PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910846

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910846

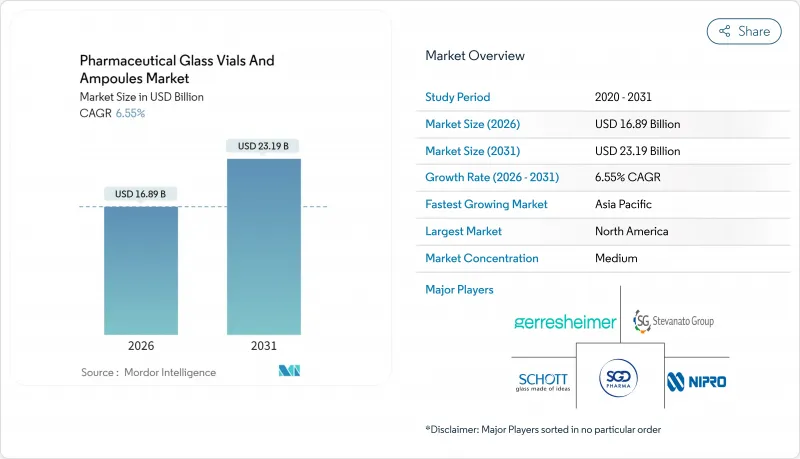

Pharmaceutical Glass Vials And Ampoules - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

pharmaceutical glass vials and ampoules market size in 2026 is estimated at USD 16.89 billion, growing from 2025 value of USD 15.85 billion with 2031 projections showing USD 23.19 billion, growing at 6.55% CAGR over 2026-2031.

Robust fundamentals including expanding biologics pipelines, demanding cold-chain requirements for mRNA therapeutics, and global serialization mandates continue to favor glass over polymer alternatives. Type I borosilicate retains primacy because its chemical inertness and thermal stability safeguard high-value injectables from leachables and breakage. Technology upgrades such as ready-to-use (RTU) sterile platforms lower contamination risk and trim fill-finish cycle times, strengthening supplier pricing power. Regionally, Asia-Pacific registers outsized capital inflows into vial manufacturing, while North America's stringent FDA standards solidify its dominant share position. Competitive intensity remains moderate, with leaders funneling investment into surface-coating science, hydrogen-fired furnaces, and automated visual inspection to defend margins in an otherwise cost-sensitive environment.

Global Pharmaceutical Glass Vials And Ampoules Market Trends and Insights

Post-pandemic Vaccine Pipeline Boosts Vial Demand

Global vaccine development no longer tapers after seasonal campaigns; instead, multi-pathogen programs targeting RSV, malaria, and combination boosters are expanding. Capacity additions such as SCHOTT's USD 1.13 billion upgrade elevate small-volume Type I production to meet multi-dose presentation needs. Regulators insist on final-container stability testing from Phase I onward, lifting glass consumption per program by roughly 40%. Pediatric formulations often specify 2 mL and 5 mL vials, accentuating demand for dimensional accuracy and stringent particulate thresholds. These dynamics collectively reinforce a secular uplift in core vial volumes despite intermittent procurement pauses once pandemic stockpiles normalize.

Biologics Shift Toward Chemically Inert Borosilicate

Large-molecule pipelines demand containers that resist alkali leaching and surface reactivity. FDA guidance released in 2024 underscores compatibility testing protocols that implicitly steer developers toward Type I borosilicate. Stevanato's EZ-fill platform reduces extractables below 1 ppm, a threshold attractive to biosimilar launches where process comparability is scrutinized. The financial calculus is direct: a single product recall can erase USD 50 million in finished-goods value, making higher unit-price glass a rational hedge against stability failures. Consequently, borosilicate suppliers preserve premium pricing even while polymer containers nibble away at low-risk, commodity fills.

Polymer Vials Cannibalising Commodity Glass Share

Cyclic olefin polymer containers such as West's Crystal Zenith line secure orders for diagnostic reagents and early-phase biologics, where break-resistance and flexible lead times outrank lifetime compatibility. Unit economics favor polymers by 20-30% once handling losses and secondary packaging are tallied. Although FDA compatibility hurdles deter polymer uptake for commercial therapeutics, high-volume, lower-risk segments remain vulnerable to substitution. Suppliers of standard blown V-ials therefore experience volume compression at the low end, prompting a strategic pivot toward higher-margin, coated or RTU formats.

Other drivers and restraints analyzed in the detailed report include:

- Sustainability and Recyclability Regulations Favour Glass

- RFID-Serialisation Mandates for Colour-Coded Ampoules

- Fragility/Breakage Recalls Increase Risk-Mitigation Cost

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Type I borosilicate retained 64.71% of 2025 revenues, underscoring its entrenched regulatory acceptance and vast stability data bank. The pharmaceutical glass vials and ampoules market size attributed to this material outpaces all other substrates because risk-averse drug makers prioritize known performance envelopes when filing new applications. Hybrid and coated variants, however, deliver the fastest 7.4% CAGR as gene-therapy payloads push extractable allowances ever lower. SCHOTT's Everic series demonstrates how plasma-enhanced surfaces reduce particle generation, a metric increasingly scrutinized under USP <790> guidelines. As litigation costs soar, procurement teams weigh the premium of enhanced glass against the catastrophic downside of biologic batch failures, creating a price-in-elastic niche where quality trumps unit economics. Soda-lime glass-types II and III-survive mostly in legacy, small-molecule injectables and diagnostic reagents, but their share steadily erodes in favor of higher-grade materials. Aluminum-silicate formulations remain niche, reserved for extreme thermal-shock scenarios such as freeze-drying of high-value oncology APIs.

Across a five-year horizon, analysts expect borosilicate to retain a majority stake yet cede incremental share to surface-engineered hybrids designed for high-pH viral vector suspensions. Supplier investments in hydrogen-assisted furnaces and electric melting reduce the carbon intensity gap between material classes, accommodating ESG-driven sourcing mandates. Early-adopter CDMOs are bundling container specification counseling into tech-transfer packages, effectively locking in hybrid glass at the process-validation stage and cementing multiyear demand visibility for premium grades.

Vaccines accounted for 45.88% of 2025 unit demand, undergirded by ongoing pediatric immunization and emerging travel-health indications. Given volume predictability, vial formats have converged on standardized neck dimensions facilitating interchangeable stoppers and automated filling lines. Meanwhile, biologics and biosimilars claim the highest 8.09% growth trajectory, fueled by monoclonal antibody launches post-patent cliff. Here, the pharmaceutical glass vials and ampoules market share shifts toward smaller fill volumes that mitigate wastage for high-price therapies. RTU nest-and-tub formats resonate with biologics lines operating in multiproduct facilities, offering rapid changeovers that boost overall equipment effectiveness.

Small-molecule injectables preserve relevance where drug stability, not packaging, constrains shelf life; however, rising adoption of auto-injectors and prefilled syringes gradually siphons volume from traditional vials. Insulin maintains steady throughput thanks to entrenched cold-chain infrastructure, but continuous-delivery devices are beginning to recalibrate container demand forecasts. Diagnostic reagents, although cost-sensitive, continue to specify glass where solvent polarity or buffered media attack polymer walls, ensuring a residual baseline volume even amid polymer advances.

The Pharmaceutical Glass Vials and Ampoules Market Report is Segmented by Material Type (Type I Borosilicate Glass, Type II/III Soda-Lime Glass and More), Application (Vaccines, Insulin and More), End User (Pharmaceutical Manufacturers, Biotechnology Companies and More), Manufacturing Technology (Tubular Glass Forming, Moulded Glass Forming and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America retained 38.92% of 2025 revenues, buoyed by expansive biologics capacity, Biologics License Application pipelines, and the FDA's strict container-closure protocols that privilege Type I borosilicate. Canada's federal bio-manufacturing initiative adds incremental demand, reinforcing regional supply commitments with multi-year offtake agreements. The pharmaceutical glass vials and ampoules market size in Asia-Pacific, while smaller in absolute terms, grows at a 9.02% CAGR on the back of Chinese GMP enhancements and Indian production-linked incentives that subsidize furnace modernization. Contract packagers in South Korea and Singapore lure global brands with competitively priced RTU offerings that meet ICH standards, trimming lead times into Japan and Australia.

Europe commands robust share underpinned by legacy manufacturers and a strong sustainability framework; yet rising carbon-credit costs pressure margins, nudging procurement to evaluate mixed sourcing models tapping Thai and Indonesian plants for commodity volumes. Latin America benefits from near-shoring strategies by U.S. pharma, particularly in Mexico where USMCA trade provisions smooth customs hurdles for vial supply. The Middle East and Africa remain nascent but strategic, with Gulf Cooperation Council nations funding vaccine fill-finish hubs that stipulate local content thresholds, foreshadowing fresh regional demand for primary containers. Collectively, geographic diversification mitigates single-region disruption risk, but it forces suppliers to harmonize quality systems across heterogeneous regulatory landscapes. Multisite qualification emerges as a decisive criterion in request-for-proposal scoring, pushing small regional producers to partner or consolidate.

- SCHOTT AG

- Gerresheimer AG

- Stevanato Group S.p.A.

- Nipro Corporation

- SGD S.A. (SGD Pharma)

- Corning Incorporated

- Bormioli Pharma S.p.A.

- Stoelzle Oberglas GmbH

- Accu-Glass LLC

- APPL Solutions Pvt Ltd

- Shandong Pharmaceutical Glass Co., Ltd

- Chongqing Zhengchuan Pharmaceutical Packaging Co., Ltd

- Cangzhou Four Star Glass Co., Ltd

- Origin Pharma Packaging Ltd

- DWK Life Sciences GmbH

- West Pharmaceutical Services Inc.

- Sisecam Cambalkon Sanayi A.S.

- Stoelzle Glass Group

- Ardagh Group S.A.

- Beatson Clark Ltd

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Post-pandemic vaccine pipeline boosts vial demand

- 4.2.2 Biologics shift toward chemically inert borosilicate

- 4.2.3 Sustainability and recyclability regulations favour glass

- 4.2.4 RFID-serialisation mandates for colour-coded ampoules

- 4.2.5 mRNA cold-chain needs ultra-low expansion glass

- 4.3 Market Restraints

- 4.3.1 Polymer vials cannibalising commodity glass share

- 4.3.2 Fragility/breakage recalls increase risk-mitigation cost

- 4.3.3 Sodium-ion leaching in high-pH gene-therapy fills

- 4.3.4 Energy-intensive furnaces face carbon-pricing pressure

- 4.4 Industry Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porters Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

- 4.8 Impact of Macroeconomic Factors on the Market

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Material Type

- 5.1.1 Type I Borosilicate Glass

- 5.1.2 Type II/III Soda-Lime Glass

- 5.1.3 Aluminum-Silicate Glass

- 5.1.4 Hybrid / Surface-Coated Glass

- 5.2 By Application

- 5.2.1 Vaccines

- 5.2.2 Insulin

- 5.2.3 Biologics and Biosimilars

- 5.2.4 Small-Molecule Injectables

- 5.2.5 Diagnostic Reagents

- 5.3 By End User

- 5.3.1 Pharmaceutical Manufacturers

- 5.3.2 Biotechnology Companies

- 5.3.3 CDMOs / CMOs

- 5.3.4 Research and Academic Laboratories

- 5.3.5 Hospitals and Clinics

- 5.4 By Manufacturing Technology

- 5.4.1 Tubular Glass Forming

- 5.4.2 Moulded Glass Forming

- 5.4.3 Ready-to-Use (RTU) Sterile

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Chile

- 5.5.2.4 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 India

- 5.5.4.4 South Korea

- 5.5.4.5 Australia

- 5.5.4.6 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 Saudi Arabia

- 5.5.5.1.2 United Arab Emirates

- 5.5.5.1.3 Turkey

- 5.5.5.1.4 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Nigeria

- 5.5.5.2.3 Kenya

- 5.5.5.2.4 Rest of Africa

- 5.5.5.1 Middle East

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, Recent Developments)

- 6.4.1 SCHOTT AG

- 6.4.2 Gerresheimer AG

- 6.4.3 Stevanato Group S.p.A.

- 6.4.4 Nipro Corporation

- 6.4.5 SGD S.A. (SGD Pharma)

- 6.4.6 Corning Incorporated

- 6.4.7 Bormioli Pharma S.p.A.

- 6.4.8 Stoelzle Oberglas GmbH

- 6.4.9 Accu-Glass LLC

- 6.4.10 APPL Solutions Pvt Ltd

- 6.4.11 Shandong Pharmaceutical Glass Co., Ltd

- 6.4.12 Chongqing Zhengchuan Pharmaceutical Packaging Co., Ltd

- 6.4.13 Cangzhou Four Star Glass Co., Ltd

- 6.4.14 Origin Pharma Packaging Ltd

- 6.4.15 DWK Life Sciences GmbH

- 6.4.16 West Pharmaceutical Services Inc.

- 6.4.17 Sisecam Cambalkon Sanayi A.S.

- 6.4.18 Stoelzle Glass Group

- 6.4.19 Ardagh Group S.A.

- 6.4.20 Beatson Clark Ltd

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-Space and Unmet-Need Assessment