PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910825

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910825

Europe Electric Truck - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

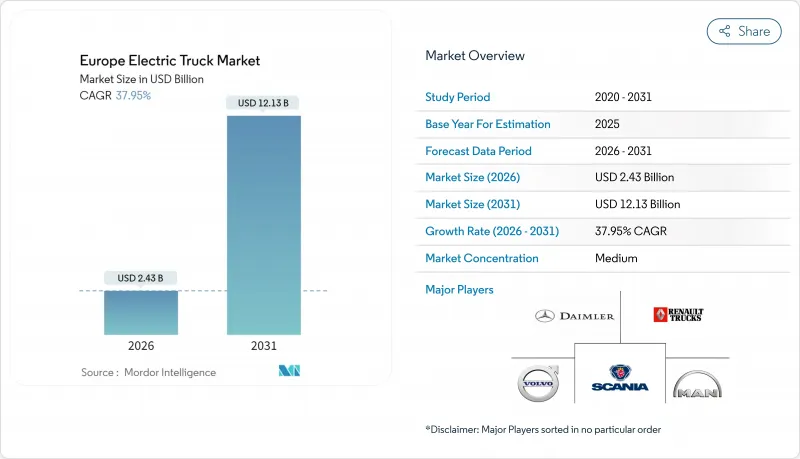

The European electric truck market is expected to grow from USD 1.76 billion in 2025 to USD 2.43 billion in 2026 and is forecast to reach USD 12.13 billion by 2031 at 37.95% CAGR over 2026-2031.

This steep growth path is driven by the European Union's binding CO2-reduction targets, falling battery pack prices, and the rapid build-out of megawatt-class charging corridors. Together, these forces shift electric trucks from pilot projects to mainstream fleet assets, especially in high-utilization logistics routes. Regulatory deadlines compel manufacturers to ramp output, while corporate sustainability pledges translate into firm purchase orders that stabilize demand and spur scale economies. At the same time, improvements in battery energy density, rising renewable-power penetration, and innovative financing models narrow the remaining total-cost-of-ownership premium versus diesel, further accelerating adoption across regional and long-haul applications. As a result, the European electric truck market is moving from early-adopter clusters to a broad commercial footprint that touches every major freight corridor on the continent.

Europe Electric Truck Market Trends and Insights

EU CO2 Emission Standards and 2040 ZEV Sales Mandate

Binding CO2 reduction targets make zero-emission trucks a legal requirement rather than a voluntary sustainability choice. Interim 2030 and 2035 benchmarks provide a clear volume signal that enables manufacturers to justify multi-billion-dollar electrification investments. Fleet operators face steep non-compliance penalties, propelling procurement toward battery-electric and fuel-cell models at scale. National policies such as Germany's emission-free urban zones tighten the compliance net further, ensuring that the European electric truck market gains momentum well before the 2040 deadline.

Rapid Battery-Pack Cost Declines

In 2024, battery pack prices dropped by 20%, settling at USD 115 per kilowatt-hour (kWh). Cost parity with diesel emerges first in high-mileage logistics fleets that cover more than 80,000 km annually, where fuel savings offset capital premiums. Wider adoption of LFP chemistry cuts raw-material exposure, boosts cycle life beyond 4,000 charges, and further lowers total ownership cost. European gigafactory build-outs shorten supply chains and anchor regional content, reinforcing the scale economies that sustain the steep learning curve.

High Upfront Vehicle Cost Versus Diesel

Electric trucks still carry a 40-60% sticker premium compared with diesel, a barrier for price-sensitive operators in Central and Southern Europe. The premium reflects battery costs, low production volumes, and technology complexity, though rapid cost declines suggest this restraint will diminish significantly by 2027-2028. Limited access to cheap financing amplifies the issue for small fleets. However, truck-as-a-service models and government incentives increasingly neutralize this disadvantage by converting capital expenditure into operational expense structures that better align with cash flow patterns.

Other drivers and restraints analyzed in the detailed report include:

- Corporate Fleet-Decarbonization Commitments

- Purchase Incentives and Road-Toll Exemptions

- Sparse Public HDV-Ready Charging Infrastructure

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Battery-electric trucks held 76.12% of the European electric truck market size in 2025, while fuel-cell models track the steepest 42.75% CAGR through 2031. The initial dominance arises from a dense charging-station footprint, proven reliability in parcel delivery and regional freight, and lower operating costs for fleets that rack up daily mileage. Over the forecast period, hydrogen refueling networks extend across Scandinavia and Germany, catalyzing fuel-cell uptake in heavy haul and temperature-sensitive commodities that demand high uptime and quick turnarounds. Plug-in hybrids occupy a narrowing transition niche as zero-emission zoning rules begin to exclude combustion back-up modes entirely.

Fleet use-case alignment will continue to favor battery-electric formats in city and short regional corridors because overnight depot charging remains the simplest infrastructure model. Fuel-cell traction intensifies in routes exceeding 600 km per day, especially where payload penalties from large battery packs would otherwise erode revenue per trip. As battery-energy density improves and charging curves steepen, a measurable share of current fuel-cell prospect routes may flip to pure battery solutions, underscoring the dynamic nature of competition inside the Europe electric truck market.

Heavy-duty rigid trucks over 12 tons currently deliver 47.05% of Europe's electric truck market size in 2025. Their predictable hub-and-spoke logistics cycles maximize battery utilization and justify depot-charging investment. From 2026 onward, the tractor-trailer segment shows the fastest ramp, with a 39.05% CAGR as megawatt chargers roll out on the pan-European freight network and advanced thermal management maintains pack longevity under long-haul duty cycles. Light trucks up to 3.5 tons continue experiencing steady adoption in dense urban zones governed by emission-free mandates. Medium-duty specials such as garbage compactors or crane-equipped chassis see growing municipal interest, but at lower annual volume.

The competitive theater is intensifying around heavy-duty tractors, where newcomers from China and emerging European startups pitch integrated hardware-plus-software stacks that promise lower total cost. Legacy OEMs respond with modular platforms optimized for both regional and cross-border applications, aiming to protect service-network advantages. As a result, the European electric truck market will witness fast price discovery in the tractor segment, setting reference points for the rest of the portfolio.

The Europe Electric Truck Market Report is Segmented by Propulsion (Battery-Electric and More), Truck Type (Light Truck, Medium-Duty Truck, and More), Battery (NMC, LFP, and Others), Capacity (Below 50kWh, 50-250kWh, and More), Range (Up To 200km, 201-400km, and More), Application (Logistics and Parcel, Municipal Services, and More), and Country (Germany, UK, and More). Market Forecasts in Value (USD) and Volume (Units).

List of Companies Covered in this Report:

- AB Volvo

- Daimler Truck AG (Mercedes-Benz Trucks)

- Scania AB

- MAN Truck and Bus (SE)

- DAF Trucks N.V.

- Renault Trucks

- IVECO Group N.V.

- BYD Co. Ltd.

- Tesla Inc.

- Einride AB

- Tevva Motors Ltd.

- E-Force One AG

- Quantron AG

- Ford Motor Company

- Nikola Motor Europe

- Hyundai Motor Company

- E-Trucks Europe BV

- Lion Electric (EU operations)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 EU CO2 Emission Standards and 2040 ZEV Sales Mandate

- 4.2.2 Rapid Battery-Pack Cost Declines

- 4.2.3 Corporate Fleet-Decarbonisation Commitments

- 4.2.4 Purchase Incentives and Road-Toll Exemptions

- 4.2.5 Megawatt-Charging Corridors Unlocking Long-Haul Routes

- 4.2.6 Truck-As-A-Service Financing Models

- 4.3 Market Restraints

- 4.3.1 High Upfront Vehicle Cost Vs. Diesel

- 4.3.2 Sparse Public HDV-Ready Charging Infrastructure

- 4.3.3 Depot-Level Grid-Capacity Constraints

- 4.3.4 Shortage of E-Truck Maintenance Skills and Parts

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size and Growth Forecasts (Value (USD) and Volume (Units))

- 5.1 By Propulsion Type

- 5.1.1 Battery-Electric

- 5.1.2 Fuel-Cell Electric

- 5.1.3 Plug-in Hybrid

- 5.2 By Truck Type

- 5.2.1 Light Truck (Up to 3.5 t)

- 5.2.2 Medium-Duty Truck (3.6 to 12 t)

- 5.2.3 Heavy-Duty Truck (Above 12 t)

- 5.2.4 Tractor-Trailer

- 5.3 By Battery Type

- 5.3.1 Lithium-Nickel-Manganese-Cobalt Oxide (NMC)

- 5.3.2 Lithium-Iron-Phosphate (LFP)

- 5.3.3 Others (NCA, LTO, solid-state prototypes)

- 5.4 By Battery Capacity

- 5.4.1 Less Than 50 kWh

- 5.4.2 50 to 250 kWh

- 5.4.3 Above 250 kWh

- 5.5 By Range

- 5.5.1 Up to 200 km (urban)

- 5.5.2 201 to 400 km (regional)

- 5.5.3 Above 400 km (long-haul)

- 5.6 By Application

- 5.6.1 Logistics and Parcel

- 5.6.2 Municipal Services (Waste, Street-sweep)

- 5.6.3 Construction and Mining

- 5.6.4 Retail and FMCG Delivery

- 5.6.5 Utility and Other Industrial

- 5.7 By Country

- 5.7.1 Germany

- 5.7.2 United Kingdom

- 5.7.3 France

- 5.7.4 Italy

- 5.7.5 Netherlands

- 5.7.6 Spain

- 5.7.7 Sweden

- 5.7.8 Norway

- 5.7.9 Denmark

- 5.7.10 Belgium

- 5.7.11 Poland

- 5.7.12 Rest of Europe

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (Includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 AB Volvo

- 6.4.2 Daimler Truck AG (Mercedes-Benz Trucks)

- 6.4.3 Scania AB

- 6.4.4 MAN Truck and Bus (SE)

- 6.4.5 DAF Trucks N.V.

- 6.4.6 Renault Trucks

- 6.4.7 IVECO Group N.V.

- 6.4.8 BYD Co. Ltd.

- 6.4.9 Tesla Inc.

- 6.4.10 Einride AB

- 6.4.11 Tevva Motors Ltd.

- 6.4.12 E-Force One AG

- 6.4.13 Quantron AG

- 6.4.14 Ford Motor Company

- 6.4.15 Nikola Motor Europe

- 6.4.16 Hyundai Motor Company

- 6.4.17 E-Trucks Europe BV

- 6.4.18 Lion Electric (EU operations)

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment