PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910723

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910723

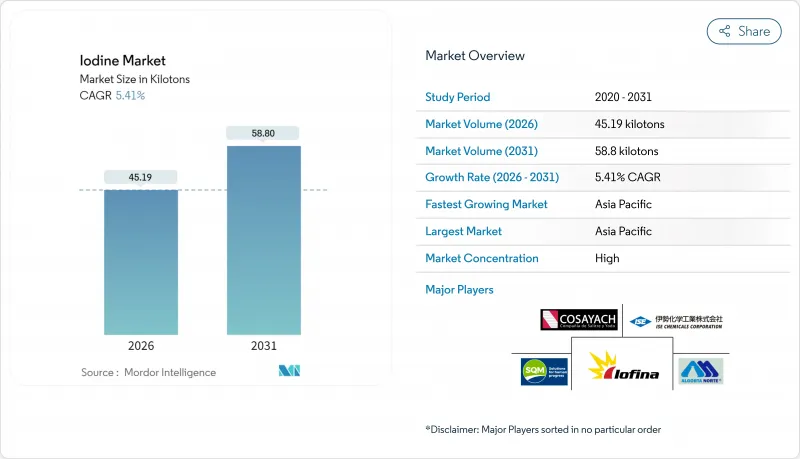

Iodine - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

Iodine market size in 2026 is estimated at 45.19 kilotons, growing from 2025 value of 42.87 kilotons with 2031 projections showing 58.8 kilotons, growing at 5.41% CAGR over 2026-2031.

Volume growth reflects the element's irreplaceable role in X-ray/CT imaging, LCD and OLED polarizers, livestock hygiene products, and specialty chemicals, all of which lack cost-effective substitutes. Medical imaging remains the pivotal demand anchor, while underground brine extraction technologies such as WET IOsorb continue lowering production costs and diluting the dominance of Chilean caliche ore resources. Asia-Pacific leads consumption on the back of Chinese electronics manufacturing and India's expanding diagnostic capacity, even as the region's import dependency magnifies exposure to supply disruptions. Tight global inventories following 2022-2023 shortages have prompted downstream users to sign longer contracts, stabilize spot prices, and encourage recycling initiatives, creating a more predictable yet still fragile supply-demand balance.

Global Iodine Market Trends and Insights

Rising Demand for X-Ray/CT Contrast Media

Global diagnostic workloads keep climbing, and more than 10 million Medicare contrast CT scans in 2023 alone illustrated the cost of any supply shocks. Contract-media producers have responded by expanding Irish-based capacity and by committing to multi-year feedstock contracts that lock in iodine supply even at premium prices. Sustainability initiatives that emphasize individualized dosing and multi-dose vials are shifting growth toward a procedure-volume model rather than per-procedure intensity, which steadies long-run demand. Hospitals are concurrently diversifying suppliers to shield themselves from the spot-market spikes that pushed prices above USD 100 per kg in 2011. As radiology departments modernize across India and Southeast Asia, the iodine market gains an additional structural tailwind that offsets mature-economy saturation.

Growing Iodine-Deficiency Disorders

Universal Salt Iodization lifted India's household coverage to 92.4% in the latest survey, yet mild deficiency persists among pregnant and lactating women, proving that fortification alone cannot guarantee adequate intake. China's 2025 dietary-reference update further validated region-specific nutrition strategies that increasingly rely on controlled-release fertilizers and biofortified crops to close residual gaps. Regulatory agencies from the U.S. FDA to Hong Kong's Centre for Food Safety are concurrently tightening label rules to prevent accidental overconsumption from seaweed snacks whose single-serve iodine content can exceed 400 µg. These parallel trends support measured volume growth for pharmaceutical-grade iodates used in food processing while spurring innovation in slow-release fertilizer coatings that add non-medical demand.

Toxicity Concerns and Handling Costs

OSHA caps workplace iodine vapor at 0.1 ppm, while ACGIH recommends an even tighter 0.01 ppm, obliging processors to invest in scrubbers, isolation booths, and continuous monitoring. At the same time, the EPA's reregistration decision for iodine-based antimicrobials continues to evolve, pushing formulators toward greener solvents and demanding extra toxicological dossiers. Medical isotopes raise additional radiation-safety protocols despite low volume, compounding overhead for integrated producers. Collectively these compliance layers raise the cost floor for new entrants and can slow project sanctioning in regions with limited regulatory infrastructure.

Other drivers and restraints analyzed in the detailed report include:

- Expanding LCD and OLED Polarizer Production

- Increasing Livestock Disinfectant Use

- Regulatory Curbs on Residual Iodine in Dairy

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Caliche ore contributed 50.72% of global supply in 2025, equal to more than half of the iodine market, but its relative share continues slipping as brine projects gain acceptance. The segment's 2,500 kg ore-per-kilogram output ratio, coupled with water-use scrutiny in Chile, is eroding competitiveness versus subterranean brines that offer simpler oxidation-extraction sequences. Underground brine extraction, expanding at a 5.55% CAGR, leverages existing oil-and-gas infrastructure to minimize infrastructure cost while lowering unit energy consumption, reinforcing its position as the fastest-growing supply route. Recycling of electronics-grade polarizer film is still embryonic in tonnage but is technically viable; as recovery costs fall, reclaimed iodine may cover niche, high-purity demand, tempering first-use consumption spikes. Seaweed-based extraction, now a specialized niche, services health-food and nutraceutical producers who prize "biogenic" credentials, yet output volumes remain small relative to the main industrial streams.

The Iodine Report is Segmented by Source (Underground Brine, Caliche Ore, Seaweed, and Recycling), Form (Elementals and Isotopes, Inorganic Salts and Complexes, and Organic Compounds), End-User Industry (Animal Feed, Medical, Biocides, Optical Polarizing Films, and More), and Geography (North America, South America, Europe, Asia-Pacific, and Middle-East and Africa). The Market Forecasts are Provided in Terms of Volume (Kilotons).

Geography Analysis

Asia-Pacific held 34.27% of the iodine market in 2025 and is growing at 6.82% CAGR, fueled by China's electronics ecosystem, robust contrast-media demand, and public-health fortification programs. China's latest Five-Year Plan targets expanded diagnostic capacity, implying persistent feedstock pulls even as domestic ore and brine projects plateau. India sustains demand through high CT procedure growth and regulated iodized-salt programs, positioning the country as a major incremental consumer of pharmaceutical-grade iodates.

North America shows mature yet resilient performance underpinned by U.S. brine operations in Oklahoma and Utah, where stable vertical-integration strategies mitigate import risk. Recent investments in modular extraction units underscore a policy push to localize critical-mineral supply chains, a trend reinforced by the IO#10 facility ramp-up in 2024.

Europe maintains stringent food-safety and occupational-exposure rules, driving demand for highly purified iodates in infant nutrition and pharmaceuticals. Germany, France, and the United Kingdom anchor regional consumption, while dairy-sector residue ceilings impose a natural brake on growth. Regulatory momentum toward antimicrobial-resistance mitigation may further elevate iodine use in hospital disinfectants as chlorhexidine alternatives undergo scrutiny.

South America hinges on Chilean exports that dominate supply rather than consumption. Domestic uptake in Brazil and Argentina is climbing alongside healthcare spending and agrochemical demand, yet regional net exports remain firmly positive. The Middle East and Africa, though the smallest territory in absolute tonnage, registers double-digit procedure growth in Gulf hospitals and showcases early iodine-fertilizer trials aimed at correcting local dietary deficiencies.

- Algorta Norte

- Calibre Chemicals Pvt. Ltd.

- Cosayach

- Deep Water Chemicals

- Eskay Iodine

- Glide Chem Private Limited

- Godo Shigen Co. Ltd

- Infinium Pharmachem Limited

- Iochem Corporation

- Iofina plc

- ISE CHEMICALS CORPORATION

- K&O Energy Group Inc.

- Nippoh Chemicals Co. Ltd

- Parad Corporation Pvt Ltd

- Proto Chemical Industries

- Salvi Chemical Industries Ltd

- Samrat Pharmachem Limited

- SQM

- TOHO EARTHTECH,INC

- Woodward Iodine LLC

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Demand for X-Ray/CT Contrast Media

- 4.2.2 Growing Iodine?Deficiency Disorders

- 4.2.3 Expanding LCD and OLED Polarizer Production

- 4.2.4 Increasing Livestock Disinfectant Use

- 4.2.5 Direct Brine Extraction Cost Advantage

- 4.3 Market Restraints

- 4.3.1 Toxicity Concerns and Handling Costs

- 4.3.2 Price Volatility of Caliche-Derived Iodine

- 4.3.3 Regulatory Curbs on Residual Iodine In Dairy

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Volume)

- 5.1 By Source

- 5.1.1 Underground Brine

- 5.1.2 Caliche Ore

- 5.1.3 Seaweed

- 5.1.4 Recycling

- 5.2 By Form

- 5.2.1 Elementals and Isotopes

- 5.2.2 Inorganic Salts and Complexes

- 5.2.3 Organic Compounds

- 5.3 By End-use Industry

- 5.3.1 Animal Feed

- 5.3.2 Medical (X-ray contrast media, pharmaceuticals, iodophors and povidone-iodine)

- 5.3.3 Biocides

- 5.3.4 Optical Polarizing Films

- 5.3.5 Fluorochemicals

- 5.3.6 Nylon

- 5.3.7 Other End-user Industries

- 5.4 By Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 Japan

- 5.4.1.3 India

- 5.4.1.4 South Korea

- 5.4.1.5 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle-East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle-East and Africa

- 5.4.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share (%)**/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Algorta Norte

- 6.4.2 Calibre Chemicals Pvt. Ltd.

- 6.4.3 Cosayach

- 6.4.4 Deep Water Chemicals

- 6.4.5 Eskay Iodine

- 6.4.6 Glide Chem Private Limited

- 6.4.7 Godo Shigen Co. Ltd

- 6.4.8 Infinium Pharmachem Limited

- 6.4.9 Iochem Corporation

- 6.4.10 Iofina plc

- 6.4.11 ISE CHEMICALS CORPORATION

- 6.4.12 K&O Energy Group Inc.

- 6.4.13 Nippoh Chemicals Co. Ltd

- 6.4.14 Parad Corporation Pvt Ltd

- 6.4.15 Proto Chemical Industries

- 6.4.16 Salvi Chemical Industries Ltd

- 6.4.17 Samrat Pharmachem Limited

- 6.4.18 SQM

- 6.4.19 TOHO EARTHTECH,INC

- 6.4.20 Woodward Iodine LLC

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment