PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910686

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910686

Online Lottery - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

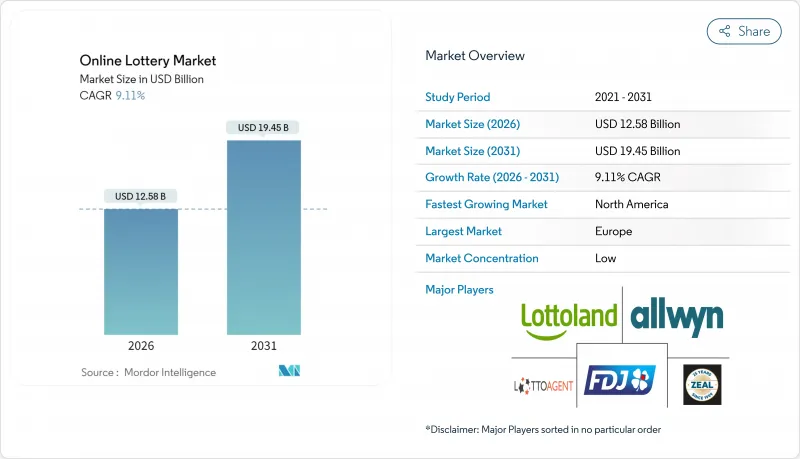

The online lottery market was valued at USD 11.53 billion in 2025 and estimated to grow from USD 12.58 billion in 2026 to reach USD 19.45 billion by 2031, at a CAGR of 9.11% during the forecast period (2026-2031).

This growth is bolstered by a surge in mobile adoption, seamless digital payment processes, and forward-thinking regulations. Currently, mobile channels account for over half of all ticket sales, and the familiarity with m-commerce streamlines the conversion process. Innovations like blockchain for enhanced transparency, mobile applications, secure payment gateways, and AI-driven user accounts are elevating player security and engagement. Strategies such as leveraging social media, targeted email campaigns, and online advertising are proving effective in both attracting and retaining lottery enthusiasts. Features like subscription services and gamified experiences are not only boosting player retention but also drawing in a younger demographic. Europe leads in market value, thanks to its clear licensing frameworks and multi-country draws. Meanwhile, recent legalizations are expanding the market base in the U.S. While younger adults are leaning towards digital-first instant games, traditional draw formats still hold their ground, largely due to the media's focus on pooled jackpots. Increased spending on cybersecurity and automation in compliance are fortifying the position of established platform providers.

Global Online Lottery Market Trends and Insights

Rising penetration of digital wallets and mobile payments integration

Lottery ticket purchases have become seamless and secure with the use of digital wallets and mobile payment options, allowing users to buy tickets anytime and anywhere. This advancement removes the challenges of traditional payment methods, increasing the customer base and driving ticket sales. In 2024, 92.8% of mobile internet users in China utilized mobile payments, according to the China Internet Network Information Center. This growth facilitates hassle-free lottery ticket purchases, bypassing the limitations of cash transactions and physical retail outlets. The European Central Bank's digital euro initiative, currently under preparation, seeks to complement existing payment systems while reducing reliance on non-European platforms, potentially streamlining cross-border lottery transactions. Mobile payment integration is particularly advantageous for instant lottery games, where the demand for immediate results aligns with the convenience of digital wallets. In developing Asian markets with limited point-of-sale infrastructure, QR code-based payment systems are emerging as strong competitors to NFC-based solutions, creating new opportunities for lottery market growth. Additionally, the adoption of stored payment credentials enhances security and supports subscription-based lottery services, fostering consistent revenue generation.

Legalization and regulatory liberalization

Legalization establishes clear regulations, licensing requirements, and consumer protections, enhancing trust in online lotteries. This increases player confidence by ensuring fair games and secure winnings. In July 2024, Massachusetts Governor Maura Healey approved the FY 2025 budget, legalizing online lottery sales. The Massachusetts Lottery plans to launch its digital platform within 16 months, requiring participants to be at least 21 years old. Finland's gaming market reform suggests an open licensing system for commercial operators in sports betting and online gaming while preserving Veikkaus's monopoly over lotteries. Singapore's Gambling Regulatory Authority issued a license to Singapore Pools under the 2022 Gambling Control Act, valid until October 2025, showcasing structured regulatory measures in Asia-Pacific. Utah State Representative Kera Birkeland intends to reintroduce a constitutional amendment in 2025 to legalize the state lottery, aiming to capture the USD 200 million spent by Utah residents on lottery tickets in neighboring states. These regulatory developments expand market opportunities and establish compliance frameworks that legitimize online lottery operations. Brazil's Law 14,790/2023 enforces responsible gambling practices, requiring operators to monitor bettor activity and implement systems to identify at-risk players, setting a regulatory standard for emerging markets.

Regulatory and legal challenges

Fragmented global regulatory standards cause confusion regarding licensing, taxation, and consumer protection. This inconsistency, present across countries and even within states, complicates market entry and operations for lottery operators. In April 2025, the Texas Lottery Commission unanimously decided to ban third-party courier services from purchasing lottery tickets, citing concerns over legality and integrity after controversial jackpot wins linked to these services. Highlighting the volatility of the regulatory environment, the Texas Senate passed Senate Bill 28, criminalizing online lottery ticket sales through couriers. In Hong Kong, the Gambling Ordinance enforces strict regulations, granting the Hong Kong Jockey Club exclusive rights to betting activities and Mark Six Lottery operations, thereby restricting market access for international operators. Similarly, Western Australia's Gambling Legislation Amendment Act 2024 strengthens regulations for interactive gambling services by increasing penalties for noncompliance and requiring operators to provide bank guarantees for lottery permits. This regulatory fragmentation increases compliance complexities and operational costs, disproportionately affecting smaller operators while favoring established players with greater regulatory expertise.

Other drivers and restraints analyzed in the detailed report include:

- Increasing global internet penetration

- Cross-border jackpot pooling boosting prize sizes

- App-store policy tightening on real-money gambling

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Mobile platforms captured 55.72% market share in 2025 and exhibit the fastest growth trajectory at 11.08% CAGR through 2031. This growth is primarily driven by the widespread use of smartphones and the integration of mobile payment systems. Desktop platforms remain relevant, particularly for complex lottery games requiring detailed interfaces, but they are experiencing a decline in user engagement as mobile optimization continues to improve. The mobile-first approach supports location-based services, push notifications for draw results, and seamless social sharing, enhancing player engagement beyond the limitations of traditional desktop platforms.

Pollard Banknote's partnership with Premier Lotteries Ireland in December 2024, which introduced a mobile app and an eInstant games portfolio, highlights the industry's focus on mobile-centric experiences. This platform includes features such as player registration, game purchases, and ticket scanning. While mobile platforms benefit from app store distribution channels, they must address regulatory challenges, including geo-gating and age verification. The fusion of mobile gaming aesthetics with traditional lottery mechanics creates hybrid experiences that attract younger demographics while adhering to regulatory standards. Additionally, cross-platform synchronization allows players to initiate transactions on mobile devices and complete them on desktop platforms, improving conversion rates across the user journey.

Draw-based lottery games commanded 32.10% market share in 2025, highlighting consumers' strong preference for traditional lotteries with scheduled draws and attractive jackpots. These games, such as EuroMillions, utilize cross-border jackpot pooling to generate prize sizes that individual jurisdictions cannot achieve alone. Instant lottery games are experiencing rapid growth, with a 10.12% CAGR projected through 2031, driven by the appeal of immediate gratification and mobile gaming features that attract digital-native audiences. Additionally, sports lotteries and other emerging game types combine traditional lottery mechanics with modern entertainment formats, though regulatory frameworks differ significantly across regions.

Instant games are leveraging technological advancements to deliver enhanced graphics, animations, and interactive features that mimic mobile gaming experiences while adhering to lottery compliance standards. Furthermore, the adoption of blockchain technology in lottery operations is transforming the industry by providing transparent and immutable records for both draw-based and instant games. This innovation helps reduce fraud and facilitates smart contract automation. The diversification of game types reflects operators' efforts to meet the varied preferences of players, ranging from those seeking life-changing jackpots to casual participants favoring quick, smaller-value wins.

The Online Lottery Market Report is Segmented by Platform Type (Desktop, Mobile), Game Type (Draw-Based Lottery, Instant Lottery, Sports Lottery, Others), Age Group (Below 25 Years, 25-40 Years, 40-55 Years, 55+ Years), End User (Male, Female), and Geography (North America, Europe, Asia-Pacific, Rest of the World). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Europe maintained a 45.20% market share in 2025, supported by well-established cross-border lottery operations such as EuroMillions. EuroMillions operates across nine countries with standardized prize structures and revenue distribution mechanisms. The UK experienced a major shift as Allwyn Entertainment became the Fourth Licence operator. This transition involved a GBP 350 million investment, introducing over 30 new systems and complex data migrations, with the goal of doubling returns to Good Causes. Germany continues to adapt its regulatory framework under the State Treaty on Gambling, which structured online gambling regulations and addressed stigmatization concerns highlighted in recent social media studies. Nordic countries are making significant progress, with Finland planning a comprehensive gaming market reform to introduce open licensing systems for commercial operators by January 2027. Additionally, the European Central Bank's digital euro initiative is creating a unified payment infrastructure that could streamline cross-border lottery transactions and reduce reliance on non-European payment providers.

North America is experiencing the fastest regional growth, with a 10.44% CAGR projected through 2031. This growth is driven by state-level legalization efforts and investments in technological infrastructure, which are expanding the addressable market. In July 2024, Massachusetts approved online lottery sales, allocating funds to early childhood education programs. Virginia extended its iLottery contract with NeoPollard Interactive through 2028, continuing a partnership that has achieved record gross sales. In Canada, Alberta launched online draw-based lottery games, marking the first integration of draw games in North America and showcasing provincial innovation in digital lottery delivery. However, regulatory fragmentation poses challenges, as seen in Texas's ban on third-party courier services, while other states embrace digital lottery expansion. Advanced mobile payment systems and high smartphone penetration rates are driving lottery digitization in the region, though federal gambling regulations create compliance challenges for interstate lottery operations.

Asia-Pacific and other global markets offer diverse growth opportunities, though these are constrained by varying regulatory approaches and cultural attitudes toward gambling. Singapore's Gambling Regulatory Authority, under the 2022 Gambling Control Act, has authorized Singapore Pools as the exclusive operator for online non-casino gambling services, including public lotteries, reflecting structured regulatory frameworks in developed Asian markets. Australia's regulatory landscape is evolving with the implementation of the National Consumer Protection Framework and the BetStop self-exclusion register, alongside reviews of foreign-matched lotteries and online keno services. In South America, Brazil's Law 14,790/2023 emphasizes responsible gambling measures and mandates operator monitoring systems, setting a regulatory precedent for emerging markets in the region. As digital infrastructure continues to develop in emerging economies, disparities in internet penetration between high-income and low-income countries highlight significant growth potential.

- Allwyn Entertainment

- PlayHugeLottos

- Francaise des Jeux

- ZEAL Network SE

- Lotto Direct Ltd

- Lottoland

- Lotto Agent

- LottoKings

- WinTrillions

- Lotto247

- Annexio Ltd.

- China Welfare Lottery

- Intralot

- Sisal

- The Lottery Corporation

- International Game Technology (IGT)

- Flutter Entertainment (The Lotteries Pilot)

- NeoGames

- Pollard Banknote

- Jumbo Interactive

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising penetration of digital wallets and mobile payments integration

- 4.2.2 Legalization and regulatory liberalization

- 4.2.3 Increasing global internet penetration

- 4.2.4 Cross-border jackpot pooling boosting prize sizes

- 4.2.5 Advancement of digital technologies

- 4.2.6 Micro-influencer affiliate marketing lowering acquisition costs

- 4.3 Market Restraints

- 4.3.1 Regulatory and legal challenges

- 4.3.2 App-store policy tightening on real-money gambling

- 4.3.3 Cybersecurity threats and fraud risks

- 4.3.4 Negative public perception and stigma

- 4.4 Consumer Behaviour Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS

- 5.1 By Platform Type

- 5.1.1 Desktop

- 5.1.2 Mobile

- 5.2 By Game Type

- 5.2.1 Draw-based Lottery

- 5.2.2 Instant Lottery

- 5.2.3 Spots Lottery

- 5.2.4 Others

- 5.3 By Age Group

- 5.3.1 Below 25 Years

- 5.3.2 25-40 Years

- 5.3.3 40-55 Years

- 5.3.4 55+ Years

- 5.4 By End User

- 5.4.1 Male

- 5.4.2 Female

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.1.4 Rest of North America

- 5.5.2 Europe

- 5.5.2.1 United Kingdom

- 5.5.2.2 Germany

- 5.5.2.3 Sweden

- 5.5.2.4 France

- 5.5.2.5 Spain

- 5.5.2.6 Italy

- 5.5.2.7 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 Oceanic Countries

- 5.5.3.2 Rest of Asia-Pacific

- 5.5.4 Rest of the Wolrd

- 5.5.4.1 South America

- 5.5.4.2 Middle East and Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Allwyn Entertainment

- 6.4.2 PlayHugeLottos

- 6.4.3 Francaise des Jeux

- 6.4.4 ZEAL Network SE

- 6.4.5 Lotto Direct Ltd

- 6.4.6 Lottoland

- 6.4.7 Lotto Agent

- 6.4.8 LottoKings

- 6.4.9 WinTrillions

- 6.4.10 Lotto247

- 6.4.11 Annexio Ltd.

- 6.4.12 China Welfare Lottery

- 6.4.13 Intralot

- 6.4.14 Sisal

- 6.4.15 The Lottery Corporation

- 6.4.16 International Game Technology (IGT)

- 6.4.17 Flutter Entertainment (The Lotteries Pilot)

- 6.4.18 NeoGames

- 6.4.19 Pollard Banknote

- 6.4.20 Jumbo Interactive

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK