layouts and safety standards, driving demand for compact, resealable formats.

Europe is maintaining a steady pace, driven by regulatory initiatives promoting recyclable materials and enhanced nutrient profiles. Germany and the U.K. are pushing volumes through mainstream supermarket placements, while France and Italy are leaning towards organic and artisanal brands. The Nordic countries, with their keen focus on environmental standards, have swiftly adopted PFAS-free microwave packaging, setting a compliance benchmark for the continent. Looking ahead, the EU's stringent packaging directive, set to take effect in 2026, is poised to ignite further substrate innovations, potentially giving compliant exporters a competitive edge.

- Conagra Brands

- PepsiCo (Frito-Lay, Smartfood)

- The Hershey Company (Snyder's-Lance, SkinnyPop)

- Campbell Soup Company (Pop Secret)

- Weaver Popcorn Company

- Popcorn & Company

- Quinn Foods

- Intersnack Group

- Proper Snacks

- Eagle Family Foods

- Herr Foods

- Amish Country Popcorn

- Garrett Popcorn Shops

- American Pop Corn Company

- KP Snacks Ltd

- Utz Brands (Popcornopolis)

- Joe & Seph's

- General Mills

- AMC Entertainment Holdings, Inc. (AMC Theatres)

- Zea Maize Private Limited

- Newman's Own

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Innovations in flavor and product types

- 4.2.2 Environmental sustainability and packaging innovation

- 4.2.3 Growth of at-home entertainment and streaming services

- 4.2.4 Strategic marketing and collaborations

- 4.2.5 The premiumization of snacking

- 4.2.6 Increased efficiency through automation and robotics

- 4.3 Market Restraints

- 4.3.1 Fluctuations in raw material prices

- 4.3.2 Intense competition from alternative snacks

- 4.3.3 Negative perception of additives

- 4.3.4 Strict regulations on labeling and ingredients

- 4.4 Consumer Demand Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Product Type

- 5.1.1 Ready-to-Eat (RTE) Popcorn

- 5.1.2 Microwave Popcorn

- 5.1.3 Unpopped Kernel

- 5.2 By Nature

- 5.2.1 Conventional

- 5.2.2 Organic

- 5.3 By Flavor Profile

- 5.3.1 Salted/Traditional

- 5.3.2 Caramel

- 5.3.3 Barbecue

- 5.3.4 Cheese

- 5.3.5 Butter

- 5.3.6 Others

- 5.4 By Packaging Type

- 5.4.1 Single-Serve

- 5.4.2 Multi-Serve

- 5.4.3 Family/Bulk Packs

- 5.5 By Distribution Channel

- 5.5.1 Supermarkets/Hypermarkets

- 5.5.2 Convenience/Grocery Stores

- 5.5.3 Online Retail Stores

- 5.5.4 Other Distribution Channels

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.1.4 Rest of North America

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Argentina

- 5.6.2.3 Colombia

- 5.6.2.4 Chile

- 5.6.2.5 Rest of South America

- 5.6.3 Europe

- 5.6.3.1 United Kingdom

- 5.6.3.2 Germany

- 5.6.3.3 France

- 5.6.3.4 Italy

- 5.6.3.5 Spain

- 5.6.3.6 Russia

- 5.6.3.7 Sweden

- 5.6.3.8 Belgium

- 5.6.3.9 Poland

- 5.6.3.10 Netherlands

- 5.6.3.11 Rest of Europe

- 5.6.4 Asia-Pacific

- 5.6.4.1 China

- 5.6.4.2 Japan

- 5.6.4.3 India

- 5.6.4.4 Thailand

- 5.6.4.5 Singapore

- 5.6.4.6 Indonesia

- 5.6.4.7 South Korea

- 5.6.4.8 Australia

- 5.6.4.9 New Zealand

- 5.6.4.10 Rest of Asia Pacific

- 5.6.5 Middle East and Africa

- 5.6.5.1 United Arab Emirates

- 5.6.5.2 South Africa

- 5.6.5.3 Saudi Arabia

- 5.6.5.4 Nigeria

- 5.6.5.5 Egypt

- 5.6.5.6 Morocco

- 5.6.5.7 Turkey

- 5.6.5.8 Rest of Middle East and Africa

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Conagra Brands

- 6.4.2 PepsiCo (Frito-Lay, Smartfood)

- 6.4.3 The Hershey Company (Snyder's-Lance, SkinnyPop)

- 6.4.4 Campbell Soup Company (Pop Secret)

- 6.4.5 Weaver Popcorn Company

- 6.4.6 Popcorn & Company

- 6.4.7 Quinn Foods

- 6.4.8 Intersnack Group

- 6.4.9 Proper Snacks

- 6.4.10 Eagle Family Foods

- 6.4.11 Herr Foods

- 6.4.12 Amish Country Popcorn

- 6.4.13 Garrett Popcorn Shops

- 6.4.14 American Pop Corn Company

- 6.4.15 KP Snacks Ltd

- 6.4.16 Utz Brands (Popcornopolis)

- 6.4.17 Joe & Seph's

- 6.4.18 General Mills

- 6.4.19 AMC Entertainment Holdings, Inc. (AMC Theatres)

- 6.4.20 Zea Maize Private Limited

- 6.4.21 Newman's Own

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK