PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910677

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910677

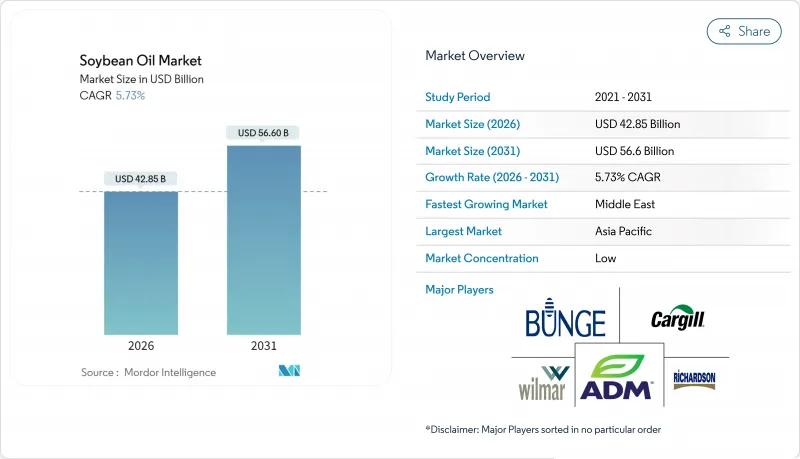

Soybean Oil - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The soybean oil market was valued at USD 40.53 billion in 2025 and estimated to grow from USD 42.85 billion in 2026 to reach USD 56.6 billion by 2031, at a CAGR of 5.73% during the forecast period (2026-2031).

This growth underscores the crop's crucial importance in ensuring food security, supporting animal nutrition, and serving as a source of low-carbon fuels. Significant drivers include increased soybean production and record-breaking crushing activities in leading producing countries such as the United States and Brazil. This has resulted in an abundant supply of soybean oil, which has contributed to downward pressure on global prices. Consistent demand from households, Fast-moving consumer goods (FMCG) companies, and the foodservice sector ensures a stable consumption base. In North America, the rise in renewable diesel production has driven up demand for soybean oil, prompting crushers to expand their capacity. The Asia-Pacific region leads global consumption, driven by China's demand for soybean meal in poultry and aquaculture. Meanwhile, the Middle East is the fastest-growing region, as Gulf states invest in food-import infrastructure to reduce supply chain risks.

Global Soybean Oil Market Trends and Insights

Expanding livestock industry driving soybean meal consumption

The global rise in protein demand is significantly boosting soybean meal consumption, which, in turn, is driving the growth of the soybean oil market. This correlation exists because higher demand for soybean meal necessitates increased soybean crushing, a process that also yields soybean oil as a by-product. Livestock operations, particularly in emerging markets, are expanding rapidly, with soybean meal serving as a crucial protein source for animal feed. In the United States, poultry stands out as the top domestic consumer, accounting for 66.2% of soybean meal usage. Following closely, swine consume 17.5% of the total, as per the Iowa Soybean Association. Urbanization is further influencing dietary patterns, resulting in increased consumption of animal protein, particularly in the Asia-Pacific region. This shift is particularly evident in the aquaculture sector, where the demand for high-protein feed formulations is intensifying. Concurrently, the global livestock industry is transitioning toward more intensive and efficient production systems, which require consistent and high-quality protein inputs to sustain growth.

Expanding food processing and fast-food industries boost oil consumption

The demand for soybean oil is witnessing significant growth as manufacturers increasingly prioritize stable, neutral-flavored oils for large-scale production processes. This rising demand, particularly from the food industry, is being driven by the rapid expansion of fast-food chains and the growing processed food manufacturing sector. These trends reflect broader consumer behavior shifts, including the increasing preference for convenience and the effects of urbanization in developing markets, where higher disposable incomes are fueling processed food consumption. The food processing sector's reliance on soybean oil is primarily due to its advantageous functional properties, such as its suitability for frying applications and its ability to extend product shelf life. These characteristics make soybean oil a critical component of global food supply chains, which require consistent quality and reliable availability across diverse geographic regions.

Competition from alternative oilseeds hinders growth

Farmers are increasingly diversifying their crop rotations, while processors actively seek more cost-effective feedstock options, resulting in alternative oilseed crops posing a significant challenge to the soybean oil market share. Canola, sunflower, and palm oil are emerging as direct competitors to soybean oil in biodiesel production. A notable development in this space is the sharp rise in used cooking oil imports, which escalated to over 3 billion pounds in 2023 from less than 300 million pounds in 2021. This surge highlights a growing shift toward feedstock diversification in renewable fuel production. The competitive landscape is further intensified by carbon intensity scoring mechanisms, which increasingly prioritize waste-based feedstocks over virgin vegetable oils. This trend has the potential to erode the premium position of soybean oil in renewable fuel markets. Competition in the protein meal segment is gaining momentum. Swine feed formulations have reduced soybean meal usage by 30% through the adoption of mid-protein alternatives.

Other drivers and restraints analyzed in the detailed report include:

- Growth in biodiesel production using soybean oil

- Rising health awareness shifts preference towards healthier oils

- Fluctuating global prices due to weather and trade policies restricts growth

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Conventional soybean oil continues to dominate the market, accounting for 95.88% of the total output in 2025. This dominance is driven by their robust supply chains and genetically adaptable traits, which enhance pest resistance and reduce herbicide usage, ultimately leading to lower production costs. These factors make conventional soybeans highly competitive in global commodity markets. Advancements in breeding and biotechnology are enabling higher yields and improved field performance, further solidifying their market position. Bayer's planned 2027 launch of Vyconic, a soybean variety tolerant to 5 herbicides, is expected to provide farmers with greater flexibility in weed management and significantly boost profitability, reinforcing the strength of conventional soybeans in the market.

Organic soybean oil, while representing a smaller segment of the market, are experiencing notable growth with a compound annual growth rate (CAGR) of 7.44%, driven by increasing consumer demand for non-GMO and clean-label products. Producers in this segment place a strong emphasis on maintaining consumer trust, which has led to the adoption of rigorous measures, including on-farm audits, digital traceability systems, and third-party testing. To cater to this growing demand, processors are investing in dedicated crushing facilities to prevent cross-contamination with conventional soybeans, despite the high costs involved. Although organic farming incurs higher expenses for certification and weed management, the premium prices offered at the farm gate incentivize growers to remain committed.

The Soybean Oil Market Report is Segmented by Nature (Conventional and Organic), Application (Food, Animal Feed, Industrial, and Others), and Geography (North America, Europe, Asia-Pacific, South America, and Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD) and Volume (Liters).

Geography Analysis

Asia-Pacific continues to dominate as the largest regional consumer, accounting for 42.86% of the global market. This dominance is driven by the rapid expansion of livestock and aquaculture industries, which heavily depend on soybean meal and oil as essential inputs. Governments in the region are actively investing in enhancing domestic production capacities and approving advanced crop technologies to reduce reliance on imports. Processors are modernizing and expanding crushing facilities, particularly near major ports, to optimize efficiency and strengthen regional supply chains. These developments are ensuring a steady supply to meet the growing demand for soybean oil products.

The Middle East is projected to witness the fastest growth, with a robust CAGR of 6.63% through 2031. National food security initiatives and the rising demand for soy-based inputs in the poultry and dairy industries drive this growth. Countries like the United Arab Emirates and Saudi Arabia are focusing on integrating soybean meal and oil into their feed systems while simultaneously investing in local oilseed processing infrastructure. The establishment of climate-controlled feed mills and advanced poultry complexes is further driving the demand for soybean oil and its derivatives. These efforts are positioning the region as a key growth market for soybean oil products.

Europe is experiencing steady growth as it navigates the dual priorities of sustainability and supply chain resilience. The introduction of stringent environmental regulations and deforestation policies is encouraging buyers to source certified and traceable soybean oil from responsible suppliers. This shift is driving the adoption of digital monitoring systems, enhanced transparency, and long-term procurement strategies. The region's focus on sustainable practices is reshaping the market landscape, fostering a transition toward environmentally compliant and ethically sourced soybean oil products. These measures are ensuring that Europe remains a significant player in the global soybean oil market.

- Cargill Incorporated

- Bunge Limited

- Wilmar International Ltd

- Richardson International Limited

- CHS Inc.

- The Scoular Company

- Archer-Daniels-Midland Company,

- Apical Group

- Granol S/A

- COFCO Group

- SD Guthrie Berhad

- AG Processing Inc.

- MWC Oil

- CJ Cheiljedang Corporation

- Nordic Soya Oy

- Galata Chemicals

- Louis Dreyfus Company B.V.

- Limketkai Manufacturing Corporation

- AMAGGI Group

- OLVEA Group

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Expanding livestock industry driving soybean meal consumption

- 4.2.2 Expanding food processing and fast-food industries boost oil consumption

- 4.2.3 Growth in biodiesel production using soybean oil

- 4.2.4 Rising health awareness shifts preference towards healthier oils like sunflower

- 4.2.5 Technological advancements in soybean oil cultivation

- 4.2.6 Government policies promoting renewable energy are supporting soybean oil demand

- 4.3 Market Restraints

- 4.3.1 Competition from alternative oilseeds hinders growth

- 4.3.2 Fluctuating global prices due to weather and trade policies restricts growth

- 4.3.3 High production costs impact profit margins

- 4.3.4 Limited availability of arable land restricts production

- 4.4 Value Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Technology Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE AND VOLUME)

- 5.1 By Nature

- 5.1.1 Conventional

- 5.1.2 Organic

- 5.2 By Application

- 5.2.1 Food

- 5.2.1.1 Spreads

- 5.2.1.2 Bakery and Confectionery

- 5.2.1.3 Other Applications

- 5.2.2 Animal Feed

- 5.2.3 Industrial

- 5.2.4 Others

- 5.2.1 Food

- 5.3 By Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.1.4 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 France

- 5.3.2.3 United Kingdom

- 5.3.2.4 Spain

- 5.3.2.5 Netherlands

- 5.3.2.6 Italy

- 5.3.2.7 Sweden

- 5.3.2.8 Norway

- 5.3.2.9 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 India

- 5.3.3.3 Japan

- 5.3.3.4 Australia

- 5.3.3.5 South Korea

- 5.3.3.6 Vietnam

- 5.3.3.7 Indonesia

- 5.3.3.8 Rest of Asia-Pacific

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 United Arab Emirates

- 5.3.5.3 South Africa

- 5.3.5.4 Rest of Middle East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves (M and A, JVs, Capacity Expansions)

- 6.3 Market Positioning Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)}

- 6.4.1 Cargill Incorporated

- 6.4.2 Bunge Limited

- 6.4.3 Wilmar International Ltd

- 6.4.4 Richardson International Limited

- 6.4.5 CHS Inc.

- 6.4.6 The Scoular Company

- 6.4.7 Archer-Daniels-Midland Company,

- 6.4.8 Apical Group

- 6.4.9 Granol S/A

- 6.4.10 COFCO Group

- 6.4.11 SD Guthrie Berhad

- 6.4.12 AG Processing Inc.

- 6.4.13 MWC Oil

- 6.4.14 CJ Cheiljedang Corporation

- 6.4.15 Nordic Soya Oy

- 6.4.16 Galata Chemicals

- 6.4.17 Louis Dreyfus Company B.V.

- 6.4.18 Limketkai Manufacturing Corporation

- 6.4.19 AMAGGI Group

- 6.4.20 OLVEA Group

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK