PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910702

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910702

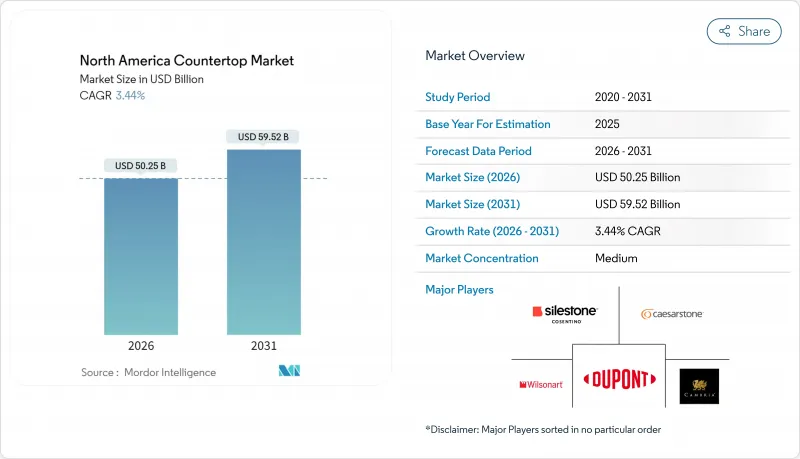

North America Countertop - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The North America counter-top market was valued at USD 48.58 billion in 2025 and estimated to grow from USD 50.25 billion in 2026 to reach USD 59.52 billion by 2031, at a CAGR of 3.44% during the forecast period (2026-2031).

Industry maturation supports steady, rather than explosive, expansion even as consumers gravitate toward premium finishes, integrated technology, and antimicrobial performance. Remodeling activity, elevated home-improvement budgets, and a rising focus on wellness-oriented surfaces buttress demand despite interest-rate headwinds. Fabricators respond by adopting automation that compresses lead times and safeguards margins, while suppliers innovate with low-silica engineered quartz to comply with emerging safety standards. Consolidation among distributors strengthens purchasing power and fosters omni-channel reach, yet installation services remain highly localized, preserving competitive fragmentation.

North America Countertop Market Trends and Insights

Remodeling Rebound & High Home-Improvement Spend

Americans spent USD 603 billion on home remodeling in 2024, underscoring the resilience of discretionary improvement budgets even amid macroeconomic uncertainty. The Harvard Joint Center for Housing Studies expects USD 466 billion in additional remodeling activity through 2025 Q2, helping the North America counter-top market maintain positive order backlogs. Kitchen and bathroom projects each represented 24% of total renovations last year, making counter-tops a priority upgrade that boosts perceived property value. Although median project spends dipped to USD 20,000, overall project counts rose, shifting demand toward mid-tier engineered surfaces that balance performance and affordability. Fabricators currently quote six-month lead times for premium installations, allowing them to preserve pricing power and offset raw-material volatility.

Rapid Shift Toward Engineered Quartz Surfaces

Engineered quartz continues to erode natural-stone share within the North America counter-top market as homeowners value uniform aesthetics and minimal upkeep. Manufacturers have accelerated R&D to introduce formulations containing less than 1% crystalline silica, directly addressing California's new occupational-safety standard. Caesarstone's ICON series and Cosentino's Q0 line both incorporate recycled content above 80%, aligning with corporate sustainability targets while enhancing consumer appeal. Microban-embedded treatments deliver verified antimicrobial protection, a feature increasingly mandated in healthcare and foodservice specifications. Advanced vein-matching and large-format production enable seamless islands exceeding 3 meters, replicating high-end marble visuals without porous drawbacks.

Volatile Natural-Stone & Resin Raw-Material Costs

Granite block prices vary wildly from USD 9 to USD 650 per cubic meter, swinging project margins for wholesalers that lock quotes 90 days in advance. Resin feedstocks, tied to petrochemical futures, tracked a 14% price spread between Q1 and Q3 2024, disrupting engineered-quartz cost projections. Ocean-freight surcharges added USD 800 per container in 2024, making long-haul imports less competitive against regional supply. Contractors report heightened bid attrition when passing surcharges downstream, particularly on price-sensitive commercial tenders. As volatility persists, buyers hedge through multi-year contracts and explore ceramic options with more stable cost curves.

Other drivers and restraints analyzed in the detailed report include:

- Growing New-Build Residential Completions

- Adoption of Antimicrobial Surface Treatments

- Environmental Scrutiny of Stone Quarrying & Resin Use

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Granite maintains its 27.85% market share in 2025 through proven durability and cost-effectiveness, while cast polymer and solid surface materials achieve the fastest growth at 4.28% CAGR through 2031. This growth differential reflects increasing demand for non-porous surfaces that eliminate sealing requirements and provide integrated antimicrobial properties. Engineered stone faces headwinds from silica regulations, driving manufacturers toward mineral surface alternatives like Caesarstone's recycled-content formulations that reduce crystalline silica exposure risks. Marble competes primarily in luxury applications where veining aesthetics justify higher maintenance requirements, while ceramic and other materials serve budget-conscious segments with improved design capabilities.

The material landscape increasingly divides between natural stone's authentic aesthetics and engineered surfaces' performance advantages, with pricing reflecting this value proposition. Quartz countertops range from USD 50-150 per square foot installed, while granite typically costs USD 40-100 per square foot, creating clear market segmentation based on maintenance preferences and budget constraints. Cast polymer's growth trajectory benefits from its ability to replicate premium aesthetics at accessible price points while providing superior stain resistance and repairability compared to natural alternatives.

The North America Countertop Market Report is Segmented by Material (Marble, Granite, Engineering Stone, Ceramic, Cast Polymer/Solid Surface, Other Materials), End-User (Residential, Commercial), Application (Kitchen Countertop, Bathroom Vanity Tops, Others), and Geography (United States, Canada, Mexico). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Cosentino Group (Silestone, Dekton)

- Caesarstone Ltd.

- Cambria Company LLC

- DuPont de Nemours, Inc. (Corian)

- Wilsonart LLC

- Formica Group

- Hanwha Surfaces (HanStone)

- LG Hausys (HI-MACS, Viatera)

- MSI Surfaces (M S International)

- Vicostone USA Inc.

- Aristech Surfaces (Avonite)

- Dal-Tile Corporation (ONE Quartz)

- Panolam Surface Systems

- Crossville Inc. (Porcelain Slabs)

- Laminam North America

- Radianz Quartz (LOTTE Chemical)

- SapienStone (Iris Ceramica)

- Curava Recycled Glass

- IceStone LLC

- Vetrazzo

- DekorStone

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Remodeling rebound & high home-improvement spend

- 4.2.2 Rapid shift toward engineered quartz surfaces

- 4.2.3 Growing new-build residential completions

- 4.2.4 Adoption of antimicrobial surface treatments

- 4.2.5 Rise of prefab DTC e-commerce countertop kits

- 4.2.6 Rising popularity of weather-resistant outdoor countertop materials

- 4.3 Market Restraints

- 4.3.1 Volatile natural-stone & resin raw-material costs

- 4.3.2 Environmental scrutiny of stone quarrying & resin use

- 4.3.3 Skilled fabricator & installer shortage

- 4.3.4 Impending OSHA crystalline-silica rules limiting fabrication methods

- 4.4 Industry Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Suppliers

- 4.5.3 Bargaining Power of Buyers

- 4.5.4 Threat of Substitutes

- 4.5.5 Industry Rivalry

- 4.6 Insights into the Latest Trends and Innovations in the Market

- 4.7 Insights on Recent Developments (New Product Launches, Strategic Initiatives, Investments, Partnerships, JVs, Expansion, M&As, etc.) in the Market

5 Market Size & Growth Forecasts

- 5.1 By Material

- 5.1.1 Marble

- 5.1.2 Granite

- 5.1.3 Engineering Stone (quartz)

- 5.1.4 Ceramic

- 5.1.5 Cast Polymer/Solid Surface Countertops

- 5.1.6 Other Materials

- 5.2 By End-Use Sector

- 5.2.1 Residential

- 5.2.2 Commercial

- 5.3 By Application

- 5.3.1 Kitchen Counter-tops

- 5.3.2 Bathroom Vanity Tops

- 5.3.3 Others (Outdoor Kitchens, Hospitality Bars, etc.)

- 5.4 By Country

- 5.4.1 United States

- 5.4.2 Canada

- 5.4.3 Mexico

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 Cosentino Group (Silestone, Dekton)

- 6.4.2 Caesarstone Ltd.

- 6.4.3 Cambria Company LLC

- 6.4.4 DuPont de Nemours, Inc. (Corian)

- 6.4.5 Wilsonart LLC

- 6.4.6 Formica Group

- 6.4.7 Hanwha Surfaces (HanStone)

- 6.4.8 LG Hausys (HI-MACS, Viatera)

- 6.4.9 MSI Surfaces (M S International)

- 6.4.10 Vicostone USA Inc.

- 6.4.11 Aristech Surfaces (Avonite)

- 6.4.12 Dal-Tile Corporation (ONE Quartz)

- 6.4.13 Panolam Surface Systems

- 6.4.14 Crossville Inc. (Porcelain Slabs)

- 6.4.15 Laminam North America

- 6.4.16 Radianz Quartz (LOTTE Chemical)

- 6.4.17 SapienStone (Iris Ceramica)

- 6.4.18 Curava Recycled Glass

- 6.4.19 IceStone LLC

- 6.4.20 Vetrazzo

- 6.4.21 DekorStone

7 Market Opportunities & Future Outlook

- 7.1 Sustainable Material Innovation Roadmap

- 7.2 Digital Fabrication & Mass Customization

- 7.3 Outdoor Living Spaces Expansion