PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910845

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910845

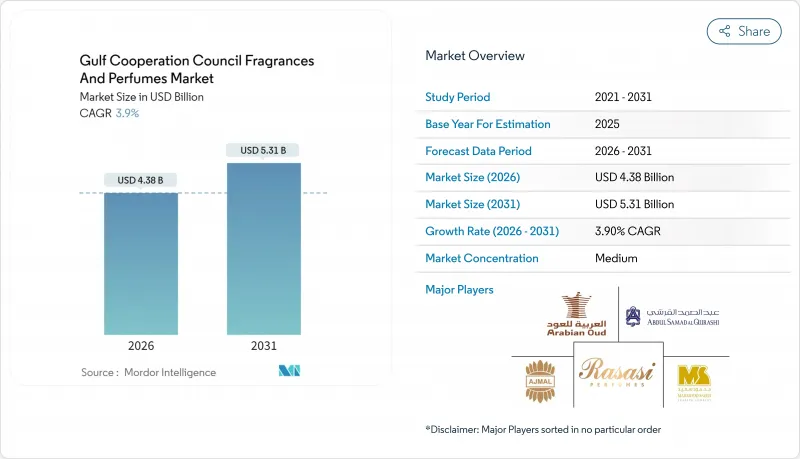

Gulf Cooperation Council Fragrances And Perfumes - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The GCC fragrances and perfumes market was valued at USD 4.22 billion in 2025 and estimated to grow from USD 4.38 billion in 2026 to reach USD 5.31 billion by 2031, at a CAGR of 3.90% during the forecast period (2026-2031).

Rooted in cultural heritage, the Gulf Cooperation Council (GCC) fragrance market is now a canvas of modern luxury and innovation. Once dominated by traditional oriental scents, the region's perfume industry has seamlessly woven Eastern and Western influences, crafting unique signature fragrances. The market's structure underscores this evolution: while Arabian Oud remains a frontrunner, there's a clear nod to contemporary trends, showcasing a blend of tradition and modernity. Retail innovations and experiential marketing strategies are reshaping the market landscape. Take, for instance, Gucci's pop-up store at the iconic Burj Al Arab, where patrons are treated to an immersive luxury fragrance shopping journey. In a similar vein, the UAE's premium brand Lecmo unveiled 'The Blue' collection, merging traditional elements with a modern touch. As consumer preferences tilt towards premium and artisanal fragrances, there's a burgeoning demand for unique, personalized scent experiences. This trend was palpable at a major perfume exhibition in Riyadh, which showcased over 200 regional and international brands. The event served as a launchpad for new products and custom fragrance creations, underscoring the industry's pivot towards sophistication and personalization in response to evolving consumer tastes. Retail strategies are evolving, with celebrity collaborations taking center stage to bolster brand visibility and deepen consumer engagement. For example, Paris Hilton's "Ruby Rush" perfume debut at Debenhams in the Mall of the Emirates, where she made a personal appearance, signing units.

Gulf Cooperation Council Fragrances And Perfumes Market Trends and Insights

Rising Demand for Halal, Niche, Artisanal, and Traditional Arabian Fragrances

The GCC fragrance market is witnessing a robust surge, fueled by a renewed appetite for halal, niche, artisanal, and traditional Arabian perfumes. This trend underscores a profound cultural affinity for scents, as consumers gravitate towards products that echo their heritage and personal identity. In 2024, FARIDAH, a brand spearheaded by Faridah F. Ajmal, made its debut in Dubai. The brand's ELEMENTS and Maktub collections spotlight natural ingredients, artisanal craftsmanship, and halal formulations. For example, the ELEMENTS line, inspired by Fire, Earth, Water, and Air, crafts unique scents that resonate with consumers seeking genuine and ethically sourced fragrances. This strategy highlights a pronounced shift towards products that mirror cultural and ethical values. In a similar vein, Saudi Arabian brand Al Dakheel Oud marries traditional perfumery with a contemporary twist. In 2024, it unveiled Abeek, a fragrance melding spicy notes with grapefruit, rose, incense, and cashmere wood. By engaging in regional showcases like the Kuwait International Perfume Exhibition, Al Dakheel Oud bolstered its presence in the GCC, appealing to consumers who cherish authentic Arabian scents with modern nuances. This heightened emphasis on halal, artisanal, and culturally attuned fragrances is redefining consumer preferences in the GCC.

Perfumes Endorsed as Gifting Options

In the GCC, the fragrances and perfumes market is witnessing a surge, largely driven by the trend of positioning perfumes as premium gifting options. Luxury perfumes, once seen as personal indulgences, are now increasingly viewed by consumers as thoughtful and prestigious gifts, especially during special occasions and celebrations. Brands and retailers are capitalizing on this shift, launching targeted campaigns and limited-edition releases to promote gifting. For example, My Perfumes unveiled special Eid collections with enticing promotional deals, directly catering to consumers in search of ready-made gifts. In a similar vein, Gallivant rolled out its Gulf Collection, explicitly branded for gifting, drawing in customers desiring regionally inspired premium gifts. V Perfumes, seizing the moment during cultural events like Youm Al-Otoor, presented exclusive gifts and promotions, encouraging purchases for loved ones. Such strategic moves not only bolster brand visibility but also broaden the market by tapping into the celebratory and gifting-driven consumption. By synchronizing product launches with pivotal cultural and social events, fragrance brands are not just creating opportunities for repeat purchases but are also reinforcing consumer loyalty. This emphasis on gifting is reshaping buying behaviors, transforming what were once seasonal demand spikes into consistent market growth opportunities.

High Penetration of Counterfeit Perfumes

Counterfeit perfumes are significantly hampering the growth of the GCC fragrances and perfumes market. These fakes not only erode consumer trust but also divert spending away from legitimate brands. When consumers encounter low-quality counterfeit products, they often mistakenly attribute issues like poor fragrance longevity or inconsistent scent profiles to premium brands. This misassociation discourages repeat purchases and diminishes overall market confidence. The challenge is especially pronounced in major retail hubs and online marketplaces, where counterfeit products are rampant. Recent enforcement actions highlight the magnitude of the problem. The Saudi Authority for Intellectual Property (SAIP) spearheaded a significant crackdown on counterfeit goods, targeting 61 businesses in Riyadh, Jeddah, and Dammam. They seized over 23,000 counterfeit cosmetics, perfumes, and fashion items . Such interventions underscore the widespread nature of counterfeiting in the region. This not only diminishes legitimate market revenue but also compels brands to heavily invest in anti-counterfeit technologies, authentication measures, and consumer awareness campaigns. The rise of counterfeit perfumes is steering consumer behavior towards caution. This shift reduces the willingness to invest in high-end or niche fragrances, thereby limiting the growth potential of premium segments. Without stronger enforcement and heightened consumer education, the market's aspirations in the GCC remain stunted.

Other drivers and restraints analyzed in the detailed report include:

- Increased Demand for Luxury and Ultra-Luxury Perfumes

- Increase in Tourism and Duty-Free Shopping

- Market Saturation and Intense Competition

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

In 2025, Eau de Parfum dominates the market with a commanding 64.72% share, underscoring a clear consumer preference for its concentrated formulations. These offer enhanced longevity and sillage, particularly suited to the GCC's climate. Brands are keenly attuning their offerings to these regional tastes. For example, Floris London rolled out Middle East-exclusive Eau de Parfum variants, infusing amber, woody amber, and frankincense to amplify depth and longevity. In a similar vein, Ajmal Perfumes curates premium Eau de Parfum collections, delivering intense, enduring scents tailored for the region's luxury-seeking clientele.

Eau de Toilette is on the rise, charting the fastest growth with a projected 4.62% CAGR from 2026 to 2031. This surge is largely fueled by younger consumers gravitating towards lighter, versatile fragrances ideal for daily wear and layering. Meanwhile, categories like Eau de Cologne, along with traditional formats such as concentrated perfume oils (CPO) and attars, continue to cater to niche demands and cultural inclinations. Across these segments, product innovation is thriving, spotlighting hybrid formulations. These blends marry Western techniques with Arabian ingredients. A prime example is Gallivant's Gulf Collection, which showcases citrus-enhanced and oud-vanilla accords, presenting contemporary takes on classic scents that resonate with both casual users and dedicated fragrance aficionados.

Luxury fragrances dominate the GCC fragrances and perfumes market with 80.78% share in 2025 and lead growth with a 4.95% CAGR (2026-2031), reflecting strong consumer preference for high-quality, prestigious scent experiences. Cultural values associating fragrance with status, hospitality, and personal identity drive sustained demand for premium and artisanal offerings. Brands are tailoring their portfolios to meet these expectations; for example, Chalhoub Group's exclusive distribution of Roberto Cavalli fragrances across the UAE, Bahrain, Kuwait, Saudi Arabia, and Egypt highlights the alignment between global luxury houses and regional consumer demand. Similarly, Gallivant's Gulf Collection and Ajmal Perfumes' luxury lines provide long-lasting, signature scents, blending traditional Arabian ingredients with contemporary perfumery, catering to the region's discerning clientele.

Mass-market fragrances maintain a presence through value-oriented SKUs and discovery sets, enabling trial and entry-level access while serving younger, price-conscious consumers exploring fragrance preferences. This segment focuses on lighter, versatile options suitable for daily wear, layering, and introductory experiences, allowing consumers to explore scents without committing to high-end products. Retailers leverage promotions, gift sets, and accessible packaging to drive adoption and trial among emerging consumers, supporting gradual market growth in this segment.

The GCC Fragrances and Perfumes Market Report is Segmented by Category (Mass, Luxury), Product Type (Eau De Parfum, Eau De Toilette, and More), End User (Women, Men, Unisex), Formulation (Natural, Synthetic), Distribution Channel (Supermarkets/Hypermarkets, Specialty Stores, and More), and Geography (Saudi Arabia, United Arab Emirates, and More). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Rasasi Perfumes Industry LLC

- Arabian Oud Company

- Abdul Samad Al Qurashi Company Ltd.

- Ajmal Perfumes LLC

- Mahmood Saeed Group

- Al Haramain Perfumes Group of Companies

- Lattafa Perfumes LLC

- Swiss Arabian Perfumes Group

- Nabeel Perfumes Group of Companies

- Surrati Perfume Factory Ltd.

- Sterling Perfumes Industries LLC (Armaf)

- Amouage SAOC

- LVMH Moet Hennessy Louis Vuitton SE

- Chanel S.A.

- Al Majed for Oud Company

- The Estee Lauder Companies Inc.

- Puig S.L.

- Coty Inc.

- L'Oreal S.A.

- Ahmed Al Maghribi Perfumes

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Demand for Halal, Niche, Artisanal, and Traditional Arabian Fragrances

- 4.2.2 Aggressive Marketing and Strategic Investments by Key Players

- 4.2.3 Perfumes Endorsed as Gifting Options

- 4.2.4 Increased Demand for Luxury and Ultra-Luxury Perfumes

- 4.2.5 Increase in Tourism and Duty-Free Shopping

- 4.2.6 Growing Demand for Organic, Natural, and Sustainably Sourced Fragrances

- 4.3 Market Restraints

- 4.3.1 High Penetration of Counterfeit Perfumes

- 4.3.2 Strict Regulations and Compliance Requirements

- 4.3.3 Market Saturation and Intense Competition

- 4.3.4 Rising Costs of Raw Materials and Sustainable Ingredients

- 4.4 Consumer Behavior Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers/Consumers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Product Type

- 5.1.1 Eau de Parfum

- 5.1.2 Eau de Toilette

- 5.1.3 Eau de Cologne

- 5.1.4 Others

- 5.2 By Category

- 5.2.1 Mass

- 5.2.2 Luxury

- 5.3 By End User

- 5.3.1 Women

- 5.3.2 Men

- 5.3.3 Unisex

- 5.4 By Formulation

- 5.4.1 Natural

- 5.4.2 Synthetic

- 5.5 By Distribution Channel

- 5.5.1 Supermarkets/Hypermarkets

- 5.5.2 Specialty Stores

- 5.5.3 Online Retail Stores

- 5.5.4 Others

- 5.6 By Country

- 5.6.1 Saudi Arabia

- 5.6.2 United Arab Emirates

- 5.6.3 Qatar

- 5.6.4 Oman

- 5.6.5 Kuwait

- 5.6.6 Bahrain

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 Rasasi Perfumes Industry LLC

- 6.4.2 Arabian Oud Company

- 6.4.3 Abdul Samad Al Qurashi Company Ltd.

- 6.4.4 Ajmal Perfumes LLC

- 6.4.5 Mahmood Saeed Group

- 6.4.6 Al Haramain Perfumes Group of Companies

- 6.4.7 Lattafa Perfumes LLC

- 6.4.8 Swiss Arabian Perfumes Group

- 6.4.9 Nabeel Perfumes Group of Companies

- 6.4.10 Surrati Perfume Factory Ltd.

- 6.4.11 Sterling Perfumes Industries LLC (Armaf)

- 6.4.12 Amouage SAOC

- 6.4.13 LVMH Moet Hennessy Louis Vuitton SE

- 6.4.14 Chanel S.A.

- 6.4.15 Al Majed for Oud Company

- 6.4.16 The Estee Lauder Companies Inc.

- 6.4.17 Puig S.L.

- 6.4.18 Coty Inc.

- 6.4.19 L'Oreal S.A.

- 6.4.20 Ahmed Al Maghribi Perfumes

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK