PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910838

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910838

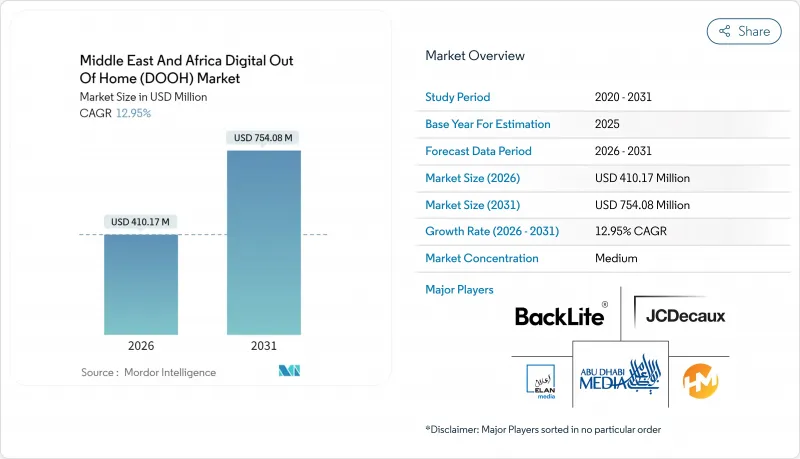

Middle East And Africa Digital Out Of Home (DOOH) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

Middle East and Africa Digital Out-of-Home (DOOH) market size in 2026 is estimated at USD 0.41 billion, growing from 2025 value of USD 0.36 billion with 2031 projections showing USD 0.75 billion, growing at 12.95% CAGR over 2026-2031.

The expansion reflects the integration of NEOM's USD 500 billion smart-city infrastructure, the UAE's near-universal 5G coverage, and country-wide digital transformation agendas that embed out-of-home screens into mobility, retail, and tourism networks. Rising smartphone penetration, public-transit buildout, and a regulatory push toward data-driven public services reinforce the Middle East and Africa Digital Out-of-Home (DOOH) market's positioning as a core smart-city utility. International media owners are accelerating their investment because climate-resilient hardware, renewable-powered LED arrays, and AI scheduling now align with environmental mandates. Regional operators, meanwhile, utilize cultural expertise and government partnerships to safeguard their inventory from new entrants, thereby creating a dynamic blend of global technology and local insight.

Middle East And Africa Digital Out Of Home (DOOH) Market Trends and Insights

Ongoing Shift Toward Digital Advertising

Advertisers in the region are redirecting their budgets from static billboards to data-driven networks as social media engagement peaks and mobile web traffic surpasses 80% of overall browsing. Egypt's ICT value-added increased by 15.2% in FY 2023, reflecting a broader momentum in digital commerce that fuels demand for measurable campaigns. Programmatic platforms such as VIOOH or Broadsign have migrated online buying conventions, audience segments, dynamic creatives, and attribution to roadside and mall screens. National visions, such as Saudi Vision 2030 and UAE Vision 2021, view DOOH inventory as a connective tissue that links e-government apps with public messaging, making the Middle East and Africa Digital Out-of-Home (DOOH) market integral to omnichannel communication. Agencies leverage cross-device identifiers to serve synchronized ads to commuters' phones after exposure to digital bus-shelter panels, proving incremental reach that traditional OOH could not quantify.

Expansion of Public-Transit Infrastructure

GCC governments invest heavily in metro, tram, and bus rapid-transit projects, creating new screen real estate and captive audiences. Riyadh Metro, Dubai Route 2020, and Doha's Lusail tram collectively add hundreds of stations earmarked for digital concessions. Transit authorities prefer digital formats because schedules, safety alerts, and commercial content can be shared on the same display, improving the passenger experience and monetizing assets. The predictable footfall of commuters provides media owners with robust impression counts, encouraging global brands to reallocate their television budgets. With mass-transit passenger volume forecast to double by 2030, the Middle East and Africa Digital Out-of-Home (DOOH) market anticipates steady inventory growth tied to infrastructure milestones.

Stringent Advertising Regulations in GCC

Dubai's 2020 Decree No. 06 requires prior approval for every advertisement and prohibits placements on certain cultural sites, forcing media owners to navigate a complex web of municipal and federal regulations. The UAE's National Media Council further mandates the prominence of the Arabic language and respect for religious values. Kuwait's licensing statutes impose extra fees on animated bus wraps. While the guidelines protect social norms, they prolong campaign approval cycles and limit creative latitude, reducing the speed-to-launch of the Middle East and Africa Digital Out-of-Home (DOOH) market compared to Western peers.

Other drivers and restraints analyzed in the detailed report include:

- Accelerating Adoption of Programmatic DOOH

- Saudi Giga-Projects Boosting Smart-City Media

- Persistence of Traditional OOH in Rural Areas

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Indoor screens accounted for 27.35% of the Middle East and Africa Digital Out-of-Home (DOOH) market size in 2025 and are projected to register a 13.6% CAGR through 2031. Shopping malls in Dubai, Riyadh, and Kuwait City retrofit atriums with interactive 8K walls that double as art installations during off-peak hours, expanding revenue beyond tenant rents. Airport operators, such as Dubai Airports, renewed long-term concessions with JCDecaux to deliver data-rich, premium inventory that reaches 86 million annual passengers. Mall operators value indoor networks for omnichannel commerce; QR codes on totems link shoppers to loyalty apps, increasing dwell time and basket size. Indoor growth also benefits from climate control, which extends hardware life and moderates maintenance costs associated with desert heat.

Outdoor media maintained a 72.65% share of the Middle East and Africa Digital Out-of-Home (DOOH) market size in 2025. Highway digital billboards around Abu Dhabi's Sheikh Zayed Road and Riyadh's Northern Ring Road capture commuter eyeballs for up to 90 seconds, enabling long-form storytelling. Government road-safety mandates allocate up to 10% of screen time for public messages, reinforcing the medium's civic utility. Although capex is higher, outdoor sites command superior CPM premiums due to scale and exclusivity. Smart-city master plans integrate roadside pylons with traffic sensors, creating IoT-linked units that update content to manage congestion, merging advertising with public-service information.

Billboards captured 52.10% of the Middle East and Africa Digital Out-of-Home (DOOH) market share in 2025, underpinned by the region's car-centric commuting patterns. Static and full-motion faces along Dubai's E 11 corridor deliver 6 million weekly impressions, attracting automotive and banking advertisers. Yet transit advertising is set to outpace all other uses with a 14.05% CAGR through 2031, reflecting expansion of metro lines, tram corridors, and BRT lanes. For example, the Riyadh Metro's 85 stations feature dedicated zones with 4K screens that sync with mobile ticketing apps and offer augmented-reality maps in six languages.

Street furniture, including smart bus shelters and digital way-finding kiosks, benefits from municipal tenders that bundle advertising with wireless charging and air-quality sensors. This "screen-plus-utility" model allows operators to monetize both ad inventory and data analytics, improving ROI. Sports venues, entertainment districts, and expo centers represent niche but high-yield segments; the 2028 Asian Winter Games in Saudi Arabia's Trojena ski resort will deploy immersive LED tunnels, setting experiential benchmarks for future events.

The Middle East and Africa Digital Out of Home (DOOH) Market is Segmented by Location (Indoor and Outdoor), Application (Billboard, Transit, and Other Applications), Sales Channel (Direct Buys, Programmatic Guaranteed, and Real-Time Bidding), Format Type (Digital Billboards, Digital Posters, and More), End-User (Commercial, Institutional, and More), and Country. The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- JCDecaux SE

- ELAN Media W.L.L.

- BackLite Media LLC

- Hypermedia FZ LLC

- Abu Dhabi Media Company PJSC

- Dooha Media W.L.L.

- EyeMedia Advertising W.L.L.

- Pikasso SARL

- Elevision Media FZ LLC

- Al Arabia Outdoor Advertising CJSC

- Faden Media Company Ltd.

- Hills Advertising LLC

- Arabian Outdoor Advertising LLC

- MBC Media Solutions FZ LLC

- Al Barq Digital Media LLC

- Publicity Qatar W.L.L.

- Sahara Media Advertising Co. LLC

- Ethraa Advertising Company LLC

- Wow Media LLC

- Al Fahad Advertising LLC

- Blue Rhine Media LLC

- Pixcom Technologies LLC

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Ongoing shift toward digital advertising

- 4.2.2 Expansion of public-transit infrastructure

- 4.2.3 Accelerating adoption of programmatic DOOH

- 4.2.4 Saudi giga-projects boosting smart-city media

- 4.2.5 5G-enabled real-time dynamic creative triggers

- 4.2.6 ESG push for renewable-powered LED displays

- 4.3 Market Restraints

- 4.3.1 Stringent advertising regulations in GCC

- 4.3.2 Persistence of traditional OOH in rural areas

- 4.3.3 Fragmented audience-measurement standards

- 4.3.4 High ambient-temperature maintenance costs

- 4.4 Industry Value Chain Analysis

- 4.5 Technological Outlook

- 4.6 Regulatory Landscape

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Impact of Macroeconomic Factors on the Market

5 MARKET SIZE AND GROWTH FORECASTS (VALUES)

- 5.1 By Location

- 5.1.1 Indoor

- 5.1.2 Outdoor

- 5.2 By Application

- 5.2.1 Billboard

- 5.2.2 Transit

- 5.2.3 Street Furniture

- 5.2.4 Other Applications

- 5.3 By Sales Channel

- 5.3.1 Direct Buys

- 5.3.2 Programmatic Guaranteed

- 5.3.3 Real-Time Bidding (Open Exchange)

- 5.4 By Format Type

- 5.4.1 Digital Billboards

- 5.4.2 Digital Posters

- 5.4.3 Video Screens (Large-Format LED)

- 5.4.4 Interactive Kiosks

- 5.4.5 3D Holographic Displays

- 5.5 By End-User

- 5.5.1 Commercial

- 5.5.2 Institutional

- 5.5.3 Infrastructural

- 5.5.4 Retail and Entertainment Venues

- 5.6 By Country

- 5.6.1 Saudi Arabia

- 5.6.2 United Arab Emirates

- 5.6.3 Kuwait

- 5.6.4 Qatar

- 5.6.5 Morocco

- 5.6.6 Egypt

- 5.6.7 Rest of Middle East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)}

- 6.4.1 JCDecaux SE

- 6.4.2 ELAN Media W.L.L.

- 6.4.3 BackLite Media LLC

- 6.4.4 Hypermedia FZ LLC

- 6.4.5 Abu Dhabi Media Company PJSC

- 6.4.6 Dooha Media W.L.L.

- 6.4.7 EyeMedia Advertising W.L.L.

- 6.4.8 Pikasso SARL

- 6.4.9 Elevision Media FZ LLC

- 6.4.10 Al Arabia Outdoor Advertising CJSC

- 6.4.11 Faden Media Company Ltd.

- 6.4.12 Hills Advertising LLC

- 6.4.13 Arabian Outdoor Advertising LLC

- 6.4.14 MBC Media Solutions FZ LLC

- 6.4.15 Al Barq Digital Media LLC

- 6.4.16 Publicity Qatar W.L.L.

- 6.4.17 Sahara Media Advertising Co. LLC

- 6.4.18 Ethraa Advertising Company LLC

- 6.4.19 Wow Media LLC

- 6.4.20 Al Fahad Advertising LLC

- 6.4.21 Blue Rhine Media LLC

- 6.4.22 Pixcom Technologies LLC

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment