PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910671

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910671

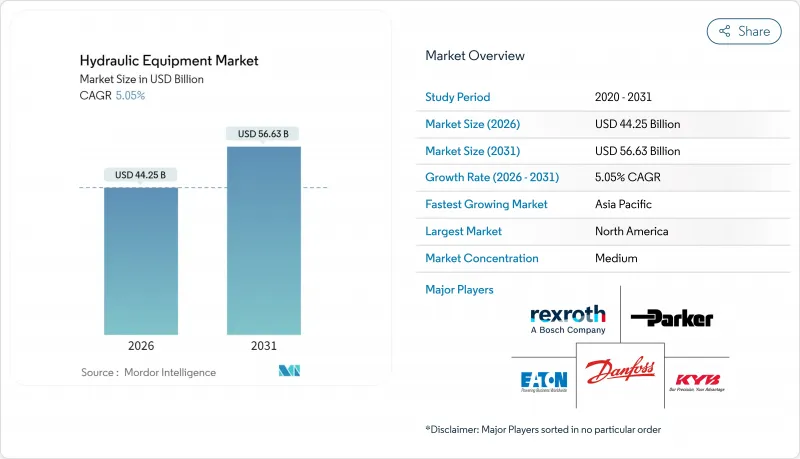

Hydraulic Equipment - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The hydraulic equipment market was valued at USD 42.11 billion in 2025 and estimated to grow from USD 44.25 billion in 2026 to reach USD 56.63 billion by 2031, at a CAGR of 5.05% during the forecast period (2026-2031).

This steady momentum underscores the sector's resilience in the face of cyclical slowdowns, raw material volatility, and intensifying pressures from electrification. Robust public infrastructure spending in the United States and China, rising warehouse automation in global e-commerce, and expanding precision agriculture underpin demand, even as equipment makers accelerate the shift toward energy-efficient electro-hydraulic hybrids. Heightened consolidation, exemplified by Applied Industrial Technologies' acquisition of Hydradyne, signals how suppliers are responding to margin compression and the need for digital, power-dense solutions. North America remains the largest regional base, supported by unprecedented water infrastructure appropriations, while the Asia-Pacific records the fastest gains as China and India commit multi-trillion-dollar stimulus to transport and urban services.

Global Hydraulic Equipment Market Trends and Insights

Accelerated Warehouse Automation in E-commerce Fulfillment

Explosive e-commerce order volumes compel distribution centers to deploy autonomous forklifts, shuttle systems, and goods-to-person robots that rely on compact servo-hydraulic cylinders for milli-meter accuracy. Amazon's network of mobile robots illustrates how 24/7 operation requires leak-free, sensor-equipped hydraulics offering predictive failure alerts to minimize downtime. Warehouse operators typically report 40% productivity gains, enabling component suppliers to charge premium prices for ultra-reliable, contamination-controlled assemblies.

Government-Funded Mega-Infrastructure Programmes

Multi-year public works-from the USD 1.2 trillion U.S. Infrastructure Investment and Jobs Act to China's USD 1.4 trillion local-government debt plan-create demand visibility for excavators, concrete pumps, and large-bore cylinders. Extended project pipelines allow OEMs to lock-in long-term contracts, expand regional service hubs, and co-develop application-specific hydraulics for bridge, port, and renewable-energy construction.

Intensifying Raw-Material Price Volatility for Steel and Rare Earths

Steel prices swung 40% in 2024, while China's dominance of rare-earth processing exposes magnet-motor supply chains to geopolitical risk. Tariffs of 44-54% on Chinese hydraulic components further compress margins, forcing suppliers to hedge commodities, redesign to reduce material intensity, or pursue scale through mergers.

Other drivers and restraints analyzed in the detailed report include:

- Shift to Energy-Efficient Electro-Hydraulic Hybrids

- Increasing Off-Highway Electrification

- Skilled-Labor Shortage for Maintenance and Retrofits

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Pumps anchored 27.85% of the hydraulic equipment market in 2025 as the indispensable power-source across construction, agriculture, and industrial machinery. Variable-displacement and load-sensing models cut fuel draw, satisfying OEM efficiency targets and boosting aftermarket retrofit sales. The hydraulic equipment market size for pumps is positioned to advance with infrastructure investment cycles through 2031. Filters and accumulators log the quickest gains at a 6.18% CAGR as stricter ISO 4406 cleanliness codes make contamination control decisive during warranty negotiations. Demand for high-flow, low-delta-pressure filter media elevates margins, while nitrogen-charged bladders store regenerative energy in hybrid circuits, extending the hydraulic equipment market share of this sub-segment across mobile applications.

Valve suppliers capitalize on precision flow control required by tele-operation and autonomous tasks. Cylinders benefit from e-commerce warehouse robotics that necessitate repeatable, high-cycle linear motion. Motors and transmissions cater to specialty mobile equipment where torque density and overload capacity remain critical. Ancillary components-reservoirs, manifolds, coolers-gain from integrated power-packs that simplify OEM assembly lines and shorten time-to-market.

Construction contributed 31.05% of hydraulic equipment market revenue in 2025, buoyed by global public-works pipelines and commercial real-estate starts. Fleet operators adopt electro-hydraulic hybrids to meet stricter job-site emissions caps, sustaining high utilization and parts consumption. The hydraulic equipment market size for construction is poised for stable mid-single-digit growth as bridge, port, and rail projects consume long-stroke actuators and heavy-duty pumps over multi-year timelines. Aerospace and defense, however, posts the sharpest trajectory at 6.35% CAGR as commercial narrow-body production ramps and defense agencies modernize airframes. High-pressure, weight-optimized actuation for flight-control and landing-gear commands premium pricing, increasing the hydraulic equipment market share captured by aerospace suppliers.

Agriculture maintains steady gains as precision farming embeds GPS-guided hydraulics for centimeter-level seed placement. Material-handling thrives on omnichannel retail logistics, while oil and gas demand stabilizes around offshore construction and pipeline maintenance. Machine-tool, plastics, and automotive segments experience mixed trends tied to global manufacturing cycles yet remain indispensable volume anchors for seal, valve, and small-bore cylinder demand.

The Hydraulic Equipment Market Report is Segmented by Equipment Type (Pumps, Valves, Cylinders, Motors, Filters and Accumulators, Transmissions, and Others), End-User Industry (Construction, Agriculture, Material Handling, and More), Application (Mobile Hydraulics and Industrial Stationary Hydraulics), Operating-Pressure Range (Low, Medium, and High), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America generated 37.65% of global revenue in 2025, supported by USD 68.8 billion in obligated water-infrastructure funds and USD 850 million dedicated to reclamation projects. Robust warehouse-automation investments and aging fleet replacements underpin sales of cylinders, proportional valves, and filtration kits. Nevertheless, the softness of transport equipment presents a headwind, prompting suppliers to emphasize aftermarket service contracts and digitalized maintenance offers.

The Asia-Pacific region registers the fastest growth, with an 8.07% CAGR through 2031, as China's USD 1.4 trillion credit package and India's urban-rail and water-supply programs sustain demand peaks beyond domestic cycles. Local OEMs partner with component specialists to meet Tier 4f standards, while tariff disputes prompt multinational suppliers to diversify assembly footprints into Southeast Asia. High-pressure micro-pumps and contamination-resistant valves are seeing a rising take-up in Korean and Japanese precision-manufacturing clusters.

Europe presents a mixed outlook: German fluid-power orders fell 8% in 2024, yet projects such as France's Grand Paris Express and Italy's wind-farm builds drive niche high-pressure requirements. PFAS restrictions are accelerating the shift to bio-based seals, prompting significant R&D investment across the hydraulic equipment market. The REPowerEU plan's EUR 300 billion (USD 339 billion) allocation for renewable energy infrastructure multiplies demand for telescopic cylinders in offshore wind installation vessels, cushioning macroeconomic softness.

- Bosch Rexroth AG

- Parker Hannifin Corporation

- HYDAC International GmbH

- Danfoss A/S

- SMC Corporation

- Festo SE and Co. KG

- Norgren Limited (IMI plc)

- Bucher Hydraulics GmbH (Bucher Industries AG)

- HAWE Hydraulik SE

- Linde Hydraulics GmbH and Co. KG

- Caterpillar Inc.

- KYB Corporation

- Eaton Corporation plc

- Kawasaki Heavy Industries Ltd.

- Yuken Kogyo Co., Ltd.

- Daikin Industries, Ltd.

- Komatsu Ltd.

- Sun Hydraulics LLC (Helios Technologies, Inc.)

- Moog Inc.

- Argo-Hytos Group AG

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Industry Supply-Chain Analysis

- 4.3 Regulatory Landscape

- 4.4 Technological Outlook

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Market Drivers

- 4.6.1 Accelerated warehouse automation in e-commerce fulfilment

- 4.6.2 Government-funded mega infrastructure programmes

- 4.6.3 Shift to energy-efficient electro-hydraulic hybrids

- 4.6.4 Increasing off-highway electrification driving compact power-dense hydraulics

- 4.6.5 Growing adoption of precision agriculture machinery

- 4.6.6 Ageing industrial machinery replacement cycle in OECD

- 4.7 Market Restraints

- 4.7.1 Total cost of ownership (TCO) higher than electric drives in light-duty ranges

- 4.7.2 Intensifying raw-material price volatility for steel and rare earths

- 4.7.3 Rising ESG scrutiny over hydraulic-fluid leakage

- 4.7.4 Skilled-labour shortage for maintenance and retrofits

- 4.8 Impact of Macroeconomic Factors

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Equipment Type

- 5.1.1 Pumps

- 5.1.2 Valves

- 5.1.3 Cylinders

- 5.1.4 Motors

- 5.1.5 Filters and Accumulators

- 5.1.6 Transmissions

- 5.1.7 Others

- 5.2 By End-user Industry

- 5.2.1 Construction

- 5.2.2 Agriculture

- 5.2.3 Material Handling

- 5.2.4 Aerospace and Defence

- 5.2.5 Machine Tools

- 5.2.6 Oil and Gas

- 5.2.7 Hydraulic Press

- 5.2.8 Plastics

- 5.2.9 Automotive

- 5.2.10 Other End-users

- 5.3 By Application

- 5.3.1 Mobile Hydraulics

- 5.3.2 Industrial Stationary Hydraulics

- 5.4 By Operating-Pressure Range

- 5.4.1 Low (Less than 150 bar)

- 5.4.2 Medium (150-350 bar)

- 5.4.3 High (Greater than 350 bar)

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Colombia

- 5.5.2.4 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 United Kingdom

- 5.5.3.2 Germany

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 South Korea

- 5.5.4.4 India

- 5.5.4.5 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 Saudi Arabia

- 5.5.5.1.2 United Arab Emirates

- 5.5.5.1.3 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Egypt

- 5.5.5.2.3 Rest of Africa

- 5.5.5.1 Middle East

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Bosch Rexroth AG

- 6.4.2 Parker Hannifin Corporation

- 6.4.3 HYDAC International GmbH

- 6.4.4 Danfoss A/S

- 6.4.5 SMC Corporation

- 6.4.6 Festo SE and Co. KG

- 6.4.7 Norgren Limited (IMI plc)

- 6.4.8 Bucher Hydraulics GmbH (Bucher Industries AG)

- 6.4.9 HAWE Hydraulik SE

- 6.4.10 Linde Hydraulics GmbH and Co. KG

- 6.4.11 Caterpillar Inc.

- 6.4.12 KYB Corporation

- 6.4.13 Eaton Corporation plc

- 6.4.14 Kawasaki Heavy Industries Ltd.

- 6.4.15 Yuken Kogyo Co., Ltd.

- 6.4.16 Daikin Industries, Ltd.

- 6.4.17 Komatsu Ltd.

- 6.4.18 Sun Hydraulics LLC (Helios Technologies, Inc.)

- 6.4.19 Moog Inc.

- 6.4.20 Argo-Hytos Group AG

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment