PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910653

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910653

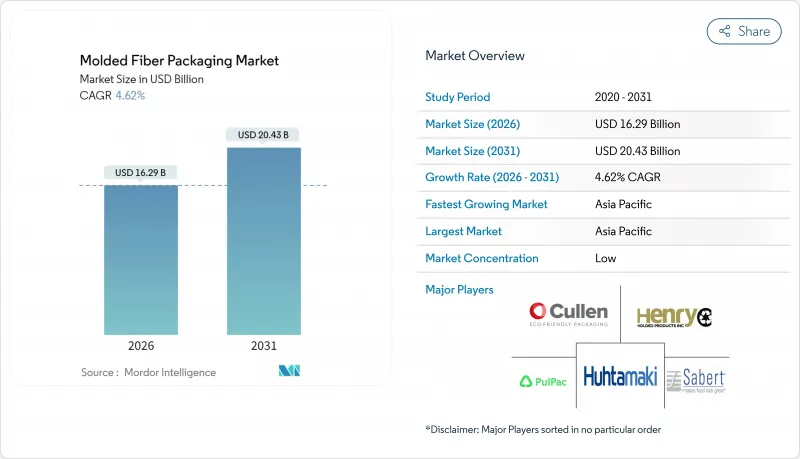

Molded Fiber Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The molded fiber packaging market size in 2026 is estimated at USD 16.29 billion, growing from 2025 value of USD 15.57 billion with 2031 projections showing USD 20.43 billion, growing at 4.62% CAGR over 2026-2031.

Rising single-use plastic bans, rapid scale-up of dry molded fiber technology that cuts CO2 emissions by 80% and boosts throughput tenfold, and growing e-commerce volumes collectively underpin demand. Producers are accelerating hybrid fiber R&D to balance cost, mechanical strength, and sustainability, while quick service restaurant (QSR) commitments to compostable formats are expanding high-volume end-markets. Intensifying mergers are reshaping buyer-supplier dynamics, yet margin pressure persists because European pulp prices peaked at EUR 1,380 (USD 1,496) per metric ton in April 2024.

Global Molded Fiber Packaging Market Trends and Insights

Regulatory bans on single-use plastics

Fast-moving legislation is converting compliance risk into immediate molded fiber orders. Virginia's expanded polystyrene prohibition for large food vendors takes effect in July 2025, Oregon implemented similar rules in January 2025, and the European Union Regulation 2025/40 mandates 65% recycled content in plastic packaging by 2040. Australia's 2024 packaging reform embeds extended producer responsibility that internalizes disposal costs. These aligned mandates accelerate substitution, making the molded fiber packaging market a default choice for retailers and food brands.

Growth of e-commerce and food-delivery channels

Direct-to-consumer meal kits and grocery delivery require insulation and shock protection that lightweight plastics struggle to provide sustainably. TemperPack's fiber-based liners reduce outbound shipments enough to remove 400 trucks annually for a single client, illustrating freight savings that offset material price premiums. Unmet demand, documented by repeated customer backlogs, is pushing the molded fiber packaging market toward capacity expansion incentives.

Price volatility of high-grade recycled fiber

European pulp spot prices hit EUR 1,380 (USD 1,496) per metric ton in April 2024, a 14% year-over-year jump that squeezed converters unable to hedge. Nordic supply disruptions and stricter deforestation rules spur mill closures, amplifying cost swings. Smaller firms in the molded fiber packaging industry face working-capital strain, prompting alliances or exit.

Other drivers and restraints analyzed in the detailed report include:

- QSR adoption of compostable clamshells

- Commercialization of 3-D dry-molded fiber technology

- Barrier-property limitations for wet foods

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Transfer-molded fiber captured a commanding 49.62% share in 2025, anchoring the molded fiber packaging market through its installed base and versatility. Thermoformed formats, though smaller, are projected to grow at 6.45% CAGR as improved barrier coatings and aesthetics attract premium brands. Thick wall molding remains vital for industrial cushioning, and processed grades cater to decorative finishes. Light delignification boosts tensile strength by 22%, enhancing viability for electronics packaging. The molded fiber packaging market size for thermoformed items is forecast to increase steadily as 3D dry molding reduces cycle times and tooling costs.

Innovation momentum is shifting toward hybrid laminations that enhance the grease and moisture resistance of transfer parts. Producers leverage computer-aided fluid dynamics to optimize vacuum cycles, trimming fiber usage by up to 12%. Competitive dynamics thus hinge on proprietary forming screens and water-recovery systems that lower operating costs.

Trays remained the backbone with 34.07% of 2025 revenues, yet clamshells and containers are set for 5.17% CAGR because QSR chains require hinge integrity and stacking efficiency. Growth of convenience snacking and meal-delivery services further accelerates demand. End-caps and inserts meet electronics and appliance shock-absorption needs, while cups gain traction as polyethylene-free barriers emerge.

Mineral fillers such as calcium carbonate and kaolin improve rigidity and whiteness, raising line speeds without prohibitive cost increases. However, overdosing minerals can drop impact resistance, so formulators calibrate filler ratios carefully. The molded fiber packaging market size attributable to clamshells could reach a mid-single-digit billion-dollar level by decade-end if current adoption curves sustain.

The Molded Fiber Packaging Market Report is Segmented by Molded Fiber Type (Thick Wall, Transfer Molded, Thermoformed, and Processed), Product Type (Trays, Clamshells and Containers, and More), Raw-Material Source (Recycled Paper, Virgin Pulp, and More), End-User Industry (Food and Beverages, Electronics and Appliances, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

The Asia-Pacific region led the molded fiber packaging market with a 38.45% share in 2025 and is projected to compound at a 6.65% rate through 2031, as China and India scale back bans on difficult-to-recycle plastics. Government subsidies for sustainable materials encourage domestic machinery purchases, and labor cost advantages shorten payback periods. Robust middle-class consumption lifts volumes for convenience foods, electronics, and pharmaceuticals.

North America benefits from regulatory catalysts, such as California SB 54, which mandates a 25% reduction in plastic by 2032. Brand pledges drive early adoption of fiber clamshells, while domestic pulp resources cushion raw-material volatility. Nevertheless, tight labor markets and high energy costs compel investments in automation that favor large converters.

Europe emphasizes circularity, with Regulation 2025/40 tightening recycled-content thresholds. Manufacturers in Austria and Finland leverage advanced fiber-forming lines to supply EU-wide demand. Japan's updated positive list regime, effective June 2025, requires rigorous migration testing, creating entry barriers that disciplined suppliers can exploit. South America and the Middle East and Africa offer untapped growth pockets where urbanization and waste infrastructure upgrades converge with lower per-capita plastic use, paving pathways for molded fiber adoption.

- Huhtamaki Oyj

- Brodrene Hartmann A/S

- Sonoco Products Company

- UFP Technologies Inc.

- Omni-PAC Group UK

- Henry Molded Products Inc.

- Pactiv Evergreen Inc.

- Cullen Packaging Ltd.

- Genpak LLC

- Sabert Corporation

- International Paper Co.

- Enviropak Corporation

- Keiding Inc.

- PulPac AB

- Stora Enso Oyj

- Heracles Packaging SA

- Earthpac (US)

- Fiber Mold A/S

- Fabri-Kal Corporation

- TMP Technologies

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Shift in consumer preference toward recyclable and eco-friendly packaging

- 4.2.2 Regulatory bans on single-use plastics

- 4.2.3 Growth of e-commerce and food-delivery channels

- 4.2.4 QSR adoption of compostable clamshells

- 4.2.5 Commercialization of 3-D dry-molded fiber technology

- 4.2.6 Brand-level carbon-neutral pledges

- 4.3 Market Restraints

- 4.3.1 Price volatility of high-grade recycled fiber

- 4.3.2 Bioplastics and coated paperboard substitutes

- 4.3.3 Barrier-property limitations for wet foods

- 4.3.4 Capital-intensive custom tooling requirements

- 4.4 Industry Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Rivalry

- 4.8 Impact of Macroeconomic Factors on the Market

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Molded Fiber Type

- 5.1.1 Thick Wall

- 5.1.2 Transfer Molded

- 5.1.3 Thermoformed

- 5.1.4 Processed

- 5.2 By Product Type

- 5.2.1 Trays

- 5.2.2 Clamshells and Containers

- 5.2.3 Cups and Cup-Carriers

- 5.2.4 Plates and Bowls

- 5.2.5 Other Product Types

- 5.3 By Raw-Material Source

- 5.3.1 Recycled Paper

- 5.3.2 Virgin Pulp

- 5.3.3 Hybrid Fiber Blends

- 5.4 By End-user Industry

- 5.4.1 Food and Beverages

- 5.4.2 Electronics and Appliances

- 5.4.3 Healthcare and Medical Devices

- 5.4.4 Industrial

- 5.4.5 Other End-user Industries

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Chile

- 5.5.2.4 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 United Kingdom

- 5.5.3.2 Germany

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 India

- 5.5.4.4 South Korea

- 5.5.4.5 Australia and New Zealand

- 5.5.4.6 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 United Arab Emirates

- 5.5.5.1.2 Saudi Arabia

- 5.5.5.1.3 Turkey

- 5.5.5.1.4 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Kenya

- 5.5.5.2.3 Nigeria

- 5.5.5.2.4 Rest of Africa

- 5.5.5.1 Middle East

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Huhtamaki Oyj

- 6.4.2 Brodrene Hartmann A/S

- 6.4.3 Sonoco Products Company

- 6.4.4 UFP Technologies Inc.

- 6.4.5 Omni-PAC Group UK

- 6.4.6 Henry Molded Products Inc.

- 6.4.7 Pactiv Evergreen Inc.

- 6.4.8 Cullen Packaging Ltd.

- 6.4.9 Genpak LLC

- 6.4.10 Sabert Corporation

- 6.4.11 International Paper Co.

- 6.4.12 Enviropak Corporation

- 6.4.13 Keiding Inc.

- 6.4.14 PulPac AB

- 6.4.15 Stora Enso Oyj

- 6.4.16 Heracles Packaging SA

- 6.4.17 Earthpac (US)

- 6.4.18 Fiber Mold A/S

- 6.4.19 Fabri-Kal Corporation

- 6.4.20 TMP Technologies

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment