PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910719

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910719

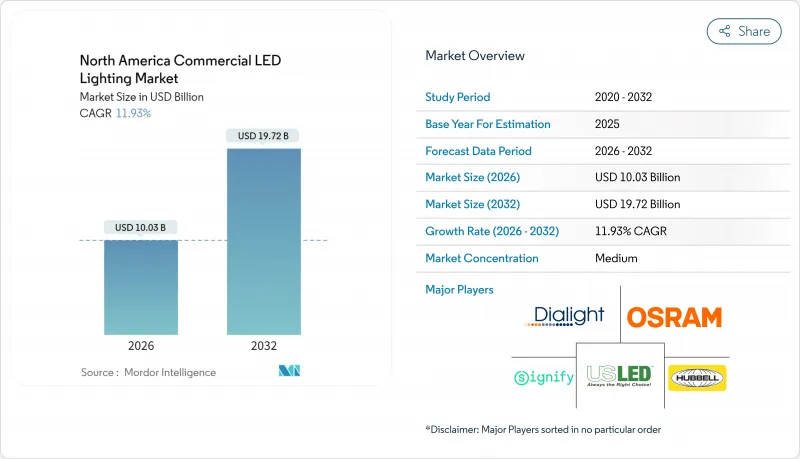

North America Commercial LED Lighting - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2032)

The North America Commercial LED Lighting market is expected to grow from USD 8.96 million in 2025 to USD 10.03 million in 2026 and is forecast to reach USD 19.72 million by 2032 at 11.93% CAGR over 2026-2032.

The North America Commercial LED Lighting market is transitioning from purely efficiency-driven upgrades toward fully networked, sensor-rich systems that align with smart-building initiatives. Regulatory tightening most notably the Department of Energy's 120 lumens-per-watt mandate effective July 2028 removes legacy fluorescent technologies, while corporate net-zero targets sustain retrofit momentum. Price declines across luminaires deepen the total-cost-of-ownership advantage, making broad adoption economical even for mid-sized facilities. Simultaneously, human-centric lighting features and IoT connectivity strengthen value propositions that go beyond energy savings. Competitive intensity increases as vendors balance margin pressure from commodity products with opportunities in premium, software-enabled solutions.

North America Commercial LED Lighting Market Trends and Insights

Stringent Energy-Efficiency Regulations and Building Codes Drive Market Transformation

Federal and state policies reshape purchasing criteria across the North America Commercial LED Lighting market by enforcing higher efficacy thresholds and advanced control requirements. The Department of Energy will compel all general-service lamps sold after July 2028 to deliver at least 120 lm/W, accelerating retirement of compact fluorescent lamps that still populate nearly half of commercial sockets ASHRAE/IES 90.1-2022 concurrently sets stricter lighting power densities and daylight-responsive controls that favor LED systems with integrated sensors. California's Title 24 Part 6 pushes even more aggressive timelines, creating regional surges in retrofit activity. These layered regulations raise entry barriers, benefiting incumbent manufacturers with compliant product portfolios and certification expertise. Consequently, the North America Commercial LED Lighting market gains predictable demand visibility, allowing vendors to scale component procurement and stabilize pricing.

Declining LED Luminaire Prices and Total-Cost-of-Ownership Advantage Accelerate Commercial Adoption

Rapid cost compression across LED packages and drivers lowers upfront fixture prices, enabling projects to justify payback periods shorter than two years in many commercial retrofits. Contemporary troffer designs deliver 110 lm/W efficacy-40% higher than fluorescent references-while extending rated life to roughly 85,000 hours; maintenance cycles drop proportionally, cutting operating expenses for facility managers . High-bay conversions record energy savings of 50-70% in distribution centers, generating six-figure annual utility reductions in large venues. Utility incentives across multiple U.S. states further shave 10-15% from capital costs, tipping financing decisions decisively toward LED. Together, these economic levers reinforce the North America Commercial LED Lighting market's momentum in the short term as payback math becomes compelling even for budget-constrained property owners

Price Erosion Squeezing Vendor Margins Intensifies Competitive Pressure

Commoditization in basic luminaires fuels downward price pressure, challenging manufacturers to protect profitability. Market leaders such as Signify and mid-tier brands alike witness share price volatility as investors question growth prospects amid falling average selling prices Acuity Brands counters the trend by prioritizing intelligent-spaces solutions, which expanded 16.7% in fiscal 2024 and lifted earnings per share 24.9% despite a topline dip. Smaller manufacturers lacking scale or specialization explore mergers or exit, accelerating consolidation within the North America Commercial LED Lighting market. Tariff uncertainty-especially proposals to levy 25% duties on Mexican-assembled luminaires-adds cost risk, complicating pricing strategies for vendors with cross-border supply chains.

Other drivers and restraints analyzed in the detailed report include:

- Growth of Smart, Connected, and IoT-Enabled Lighting Creates New Value Propositions

- Shift Toward Human-Centric and Wellness-Focused Lighting Drives Premium Segment Growth

- High Retrofit and Installation Costs in Legacy Facilities Limit Market Penetration

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The office category commanded 29.65% of the North America Commercial LED Lighting market share in 2025, underpinned by large-scale corporate retrofits aimed at meeting ESG commitments and boosting employee experience. Offices increasingly deploy human-centric, tunable-white luminaires and occupancy sensors to optimize energy while enhancing circadian support. These premium requirements sustain higher average selling prices, helping vendors offset margin compression elsewhere. Concurrently, facility managers prefer networked fixtures that integrate seamlessly with HVAC and access-control systems, reinforcing the North America Commercial LED Lighting market's shift toward converged building platforms.

Retail environments, while smaller in revenue today, are the fastest-growing segment at a 16.95% CAGR through 2032. Merchandisers cite sales uplifts up to 25% from strategic accent lighting that sharpens product visibility and shapes shopper mood. Store chains also refresh lighting more frequently to align with brand-experience updates, creating recurring demand cycles. Hospitality, healthcare, and education follow with specialized requirements-ranging from circadian support in patient rooms to glare-controlled downlights in classrooms-offering differentiated avenues for manufacturers. Industrial and warehouse settings deploy high-bay retrofits that realize quick paybacks, but the competitive landscape there remains price-sensitive. Collectively, cross-vertical momentum sustains the breadth of the North America Commercial LED Lighting market, protecting it against single-sector slowdowns.

North America Commercial LED Lighting Market is Segmented by Application (Retail Stores, Office, Hospitality, Architectural, Healthcare Facilities, and More), Form Factor (Troffers, Downlights, High-Bay, Track Lights, Suspended Pendants, and More), Distribution Channel (Direct Sales, Retail/Wholesale, ESCO/Lighting-as-a-Service Providers, Online/E-commerce), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Signify Holding (Philips Lighting & Cooper Lighting)

- Acuity Brands Inc.

- Hubbell Inc.

- Cree Lighting (IDEAL Industries)

- Dialight PLC

- US LED Ltd.

- Osram Licht AG

- Technical Consumer Products Inc.

- Current Lighting Solutions LLC (GE Current)

- Zumtobel Group

- Lutron Electronics Co.

- Legrand S.A.

- Leviton Manufacturing Co.

- Samsung Electronics America

- LG Innotek USA

- Nichia America Corp.

- Orion Energy Systems Inc.

- Energy Focus Inc.

- Digital Lumens Inc.

- Fagerhult Group (North America)

- Revolution Lighting Technologies

- Cooper Lighting Solutions

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Stringent energy-efficiency regulations and building codes

- 4.2.2 Declining LED luminaire prices and TCO advantage

- 4.2.3 Growth of smart, connected and IoT-enabled lighting

- 4.2.4 Shift toward human-centric and wellness-focused lighting

- 4.2.5 Corporate net-zero and ESG targets accelerating retrofits

- 4.2.6 Demand from indoor vertical farming and micro-fulfilment hubs

- 4.3 Market Restraints

- 4.3.1 Price erosion squeezing vendor margins

- 4.3.2 High retrofit and installation costs in legacy facilities

- 4.3.3 Critical component shortages (phosphors, drivers, ICs)

- 4.3.4 Competition from OLED / micro-LED illumination panels

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

5 MARKET SIZE and GROWTH FORECASTS (VALUE, 2022-2030)

- 5.1 By Application

- 5.1.1 Retail Stores (Showrooms, Malls, Shops)

- 5.1.2 Office

- 5.1.3 Hospitality (Restaurants, Casinos, Hotels)

- 5.1.4 Architectural (Decorative)

- 5.1.5 Healthcare Facilities

- 5.1.6 Educational Institutions

- 5.1.7 Industrial and Warehouse

- 5.1.8 Outdoor Commercial (Parking, Facades)

- 5.2 By Form Factor

- 5.2.1 Troffers

- 5.2.2 Downlights

- 5.2.3 High-Bay

- 5.2.4 Track Lights

- 5.2.5 Suspended Pendants

- 5.2.6 Panel Lights

- 5.2.7 Linear Strips

- 5.2.8 Others

- 5.3 By Distribution Channel

- 5.3.1 Direct Sales

- 5.3.2 Retail / Wholesale

- 5.3.3 ESCO / Lighting-as-a-Service Providers

- 5.3.4 Online / E-commerce

- 5.4 By Country

- 5.4.1 United States

- 5.4.2 Canada

- 5.4.3 Mexico

6 COMPETITIVE LANDSCAPE

- 6.1 Market Share Analysis

- 6.2 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.2.1 Signify Holding (Philips Lighting & Cooper Lighting)

- 6.2.2 Acuity Brands Inc.

- 6.2.3 Hubbell Inc.

- 6.2.4 Cree Lighting (IDEAL Industries)

- 6.2.5 Dialight PLC

- 6.2.6 US LED Ltd.

- 6.2.7 Osram Licht AG

- 6.2.8 Technical Consumer Products Inc.

- 6.2.9 Current Lighting Solutions LLC (GE Current)

- 6.2.10 Zumtobel Group

- 6.2.11 Lutron Electronics Co.

- 6.2.12 Legrand S.A.

- 6.2.13 Leviton Manufacturing Co.

- 6.2.14 Samsung Electronics America

- 6.2.15 LG Innotek USA

- 6.2.16 Nichia America Corp.

- 6.2.17 Orion Energy Systems Inc.

- 6.2.18 Energy Focus Inc.

- 6.2.19 Digital Lumens Inc.

- 6.2.20 Fagerhult Group (North America)

- 6.2.21 Revolution Lighting Technologies

- 6.2.22 Cooper Lighting Solutions

7 MARKET OPPORTUNITIES and FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment