PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910662

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910662

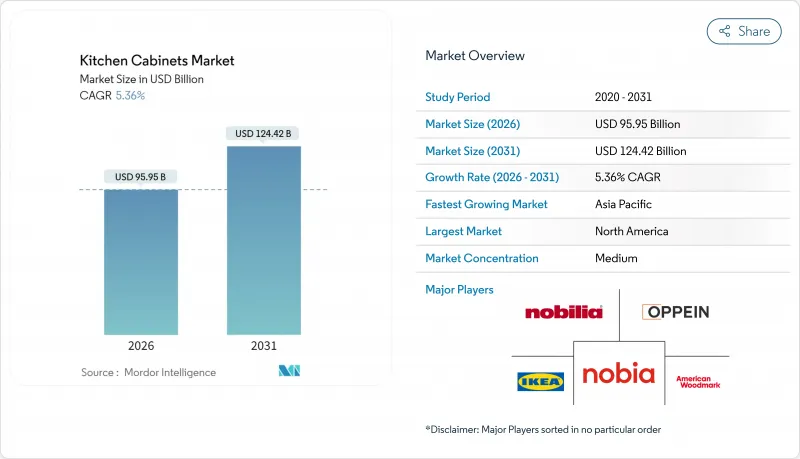

Kitchen Cabinets - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The kitchen cabinets market was valued at USD 91.07 billion in 2025 and estimated to grow from USD 95.95 billion in 2026 to reach USD 124.42 billion by 2031, at a CAGR of 5.36% during the forecast period (2026-2031).

Steady renovation outlays in North America and Europe, rapid apartment construction in the Asia-Pacific, and accelerating e-commerce adoption collectively anchor demand. Regulatory requirements for low-emission substrates, rising home-equity levels, and automation investments further reinforce growth momentum. Meanwhile, skilled-labor shortages and input-price swings encourage manufacturers to standardize components and embrace prefabricated designs. Consolidation among leading players lifts operational scale yet keeps room for regional specialists, sustaining healthy rivalry across the kitchen cabinets market through 2030.

Global Kitchen Cabinets Market Trends and Insights

Residential Renovation Boom in Mature Economies

Solid labor markets and record home-equity levels give homeowners the financial latitude to upgrade kitchens rather than relocate. Harvard researchers foresee a 1.2% uptick in owner-occupied remodeling outlays for 2025. The National Association of Home Builders anticipates a 5% lift in overall remodeling, citing a surge in homes aged 20-39 years that will peak at 24.2 million by 2027. Kitchen projects consistently deliver top "Joy Scores," motivating discretionary spending on semi-custom fixtures and smart storage. Homeowners also value energy-efficient lighting and soft-close hardware that elongate lifecycle and curb noise. These factors keep average selling prices firm, sustaining margin strength for suppliers in the kitchen cabinets market. Furthermore, renovation incentives tied to aging-in-place programs spur accessibility upgrades such as pull-down shelves and wider drawer rails, expanding demand for tailored solutions.

Urban Apartment Growth in Asia-Pacific

Asia-Pacific's demographic shift drives an unparalleled pipeline of compact units that rely on modular cabinetry. China's urban population surpassed 930 million in 2024, while renovation subsidies have upgraded 44.34 million dwellings since 2019. India must erect up to 100 million homes this decade as 70 million households cross ownership thresholds. Large cities such as Guangzhou and Chengdu plan to absorb millions more residents by 2035, anchoring long-term installation volume. Developers favor frameless boxes that maximize cubic inches without expanding footprints. Height-adjustable wall cabinets and pull-out pantries cater to ergonomic needs in tight quarters, elevating functionality. Rising disposable incomes translate into a willingness to pay for premium finishes, pushing per-unit revenue higher and reinforcing regional outperformance within the kitchen cabinets market.

Raw-Material Price Volatility

Softwood prices spiked 23% year-over-year in April 2025, and prospective duty hikes on Canadian imports from 14.5% to 34.5% threaten further escalation. Canada supplies 85% of U.S. softwood imports, making the tariff lever a potent disruptor. Engineered-wood antidumping duties on Vietnamese plywood cost American Woodmark USD 4.9 million in fiscal 2024. Volatile pricing complicates bid validity periods, pushing contractors to insert escalation clauses that dampen customer confidence. Manufacturers hedge through forward contracts and diversify sourcing, yet pass-through timing lags depress margins when spikes hit suddenly. Persistent swings therefore trim volume growth and muddy forecasting for the kitchen cabinets market.

