PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910725

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910725

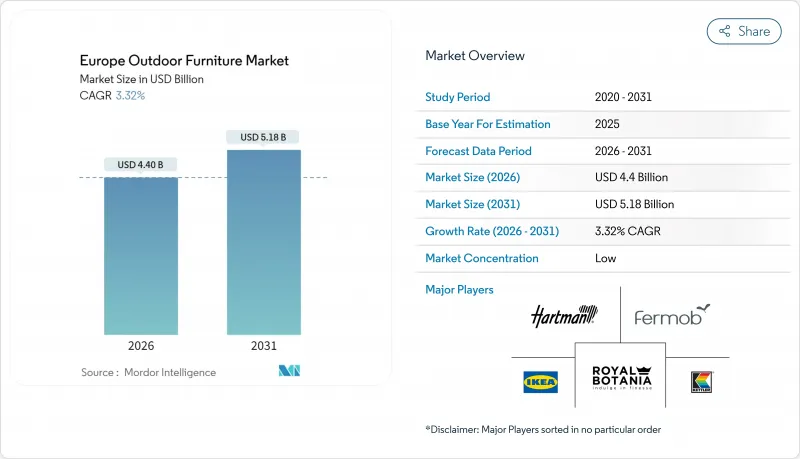

Europe Outdoor Furniture - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

Europe outdoor furniture market size in 2026 is estimated at USD 4.4 billion, growing from 2025 value of USD 4.26 billion with 2031 projections showing USD 5.18 billion, growing at 3.32% CAGR over 2026-2031.

Demand momentum is rooted in sustained hospitality refurbishment programs, growing residential investments in balcony and patio upgrades, and the region-wide regulatory pivot toward circular design. Producers have adapted to macroeconomic headwinds by moderating prices and widening sustainable product lines, which has helped the Europe outdoor furniture market maintain positive volume traction. Strategic production ramp-ups-including IKEA's price rollback and factory additions-signal continuing confidence in mid-term demand fundamentals . At the same time, raw-material cost swings and seasonal buying patterns remain structural challenges that suppliers must manage through agile sourcing and inventory practices.

Europe Outdoor Furniture Market Trends and Insights

Growth in Hospitality & Tourism Contract Demand

Hotel, restaurant, and leisure operators are refurbishing terraces and poolside zones to meet travelers' preference for open-air experiences, which drives bulk furniture procurements and fuels commercial segment dominance. Compagnie des Alpes recorded more than 10 million visitors in its most recent fiscal year and earmarked fresh capex for outdoor capacity upgrades, highlighting steady contract pipelines . Mediterranean destinations enjoy extended high-season windows that amplify furniture turnover, while mountain and northern resorts invest in weather-resistant fixtures to lengthen operating days. Sustainability specifications are becoming standard in tenders, favoring certified timber and recycled plastic constructions. This driver's medium-term impact reflects the hospitality sector's phased renovation cycles and macro-tourism recovery.

Rising Consumer Spend on Outdoor Living Spaces

Hybrid work patterns have prompted European households to view balconies, patios, and gardens as functional extensions of interior rooms. The residential slice of the Europe outdoor furniture market is therefore growing faster than the commercial slice as consumers channel discretionary budgets toward lounge sets, daybeds, and ergonomic chairs. IKEA accelerated this shift by trimming average price points 10% during FY 2024 to catalyze volume gains without sacrificing design quality. Nordic consumers, who prize nature immersion and long daylight hours, lead per-capita spending on premium sets that marry aesthetics with durability. The long-term horizon of this driver rests on generational lifestyle preferences that consistently emphasize well-equipped outdoor zones.

Raw-Material Cost Volatility

European lumber prices have seesawed since 2022, when Swedish softwood exports to the continent fell 5%, tightening regional supply and inflating input costs. Wood-based products, which account for 40.7% of the Europe outdoor furniture market, bear the brunt of this turbulence. Manufacturers attempt to hedge by sourcing from alternate geographies, yet freight surcharges and certification inconsistencies raise landed costs. Passing hikes through to consumers remains difficult because price sensitivity rises during economic uncertainty. Metal and recycled-plastic feedstocks also encounter energy-linked price swings, compressing margins in the short run.

Other drivers and restraints analyzed in the detailed report include:

- Expansion of E-commerce Furniture Retail

- EU Green Public-Procurement Sustainability Push

- Seasonal Sales Cyclicality

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Chairs held 41.10% of the Europe outdoor furniture market in 2025 on account of their ubiquity across dining, cafe, and event venues. The Europe outdoor furniture market size for chairs benefits from high replacement frequency because casual seating weathers faster than tables. Loungers and daybeds are forecast to post a 5.62% CAGR through 2031 as wellness trends boost demand for relaxation-oriented layouts. Manufacturers differentiate these premium items through adjustable backrests, quick-dry foams, and smartphone docking features that extend stay times for hospitality patrons. Multifunctional sets that combine modular ottomans with storage compartments resonate in urban apartments where space is scarce.

Demand for tables and full dining sets remains steady because families prioritize coordinated aesthetics and durable surfaces for alfresco meals. Smart integrations, including solar charging spots, are moving from novelty to value-added option, especially in lounge furniture. HAHN Kunststoffe leverages recycled polymer slats to produce maintenance-free seating that satisfies Blue Angel criteria while lowering lifecycle costs. Commercial tenders increasingly mandate stackability and rapid cleaning features to streamline operations. The long-tail "other" category, embracing benches, planters, and umbrellas, delivers steady incremental revenue that rounds out assortments.

Wood accounted for 40.30% of the Europe outdoor furniture market in 2025, buoyed by its natural feel and consumers' perception of premium craftsmanship. Raw-material headwinds and forestry certification expenses, however, expose profitability to volatility. Conversely, plastic-especially post-consumer recycled grades-will register the quickest gains, expanding at a 4.72% CAGR as municipal recycling targets push buyers toward circular alternatives. The Europe outdoor furniture market size for recycled-plastic seating is projected to widen further once supply chains mature and colorfastness improves. Metal frames thrive in modern bistro concepts, providing slim profiles and durability against wind loads.

Composite materials blend natural fibers with high-density polyethylene, offering wood-like aesthetics without splintering, and earn growing interest from public-space specifiers seeking vandal-resistant surfaces. EU EPR policies reward designs with mono-material construction that simplifies end-of-life processing, thereby favoring plastics and metals over multi-layered wood-plastic hybrids. VAT incentives for repaired or refurbished furniture in several member states additionally nudge buyers away from virgin hardwoods. Certification logos such as FSC and Blue Angel have become must-have badges during procurement, guiding both commercial and residential decisions. Suppliers that align material science innovations with compliance regimes stand to capture outsized share gains.

The Europe Outdoor Furniture Report is Segmented by Product Type (Chairs, Tables, Seating Sets, Loungers and Daybeds, Dining Sets, Other Products), Material (Wood, Metal, Plastic, Other Materials), End User (Residential, Commercial), Distribution Channel (B2C Channels Including Specialty Stores, and Other), and Geography (United Kingdom, and Other). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- IKEA Group

- Kettler

- Hartman Outdoor Products

- Fermob

- Royal Botania

- Jardinico

- Solpuri

- Gloster Furniture

- Brown Jordan Inc.

- Unopiu

- Barlow Tyrie

- Lafuma Mobilier

- Outdoorchef

- Alexander Rose

- Dedon

- Tribu

- Manutti

- ScanCom International

- Sika-Design

- Westminster Teak

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growth in hospitality & tourism contract demand

- 4.2.2 Rising consumer spend on outdoor living spaces

- 4.2.3 Expansion of e-commerce furniture retail

- 4.2.4 EU green public-procurement sustainability push

- 4.2.5 Hybrid-work demand for balcony & patio furnishing

- 4.2.6 Emergence of smart, multifunctional outdoor furniture designs

- 4.3 Market Restraints

- 4.3.1 Raw-material cost volatility

- 4.3.2 Seasonal sales cyclicality

- 4.3.3 EU extended-producer-responsibility (EPR) costs

- 4.3.4 Rise of rental/subscription furniture models

- 4.3.5 Influx of low-cost imports intensifying price competition

- 4.4 Industry Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Competitive Rivalry

- 4.6 Insights into the Latest Trends and Innovations in the Market

- 4.7 Insights on Recent Developments (New Product Launches, Strategic Initiatives, Investments, Partnerships, JVs, Expansion, M&As, etc.) in the Industry

5 Market Size & Growth Forecasts

- 5.1 By Product Type

- 5.1.1 Chairs

- 5.1.2 Tables

- 5.1.3 Seating Sets

- 5.1.4 Loungers and Daybeds

- 5.1.5 Dining Sets

- 5.1.6 Other Products

- 5.2 By Material

- 5.2.1 Wood

- 5.2.2 Metal

- 5.2.3 Plastic

- 5.2.4 Other Materials

- 5.3 By End User

- 5.3.1 Residential

- 5.3.2 Commercial

- 5.4 By Distribution Channel

- 5.4.1 B2C Channels

- 5.4.1.1 Specialty Stores

- 5.4.1.2 Home Centers

- 5.4.1.3 Online

- 5.4.1.4 Other Distribution Channels

- 5.4.2 B2B Channel/Contractors

- 5.4.1 B2C Channels

- 5.5 By Country

- 5.5.1 United Kingdom

- 5.5.2 Germany

- 5.5.3 France

- 5.5.4 Spain

- 5.5.5 Italy

- 5.5.6 BENELUX (Belgium, Netherlands, and Luxembourg)

- 5.5.7 NORDICS (Denmark, Finland, Iceland, Norway, and Sweden)

- 5.5.8 Rest of Europe

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 IKEA Group

- 6.4.2 Kettler

- 6.4.3 Hartman Outdoor Products

- 6.4.4 Fermob

- 6.4.5 Royal Botania

- 6.4.6 Jardinico

- 6.4.7 Solpuri

- 6.4.8 Gloster Furniture

- 6.4.9 Brown Jordan Inc.

- 6.4.10 Unopiu

- 6.4.11 Barlow Tyrie

- 6.4.12 Lafuma Mobilier

- 6.4.13 Outdoorchef

- 6.4.14 Alexander Rose

- 6.4.15 Dedon

- 6.4.16 Tribu

- 6.4.17 Manutti

- 6.4.18 ScanCom International

- 6.4.19 Sika-Design

- 6.4.20 Westminster Teak

7 Market Opportunities & Future Outlook

- 7.1 Urban Balcony & Small-Space Outdoor Solutions

- 7.2 Premiumization & Luxury Outdoor Lifestyle Products