PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910840

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910840

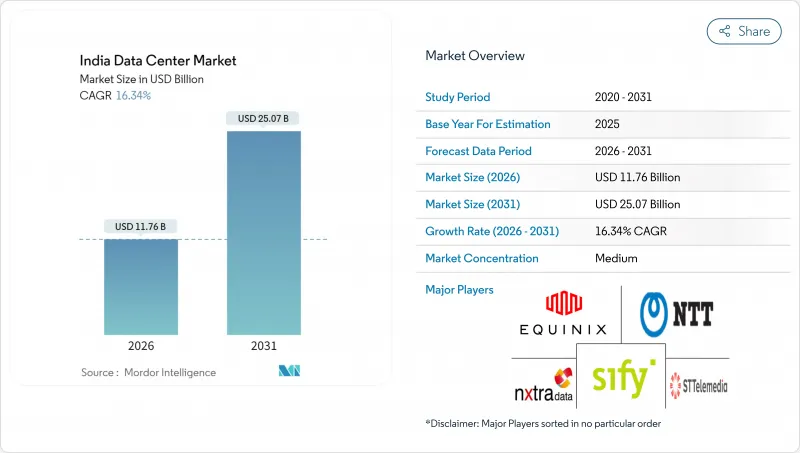

India Data Center - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

India Data Center Market size in 2026 is estimated at USD 11.76 billion, growing from 2025 value of USD 10.11 billion with 2031 projections showing USD 25.07 billion, growing at 16.34% CAGR over 2026-2031.

In terms of IT load capacity, the market is expected to grow from 4.48 thousand megawatt in 2025 to 12.47 thousand megawatt by 2030, at a CAGR of 22.72% during the forecast period (2025-2030). The market segment shares and estimates are calculated and reported in terms of MW. This sharp expansion stems from six forces: hyperscale cloud investments unlocked by Digital India incentives, explosive OTT traffic that pulls edge nodes into tier-2 cities, mandatory data localization rules, power purchase agreements that derisk renewable sourcing, submarine cable capacity that quadruples international bandwidth, and surging AI workloads that push rack densities above 50 kW. Cloud providers have lined up multi-billion-USD campuses, while domestic operators are pivoting to GPU-ready designs and renewable capacity additions. International connectivity upgrades at Mumbai and Chennai reduce latency for cross-border traffic, enhancing the attractiveness of the India data center market to Asia-Pacific interconnection hubs. Simultaneously, RBI and MeitY localization mandates create non-discretionary demand from BFSI and public-sector users, anchoring long-term utilization. Against this backdrop, operators with renewable power, high-density cooling, and coastal land banks are securing strategic advantages.

India Data Center Market Trends and Insights

Explosive Growth in Hyperscale Cloud Deployments Post-Digital India Incentives

Reliance Industries unveiled a USD 30 billion, 3 GW AI campus in Jamnagar, marking the largest single data center investment in India. AWS, Microsoft, and Google have together pledged more than USD 15 billion for new capacity around Mumbai, Chennai, and Hyderabad, facilitated by infrastructure status benefits and single-window clearances. The India AI Mission earmarked INR 10,371 crore (USD 1.25 billion) for 10,000 GPUs, validating sustained policy support. These moves are reshaping facility design toward 50-120 kW racks, liquid cooling, and on-site renewables, shifting competition from generic colocation toward purpose-built hyperscale campuses.

Escalating Domestic OTT Video Traffic Driving Edge Node Demand

OTT subscriptions keep rising in double digits, driving latency-sensitive caches into tier-2 cities such as Pune, Jaipur and Kochi. Rural broadband lines in Assam, Bihar and Uttar Pradesh East surpassed urban connections in 2024, underlining the need for distributed infrastructure. Edge sites of 5-20 MW help providers meet sub-50 ms latency, trim backhaul costs and improve user experience. Regional operators specializing in compact footprints are capitalizing on this shift as global CDNs deploy regional PoPs to localize high-definition content.

Inter-State Power Tariff Differentials Eroding Cost Competitiveness

Industrial tariffs vary from INR 4.50 in Andhra Pradesh to INR 8.00 in Maharashtra, a 40-50% spread that magnifies over a 20-year asset life. AI racks that draw 15-20 times the power of legacy servers feel this disparity most keenly. Pending policy talks on open-access procurement could ease the gap, yet timelines remain undefined. Operators therefore pursue captive solar-wind hybrids and multi-state renewable PPAs, illustrated by Google's tie-up with the 30 GW Khavda project in Gujarat.

Other drivers and restraints analyzed in the detailed report include:

- Mandated Data Localization Under RBI and MeitY Policies

- Rising AI-ML Workload Intensity Requiring GPU-Dense Racks

- Land Acquisition Delays in Coastal High-Demand Hubs

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Large facilities represented 22.08% of 2025 revenue, cementing their role as anchor hubs for hyperscale tenants. Shared infrastructure and 50-200 MW scale deliver operating leverage and cross-connect depth. Medium sites, however, will clock a 19.22% CAGR, propelled by edge-node rollouts in tier-2 cities that lower OTT latency and support IoT applications. This distributed mesh allows providers to place compute closer to end users, complementing megacampuses rather than replacing them. As AI models mature, demand is bifurcating between a few giga-watt campuses and numerous mid-sized outposts.

Operators are calibrating expansion plans to balance land costs, grid access, and latency targets. Large-campus developers favor coastal or power-rich inland corridors where multiple subsea cables or renewable clusters offer long-term resilience. Medium-site builders seek brownfield buildings with robust fiber backbones that can be brought online within 12-18 months, a timeline crucial for OTT and gaming platforms racing to meet user-experience thresholds. Sustainability mandates also influence sizing decisions because water-efficient cooling and on-site solar form factors scale more predictably in 20-50 MW blocks. These variables reinforce a two-tier build strategy that anchors the India data center market size at hub locations while radiating smaller nodes into consumption zones.

Tier 3 remains the baseline, retaining a 49.05% 2025 share thanks to N+1 redundancy, which balances capex and achieves 99.982% availability. Yet Tier 4 is accelerating at 20.25% CAGR as BFSI, healthcare, and real-time trading platforms demand 99.995% uptime. Operators that can deliver concurrently maintainable, fault-tolerant layouts with 2N power trains are capturing high-value workloads. Tier 1 and Tier 2 rooms persist for development and testing, as well as cost-sensitive use cases, but face gradual erosion as criticality increases.

Regulators and insurers are increasingly aligning service-level agreements with Tier 4 benchmarks, nudging enterprises to migrate their mission-critical stacks upward. Capital costs are mitigated by modular designs that allow operators to phase in investment while achieving Tier 4 credentials from day one. In parallel, hybrid-cloud architects push for standardized Tier 3 footprints at secondary sites to simplify disaster-recovery blueprints without incurring the full expense of a Tier 4 footprint. The net result is a stratified uptime landscape where premium fault tolerance coexists with pragmatic redundancy tiers, collectively broadening the India data center market share for operators that offer clear service-level differentiation.

The India Data Center Market Report is Segmented by Data Center Size (Large, Massive, Medium, Mega, and Small), Tier Type (Tier 1 and 2, Tier 3, and Tier 4), Data Center Type (Hyperscale/Self-built, Enterprise/Edge, and Colocation), End User (BFSI, IT and ITES, E-Commerce, Government, Manufacturing, Media and Entertainment, Telecom, and More), and Hotspot. The Market Forecasts are Provided in Terms of IT Load Capacity (MW).

List of Companies Covered in this Report:

- NTT Ltd

- CtrlS Datacenters Ltd

- AdaniConneX Private Limited

- STT Telemedia Global Data Centres India Private Limited

- Amazon Web Services Inc

- Princeton Digital Group Limited

- Sify Technologies Limited

- Colt Data Centre Services Holdings Limited

- Nxtra Data Limited

- SAP SE

- Yotta Infrastructure Solutions LLP

- RackBank Datacenters Private Limited

- MilesWeb Internet Services Pvt Ltd

- Pi DATACENTERS Pvt Ltd

- Reliance Communications Limited

- Equinix Inc

- Digital Realty Trust Inc

- Web Werks India Pvt Ltd

- Tata Communications Limited

- Bridge Data Centres India Private Limited

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Explosive growth in hyperscale cloud deployments post-Digital India incentives

- 4.2.2 Escalating domestic OTT video traffic driving edge node demand

- 4.2.3 Mandated data localisation under RBI and MeitY policies

- 4.2.4 Availability-linked power-purchase agreements for captive solar-wind hybrid energy

- 4.2.5 Submarine cable landing expansions boosting international bandwidth supply

- 4.2.6 Rising AI-ML workload intensity requiring GPU-dense racks

- 4.3 Market Restraints

- 4.3.1 Inter-state power tariff differentials eroding cost competitiveness

- 4.3.2 Land acquisition delays in coastal high-demand hubs

- 4.3.3 Slow clearances for diesel-based backup generators in urban cores

- 4.3.4 Shortage of specialised data center construction labour

- 4.4 Market Outlook

- 4.4.1 IT Load Capacity

- 4.4.2 Raised Floor Space

- 4.4.3 Colocation Revenue

- 4.4.4 Installed Racks

- 4.4.5 Rack Space Utilization

- 4.4.6 Submarine Cable

- 4.5 Key Industry Trends

- 4.5.1 Smartphone Users

- 4.5.2 Data Traffic Per Smartphone

- 4.5.3 Mobile Data Speed

- 4.5.4 Broadband Data Speed

- 4.5.5 Fiber Connectivity Network

- 4.5.6 Regulatory Framework

- 4.6 Value Chain and Distribution Channel Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (MEGAWATT)

- 5.1 By Data Center Size

- 5.1.1 Large

- 5.1.2 Massive

- 5.1.3 Medium

- 5.1.4 Mega

- 5.1.5 Small

- 5.2 By Tier Type

- 5.2.1 Tier 1 and 2

- 5.2.2 Tier 3

- 5.2.3 Tier 4

- 5.3 By Data Center Type

- 5.3.1 Hyperscale / Self-built

- 5.3.2 Enterprise / Edge

- 5.3.3 Colocation

- 5.3.3.1 Non-Utilized

- 5.3.3.2 Utilized

- 5.3.3.2.1 Retail Colocation

- 5.3.3.2.2 Wholesale Colocation

- 5.4 By End User

- 5.4.1 BFSI

- 5.4.2 IT and ITES

- 5.4.3 E-Commerce

- 5.4.4 Government

- 5.4.5 Manufacturing

- 5.4.6 Media and Entertainment

- 5.4.7 Telecom

- 5.4.8 Other End Users

- 5.5 By Hotspot

- 5.5.1 Bengaluru

- 5.5.2 Chennai

- 5.5.3 Hyderabad

- 5.5.4 Mumbai

- 5.5.5 Delhi-NCR

- 5.5.6 Rest of India

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 NTT Ltd

- 6.4.2 CtrlS Datacenters Ltd

- 6.4.3 AdaniConneX Private Limited

- 6.4.4 STT Telemedia Global Data Centres India Private Limited

- 6.4.5 Amazon Web Services Inc

- 6.4.6 Princeton Digital Group Limited

- 6.4.7 Sify Technologies Limited

- 6.4.8 Colt Data Centre Services Holdings Limited

- 6.4.9 Nxtra Data Limited

- 6.4.10 SAP SE

- 6.4.11 Yotta Infrastructure Solutions LLP

- 6.4.12 RackBank Datacenters Private Limited

- 6.4.13 MilesWeb Internet Services Pvt Ltd

- 6.4.14 Pi DATACENTERS Pvt Ltd

- 6.4.15 Reliance Communications Limited

- 6.4.16 Equinix Inc

- 6.4.17 Digital Realty Trust Inc

- 6.4.18 Web Werks India Pvt Ltd

- 6.4.19 Tata Communications Limited

- 6.4.20 Bridge Data Centres India Private Limited

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and unmet-need assessment