PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910706

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910706

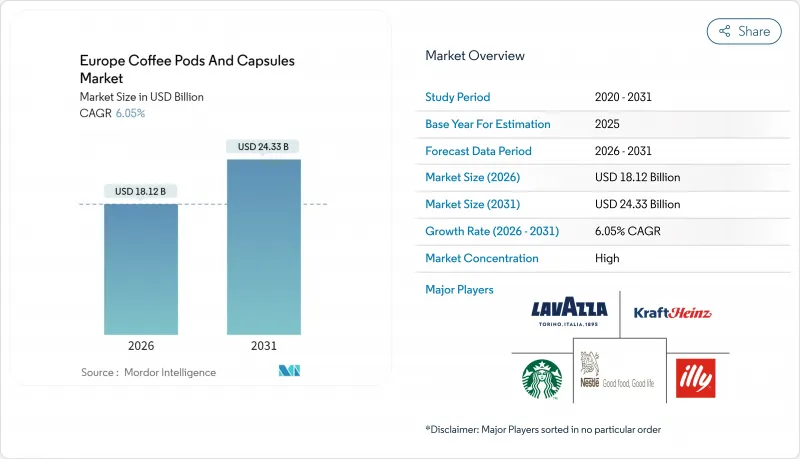

Europe Coffee Pods And Capsules - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

Europe coffee pods and capsules market size in 2026 is estimated at USD 18.12 billion, growing from 2025 value of USD 17.09 billion with 2031 projections showing USD 24.33 billion, growing at 6.05% CAGR over 2026-2031.

The market growth is driven by increasing consumer demand for convenient, high-quality, single-serve coffee options that provide consistent flavor and freshness. The strong coffee culture in Europe and growing preference for premium, specialty, and flavored coffee varieties contribute to market expansion. Companies in the market focus on developing improved brewing technologies, sustainable packaging, and eco-friendly capsules to meet environmental regulations and consumer preferences. The market features distinct product differentiation and direct-to-consumer sales models, enabling companies to build customer loyalty and address varied consumer needs. Europe maintains its position as a global leader in coffee consumption, with consumers prioritizing convenience, quality, and sustainability in their coffee pod and capsule choices. These market dynamics, combined with technological improvements and changing consumer habits, support continued market growth.

Europe Coffee Pods And Capsules Market Trends and Insights

Increasing demand for single-serve coffee

The Europe coffee pods and capsules market is experiencing significant growth, driven by increasing consumer demand for single-serve coffee solutions. European consumers prefer convenient and efficient coffee brewing methods that align with their busy lifestyles. Coffee pods and capsules provide consistent, quality coffee with minimal preparation and cleanup time, making them suitable for both home and office use. The growing presence of single-serve coffee machines in European households, especially in Western Europe, increases the demand for compatible pods and capsules. Higher consumer purchasing power has led to increased spending on premium coffee experiences and products, further supporting single-serve format adoption. Supporting this trend, according to IfD Allensbach, in 2024, roughly 13.2 million Germans aged 14 years and older expressed a preference for coffee pods and capsules, illustrating strong consumer acceptance and market potential in one of Europe's largest coffee markets .

Growing interest in flavored and specialty coffee

The Europe coffee pods and capsules market demonstrates substantial growth driven by the increasing consumer preference for flavored and specialty coffee varieties. Consumer behavior exhibits a significant shift from conventional coffee selections toward sophisticated options encompassing caramel, vanilla, hazelnut, and seasonal variants. This transformation indicates an elevated demand for premium, convenient coffee experiences across residential and commercial environments. Market expansion is fundamentally supported by the integration of single-origin and artisanal blends, addressing consumer requirements for distinguished taste characteristics. For instance, in November 2024, Little's Coffee's introduction of Toffee Nut-flavored Nespresso-compatible pods exemplifies the industry's strategic response to evolving consumer preferences. The comprehensive portfolio of flavored and specialty coffee capsules facilitates sustained market expansion and product development through continuous consumer acquisition and retention.

Environmental concerns over waste generation

Environmental concerns regarding waste generation present a significant constraint to the Europe coffee pods and capsules market growth. The utilization of single-serve coffee pods and capsules, primarily manufactured from plastic, aluminum, and composite materials, generates substantial non-biodegradable waste that presents recycling challenges. Despite the convenience offered by coffee capsules, their limited recyclability has resulted in environmental degradation, with a significant proportion being disposed of in landfills or incineration facilities. The annual consumption volume of capsules produces millions of tons of waste material, contributing to environmental pollution and negatively impacting freshwater and marine ecosystems through prolonged degradation periods and toxic substance release. The manufacturing process of raw materials, particularly aluminum, necessitates substantial energy consumption and results in environmental deterioration through mining operations. Heightened environmental consciousness among consumers and the implementation of stringent regulations have necessitated manufacturers to implement sustainable packaging alternatives.

Other drivers and restraints analyzed in the detailed report include:

- Strong coffee culture and consumption patterns in Europe

- Innovation in sustainable and compostable capsules

- Supply chain disruptions

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Coffee capsules dominate the Europe coffee pods and capsules market with a significant 65.78% share in 2025, driven by convenience, machine compatibility, premiumization, and innovation. Capsules offer a highly convenient single-serve coffee solution, enabling consumers to brew consistent, high-quality coffee quickly at home or in the office, aligning with busy modern lifestyles. This convenience is enhanced by the widespread adoption of compatible machines, which have established a strong consumer base loyal to capsule use. Capsules also deliver a premium coffee experience, preserving freshness and flavor through airtight packaging, meeting the growing consumer demand for specialty and gourmet coffee varieties. The market continues to expand as leading global brands invest in research and development of recyclable and biodegradable capsules.

Pods demonstrate superior growth momentum in the Europe coffee pods and capsules market, with a projected CAGR of 6.82% through 2031, indicating increasing consumer preference for artisanal and sustainable single-serve coffee options. This growth stems from rising demand for pods that combine a fresher, traditional filter coffee experience with convenience. For instance, in September 2024, New England Coffee Company introduced BPI-certified commercially compostable single-serve pods made with plant-based mesh. This development reflects the industry's movement toward environmentally responsible products, as consumers increasingly select biodegradable and compostable packaging solutions. These innovations demonstrate how sustainability and quality improvements drive pod market growth, establishing pods as a rapidly expanding segment within Europe's single-serve coffee market.

Plain coffee constitutes a substantial 70.55% market share in the Europe coffee pods and capsules market in 2025, demonstrating the region's predominant consumer inclination towards traditional, unflavored coffee variants. This market predominance is attributed to consumers' established predilection for authentic coffee characteristics, encompassing origin-specific attributes, varietal distinctions, and roasting methodologies. The region's historical coffee heritage, which prioritizes premium quality and distinguished taste profiles, substantiates the preference for classical coffee offerings. The considerable market share of plain coffee indicates persistent consumer demand for standardized flavor experiences rather than specialty variants.

The flavored segment of the Europe coffee pods and capsules market is growing at a CAGR of 8.05%. This growth stems from consumers seeking personalized coffee experiences beyond traditional unflavored options. Consumers are increasingly selecting varieties like caramel, vanilla, hazelnut, and seasonal flavors to diversify their coffee consumption. The trend reflects a shift where coffee drinking encompasses both caffeine needs and taste exploration. Manufacturers have expanded their product lines with flavored options, supported by advancements in brewing system compatibility and packaging that maintains flavor quality. The segment particularly attracts younger consumers and those who prefer convenient premium coffee experiences at home or work.

The Europe Coffee Pods and Capsules Market Report is Segmented by Product Type (Pods and Capsules), by Flavor (Plain and Flavored), Packaging Type (Aluminium, Plastic, and Compostable/Biodegradable), Coffee Roast (Light Roast, Medium Roast, and Dark Roast), Distribution Channel (On-Trade and Off-Trade), and Geography (United Kingdom, Germany, Italy, and More). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Nestle S.A.

- JAB Holding Company

- Luigi Lavazza S.p.A.

- Starbucks Corporation

- Illycaffe S.p.A.

- The Kraft Heinz Company

- Kimbo S.p.A.

- Strauss Group Ltd

- Bewley's Limited

- Keurig Dr Pepper Inc.

- Melitta Group

- Kruger GmbH & Co. KG

- Caffe Borbone S.r.l.

- Halo Coffee

- Tchibo GmbH

- Dualit Ltd.

- Colonna Coffee

- Caffitaly System S.p.A.

- Bestpresso Inc.

- Cafes Novell S.A.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing demand for single-serve coffee

- 4.2.2 Growing interest in flavored and specialty coffee

- 4.2.3 Strong coffee culture and consumption patterns in Europe

- 4.2.4 Innovation in sustainable and compostable capsules

- 4.2.5 Increasing consumer preference for premium coffee experiences

- 4.2.6 Rising penetration of coffee machines in households

- 4.3 Market Restraints

- 4.3.1 Environmental concerns over waste generation

- 4.3.2 Supply chain disruptions

- 4.3.3 Competition from fresh-ground and whole-bean coffee

- 4.3.4 Counterfeit and low-grade capsules

- 4.4 Consumer Behaviour Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Product Type

- 5.1.1 Pods

- 5.1.2 Capsules

- 5.2 By Flavor

- 5.2.1 Plain

- 5.2.2 Flavored

- 5.3 By Packaging Material

- 5.3.1 Aluminium

- 5.3.2 Plastic

- 5.3.3 Compostable/Biodegradable

- 5.4 By Coffee Roast

- 5.4.1 Light Roast

- 5.4.2 Medium Roast

- 5.4.3 Dark Roast

- 5.5 By Distribution Channel

- 5.5.1 On-trade

- 5.5.2 Off-trade

- 5.5.2.1 Supermarkets/Hypermarkets

- 5.5.2.2 Specialty Stores

- 5.5.2.3 Online Retail Stores

- 5.5.2.4 Other Distribution Channels

- 5.6 By Geography

- 5.6.1 Germany

- 5.6.2 United Kingdom

- 5.6.3 Italy

- 5.6.4 France

- 5.6.5 Spain

- 5.6.6 Netherlands

- 5.6.7 Poland

- 5.6.8 Belgium

- 5.6.9 Sweden

- 5.6.10 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Nestle S.A.

- 6.4.2 JAB Holding Company

- 6.4.3 Luigi Lavazza S.p.A.

- 6.4.4 Starbucks Corporation

- 6.4.5 Illycaffe S.p.A.

- 6.4.6 The Kraft Heinz Company

- 6.4.7 Kimbo S.p.A.

- 6.4.8 Strauss Group Ltd

- 6.4.9 Bewley's Limited

- 6.4.10 Keurig Dr Pepper Inc.

- 6.4.11 Melitta Group

- 6.4.12 Kruger GmbH & Co. KG

- 6.4.13 Caffe Borbone S.r.l.

- 6.4.14 Halo Coffee

- 6.4.15 Tchibo GmbH

- 6.4.16 Dualit Ltd.

- 6.4.17 Colonna Coffee

- 6.4.18 Caffitaly System S.p.A.

- 6.4.19 Bestpresso Inc.

- 6.4.20 Cafes Novell S.A.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK