PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910826

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910826

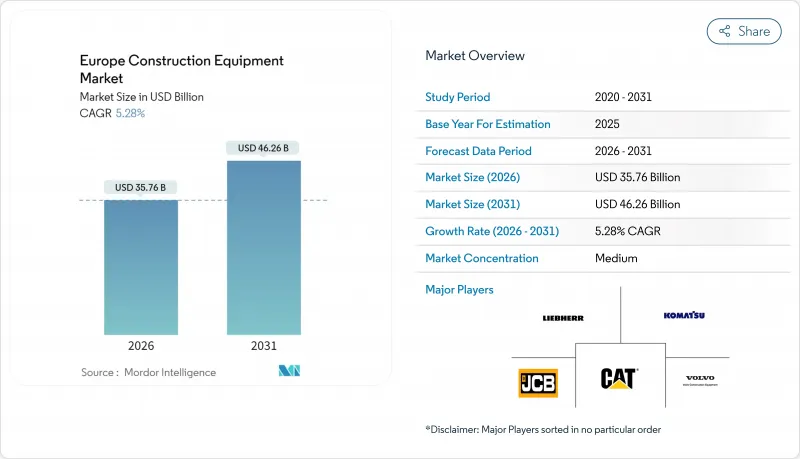

Europe Construction Equipment - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Europe Construction Equipment Market was valued at USD 33.97 billion in 2025 and estimated to grow from USD 35.76 billion in 2026 to reach USD 46.26 billion by 2031, at a CAGR of 5.28% during the forecast period (2026-2031).

Rising public-works spending linked to the EU Green Deal, the European Central Bank's 2025 rate-cut cycle, and the ongoing rollout of Stage V emissions rules are the primary forces shaping demand. Equipment buyers are tilting toward battery-electric models for urban projects, while diesel machines remain essential on heavy infrastructure sites. Chinese original-equipment manufacturers (OEMs) are using direct financing and local support centers to narrow competitive gaps with incumbent Western brands. Simultaneously, rental-fleet oversupply is suppressing average selling prices, accelerating the pivot to service-centric revenue streams and subscription telematics bundles.

Europe Construction Equipment Market Trends and Insights

EU Green Deal-Linked Public-Works Pipeline

Member states are channeling unprecedented capital into climate-resilient infrastructure, compressing procurement cycles from 18-24 months to as few as 12 months. Germany's off-budget fund is already lifting real construction outlays by minimal in 2025 after a slight contraction in 2024. This spending wave boosts demand for excavators, motor graders, and compact machines needed for renewable-energy installations. Contractors increasingly favor Stage V-compliant or electric models, even when premiums exceed more than one-tenth, to secure eligibility for Green Deal tenders. Suppliers therefore face mounting pressure to maintain higher inventory buffers that match accelerated project timelines.

Recovery Of Residential Starts As Ecb Rate-Cut Cycle Begins (2025-26)

Housing investment turned positive slightly in Q1 2025, the first upturn since 2022. Mortgage approvals and construction loan demand have strengthened, especially in Germany, where pent-up housing needs accumulated during the high-rate period. Compact excavators, mini loaders, and telehandlers benefit the most because urban infill projects dominate new housing activity. Easier credit is also pulling small contractors back into the equipment-financing market, widening the customer base for entry-level electric machines.

Rental-Fleet Oversupply Suppressing New-Unit ASPs

Aggressive fleet expansion during 2021-2022 left rental utilization at only 63.4% in 2024, pushing rental rates down on year over year. Sluggish rental growth has forced companies to cut fleet spending by minimal, creating channel inventory bulges of six to nine months. Manufacturers respond with longer financing terms and service credits, but these steps erode margins and slow innovation budgets.

Other drivers and restraints analyzed in the detailed report include:

- Accelerated Fleet Electrification To Meet Stage V/Vi Co2 & Nox Caps

- Growing Demand For Compact Equipment On Urban Infill Sites

- Scarcity of Certified Operators Inflating Project Timelines

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Excavators captured 44.78% of the Europe construction equipment market share in 2025 and are projected to grow at a 5.32% CAGR to 2031, outpacing the overall Europe construction equipment market. Telescopic handlers follow closely in growth, fuelled by warehouse automation projects that demand precision placement at height. Cranes maintain steady volume but see margin pressure from lower-priced imports, while motor graders gain from transport-corridor spending.

Electrification reshapes competitive dynamics within each subcategory. Liebherr's L 507 E wheel loader delivers 16-hour run-time, showing functional parity with diesel units. Loader and backhoe segments face intense price competition from Chinese OEMs, whereas specialized tunneling equipment retains higher entry barriers thanks to complex safety certifications. Contractors increasingly prefer multi-functional attachments that turn excavators into demolition, recycling, or grading tools, boosting average selling price per unit and locking buyers into proprietary hydraulic interfaces.

Internal combustion engines still hold 80.66% of the Europe construction equipment market size in 2025, but battery-electric units are climbing fastest at a 5.39% CAGR. Hybrid drive-trains bridge constraints where charging infrastructure is lacking, yet total cost of ownership advantages favor full electrics on high-utilization sites. Provincial mandates in Norway and the Netherlands restrict diesel equipment on public projects, triggering regional spikes in electric orders that outstrip factory lead times.

Capital costs for electric machines are one-fifth higher, but contractors running 1,500 hours annually recoup premiums in under four years through fuel and maintenance savings. Hydrogen fuel cells remain niche, but Liebherr's pilot hydrogen excavator has sparked interest for use in remote wind farms where grid supply is thin. Manufacturers must now manage dual product platforms-diesel and electric-stretching R&D budgets and supply chains. Battery sourcing is complicated by lithium and rare-earth price swings that raise bills of material, a restraint subtracting 0.5 percentage points from Europe construction equipment market CAGR projections.

The Europe Construction Equipment Market Report is Segmented by Machinery Type (Cranes, Telescopic Handler, and More), Power Source (Internal-Combustion, Hybrid, and More), End-User Industry (Infrastructure & Construction, Mining & Quarrying, and More), Application (Earthmoving, Lifting & Material Handling, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD) and Volume (Units).

List of Companies Covered in this Report:

- Caterpillar Inc.

- AB Volvo (Volvo CE)

- Liebherr Group

- CNH Industrial N.V.

- Komatsu Ltd.

- JCB Ltd.

- Hitachi Construction Machinery

- Deere & Company

- Sandvik AB

- Manitou Group

- Atlas Copco AB

- XCMG Europe

- Sany Europe GmbH

- Doosan Bobcat EMEA

- Wirtgen Group

- Kubota Corp.

- Terex Corp.

- Bomag GmbH

- Wacker Neuson SE

- Hyundai Construction Equipment Europe

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 EU Green Deal-Linked Public-Works Pipeline

- 4.2.2 Recovery Of Residential Starts As Ecb Rate-Cut Cycle Begins (2025-26)

- 4.2.3 Accelerated Fleet Electrification To Meet Stage V/Vi Co2 & Nox Caps

- 4.2.4 Growing Demand For Compact Equipment On Urban Infill Sites

- 4.2.5 OEM-Led Subscription & Telematics Bundles Boosting Aftermarket Revenue

- 4.2.6 Surge In Battery-Electric Telehandlers For Warehouse-Automation Build-Outs

- 4.3 Market Restraints

- 4.3.1 Rental-Fleet Oversupply Suppressing New-Unit Asps

- 4.3.2 Scarcity Of Certified Operators Inflating Project Timelines

- 4.3.3 Lithium & Rare-Earth Price Volatility Hitting Ev-Equipment Bom Costs

- 4.3.4 Persistent Ce-Mark/Homologation Delays For Chinese Imports

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value (USD) and Volume (Units))

- 5.1 By Machinery Type

- 5.1.1 Cranes

- 5.1.2 Telescopic Handler

- 5.1.3 Excavator

- 5.1.4 Loader and Backhoe

- 5.1.5 Motor Graders

- 5.1.6 Others

- 5.2 By Power Source

- 5.2.1 Internal-Combustion

- 5.2.2 Hybrid

- 5.2.3 Battery-Electric

- 5.2.4 Hydrogen Fuel-Cell

- 5.3 By End-user Industry

- 5.3.1 Infrastructure & Construction

- 5.3.2 Mining & Quarrying

- 5.3.3 Oil & Gas

- 5.3.4 Manufacturing & Warehousing

- 5.3.5 Agriculture & Forestry

- 5.3.6 Utilities & Renewable Energy

- 5.4 By Application

- 5.4.1 Earthmoving

- 5.4.2 Lifting & Material Handling

- 5.4.3 Excavation & Demolition

- 5.4.4 Road Building & Paving

- 5.4.5 Tunnelling

- 5.4.6 Recycling & Waste Management

- 5.5 By Country

- 5.5.1 Germany

- 5.5.2 United Kingdom

- 5.5.3 France

- 5.5.4 Italy

- 5.5.5 Spain

- 5.5.6 Russia

- 5.5.7 Netherlands

- 5.5.8 Belgium

- 5.5.9 Poland

- 5.5.10 Rest of Europe

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (Includes Global Level Overview, Market Level Overview, Core Segments, Financials as Available, Strategic Information, Market Rank/Share for Key Companies, Products and Services, SWOT Analysis, and Recent Developments)

- 6.4.1 Caterpillar Inc.

- 6.4.2 AB Volvo (Volvo CE)

- 6.4.3 Liebherr Group

- 6.4.4 CNH Industrial N.V.

- 6.4.5 Komatsu Ltd.

- 6.4.6 JCB Ltd.

- 6.4.7 Hitachi Construction Machinery

- 6.4.8 Deere & Company

- 6.4.9 Sandvik AB

- 6.4.10 Manitou Group

- 6.4.11 Atlas Copco AB

- 6.4.12 XCMG Europe

- 6.4.13 Sany Europe GmbH

- 6.4.14 Doosan Bobcat EMEA

- 6.4.15 Wirtgen Group

- 6.4.16 Kubota Corp.

- 6.4.17 Terex Corp.

- 6.4.18 Bomag GmbH

- 6.4.19 Wacker Neuson SE

- 6.4.20 Hyundai Construction Equipment Europe

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment