PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910835

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910835

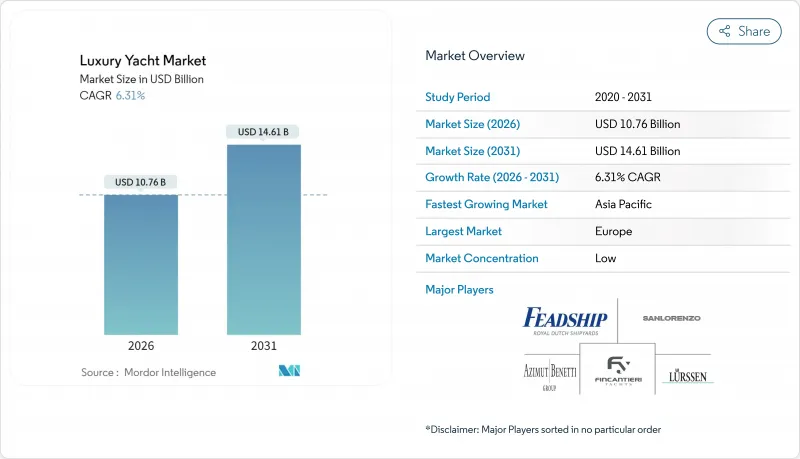

Luxury Yacht - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

Luxury yacht market size in 2026 is estimated at USD 10.76 billion, growing from 2025 value of USD 10.12 billion with 2031 projections showing USD 14.61 billion, growing at 6.31% CAGR over 2026-2031.

Current momentum stems from the rise in ultra-high-net-worth individuals (UHNWIs), rapid propulsion innovation, and a cultural shift toward experiential assets. Hybrid and electric systems gain traction as builders seek compliance with future IMO greenhouse-gas rules, while expedition-style yachts broaden cruising grounds beyond the Mediterranean. Consolidation among builders and marina operators intensifies, with private-equity funds targeting infrastructure that secures berth availability. Meanwhile, tariffs on European, Chinese, and Taiwanese vessels create a near-term pricing advantage for U.S. yards and could prompt regional reshoring in the luxury yacht market.

Global Luxury Yacht Market Trends and Insights

Surge in Yacht-Tourism Boom

Yacht tourism will demonstrate healthy growth, accounting for 26% of the marine economy by 2030. Yacht tourists spend approximately USD 287 daily, nearly double conventional tourists, significantly impacting local economies. The sector benefits from post-pandemic travel preferences favoring private, controlled environments, with overcrowded destinations. Charter companies increasingly invest in larger, more luxurious vessels to capture this premium spending, with yacht sailing programs emerging as the most valued attribute among tourists. Safety training and accessible locations within one hour of transport represent optimal combinations that tourists prefer, driving infrastructure development in emerging cruising destinations.

Rising UHNWIs in Emerging Markets

The ultra-wealthy population is projected to grow considerably by 2028, reaching over 587,000 individuals with a net worth exceeding USD 30 million. Emerging markets drive disproportionate growth, with Vietnam forecasting 95% centi-millionaire growth, India 80%, and Mauritius 75%. These new wealth centers prioritize experiential luxury over traditional assets, with yachts representing passion investments that combine status, privacy, and lifestyle benefits. The shift toward sustainable investments among 20% of UHNW investors creates demand for hybrid and electric propulsion systems. Younger generations increasingly drive wealth mobility and investment decisions, favoring technologically advanced vessels with environmental credentials.

High Ownership and Maintenance Costs

Rising operational expenses strain yacht ownership economics, with Princess Yachts reporting a GBP 61 million loss in 2022 on revenues of GBP 315 million amid challenging market conditions. The company announced 250 workforce reductions due to rising operational costs and challenging global market conditions. Marina costs escalate as premium facilities command higher rates, with Safe Harbor Marinas' USD 5.65 billion valuation reflecting 21 times the estimated 2024 Funds from Operations. Interest rate increases compound financing costs for yacht purchases, while insurance premiums rise due to increased claims and replacement values. These factors drive owners toward fractional ownership models and charter arrangements to distribute costs across multiple users.

Other drivers and restraints analyzed in the detailed report include:

- Growing Demand for Expedition/Explorer Yachts

- Shift Toward Hybrid and Electric Propulsion

- Supply-Chain Bottlenecks for Specialized Components

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

In 2025, motor yachts dominated the luxury yacht market, securing a commanding 66.68% share, reflecting established consumer preferences for spacious layouts, extended range capabilities, and proven reliability across diverse cruising conditions. Hybrid/electric yachts emerge as the fastest-growing segment at 10.09% CAGR through 2031, driven by environmental regulations and technological advancements. Sailing yachts maintain steady demand among purist owners seeking traditional experiences, while catamaran yachts gain traction for charter operations due to stability and space efficiency. Explorer yachts represent a specialized but rapidly expanding niche, with 58 new vessels launching in 2025 targeting adventure-oriented owners.

The electrification trend accelerates as manufacturers integrate hybrid systems offering reduced noise, improved fuel efficiency, and modular powertrains allowing easy upgrades. Ferretti Group unveiled the Riva El-Iseo, their first full-electric model in the E-Luxury segment, combining traditional design with modern electric technology. Solar energy integration and AI-powered energy management systems optimize power consumption, enhancing the luxury experience while addressing environmental concerns. Motor yacht manufacturers increasingly offer hybrid variants across their model ranges to capture environmentally conscious buyers without sacrificing performance expectations.

The 20 to 40-meter segment emerged as the frontrunner, holding 43.62% of the market share in 2025, striking a balance between space, operational complexity, and marina accessibility, making it the prime choice for private ownership. Vessels above 80 meters achieve the highest growth rate at 11.74% CAGR through 2031, reflecting ultra-wealthy buyers' preference for floating estates with comprehensive amenities. The up to 20-meter segment serves entry-level luxury buyers and charter operations, while 40 to 60-meter yachts cater to established owners seeking enhanced capabilities. The 60-to-80-meter range targets experienced owners transitioning to larger vessels with expanded crew and guest accommodations.

Superyacht construction increasingly incorporates advanced materials and technologies, with carbon composites moving beyond racing applications into luxury vessels for weight reduction and performance optimization. The Scheherazade exemplifies this trend, incorporating carbon composites in masts, rigging, and deck structures. Larger vessels benefit from economies of scale in hybrid propulsion integration, with Rolls-Royce's systems ranging from 1,000 to 4,000 kilowatts suitable for various yacht sizes. The size escalation reflects owners' desire for self-sufficiency during extended cruising, driving demand for vessels with enhanced range, storage, and onboard facilities.

The Luxury Yacht Market Report is Segmented by Type (Motor Yacht, Sailing Yacht, and More), Size (Up To 20 Meter, 20 To 40 Meter, and More), Hull Material (Fiberglass/Composite, Aluminum, and More), Propulsion System (Diesel, Diesel-Electric/Hybrid, and More), End-User (Private Individuals, Charter Companies, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD) and Volume (Units).

Geography Analysis

Europe commanded 42.62% of the luxury yacht market in 2025 on the strength of enduring shipbuilding clusters in Italy, the Netherlands, and Germany. Italian yards delivered half of all 24 m-plus vessels globally, with Azimut-Benetti aiming for EUR 1.5 billion turnover by 2025 despite soft luxury-goods sentiment. EU climate legislation spurs R&D in hybrid propulsion, allowing builders to market compliance as a competitive edge to carbon-conscious buyers. However, 20% U.S. import tariffs on EU yachts may divert some American orders to domestic brands, potentially trimming Europe's share over the forecast horizon.

Asia-Pacific is the fastest-growing region at an 11.24% CAGR. The 2025 Hong Kong Superyacht Summit drew 250 executives who outlined marina expansions in Hainan, Cebu, and Langkawi. Chinese registrations increase as the easing of coastal cruising permits streamlines itineraries. India's coastline modernization plan earmarks eleven new marinas, positioning Goa as a charter springboard for the Maldives. Nevertheless, bureaucratic clearance protocols and limited deep-water berths still inhibit full exploitation of regional demand in the luxury yacht market.

North America remains a mature yet expanding arena. The U.S. marina sector booked USD 6.7 billion in 2023 revenue with occupancy above 90% in many hubs. Blackstone's record purchase of Safe Harbor Marinas grants the fund 138 properties and underscores the strategic value of berth infrastructure. Universal 10% import tariffs, escalating to 20-54% by source country, buttress domestic builders such as Westport and Christensen. Skill shortages, however, increase crew wages by double-digit percentages, nudging some owners toward less labor-intensive displacement yachts, a trend reverberating across the luxury yacht market.

- Azimut-Benetti Group

- Lurssen Werft

- Feadship

- Ferretti Group

- Sanlorenzo

- Heesen Yachts

- Oceanco

- Fincantieri Yachts

- Nobiskrug

- Sunseeker International

- Royal Huisman

- Damen Yachting

- Palumbo Superyachts

- Gulf Craft

- Princess Yachts

- Sunreef Yachts

- Westport Yachts

- Trinity Yachts

- Baglietto

- Baltic Yachts

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surge in yacht-tourism boom

- 4.2.2 Rising UHNWIs in emerging markets

- 4.2.3 Growing demand for expedition / explorer yachts

- 4.2.4 Shift toward hybrid and electric propulsion

- 4.2.5 Private-island and remote-marina build-out

- 4.2.6 Rise of fractional-ownership platforms

- 4.3 Market Restraints

- 4.3.1 High ownership and maintenance costs

- 4.3.2 Supply-chain bottlenecks for specialised components

- 4.3.3 Stringent environmental emission regulations

- 4.3.4 Shortage of skilled crew inflating operating costs

- 4.4 Value / Supply-Chain Analysis

- 4.5 Technological Outlook

- 4.6 Regulatory Landscape

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size and Growth Forecasts (Value (USD) and Volume (Units))

- 5.1 By Type

- 5.1.1 Motor Yacht

- 5.1.2 Sailing Yacht

- 5.1.3 Hybrid / Electric Yacht

- 5.1.4 Catamaran Yacht

- 5.1.5 Explorer / Others

- 5.2 By Size

- 5.2.1 Up to 20 m

- 5.2.2 20 to 40 m

- 5.2.3 40 to 60 m

- 5.2.4 60 to 80 m

- 5.2.5 Above 80 m

- 5.3 By Hull Material

- 5.3.1 Fiberglass / Composite

- 5.3.2 Aluminum

- 5.3.3 Steel

- 5.3.4 Carbon Fiber

- 5.3.5 Others

- 5.4 By Propulsion System

- 5.4.1 Diesel

- 5.4.2 Diesel-Electric / Hybrid

- 5.4.3 Full Electric

- 5.4.4 Hydrogen Fuel Cell (Emerging)

- 5.5 By End-User

- 5.5.1 Private Individuals

- 5.5.2 Charter Companies

- 5.5.3 Corporate and Events

- 5.5.4 Fractional-Ownership Clubs

- 5.5.5 Government and Naval (VIP)

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Rest of North America

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Argentina

- 5.6.2.3 Chile

- 5.6.2.4 Rest of South America

- 5.6.3 Europe

- 5.6.3.1 Italy

- 5.6.3.2 Germany

- 5.6.3.3 United Kingdom

- 5.6.3.4 France

- 5.6.3.5 Netherlands

- 5.6.3.6 Spain

- 5.6.3.7 Rest of Europe

- 5.6.4 Asia-Pacific

- 5.6.4.1 China

- 5.6.4.2 Japan

- 5.6.4.3 South Korea

- 5.6.4.4 Australia

- 5.6.4.5 India

- 5.6.4.6 Rest of Asia-Pacific

- 5.6.5 Middle East and Africa

- 5.6.5.1 Saudi Arabia

- 5.6.5.2 United Arab Emirates

- 5.6.5.3 Egypt

- 5.6.5.4 South Africa

- 5.6.5.5 Rest of Middle East and Africa

- 5.6.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Segments, Financials as Available, Strategic Information, Market Rank/Share for Key Companies, Products and Services, SWOT Analysis, and Recent Developments)

- 6.4.1 Azimut-Benetti Group

- 6.4.2 Lurssen Werft

- 6.4.3 Feadship

- 6.4.4 Ferretti Group

- 6.4.5 Sanlorenzo

- 6.4.6 Heesen Yachts

- 6.4.7 Oceanco

- 6.4.8 Fincantieri Yachts

- 6.4.9 Nobiskrug

- 6.4.10 Sunseeker International

- 6.4.11 Royal Huisman

- 6.4.12 Damen Yachting

- 6.4.13 Palumbo Superyachts

- 6.4.14 Gulf Craft

- 6.4.15 Princess Yachts

- 6.4.16 Sunreef Yachts

- 6.4.17 Westport Yachts

- 6.4.18 Trinity Yachts

- 6.4.19 Baglietto

- 6.4.20 Baltic Yachts

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment