PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910844

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910844

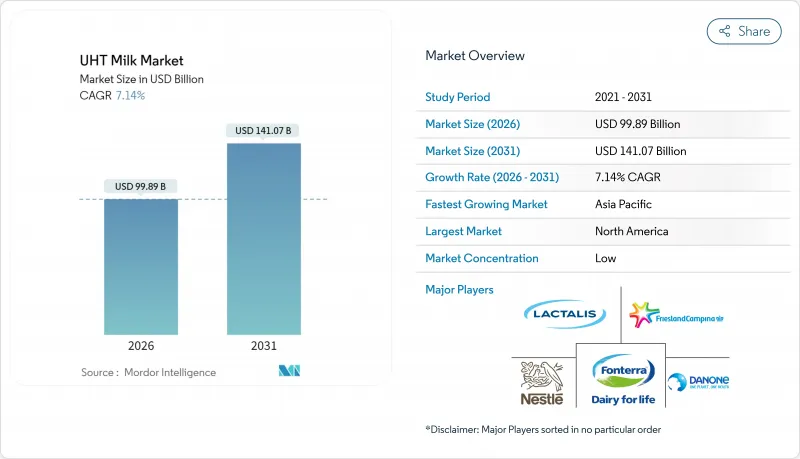

UHT Milk - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The UHT milk market is expected to grow from USD 93.23 billion in 2025 to USD 99.89 billion in 2026 and is forecast to reach USD 141.07 billion by 2031 at 7.14% CAGR over 2026-2031.

The steady expansion demonstrates how shelf-stable dairy formats meet changing consumer routines, support ambient logistics, and help processors reduce food-loss risks. Ongoing advances in ultra-high-temperature treatment safeguard vitamin and protein levels while pushing commercial shelf life well beyond six months, which lowers reliance on refrigerated supply chains and widens retail access. Mature regions continue to migrate toward premium lactose-free and fortified propositions, whereas emerging markets concentrate on affordability and basic nutrition; this divergence allows manufacturers to tier product portfolios without overhauling core production infrastructure. Competitive intensity rises as aluminum-free aseptic barriers, next-generation heat exchangers, and AI-guided process controls compress costs and elevate sustainability credentials. Pressures from plant-based beverages, energy-use scrutiny, and packaging-material volatility sharpen the need for differentiated brand stories that combine nutrition, convenience, and verified environmental progress.

Global UHT Milk Market Trends and Insights

Convenience and Long Shelf-Life Acceptance

As consumers increasingly prioritize convenience, the adoption of UHT milk is gaining momentum, especially in areas lacking robust cold-chain infrastructure. UHT technology offers a game-changing solution: a shelf life of 6-9 months without the need for refrigeration. This not only tackles logistical hurdles in emerging markets but also caters to urban lifestyles that demand on-the-go consumption. Recent research highlights a pronounced preference for UHT milk among Generation Z in Indonesia, largely attributed to its convenience. A striking 90% of surveyed individuals cite nutritional benefits as their primary reason for milk consumption, with many valuing the extended shelf life. This trend underscores a shift in demand, as younger consumers increasingly favor convenience over the traditional allure of fresh milk. Further underscoring UHT milk's significance, military procurement programs, notably the Defense Logistics Agency, have integrated UHT products into operational rations, capitalizing on their ambient storage advantages. Given the alignment of consumer convenience trends and institutional endorsements, it's evident that this momentum will persist well into the forecast period.

Rising Urban Middle-Class Demand in APAC

China's dairy market has undergone a significant transformation, highlighted by the introduction of UHT technology during its rapid mechanization phase from 1979 to 2007. This technological leap propelled China's dairy output to an impressive 30.546 million tonnes by 2023. Dominating the landscape, the dual oligopoly of Yili and Mengniu commands nearly 80% of China's UHT milk market. These established players adeptly harness distribution networks and brand recognition, riding the wave of a burgeoning middle class. Bolstering this growth, government initiatives, such as school milk programs, have spurred demand. Concurrently, technological strides have ensured the efficient delivery of shelf-stable products to a broad consumer base. This demographic advantage fosters a self-reinforcing cycle: as incomes rise, urbanization accelerates, and dietary preferences diversify, the region's growth momentum remains robust and sustained.

Competition from Plant-Based Dairy Alternatives

Plant-based milk alternatives are gaining market share, thanks to their eco-friendly image and adaptability to diverse diets. According to the United States Department of Agriculturedata from 2023, 1.58 million people in Germany consumed plant-based food and beverages. Assessments of environmental impacts consistently highlight the advantages of plant-based options. Oat and soy drinks, for instance, emit fewer greenhouse gases and use less water than their dairy counterparts. However, these plant-based drinks often need fortification to match the micronutrient levels found in dairy. The industry's acknowledgment of the rising competition is evident, as seen with Tetra Pak adapting its direct UHT processing technology for these plant-based beverages. Tetra Pak has fine-tuned its processing methods to ensure plant protein stability and color retention. Moreover, younger consumers are increasingly turning to plant-based options, driven by ethical and environmental concerns. This shift poses a long-term challenge for traditional dairy products, including UHT milk.

Other drivers and restraints analyzed in the detailed report include:

- Growth of Ambient Dairy E-commerce Fulfilment

- Shift to Sustainable, Low-Carbon Cold-Chain Alternatives

- Energy Intensity of UHT Processing & ESG Scrutiny

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Whole/ Full-cream milk holds a significant 42.12% share of the market, highlighting its sustained dominance and consumer preference. This segment continues to thrive due to its rich texture, creamy taste, and strong traditional appeal. The higher fat content in full-cream milk not only enhances its flavor and mouthfeel but also makes it a preferred choice for use in a wide range of applications, including dairy-based products, confectionery, and bakery items. Its versatility and ability to improve the quality of end products further solidify its position in the market.

Skimmed milk, recognized for its low fat content, is anticipated to experience substantial growth, with a projected CAGR of 8.32% during the forecast period of 2026-2031. This growth trajectory is attributed to increasing health awareness among consumers, a shift toward low-fat and calorie-controlled dietary preferences, and rising demand from specific consumer groups. These groups include fitness enthusiasts seeking healthier options, aging populations prioritizing nutritional needs, and individuals with dietary restrictions requiring low-fat alternatives. The growing emphasis on health and wellness is expected to drive the adoption of skimmed milk across various demographics.

Lactose-free milk currently dominates the market with a substantial share of 69.92%. This leadership is largely driven by the rising prevalence of lactose intolerance globally, increasing health consciousness, and consumers' preference for easily digestible dairy alternatives. According to the MediPlus data from 2024, 30 million people in the United States were lactose intolerant. Lactose-free milk appeals to a broad demographic, including aging populations, fitness enthusiasts, and individuals with digestive sensitivities. The segment is also seeing increased penetration through innovations such as enzymatic lactose removal technologies that maintain milk's natural taste and nutritional value. The growth of e-commerce and retail availability is further accelerating consumer access and adoption.

Fortified and functional UHT milk leads the pack with a robust 10.05% CAGR, infusing vitamins, minerals, and bioactive compounds. These enhancements resonate with health-conscious consumers who prioritize convenient nutrition, even without refrigeration. This growth trajectory mirrors a broader demographic shift towards preventive healthcare and nutritional supplementation. Such trends are especially pronounced in developing regions, where prevalent micronutrient deficiencies present lucrative opportunities for fortified dairy products. The functional offerings, ranging from protein-enriched to probiotic-enhanced and omega-3 fortified, not only address specific health concerns but also command premium pricing in the market.

The UHT Milk Market is Segmented by Fat Content (Whole/Full-cream, Semi-Skimmed, Skimmed), Flavor (Unflavoured, Flavoured), Category (Lactose-Free, Fortified/Functional), Packaging Format (Cartons, Bottles, Pouches, Others), Distribution Channel (Food Service/HoReCa, Retail), and Geography (North America, Europe, Asia-Pacific, South America, Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

In 2025, North America holds a commanding 37.21% share of the market, underscoring its mature infrastructure and the established consumer acceptance of shelf-stable dairy products. The region's advanced cold-chain logistics not only optimize costs but also bolster emergency preparedness, further driving the adoption of UHT milk. In 2023, U.S. dairy exports hit USD 8.1 billion, accounting for 17% of the nation's total milk production. UHT products, benefiting from ambient shipping advantages, played a pivotal role in this international trade, as highlighted by USDEC. The FDA's endorsement of UHT processing as a legitimate sterilization method underscores the regulatory support bolstering market growth. Recent industry moves include Suntado's investment of over USD 100 million in a new UHT processing facility in Idaho, boasting a daily processing capacity of 800,000 to 1 million pounds of milk, with room for expansion. Asia-Pacific is set to outpace others with a projected CAGR of 8.66% through 2031. This growth is fueled by swift urbanization and a burgeoning middle class in search of convenient nutritional solutions. In India, the market is witnessing notable consolidation, highlighted by Hatsun Agro Product's strategic acquisition of Milk Mantra Dairy, as reported by Just Food. Initiatives like school feeding programs, backed by entities such as Tetra Pak, are ensuring 64 million children across 49 nations receive nutritious milk, solidifying a consistent demand. Furthermore, partnerships with equipment manufacturers are hastening technology adoption, leading to swift capacity boosts and quality enhancements throughout the region. Europe's UHT consumption, especially in Southern nations where it constitutes over 80% of fluid milk intake, underscores the region's entrenched market presence. Europe is at the forefront of sustainability, driven by both regulatory mandates and corporate pledges. A notable consolidation is the Arla-DMK merger, birthing the continent's largest farmer-owned cooperative, eyeing an annual revenue of USD 22.14 billion. Arla's commitment is further evident with a USD 401.91 million infusion across five UK sites, aimed at bolstering infrastructure and extending product shelf life. Meanwhile, the Middle East and Africa are emerging as hotspots, with Ethiopia's MB Plc setting up a UHT processing line with a 40,000-liter daily capacity and Uganda's Pearl Dairy diversifying its offerings with new packaging lines. Such moves highlight the growing acknowledgment of UHT milk's significance in bolstering nutrition security and driving economic growth in these developing regions.

- Nestle S.A.

- Groupe Lactalis SA (Parmalat)

- Royal FrieslandCampina N.V.

- Danone SA

- Fonterra Co-operative Group Ltd.

- China Mengniu Dairy Co. Ltd.

- Yili Group

- Arla Foods amba

- Gujarat Co-operative Milk Marketing Federation (Amul)

- Saputo Inc.

- Almarai Company

- Dairy Farmers of America Inc.

- Hochwald Foods GmbH

- Dana Dairy Group

- Clover Industries Ltd.

- Meiji Holdings Co. Ltd.

- Bright Dairy & Food Co.

- Terra Vita SpA

- Parag Milk Foods Ltd.

- Devondale Murray Goulburn

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Convenience and Long Shelf-Life Acceptance

- 4.2.2 Rising Urban Middle-Class Demand in Asia-Pacific

- 4.2.3 Growth of Ambient Dairy E-commerce Fulfilment

- 4.2.4 Shift to Sustainable, Low-Carbon Cold-Chain Alternatives

- 4.2.5 Food-service Preference for Micro-Foam-Stable UHT Milk

- 4.2.6 Premiumisation via Lactose-Free & Fortified Variants

- 4.3 Market Restraints

- 4.3.1 Fresh-Taste Perception Gap vs Pasteurised Milk

- 4.3.2 Competition from Plant-Based Dairy Alternatives

- 4.3.3 Energy Intensity of UHT Processing & ESG Scrutiny

- 4.3.4 Aseptic Carton Aluminium-Foil Supply Risk

- 4.4 Supply Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Porters Five Forces

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS

- 5.1 By Fat Content Type

- 5.1.1 Whole/Full-cream

- 5.1.2 Semi-skimmed

- 5.1.3 Skimmed

- 5.2 Flavor

- 5.2.1 Unflavoured

- 5.2.2 Flavoured

- 5.3 Category

- 5.3.1 Lactose-free

- 5.3.2 Fortified/Functional

- 5.4 Packaging Format

- 5.4.1 Cartons

- 5.4.2 Bottles

- 5.4.3 Pouches

- 5.4.4 Others

- 5.5 Distribution Channel

- 5.5.1 Food Service/HoReCa

- 5.5.2 Retail

- 5.5.2.1 Supermarkets/Hypermarkets

- 5.5.2.2 Convenience Stores

- 5.5.2.3 Online Retail

- 5.5.2.4 Others

- 5.6 Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.1.4 Rest of North America

- 5.6.2 Europe

- 5.6.2.1 Germany

- 5.6.2.2 United Kingdom

- 5.6.2.3 Italy

- 5.6.2.4 France

- 5.6.2.5 Spain

- 5.6.2.6 Netherlands

- 5.6.2.7 Poland

- 5.6.2.8 Belgium

- 5.6.2.9 Sweden

- 5.6.2.10 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 China

- 5.6.3.2 India

- 5.6.3.3 Japan

- 5.6.3.4 Australia

- 5.6.3.5 Indonesia

- 5.6.3.6 South Korea

- 5.6.3.7 Thailand

- 5.6.3.8 Singapore

- 5.6.3.9 Rest of Asia-Pacific

- 5.6.4 South America

- 5.6.4.1 Brazil

- 5.6.4.2 Argentina

- 5.6.4.3 Colombia

- 5.6.4.4 Chile

- 5.6.4.5 Peru

- 5.6.4.6 Rest of South America

- 5.6.5 Middle East and Africa

- 5.6.5.1 South Africa

- 5.6.5.2 Saudi Arabia

- 5.6.5.3 United Arab Emirates

- 5.6.5.4 Nigeria

- 5.6.5.5 Egypt

- 5.6.5.6 Morocco

- 5.6.5.7 Turkey

- 5.6.5.8 Rest of Middle East and Africa

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Ranking Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials (if available), Strategic Information, Market Rank/Share, Products & Services, Recent Developments)

- 6.4.1 Nestle S.A.

- 6.4.2 Groupe Lactalis SA (Parmalat)

- 6.4.3 Royal FrieslandCampina N.V.

- 6.4.4 Danone SA

- 6.4.5 Fonterra Co-operative Group Ltd.

- 6.4.6 China Mengniu Dairy Co. Ltd.

- 6.4.7 Yili Group

- 6.4.8 Arla Foods amba

- 6.4.9 Gujarat Co-operative Milk Marketing Federation (Amul)

- 6.4.10 Saputo Inc.

- 6.4.11 Almarai Company

- 6.4.12 Dairy Farmers of America Inc.

- 6.4.13 Hochwald Foods GmbH

- 6.4.14 Dana Dairy Group

- 6.4.15 Clover Industries Ltd.

- 6.4.16 Meiji Holdings Co. Ltd.

- 6.4.17 Bright Dairy & Food Co.

- 6.4.18 Terra Vita SpA

- 6.4.19 Parag Milk Foods Ltd.

- 6.4.20 Devondale Murray Goulburn

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK