PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910668

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910668

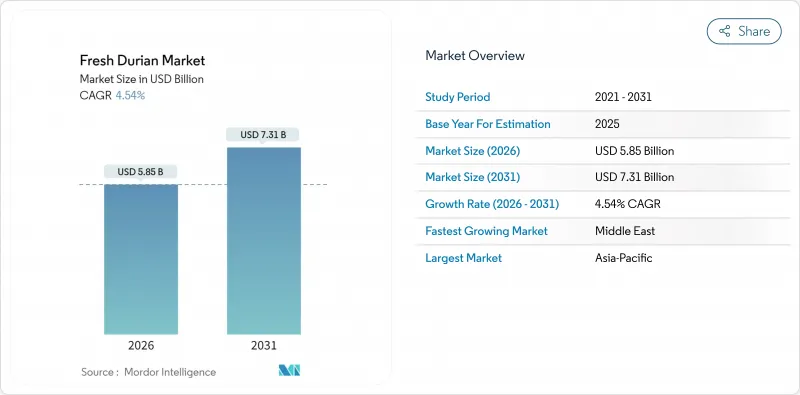

Fresh Durian - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The fresh durian market is expected to grow from USD 5.6 billion in 2025 to USD 5.85 billion in 2026 and is forecast to reach USD 7.31 billion by 2031 at 4.54% CAGR over 2026-2031.

Sustained demand from China, widening consumer acceptance across the Middle East, and rapid improvements in Southeast Asian export infrastructure continue to propel the fresh durian market toward steady value growth. Improved traceability systems, premiumization of iconic varieties such as Musang King, and government-backed orchard re-planting programs are reinforcing supply resilience for the fresh durian market even as climate volatility and labor shortages add cost pressure. Regulatory tightening, epitomized by China's new food-safety tests and Singapore's residue limits, has accelerated consolidation, favoring large growers with proven compliance records. Meanwhile, high-speed rail corridors and upgraded sorting facilities shorten time to market, balance seasonal gluts, and moderate long-standing price spikes, adding further momentum to the fresh durian market's globalization.

Global Fresh Durian Market Trends and Insights

Rising demand for premium durians

Premium varieties fetch exponentially higher prices as affluent Chinese and Gulf Cooperation Council (GCC) consumers shift focus from cost to provenance. Malaysia's frozen Musang King exports reached USD 44.49 million in 2024, up 29%, despite limited harvest volumes. Aroma profiling research links specific sulfur compounds to perceived quality, giving exporters scientific tools for consistent grading. The resulting willingness to pay premium prices reduces the market's exposure to bulk-commodity swings, opens niche digital channels, and allows small orchards to monetize meticulous cultivation practices. In turn, local government programs begin subsidizing post-harvest cold-chain upgrades, further supporting premium segments. As a result, premiumization continues to elevate average unit values within the fresh durian market.

Expanding export capacity in producer countries

New processing plants and multimodal corridors lift previous bottlenecks. Thailand's sorting hubs grew from 70 to 200 units, while the China-Laos Railway cut door-to-door transit to Kunming from three days to under 24 hours. Similar expansions in Vietnam's Dak Lak province integrate three pack-houses and a rapid vapor heat treatment line, enabling near-real-time shipments to Guangzhou. These infrastructure leaps flatten seasonal gluts and spread supply more evenly across the calendar, creating smoother revenue curves for exporters in the fresh durian market.

Tighter pesticide-residue and traceability rules

China's customs authority now mandates cadmium and Auramine O tests on every shipment after carcinogenic dye was detected in Thai fruit. The rule immediately reduced Vietnamese exports by 80% in February 2025, exposing smallholders who could not fund certified labs. Singapore's Food Agency imposes similar thresholds, triggering costly recall risks for non-compliant lots. Compliance investment lifts entry barriers and favors large integrated estates, but it also cuts contamination incidents and preserves consumer trust in the fresh durian market.

Other drivers and restraints analyzed in the detailed report include:

- Producer-country subsidy and re-planting programs

- Development of cold-resistant cultivars

- Seasonal price volatility

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The Fresh Durian Market Report is Segmented by Geography (North America, Europe, Asia-Pacific, South America, Middle East, and Africa). The Report Includes Production Analysis (Volume), Consumption Analysis (Value and Volume), Export Analysis (Value and Volume), Import Analysis (Value and Volume), and Price Trend Analysis. The Market Forecasts are Provided in Terms of Value (USD) and Volume (Metric Tons).

Geography Analysis

Asia-Pacific accounted for 39.65% of the fresh durian market size in 2025 as both the dominant production hub and the largest consumer block. Thailand secured more than half of Chinese imports but ceded ground to Vietnam, whose cross-border trucking advantage and aggressive pricing lifted its share to around 40%. Malaysia's breakthrough authorization for fresh fruit shipments in 2024 generated several million dollars in inaugural sales, signaling intensifying competition for the lucrative Guangdong and Shanghai supermarkets. Across the region, the China-Laos Railway slashed transit times, enabling more frequent shipments and tempering extreme price surges that once characterized the fresh durian market.

The Middle East's durian import bill is expanding at a 6.52% CAGR due to higher purchasing power and large expatriate inflows familiar with the fruit's flavor profile. GCC snack and confectionery spending reached USD 6.6 billion in 2024, with health-positioned durian ice creams and freeze-dried snacks gaining supermarket shelf space. Dubai's Al Aweer wholesale market added a dedicated durian ripening chamber, while Riyadh retailers promote tasting events during Ramadan, bridging flavor acceptance gaps. Yet the lack of refrigerated trucking across desert corridors still hampers broad penetration, keeping the fresh durian market concentrated in major urban centers.

North America and Europe serve as frontier territories where education drives adoption. Canada leads with specialty Asian grocers that import frozen pulp and vacuum-sealed pods. Europe's exotic fruit importers leverage Rotterdam and Antwerp to distribute to Germany and France, citing rising demand for plant-based desserts. Stringent maximum residue limits and extensive paperwork elevate costs, favoring exporters with sophisticated hazard analysis critical control point (HACCP) systems. Over the forecast horizon, growing diaspora communities and culinary tourism suggest gradual but steady volume growth for the fresh durian market in Western economies.

- Market Overview

- Market Drivers

- Market Restraints

- Regulatory Landscape

- Technological Outlook

- Value / Supply Chain Analysis

- PESTLE Analysis

- List of Stakeholders

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising demand for premium durians

- 4.2.2 Expanding export capacity in producer countries

- 4.2.3 Producer-country subsidy and re-planting programs

- 4.2.4 Development of cold-resistant cultivars

- 4.2.5 Orchard-backed investment vehicles attracting capital

- 4.2.6 Blockchain traceability unlocking premium channels

- 4.3 Market Restraints

- 4.3.1 Tighter pesticide-residue and traceability rules

- 4.3.2 Seasonal price volatility

- 4.3.3 Climate-driven pollination failures

- 4.3.4 Orchard labor shortages and rising wages

- 4.4 Regulatory Landscape

- 4.5 Technological Outlook

- 4.6 Value / Supply Chain Analysis

- 4.7 PESTLE Analysis

5 Market Size and Growth Forecasts (Value and Volume)

- 5.1 By Geography (Production Analysis (Volume), Consumption Analysis (Volume and Value), Import Analysis (Volume and Value), Export Analysis (Volume and Value), and Price Trend Analysis)

- 5.1.1 North America

- 5.1.1.1 United States

- 5.1.1.2 Canada

- 5.1.2 South America

- 5.1.2.1 Brazil

- 5.1.2.2 Ecuador

- 5.1.3 Europe

- 5.1.3.1 Netherlands

- 5.1.3.2 France

- 5.1.3.3 United Kingdom

- 5.1.3.4 Italy

- 5.1.3.5 Germany

- 5.1.4 Asia-Pacific

- 5.1.4.1 China

- 5.1.4.2 Thailand

- 5.1.4.3 Malaysia

- 5.1.4.4 Philippines

- 5.1.4.5 Vietnam

- 5.1.4.6 Indonesia

- 5.1.4.7 Japan

- 5.1.4.8 South Korea

- 5.1.5 Middle East

- 5.1.5.1 United Arab Emirates

- 5.1.5.2 Saudi Arabia

- 5.1.6 Africa

- 5.1.6.1 South Africa

- 5.1.6.2 Kenya

- 5.1.1 North America

6 Competitive Landscape

- 6.1 List of Stakeholders

- 6.1.1 Charoen Pokphand Foods Public Co. Ltd.

- 6.1.2 Top Fruits Sdn Bhd

- 6.1.3 Benum Hill Fruits

- 6.1.4 Sunshine International Co. Ltd.

- 6.1.5 Syarif Durian Indonesia

- 6.1.6 Musang Valley Plantation

- 6.1.7 Vegetexco Ho Chi Minh City

- 6.1.8 Mahakoon Trading 789 Co. Ltd.

- 6.1.9 Maylong Enterprises Corp.

- 6.1.10 Honju Fruits

- 6.1.11 Thongpad Coldstorage Co. Ltd.

- 6.1.12 Durian Wholesale Singapore Pte. Ltd.

7 Market Opportunities and Future Outlook