PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910805

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910805

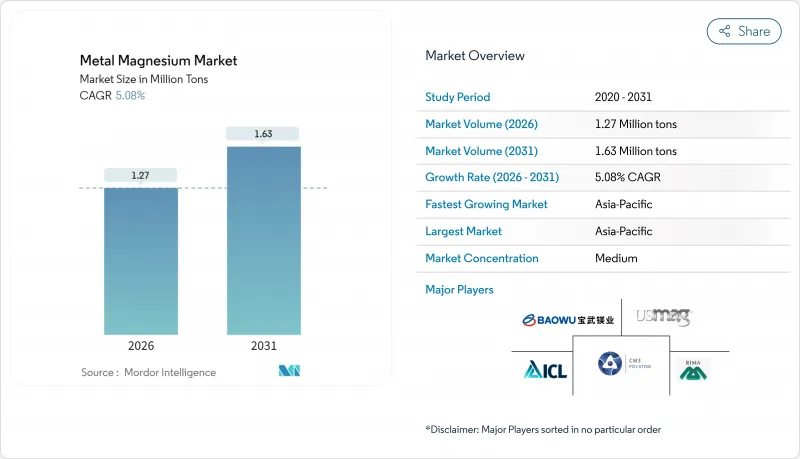

Metal Magnesium - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

Metal Magnesium Market size in 2026 is estimated at 1.27 million tons, growing from 2025 value of 1.21 million tons with 2031 projections showing 1.63 million tons, growing at 5.08% CAGR over 2026-2031.

Momentum builds around automotive lightweighting policies, rapid gigacasting adoption in electric-vehicle manufacturing, and the scale-up of carbon-neutral extraction technologies. Sustained demand from aluminum alloying, the medical sector's pivot toward biodegradable implants, and a re-ordering of global supply chains away from single-country reliance underpin the market's medium-term trajectory. New production routes that slash energy use and CO2 intensity are beginning to capture investor attention, signaling an inflection point for process innovation and geographic diversification.

Global Metal Magnesium Market Trends and Insights

Automotive and Aerospace Lightweighting Boom

Automakers intensify material substitution programs to meet fleet emission rules, making magnesium attractive for body-in-white parts, cross-members, and battery housings. Its density of 1.74-1.85 g/cm3 delivers 22-30% component weight savings versus aluminum, and emerging die-casting presses rated to 3,500 tons unlock large structural components that previously required multi-piece assemblies. Electric-vehicle platforms amplify the advantage because every kilogram removed can add driving range, while aerospace OEMs validate magnesium for non-critical cabin structures to cut fuel burn. Integrated supply contracts are now linking future metal deliveries to lifecycle carbon metrics, rewarding low-CO2 producers. Taken together, these factors lift near-term unit consumption per vehicle even as overall light-vehicle volumes stabilize

Rising Aluminum-Alloying Demand

Magnesium's role as a hardener and corrosion inhibitor in high-strength aluminum alloys positions it as a growth lever tied to EV battery enclosures, body panels, and extruded profiles. Typical additions of 0.5-1.5 wt% raise yield strength, weldability, and fatigue life. China's aluminum smelters, which exceeded 40 million tons of output in 2024, anchor global demand; their alloy mix is shifting quickly toward 6xxx and 5xxx series grades with higher Mg content. Construction applications-from curtain walls to bridge decking-add a second pillar of baseline consumption, insulating suppliers from auto-cycle swings. Continuous-casting lines fitted with in-line alloying systems now meter magnesium more precisely, cutting element losses below 3% and supporting tight cost targets.

High CO2 Footprint of Pidgeon Process

Regulators add monetary pressure through emissions-trading schemes and proposed carbon-border adjustments. EU auditors peg the Pidgeon route at 11-15 tons CO2 per ton Mg, well above the bloc's 2030 industrial-average target of 1.6 tons. Automakers that publish cradle-to-gate footprints increasingly screen suppliers on verified life-cycle data, pushing high-carbon operators to either retrofit waste-heat recovery and solar calcination or risk delisting. Secondary melted scrap partly mitigates scope-1 emissions, requiring only 5% of the primary process energy, but scrap availability remains limited by collection logistics. The policy drive accelerates the relative competitiveness of electrolytic and seawater routes.

Other drivers and restraints analyzed in the detailed report include:

- Electric-Vehicle Gigacasting Uptake

- Carbon-Neutral Seawater Electro-Magnesium Technology

- Corrosion/Fire-Safety Concerns

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Seawater electro-extraction is the fastest-growing route at a 5.62% CAGR through 2031, while the thermal Pidgeon method still holds 62.74% of current output. The metal magnesium market size for seawater extraction is estimated at 0.16 million tons and could double before 2031 if pilot plants are commercialized successfully. Cost competitiveness hinges on renewable-power tariffs below USD 0.04 per kWh, which coastal jurisdictions in the Middle East and North Africa begin to offer. Electrolytic processes, historically confined to aerospace-grade purity batches, benefit from advances in inert anodes that slash chlorine emissions, improving ESG scores.

Legacy Pidgeon producers capitalize on depreciated assets and deep operator know-how, but looming carbon-compliance fees erode the edge. Integrated miners in Shaanxi and Ningxia provinces announced USD 320 million in retrofit budgets for low-carbon ferrosilicon and autonomous ore haulage to raise efficiency. Secondary recycling, leveraging 95% metal recovery, gains traction as automakers set recycled-content thresholds, though scrap flows lag demand. International Battery Metals' modular DLE plant co-sited with brine operations demonstrates how multi-metal integration can dilute project risk while feeding the same reducer furnaces.

The Metal Magnesium Market Report is Segmented by Production Process (Thermal Pidgeon, Electrolytic, Secondary/Recycled, and Seawater Electro-Extraction), End-User Industry (Aluminum Alloys, Die-Casting, Iron and Steel, Metal Reduction, and Other End User Industries), and Geography (Asia-Pacific, North America, Europe, South America, and Middle-East and Africa). The Market Forecasts are Provided in Terms of Volume (Tons).

Geography Analysis

Asia-Pacific anchored 47.85% of global shipments in 2025 and is growing at a 5.96% CAGR. Government initiatives that bundle magnesium with "dual-use strategic metals" could channel low-interest loans toward greener capacity. Japan and South Korea optimize alloy technology for consumer electronics casings and BEV battery covers, importing ingots but exporting value-added parts.

North America lost its only large-scale primary source when US Magnesium shuttered Utah operations in late 2024. The shortfall forces automakers and defense primes to draw from Asian inventories or the smaller Canadian toll melting pool, raising freight costs and supply-security concerns.

Europe focuses on cutting embedded carbon. German recyclers scale closed-loop programs that capture sprues and runners, pushing secondary magnesium beyond 30% of regional supply. Norway, aiming to leverage hydropower, studies a 30 kt-per-year electrolytic cell park that would halve carbon intensity relative to the global average. Regulatory headwinds around the Pidgeon route encourage OEMs to diversify to Turkish and Saudi Arabian seawater projects scheduled for groundbreaking in 2026.

- American Magnesium

- ICL Group

- Fu Gu Yi De Magnesium Alloy Co., Ltd

- Baowu Magnesium Technology Co., Ltd.

- Regal Metal

- Rima Industrial

- Shanxi Bada Magnesium Co., Ltd.

- Solikamsk Magnesium Works

- Southern Magnesium & Chemicals Limited (SMCL)

- Taiyuan Tongxiang Metal Magnesium Co. Ltd

- US Magnesium LLC

- Wenxi YinGuang Magnesium Industry (Group) Co. Ltd

- Western Magnesium Corporation

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Automotive and aerospace lightweighting boom

- 4.2.2 Rising aluminium-alloying demand

- 4.2.3 Electric-vehicle gigacasting uptake

- 4.2.4 Carbon-neutral seawater electro-magnesium tech

- 4.2.5 Biodegradable Mg implants gaining traction

- 4.3 Market Restraints

- 4.3.1 Price and energy cost volatility

- 4.3.2 High CO2 footprint of Pidgeon process

- 4.3.3 Corrosion / fire-safety concerns

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Volume)

- 5.1 By Production Process

- 5.1.1 Thermal Pidgeon

- 5.1.2 Electrolytic

- 5.1.3 Secondary/Recycled

- 5.1.4 Seawater Electro-extraction

- 5.2 By End-user Industry

- 5.2.1 Aluminum Alloys

- 5.2.2 Die-Casting

- 5.2.3 Iron and Steel

- 5.2.4 Metal Reduction

- 5.2.5 Other End User Industries

- 5.3 By Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Russia

- 5.3.3.6 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share (%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, and Recent Developments)

- 6.4.1 American Magnesium

- 6.4.2 ICL Group

- 6.4.3 Fu Gu Yi De Magnesium Alloy Co., Ltd

- 6.4.4 Baowu Magnesium Technology Co., Ltd.

- 6.4.5 Regal Metal

- 6.4.6 Rima Industrial

- 6.4.7 Shanxi Bada Magnesium Co., Ltd.

- 6.4.8 Solikamsk Magnesium Works

- 6.4.9 Southern Magnesium & Chemicals Limited (SMCL)

- 6.4.10 Taiyuan Tongxiang Metal Magnesium Co. Ltd

- 6.4.11 US Magnesium LLC

- 6.4.12 Wenxi YinGuang Magnesium Industry (Group) Co. Ltd

- 6.4.13 Western Magnesium Corporation

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-need Assessment