PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910679

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910679

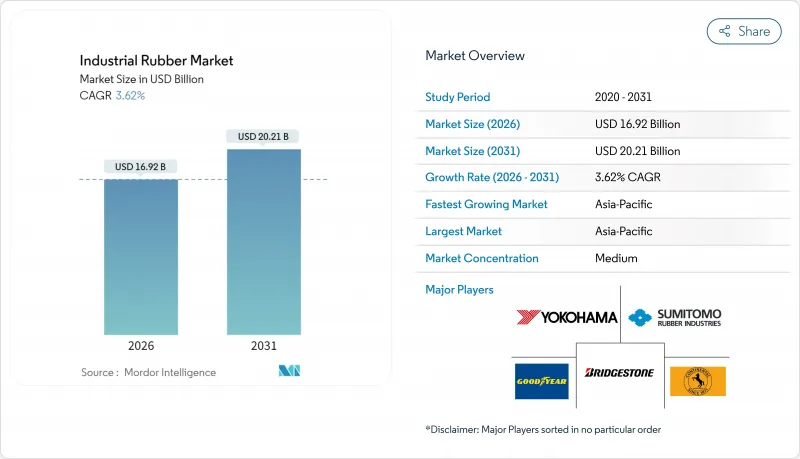

Industrial Rubber - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The industrial rubber market is expected to grow from USD 16.33 billion in 2025 to USD 16.92 billion in 2026 and is forecast to reach USD 20.21 billion by 2031 at 3.62% CAGR over 2026-2031.

Demand remains firmly anchored in automotive, construction, mining and general-industrial supply chains, with synthetic grades supplying consistent quality and scale advantages. Conveyor systems, transmission equipment and high-pressure hose assemblies continue to pull large volumes, while bio-based and reclaimed alternatives steadily widen addressable demand. Supply-side resilience is shaped by volatile crude-derived feedstocks and natural-rubber shortages; producers that balance raw-material optionality with recycling capabilities reduce earnings volatility. Asia-Pacific, holding a decisive majority share, benefits from integrated upstream raw-material bases and downstream manufacturing density, whereas North America and Europe differentiate through specialty rubber grades and regulatory compliance leadership.

Global Industrial Rubber Market Trends and Insights

Increasing application as conveyor & transmission belts

Conveyor and transmission systems underpin automated material-handling strategies that lower operating costs, cut accident frequency and boost energy efficiency. Hard-rock mining, bulk-cargo ports and parcel-sorting hubs specify multi-ply, flame-retardant belts that handle temperatures exceeding 200 °C without accelerated abrasion. Upgraded rubber compounds, often nitrile-blended or aramid-reinforced, extend belt life by up to 25% compared with conventional compounds. Major producers increasingly integrate smart-sensor arrays into belt carcasses, enabling predictive-maintenance programs that reduce unscheduled downtime by nearly 35%. Asia-Pacific miners and construction material suppliers represent the largest customer pool, but value-added demand is rising in North America's warehousing boom and Europe's recycling facilities.

Growing demand for high-pressure hoses

Expanding chemical, oil-and-gas and advanced-manufacturing activity elevates the need for hoses that tolerate extreme pressure, rapid flexing and aggressive media. Leading suppliers formulate fluoroelastomer, EPDM and hydrogenated nitrile blends to withstand over 300 PSI and multi-chemical exposure while meeting FDA and EU food-contact regulations. Producers complement compound development with crimp-coupling innovations that shorten assembly times and improve impulse-cycle life. Strategic acquisitions-such as Bridgestone's 2024 purchase of Cline Hose & Hydraulics-illustrate the push to own both product and service footprints. Custom-engineered assemblies, ship-to-stock delivery models and local certification centers round out competitive advantages in this high-mix application space.

Stringent environmental regulations

The U.S. EPA tightened National Emission Standards for Hazardous Air Pollutants in tire and mixed-rubber processing, capping volatile organics at 64 g per tonne and compelling plant retrofits by 2027. Europe's Deforestation Regulation obliges full traceability for natural-rubber imports, raising procurement costs and documentation burdens. California's investigation into 6PPD tire additives forces compound reformulation discussions amid durability concerns, while global proposals to phase out PFAS push fluoroelastomer R&D pipelines. Compliance outlays challenge smaller compounders but reward early adopters of cleaner solvents, closed-loop wash systems and bio-based feedstocks.