Other drivers and restraints analyzed in the detailed report include:

- E-Commerce-Driven RTA Cabinet Penetration

- Frameless Cabinetry Uptake in Micro-Apartments

- High Upfront Cost of Custom Cabinetry

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Semi-custom cabinets accounted for 37.85% of the kitchen cabinets market share in 2025, reflecting consumer appetite for tailored door styles and finishes that still meet mid-range budgets. The segment benefits from dealer showrooms that use design software to translate homeowner mood boards into buildable specs within hours, holding customer attention during a crucial decision window. At the opposite end of the speed spectrum, ready-to-assemble lines can ship in four to seven days versus the 25-day average for made-to-order products, enabling rapid renovation cycles that appeal to younger, time-pressed buyers. Stock formats remain relevant for entry-level buyers, yet their flat pricing leaves little room for upsell, pushing many retailers to migrate floor space toward semi-custom displays that drive higher margins. Custom cabinetry, while the smallest slice of the kitchen cabinets market size, retains a loyal luxury clientele willing to wait months for hand-finished craftsmanship and exotic veneers.

Ready-to-assemble demand is climbing at a 6.36% CAGR due to e-commerce marketplaces that simplify price comparison and doorstep delivery. IKEA's network of roughly 900 U.S. pickup lockers eases last-mile barriers, encouraging shoppers to order flat-packs online and collect them at neighbourhood hubs. Traditional manufacturers counter by launching "quick-ship" frameless series and investing in robotic dowel insertion that mimics RTA efficiency while keeping semi-custom flexibility. Builders also value RTA for multifamily projects because standardized carcasses streamline installation sequencing and reduce punch-list callbacks. As labor shortages persist, construction crews gravitate toward cabinet systems pre-fitted with clip-on rails and adjustable legs, reinforcing the growth runway for the RTA format within the broader kitchen cabinets market.

Wood captured 60.15% of global revenue in 2025, buoyed by its warm aesthetics, familiar machining techniques, and ease of on-site touch-up. Oak, maple, and birch remain the staples for North American buyers, whereas European consumers gravitate toward painted MDF with smooth edges that suit frameless furniture trends. Despite raw-material volatility, wood vendors leverage domestic lumber contracts to reduce tariff exposure, maintaining reliable lead times for volume builders. Stain-grade doors offer refinishability that prolongs service life, a trait homeowners factor into total-cost-of-ownership calculations. These attributes keep wood the keystone substrate for premium and mid-tier price points across the kitchen cabinets market.

The fastest growth sits in the "other raw materials" bucket, advancing at 5.72% CAGR as bamboo, recycled composites, and ultra-low-emitting particleboard satisfy stricter emission caps. California Air Resources Board Phase 2 formaldehyde limits push factories to adopt no-added-formaldehyde adhesives and water-borne lacquers that shrink off-gassing windows. Manufacturers pursuing ISO 14001 certification document carbon savings from bamboo, which matures in one-tenth the time of hardwoods and sequesters more CO2 per hectare. Recycled PET-wood hybrids divert plastic from landfills while providing moisture resistance favoured in coastal installations. Commercial specifiers now mandate Environmental Product Declarations, accelerating alternative-material adoption in office, hospitality, and health-care projects. These dynamics gradually rebalance the kitchen cabinets market share mix without displacing wood's cultural cachet.

The Kitchen Cabinets Market Report is Segmented by Construction Type (Ready-To-Assemble, Stock, Semi-Custom, Custom), Material (Wood, Metal, Other Raw Materials), Distribution Channel (Specialty Retail/Showrooms, Home-Centers & Mass Merchandisers, and More), End User (Residential, Commercial), and Geography (North America, South America, Europe, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America captured 34.55% of global revenue in 2025, undergirded by robust remodeling and aging inventory. Owner-occupied improvement outlays will inch 1.2% higher in 2025, while Canada's high-value markets, such as Toronto and Vancouver, chase premium finishes. Affluent consumers' willingness to pay for customization keeps margin profiles attractive, sustaining leadership for the region within the kitchen cabinets market size metrics.

Asia-Pacific is progressing at a 6.07% CAGR through 2031, propelled by mega-city programs and surging middle-class consumption. China's 66.16% urbanization rate and 44.34-million-unit renovation drive highlight deep renovation potential. India's demand outlook, pegged at 100 million incremental homes, multiplies cabinet opportunities. Rising apartment towers elevate volume, while aspirational tastes lift per-unit spend, cementing Asia-Pacific as the fastest growth vector in the kitchen cabinets market.

Europe contributes steady replacement demand anchored in design leadership and environmental compliance. Frameless systems pioneered in Germany and Italy shape global aesthetics, while stringent VOC limits push innovation toward water-borne finishes. Middle Eastern and African markets enjoy greenfield potential linked to tourism megaprojects and social-housing budgets. Latin America's currency volatility tempers immediate growth yet offers upside as macro stability returns. Diversified regional demand underpins broad resilience for the kitchen cabinets market.

- IKEA

- American Woodmark

- Nobilia

- Oppein

- Nobia AB

- Masco Cabinetry

- Cabinetworks Group

- Hacker Kuchen

- Hettich Group

- Hanssem Co.

- ZBOM Home

- SieMatic

- Scavolini

- Bulthaup

- Wurfel Kuche

- Godrej Interio

- Crystal Cabinet Works

- Wellborn Cabinet

- KraftMaid

- Vic Cabinet

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Table of Contents - Global Kitchen Cabinets Market

2 Introduction

- 2.1 Study Assumptions & Market Definition

- 2.2 Scope of the Study

3 Research Methodology

4 Executive Summary

5 Market Landscape

- 5.1 Market Overview

- 5.2 Market Drivers

- 5.2.1 Residential renovation boom in mature economies

- 5.2.2 Urban apartment growth in APAC

- 5.2.3 E-commerce-driven RTA cabinet penetration

- 5.2.4 Frameless cabinetry uptake in micro-apartments

- 5.2.5 Bamboo & fast-renewable materials compliance

- 5.2.6 AI-enabled mass-customization platforms

- 5.3 Market Restraints

- 5.3.1 Raw-material price volatility

- 5.3.2 High upfront cost of custom cabinetry

- 5.3.3 Skilled-installer shortages

- 5.3.4 Stricter IAQ emissions standards

- 5.4 Industry Value Chain Analysis

- 5.5 Porter's Five Forces

- 5.5.1 Threat of New Entrants

- 5.5.2 Bargaining Power of Suppliers

- 5.5.3 Bargaining Power of Buyers

- 5.5.4 Threat of Substitutes

- 5.5.5 Competitive Rivalry

- 5.6 Insights into the Latest Trends and Innovations in the Market

- 5.7 Insights on Recent Developments (New Product Launches, Strategic Initiatives, Investments, Partnerships, JVs, Expansion, M&As, etc.) in the Market

6 Market Size & Growth Forecasts (Value, 2024-2030)

- 6.1 By Construction Type

- 6.1.1 Ready-to-assemble (RTA) Kitchen Cabinets

- 6.1.2 Stock Kitchen Cabinets

- 6.1.3 Semi-Custom Kitchen Cabinets

- 6.1.4 Custom Kitchen Cabinets

- 6.2 By Material

- 6.2.1 Wood

- 6.2.2 Metal

- 6.2.3 Other Raw Materials

- 6.3 By Distribution Channel

- 6.3.1 Specialty Retail/Showrooms

- 6.3.2 Home-Centers & Mass Merchandisers

- 6.3.3 Online

- 6.3.4 Contractors/Trade Direct

- 6.4 By End User

- 6.4.1 Residential

- 6.4.2 Commercial (Hospitality, Offices, Others)

- 6.5 By Geography

- 6.5.1 North America

- 6.5.1.1 United States

- 6.5.1.2 Canada

- 6.5.1.3 Mexico

- 6.5.2 South America

- 6.5.2.1 Brazil

- 6.5.2.2 Peru

- 6.5.2.3 Chile

- 6.5.2.4 Argentina

- 6.5.2.5 Rest of South America

- 6.5.3 Europe

- 6.5.3.1 United Kingdom

- 6.5.3.2 Germany

- 6.5.3.3 France

- 6.5.3.4 Spain

- 6.5.3.5 Italy

- 6.5.3.6 BENELUX

- 6.5.3.7 NORDICS

- 6.5.3.8 Rest of Europe

- 6.5.4 Asia-Pacific

- 6.5.4.1 India

- 6.5.4.2 China

- 6.5.4.3 Japan

- 6.5.4.4 Australia

- 6.5.4.5 South Korea

- 6.5.4.6 South-East Asia

- 6.5.4.7 Rest of Asia-Pacific

- 6.5.5 Middle East and Africa

- 6.5.5.1 United Arab Emirates

- 6.5.5.2 Saudi Arabia

- 6.5.5.3 South Africa

- 6.5.5.4 Nigeria

- 6.5.5.5 Rest of Middle East and Africa

- 6.5.1 North America

7 Competitive Landscape

- 7.1 Market Concentration

- 7.2 Strategic Moves

- 7.3 Market Share Analysis

- 7.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 7.4.1 IKEA

- 7.4.2 American Woodmark

- 7.4.3 Nobilia

- 7.4.4 Oppein

- 7.4.5 Nobia AB

- 7.4.6 Masco Cabinetry

- 7.4.7 Cabinetworks Group

- 7.4.8 Hacker Kuchen

- 7.4.9 Hettich Group

- 7.4.10 Hanssem Co.

- 7.4.11 ZBOM Home

- 7.4.12 SieMatic

- 7.4.13 Scavolini

- 7.4.14 Bulthaup

- 7.4.15 Wurfel Kuche

- 7.4.16 Godrej Interio

- 7.4.17 Crystal Cabinet Works

- 7.4.18 Wellborn Cabinet

- 7.4.19 KraftMaid

- 7.4.20 Vic Cabinet

8 Market Opportunities & Future Outlook

- 8.1 Adoption of Bamboo and Natural Materials in Cabinet Construction

- 8.2 Surge in Frameless Cabinetry for Modern Streamlined Kitchens