PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910682

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910682

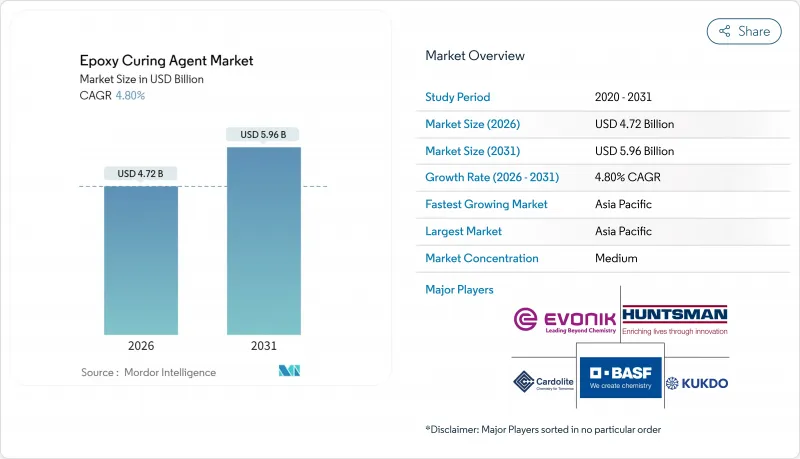

Epoxy Curing Agent - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

Epoxy Curing Agent Market size in 2026 is estimated at USD 4.72 Billion, growing from 2025 value of USD 4.5 Billion with 2031 projections showing USD 5.96 Billion, growing at 4.8% CAGR over 2026-2031.

This growth rests on Asia-Pacific infrastructure upgrades, the steady rollout of renewable-energy assets, and surging demand for lightweight composites in mobility and aerospace. Competitive dynamics are shifting as antidumping duties alter global trade flows, prompting Western producers to pivot toward high-margin specialty chemistries. Product innovation is skewing toward low-Volatile Organic Compound (VOC), bio-based, and fast-cure systems that enable shorter production cycles, while supply-chain security initiatives in North America and Europe are re-ordering sourcing strategies. As a result, the epoxy curing agents market is consolidating, yet niche entrants focusing on sustainability continue to emerge, adding complexity to the competitive landscape.

Global Epoxy Curing Agent Market Trends and Insights

Infrastructure Boom Driving Demand for High-performance Floor Coatings

Asian infrastructure megaprojects continue multiplying, spawning stringent performance specifications for industrial floors that withstand chemicals, mechanical shock, and heavy traffic. Public-sector spending across China, India, and Southeast Asia is channeling funds into data-center campuses, metro rail networks, and renewable-power facilities, all requiring durable, anti-static, and rapid-cure coatings. Consequently, formulators are tailoring low-emission epoxy systems that lower downtime for contractors while complying with tougher environmental mandates . The shift extends to smart-building concepts, where conductive floors enable integrated asset-tracking and energy-management technologies. Suppliers able to deliver balanced cost-performance packages are winning multi-year supply contracts, reinforcing the growth trajectory of the epoxy curing agents market.

Wind-turbine Blade Production Surge in APAC and Europe

Global wind-energy capacity additions crossed the 115 GW mark in 2024, and blade makers are chasing tighter takt times to meet order backlogs. Large-rotor designs demand curing agents that generate low exotherms, minimize voids, and elevate interlaminar toughness. BASF's Baxxodur range illustrates how optimized amine blends reduce cycle times without sacrificing mechanical integrity. European original equipment manufacturers (OEMs) have set temperature-reduction and recyclability targets, spurring research and development (R&D) into reversible chemistries that simplify blade component disassembly. Meanwhile, China's blade factories leverage local feedstock and logistics advantages, nudging Western players to localize production lines, thereby amplifying regional demand for epoxy curing agents market participants with Asian manufacturing footprints.

Stricter VOC Caps on Solvent-borne Amine Systems

Revisions to the U.S. National Aerosol Coatings Rule and proposed South Coast AQMD (Air Quality Management District) updates are slashing allowable VOC thresholds, forcing formulators to migrate toward water-borne, high-solids, or solvent-free chemistries . While compliance widens the addressable market for greener alternatives, it raises R&D and qualification costs, especially where performance cannot be compromised. Rapid-cure, bio-based alternatives are in development but face scale-up hurdles that could constrain near-term supply availability and hamper overall epoxy curing agents market acceleration.

Other drivers and restraints analyzed in the detailed report include:

- Miniaturization in Electronics Requiring Low-void Encapsulants

- Lightweight CFRP Adoption in Automotive and Aerospace

- Volatile Epichlorohydrin and Benzylamine Feedstock Prices

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Amines controlled 41.12% of 2025 revenue, cementing their role as the backbone chemistry for most composite, coating, and adhesive systems. Within the category, aliphatic and cycloaliphatic versions deliver UV resistance, while polyetheramines excel in flexibility-demanding environments such as protective marine coatings. Anhydrides maintain relevance in high-temperature electrical insulation and under-hood automotive components where 180°C service is routine. Phenalkamines, though niche, unlock rapid cure in humid or low-temperature jobsites, a value proposition gaining recognition among contractors pursuing all-weather productivity. The segment's adaptable performance profile collectively ensures it stays at the core of the epoxy curing agents market even as sustainability trends invite competing chemistries.

Despite amines' dominance, competitive tension persists. Polyamide suppliers stress bio-sourced dimer-acid routes to claim a carbon-reduction edge, while anhydride producers tout superior heat-cycling endurance. Specialty players experiment with hybrid amine-anhydride packages to balance latency, cure speed, and mechanical performance. Over the forecast horizon, targeted R&D in amine chemistry aims to integrate latent catalysts and nano-fillers that elevate toughness without extending cure cycles. This steady pipeline of upgrades positions the segment to keep fueling the broader epoxy curing agents market.

The Epoxy Curing Agents Market Report is Segmented by Type (Amines, Polyamides, Anhydrides, and Other Types (Phenalkamines, Amidoamines, Etc. )), Application (Paints and Coatings, Adhesives and Sealants, Composites, Electrical and Electronics, and Others), and Geography (Asia-Pacific, North America, Europe, South America, and Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific held 35.12% share in 2025 and is expanding at a 5.66% CAGR on the back of public infrastructure outlays, renewable-energy commitments, and electronics manufacturing gravitation toward the region. China's wind-turbine blade factories and India's semiconductor-assembly clusters absorb vast volumes of amine-based systems. Regional producers leverage proximity to epichlorohydrin and benzylamine feedstocks, reducing logistics costs and lead times. Sustainability regulations are tightening, but cost competitiveness remains paramount, reinforcing the need for locally integrated supply chains in the epoxy curing agents market.

North America trails in share but benefits from reshoring missions and aerospace composites leadership. Antidumping duties on Asian epoxy imports, formalized by the United States International Trade Commission in 2025, raise domestic capacity utilization and spur investment in specialty grades. Electric Vehicle (EV) battery-plant expansions in the United States and Mexico stimulate high-solids adhesive demand, while offshore-wind buildouts along the Atlantic corridor introduce a new consumption stream for blade-grade curing agents.

Europe confronts high energy costs and fierce Asian competition, forcing companies to rationalize commodity output and double down on high-value niches. Westlake's impairment of Dutch assets exemplifies this recalibration. Yet Europe's leadership in automotive composites and recyclable wind-blade R&D sustains selective demand for next-generation chemistries. Regulatory emphasis on circularity is accelerating adoption of bio-based and low-VOC curing systems, carving an innovation-led path for the regional epoxy curing agents market.

- Aditya Birla Group

- Air Products Inc.

- Atul Ltd.

- BASF

- Cardolite Corporation

- DIC Corporation

- Evonik Industries AG

- Huntsman International LLC

- KUKDO CHEMICAL CO., LTD.

- Kumho P&B Chemicals Inc.

- Mitsubishi Chemical Group Corporation

- Olin Corporation

- Shandong Deyuan Epoxy Resin Co. Ltd

- Toray Industries Inc.

- Westlake Corporation

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Infrastructure Boom Driving Demand for High-performance Floor Coatings

- 4.2.2 Wind-turbine Blade Production Surge in APAC and Europe

- 4.2.3 Miniaturization in Electronics Requiring Low-void Encapsulants

- 4.2.4 Lightweight CFRP Adoption in Automotive and Aerospace

- 4.2.5 Emergence of Ultra-fast Latent Systems for 3D-printing of Thermosets

- 4.3 Market Restraints

- 4.3.1 Stricter VOC Caps on Solvent-borne Amine Systems

- 4.3.2 Volatile Epichlorohydrin and Benzylamine Feedstock Prices

- 4.3.3 Supply Crunch in Cashew-derived Phenalkamine Feedstock

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value)

- 5.1 By Type

- 5.1.1 Amines

- 5.1.2 Polyamides

- 5.1.3 Anhydrides

- 5.1.4 Other Types (Phenalkamines, Amidoamines, etc.)

- 5.2 By Application

- 5.2.1 Paints and Coatings

- 5.2.2 Adhesives and Sealants

- 5.2.3 Composites

- 5.2.4 Electrical and Electronics

- 5.2.5 Others (Industrial Flooring and Repairs, etc.)

- 5.3 By Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 ASEAN

- 5.3.1.6 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle East and Africa

- 5.3.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products & Services, and Recent Developments)

- 6.4.1 Aditya Birla Group

- 6.4.2 Air Products Inc.

- 6.4.3 Atul Ltd.

- 6.4.4 BASF

- 6.4.5 Cardolite Corporation

- 6.4.6 DIC Corporation

- 6.4.7 Evonik Industries AG

- 6.4.8 Huntsman International LLC

- 6.4.9 KUKDO CHEMICAL CO., LTD.

- 6.4.10 Kumho P&B Chemicals Inc.

- 6.4.11 Mitsubishi Chemical Group Corporation

- 6.4.12 Olin Corporation

- 6.4.13 Shandong Deyuan Epoxy Resin Co. Ltd

- 6.4.14 Toray Industries Inc.

- 6.4.15 Westlake Corporation

7 Market Opportunities & Future Outlook

- 7.1 White-Space & Unmet-Need Assessment

- 7.2 Bio-Based Epoxy Curing Agents