Other drivers and restraints analyzed in the detailed report include:

- EV-led boom in lightweight automotive components

- Infrastructure build-out in emerging economies

- Volatile crude-oil-linked feedstock prices

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Synthetic grades, dominated by styrene-butadiene, retained a commanding 70.54% share of the industrial rubber market in 2025 as automakers, machinery OEMs and infrastructure builders demanded consistent performance across broad temperature windows. Extensive catalyst and process innovations boost tensile strength, abrasion resistance and oil tolerance, aligning properties with stringent OEM specifications. Reclaimed rubber, harvested from devulcanized end-of-life tires and buffings, expands at a 4.78% CAGR on the back of 30-50% cost savings versus virgin feedstocks and mounting circular-economy mandates. Compounders re-engineer formulations to accommodate reclaimed content of up to 25% without compromising cure kinetics, thereby moderating overall scrap. Natural-rubber supply remains central to passenger-tire elasticity and heavy-haul off-road grip, yet producers wrestle with disease-related yield drops in Southeast Asia. Bio-based synthetic routes, particularly bio-butadiene and polyisoprene from plant sugars, advance pilot-scale trials that promise to ease resource pressures while shrinking carbon footprints.

Extrusion held 44.70% share of the industrial rubber market size in 2025, favored for continuous production of hoses, profiles and sealing strips where dimensional accuracy and low scrap rates are critical. State-of-the-art screw designs increase throughput 15% and support real-time viscosity monitoring systems that cut change-over time. Injection and compression molding retain vital roles for high-volume automotive bushings and vibration isolators, benefitting from multi-cavity tooling and automated demolding robotics. Additive manufacturing, while only emerging, records the fastest 4.05% CAGR as aerospace, defense and medical users exploit 3D-printed thermoplastic polyurethane lattices for lightweight, complex geometries. Advances in photopolymerizable isoprene resins yield elastomeric parts with elongation at break surpassing 200%, bringing functional prototypes within days rather than weeks. Calendaring sustains specialty sheet markets, roofing membranes, tank linings and diaphragm sheets, thanks to microscopic gauge control afforded by precision-roll systems.

The Industrial Rubber Market Report is Segmented by Rubber Type (Natural Rubber, Synthetic Rubber, and More), Process (Extrusion, Molding and Casting, and More), Application (Conveyor Belts, Transmission Belts, and More), End-User Industry (Automotive and Transportation, Construction and Infrastructure, and More), and Geography (Asia-Pacific, North America, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific retained 58.60% share of the industrial rubber market in 2025 and is advancing at a 4.00% CAGR, underscored by its integrated plantation-to-compound supply chains, large-scale tire capacities, and vast infrastructure programs. China drives demand through EV adoption rates approaching one-third of new car sales, heightening traction for specialty tire and sealing compounds. Thailand and Indonesia together account for more than 60% of global natural-rubber output, but yields are strained by disease incidence and labor shortages, prompting government support for mechanized tapping and downstream processing upgrades. India tightens its import-export balance by expanding domestic mixing houses and encouraging reclaimed-rubber collection networks.

North America sustains mid-single-digit growth anchored in aerospace, shale-energy and logistics construction. The U.S. imports roughly 90% of its natural-rubber needs, sparking policy discourse around domestic guayule cultivation to improve supply resilience. Canada's mining expansion in critical minerals feeds conveyor-belt and hose demand, while Mexico captures OEM investments relocating supply chains closer to U.S. consumer bases.

Europe's demand profile is shaped by strict environmental regulations and rapid commercialization of bio-based materials. The EU Deforestation Regulation compels traceability for rubber imports, catalyzing digital ledger adoption among traders. Germany and France pioneer dandelion-based natural-rubber pilot farms that lower transport emissions compared with Southeast-Asian supply. Eastern European tire plants receive significant capital infusions to produce larger-rim EV tires domestically, reducing reliance on Asian imports amid shipping volatility.

Latin America and Middle East & Africa collectively contribute a modest but rising share as infrastructure projects launch new demand corridors. Brazil restarts public-works spending focused on bridge retrofits and port expansion, increasing calls for rubber bearings and hose assemblies. The Gulf Cooperation Council accelerates industrial diversification beyond hydrocarbons, with petrochemical complexes specifying EPDM seals and nitrile hoses resistant to sour gas exposure. Sub-Saharan African mining prospects in copper and lithium underpin conveyor-belt demand, yet project rollouts hinge on political stability and financing access.

- Bando Chemical Industries, LTD.

- Bridgestone Industrial

- China Petrochemical Corporation (Sinopec)

- ContiTech Deutschland GmbH

- Denka Company Limited

- ENEOS Materials Corporation

- Parker Hannifin Corp

- SIBUR Holding PJSC

- Sumitomo Rubber Industries, Ltd.

- The Goodyear Tire & Rubber Company

- THE YOKOHAMA RUBBER CO., LTD.

- Trelleborg AB

- Trinseo

- TSRC

- UBE Corporation

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing application as conveyor & transmission belts

- 4.2.2 Growing demand for high-pressure hoses

- 4.2.3 EV-led boom in lightweight automotive components

- 4.2.4 Infrastructure build-out in emerging economies

- 4.2.5 Shift to bio-based synthetic rubbers

- 4.3 Market Restraints

- 4.3.1 Stringent environmental regulations

- 4.3.2 Volatile crude-oil-linked feedstock prices

- 4.3.3 Rapid uptake of reclaimed rubber cannibalising virgin demand

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size & Growth Forecasts (Value)

- 5.1 By Rubber Type

- 5.1.1 Natural Rubber

- 5.1.2 Synthetic Rubber

- 5.1.3 Reclaimed Rubber

- 5.2 By Process

- 5.2.1 Extrusion

- 5.2.2 Molding and Casting

- 5.2.3 Calendaring

- 5.2.4 3-D Printing / Additive Manufacturing

- 5.3 By Application

- 5.3.1 Conveyor Belts

- 5.3.2 Transmission Belts

- 5.3.3 Pressure Hoses

- 5.3.4 Other Application (Roofing, Tubes, Rolls, etc.)

- 5.4 By End-User Industry

- 5.4.1 Automotive and Transportation

- 5.4.2 Construction and Infrastructure

- 5.4.3 Mining and Metals

- 5.4.4 Industrial Machinery and Equipment

- 5.4.5 Chemical and Petrochemical

- 5.4.6 Aerospace and Defence

- 5.4.7 Electrical and Electronics

- 5.4.8 Others

- 5.5 By Geography

- 5.5.1 Asia-Pacific

- 5.5.1.1 China

- 5.5.1.2 India

- 5.5.1.3 Japan

- 5.5.1.4 South Korea

- 5.5.1.5 Thailand

- 5.5.1.6 Indonesia

- 5.5.1.7 Vietnam

- 5.5.1.8 Malaysia

- 5.5.1.9 Philippines

- 5.5.1.10 Rest of Asia-Pacific

- 5.5.2 North America

- 5.5.2.1 United States

- 5.5.2.2 Canada

- 5.5.2.3 Mexico

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Russia

- 5.5.3.7 NORDIC Countries

- 5.5.3.8 Turkey

- 5.5.3.9 Rest of Europe

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Colombia

- 5.5.4.4 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 United Arab Emirates

- 5.5.5.3 Qatar

- 5.5.5.4 South Africa

- 5.5.5.5 Nigeria

- 5.5.5.6 Egypt

- 5.5.5.7 Rest of Middle East and Africa

- 5.5.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share(%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 Bando Chemical Industries, LTD.

- 6.4.2 Bridgestone Industrial

- 6.4.3 China Petrochemical Corporation (Sinopec)

- 6.4.4 ContiTech Deutschland GmbH

- 6.4.5 Denka Company Limited

- 6.4.6 ENEOS Materials Corporation

- 6.4.7 Parker Hannifin Corp

- 6.4.8 SIBUR Holding PJSC

- 6.4.9 Sumitomo Rubber Industries, Ltd.

- 6.4.10 The Goodyear Tire & Rubber Company

- 6.4.11 THE YOKOHAMA RUBBER CO., LTD.

- 6.4.12 Trelleborg AB

- 6.4.13 Trinseo

- 6.4.14 TSRC

- 6.4.15 UBE Corporation

7 Market Opportunities & Future Outlook

- 7.1 White-space & unmet-needs assessment

- 7.2 Introducing New Manufacturing Techniques to Reduce Hazardous Waste