PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910833

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910833

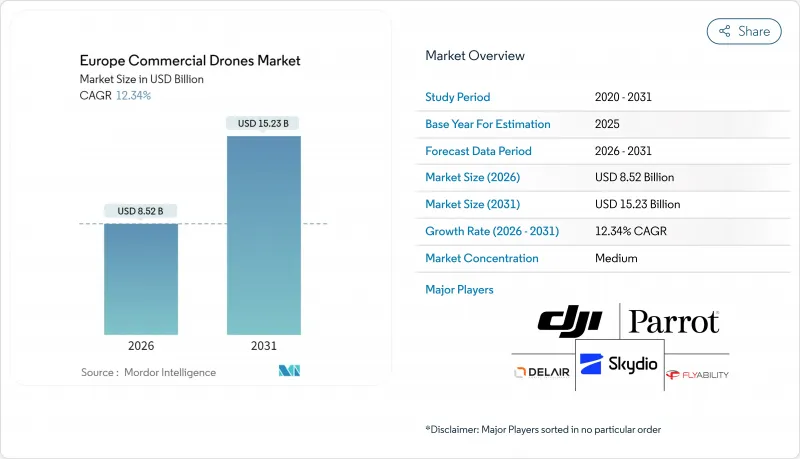

Europe Commercial Drones - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Europe commercial drones market size is worth USD 7.58 billion in 2025. The Europe commercial drones market is expected to grow from USD 7.58 billion in 2025 to USD 8.52 billion in 2026 and is forecast to reach USD 15.23 billion by 2031 at 12.34% CAGR over 2026-2031.

Regulatory clarity, expanding industrial use cases, and steady capital investment underpin this momentum. Construction, agriculture, and energy companies continue to replace manual inspection with airborne data capture at scale, while government agencies adopt drones for public-safety and border-control missions. Demand is also shifting toward larger payload classes and hybrid/VTOL airframes that combine long-range efficiency with vertical take-off flexibility. Competitive pressure remains moderate, allowing niche firms that solve specialized tasks-such as indoor swarm inspections or offshore wind-turbine blade surveys-to carve out defensible positions.

Europe Commercial Drones Market Trends and Insights

EU-wide U-space Regulatory Rollout Accelerates Market Integration

Europe's unified U-space rules create a single traffic-management layer for drones below 120 m and remove legacy fragmentation that previously forced operators to meet different national rules for every cross-border mission. Automated flight authorizations, remote-ID, and common risk assessments reduce overhead for scale operators and let service providers confidently plan long-range routes. National civil aviation agencies in Germany, the Netherlands, and France already run pilot corridors, demonstrating that fully automated airspace coordination can support hundreds of daily flights without incident. As implementation phases conclude in 2027, international fleet operators will treat the continent as a contiguous addressable market, boosting demand for hardware and software designed around the U-space interface.

BIM and Digital-Twin Workflows Transform Construction Applications

Drone photogrammetry paired with Building Information Modeling helps contractors detect site clashes at centimeter-level accuracy, cutting rework and improving worker safety. Kier Group documented USD 2 million cost avoidance on motorway upgrades by feeding high-resolution orthomosaics into its digital-twin engine. Scandinavia's strict worker-safety laws and high labor costs accelerate adoption, while German general contractors increasingly specify drone mapping in tender documents. As 5G connectivity becomes pervasive, real-time site streaming will allow off-site engineers to validate progress daily, further embedding drones into core project workflows.

GDPR Compliance Creates Operational Cost Pressures

Every drone flight over populated areas triggers personal-data safeguards. Operators must run Data Protection Impact Assessments, encrypt onboard storage, and publish public-access notice sites. Embedding privacy-by-design features adds non-recurring engineering costs at the manufacturing stage. Small service providers-especially start-ups in France and Belgium-struggle with the legal fees for ongoing compliance audits, forcing some to restrict operations to unpopulated zones or subcontract data handling to certified processors.

Other drivers and restraints analyzed in the detailed report include:

- Precision Agriculture Subsidies Catalyze Rural Technology Adoption

- Renewable Energy Infrastructure Drives Inspection Demand

- Pilot Training Infrastructure Constrains Market Expansion

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Construction generated 35.64% of revenue in 2025, anchoring the Europe commercial drones market through routine site mapping and structure inspection. The sector is expected to keep its lead as national infrastructure programs specify drone-verified progress reports. While smaller today, energy is on course for a 14.07% CAGR thanks to mandatory visual checks on new offshore wind arrays. Agriculture remains an early adopter, aided by subsidy incentives, and public-safety agencies now incorporate drones into crowd-management standard operating procedures.

Europe's commercial drone market operators serving construction often bundle data analytics, letting site managers track cubic-yard earthworks or concrete pour volumes in real time. Energy-focused vendors increasingly equip VTOL airframes with AI crack-detection algorithms, moving the task from manual review to automatic defect tagging. This shift supports higher sortie rates without proportional head-count growth.

Fixed-wing platforms held a 45.62% share in 2025 because long-range mapping remains essential in agriculture and border patrol. Hybrid/VTOL designs, however, are growing 13.82% annually as buyers seek runway-free operations. Rotary-wing craft keep their foothold in confined-space tasks such as bridge-cavity inspection, yet payload limits cap their reach.

TEKEVER's ARX system illustrates the transition: the 600 kg take-off-weight craft combines 12-hour endurance with vertical launch and can ferry modular sensor pods. Operators who formerly ran mixed fleets now prefer a single VTOL that lands in a 25 m clearing yet still covers 200 km of pipelines. Software autonomy reduces pilot workloads, easing compliance with tight duty-time rules.

The Europe Commercial Drones Market Report is Segmented by Application (Construction, Agriculture, and More), Type (Fixed-Wing Drones, and More), Weight Class (Nano/Micro, Small, and More), Mode of Operation (Remotely Piloted, Optionally Piloted, and More), End-User (Commercial and Consumer/Hobbyist, and More), and Country (United Kingdom, Germany, France, and More). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- SZ DJI Technology Co., Ltd.

- Parrot Drones SAS

- Delair SAS

- Flyability SA

- AZUR DRONES SAS

- Quantum-Systems GmbH

- Schiebel Corporation

- Wingtra

- Autel Robotics Co., Ltd.

- Skydio, Inc.

- SURVEY COPTER SAS

- Aerialtronics DV B.V.

- AltiGator

- Yuneec International (ATL Drone)

- Thales Group

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 EU-wide U-space regulatory rollout (2025-27)

- 4.2.2 Surge in drone-enabled BIM and digital-twin workflows

- 4.2.3 Precision agriculture subsidies accelerating drone adoption

- 4.2.4 Renewable energy asset inspection demand

- 4.2.5 Growth of indoor swarm-inspection service contracts

- 4.2.6 EDF-backed dual-use tech spin-offs

- 4.3 Market Restraints

- 4.3.1 GDPR-driven data-privacy compliance cost

- 4.3.2 Pilot-training and licensing bottlenecks

- 4.3.3 Lithium-battery transport restrictions

- 4.3.4 Urban anti-drone counter-measure rollout

- 4.4 Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Application

- 5.1.1 Construction

- 5.1.2 Agriculture

- 5.1.3 Energy

- 5.1.4 Entertainment

- 5.1.5 Law Enforcement

- 5.1.6 Other Applications

- 5.2 By Type

- 5.2.1 Fixed-Wing Drones

- 5.2.2 Rotary-Wing Drones

- 5.2.3 Hybrid/VTOL Drones

- 5.3 By Weight Class

- 5.3.1 Nano/Micro (Less than 2 kg)

- 5.3.2 Small (2 to 25 kg)

- 5.3.3 Medium (25 to 150 kg)

- 5.3.4 Large (Greater than 150 kg)

- 5.4 By Mode of Operation

- 5.4.1 Remotely Piloted

- 5.4.2 Optionally Piloted

- 5.4.3 Fully Autonomous

- 5.5 By End-User

- 5.5.1 Commercial and Consumer/Hobbyist

- 5.5.2 Government and Civil

- 5.6 By Country

- 5.6.1 United Kingdom

- 5.6.2 Germany

- 5.6.3 France

- 5.6.4 Spain

- 5.6.5 Italy

- 5.6.6 Netherlands

- 5.6.7 Switzerland

- 5.6.8 Poland

- 5.6.9 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 SZ DJI Technology Co., Ltd.

- 6.4.2 Parrot Drones SAS

- 6.4.3 Delair SAS

- 6.4.4 Flyability SA

- 6.4.5 AZUR DRONES SAS

- 6.4.6 Quantum-Systems GmbH

- 6.4.7 Schiebel Corporation

- 6.4.8 Wingtra

- 6.4.9 Autel Robotics Co., Ltd.

- 6.4.10 Skydio, Inc.

- 6.4.11 SURVEY COPTER SAS

- 6.4.12 Aerialtronics DV B.V.

- 6.4.13 AltiGator

- 6.4.14 Yuneec International (ATL Drone)

- 6.4.15 Thales Group

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment