PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910811

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910811

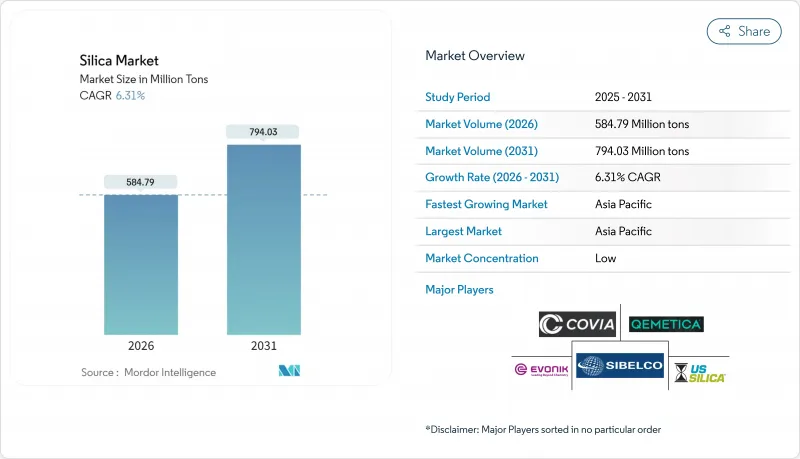

Silica - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Silica market is expected to grow from 550.08 Million tons in 2025 to 584.79 Million tons in 2026 and is forecast to reach 794.03 Million tons by 2031 at 6.31% CAGR over 2026-2031.

This robust expansion mirrors the mineral's central role in construction materials, energy-efficient tires, solar glass, and semiconductor substrates. Rising infrastructure spending in Asia-Pacific, the global push for low-rolling-resistance tires, and accelerating photovoltaic build-outs are amplifying demand, while specialty-grade suppliers secure pricing premiums through high-purity and surface-modified offerings. Freight-cost volatility and occupational-health regulations temper growth, yet investment in bio-based processing and regional beneficiation reinforce a resilient long-term outlook for the silica market.

Global Silica Market Trends and Insights

Robust Demand for Precipitated Silica in Energy-Efficient Green Tires

Low-rolling-resistance tires improve fuel economy by 3-7%, and European regulations that mandate tire-efficiency labeling spur higher silica loadings in tread compounds. Premium passenger-car tires now contain up to 90 phr of precipitated silica, double typical 2020 levels. Commercial fleets adopt similar formulations to lower diesel costs, while electric-vehicle makers intensify the trend to extend driving range.

Ongoing Build-Out of Photovoltaic Glass Manufacturing Capacity

Each gigawatt of solar deployment requires 15,000-20,000 tons of ultra-clear silica-based glass with iron content below 120 ppm. China commands over 85% of global PV-glass capacity and is pairing new float-glass lines with captive silica-beneficiation plants to guarantee feedstock quality. Thinner bifacial-panel glass further tightens purity specifications, driving investment in advanced beneficiation.

Competitive Threat from Aluminosilicate and Calcium-Silicate Fillers

Calcined-clay and metakaolin products undercut commodity-grade silica by up to 25% while offering comparable reinforcement in concrete and polymer composites. Suppliers invest in particle-surface treatments that narrow historical performance gaps, with micronized aluminosilicates gaining share in cost-sensitive construction mixes.

Other drivers and restraints analyzed in the detailed report include:

- Rising Adoption of High-Purity Silica in Advanced Semiconductor Nodes

- Shift Toward Bio-Based Rice-Husk Silica in Asia to Cut Carbon Footprint

- Volatility in Freight Cost for Bulk Silica Sand

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Crystalline grades account for 99.15% of the silica market in 2025 and are expanding at a 6.22% CAGR through 2031. Quartz remains indispensable in concrete, glass, and foundry molds thanks to thermal stability and a well-established supply chain. Tridymite and cristobalite fill smaller high-temperature ceramics niches, but their complex phase-conversion processing limits scale. Amorphous grades, while minor by tonnage, command premium pricing in green-tire compounds, high-solids battery slurries, and semiconductor CMP slurries. Specialty suppliers leverage hydrophilic and hydrophobic surface treatments that capture value beyond bulk tonnage.

Elevated environmental scrutiny encourages migration from mined crystalline inputs toward engineered amorphous forms with lower respirable-dust risk. Bio-based rice-husk silica meets this requirement while offering life-cycle carbon savings and proximity to Asian tire-manufacturing centers. Investment in vacuum flash reactors and low-alkali purification lines underscores the strategy of targeting smaller, higher-margin parcels rather than chasing commodity volume. As a result, the silica market continues bifurcating into high-purity, application-specific grades and bulk construction sand, with pricing divergence expected to widen through 2030.

The Silica Report is Segmented by Type (Amorphous (Fumed/Pyrogenic, and Hydrated), Crystalline (Quartz, Tridymite, and Cristobalite)), End-User Industry (Building and Construction, Shale Oil and Gas, Glass Manufacturing, Water Treatment, and Others), and Geography (Asia-Pacific, North America, Europe, South America, and Middle-East and Africa). The Market Forecasts are Provided in Terms of Volume (Tons).

Geography Analysis

Asia-Pacific dominates the silica market with 41.00% share in 2025 and an 8.10% CAGR to 2031. China consumes over 200 million tons annually across construction, photovoltaic glass, and chemical derivatives, underpinned by strategic reserves and integrated beneficiation hubs. India's highway expansion and smart-city programs lift domestic demand, while government subsidies accelerate rice-husk silica ventures that feed both local tire plants and export outlets.

North America holds a pivotal position in shale proppant supply, with Wisconsin, Texas, and Alberta deposits meeting stringent crush-strength specifications. Regional processing plants shorten supply chains for Gulf Coast glass furnaces, while Canadian producers capture demand from LNG construction and green-hydrogen infrastructure. Regulatory drivers, notably OSHA respirable-silica limits, push miners toward wet-processing and enclosed-handling systems that boost capex but lower insurance liabilities.

Europe presents stable, value-added demand centered on Germany, France, and the United Kingdom. Automotive and chemical users specify high-purity grades, and EU circular-economy directives promote recycled and bio-based inputs. Eastern European suppliers, led by Qemetica's expanded Polish site, benefit from proximity to both Western OEMs and growing Turkish and North African construction markets. Investments in energy-efficient kiln technology and on-site solar arrays align with EU decarbonization rules, anchoring long-term regional competitiveness.

- AGSCO Corp

- AMS Applied Material Solutions

- Cabot Corporation

- China-Henan Huamei Chemical Co. Ltd

- Covia Holdings LLC

- Denka Company Limited

- Evonik Industries AG

- Heraeus Holding

- Kemitura Group

- Madhu Silica Pvt. Ltd

- Merck KGaA

- Mitsubishi Chemical Group Corporation

- Nouryon

- OCI Company Ltd

- QEMETICA

- Sibelco

- Tokuyama Corporation

- U.S. Silica (Apollo Funds)

- W.R. Grace and Co.

- Wacker Chemie AG

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Robust demand for precipitated silica in energy-efficient "green" tires

- 4.2.2 Ongoing build-out of photovoltaic glass manufacturing capacity

- 4.2.3 Rising adoption of high-purity silica in advanced semiconductor nodes

- 4.2.4 Shift toward bio-based rice-husk silica in Asia to cut carbon footprint

- 4.2.5 Rapid uptake of fumed silica in high-solids battery slurries

- 4.3 Market Restraints

- 4.3.1 Competitive threat from aluminosilicate and calcium-silicate fillers

- 4.3.2 Volatility in freight cost for bulk silica sand

- 4.3.3 Tightening respirable-crystalline-silica exposure limits (OSHA, EU)

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Value and Volume)

- 5.1 By Type

- 5.1.1 Amorphous

- 5.1.1.1 Fumed/Pyrogenic

- 5.1.1.2 Hydrated

- 5.1.2 Crystalline

- 5.1.2.1 Quartz

- 5.1.2.2 Tridymite

- 5.1.2.3 Cristobalite

- 5.1.1 Amorphous

- 5.2 By End-user Industry

- 5.2.1 Building and Construction

- 5.2.2 Shale Oil and Gas

- 5.2.3 Glass Manufacturing

- 5.2.4 Water Treatment

- 5.2.5 Others

- 5.3 By Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Malaysia

- 5.3.1.6 Thailand

- 5.3.1.7 Indonesia

- 5.3.1.8 Vietnam

- 5.3.1.9 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Spain

- 5.3.3.6 Russia

- 5.3.3.7 Nordic Countries

- 5.3.3.8 Turkey

- 5.3.3.9 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Colombia

- 5.3.4.4 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Nigeria

- 5.3.5.4 Qatar

- 5.3.5.5 United Arab Emirates

- 5.3.5.6 Egypt

- 5.3.5.7 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share (%)/Ranking Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 AGSCO Corp

- 6.4.2 AMS Applied Material Solutions

- 6.4.3 Cabot Corporation

- 6.4.4 China-Henan Huamei Chemical Co. Ltd

- 6.4.5 Covia Holdings LLC

- 6.4.6 Denka Company Limited

- 6.4.7 Evonik Industries AG

- 6.4.8 Heraeus Holding

- 6.4.9 Kemitura Group

- 6.4.10 Madhu Silica Pvt. Ltd

- 6.4.11 Merck KGaA

- 6.4.12 Mitsubishi Chemical Group Corporation

- 6.4.13 Nouryon

- 6.4.14 OCI Company Ltd

- 6.4.15 QEMETICA

- 6.4.16 Sibelco

- 6.4.17 Tokuyama Corporation

- 6.4.18 U.S. Silica (Apollo Funds)

- 6.4.19 W.R. Grace and Co.

- 6.4.20 Wacker Chemie AG

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment