PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910848

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910848

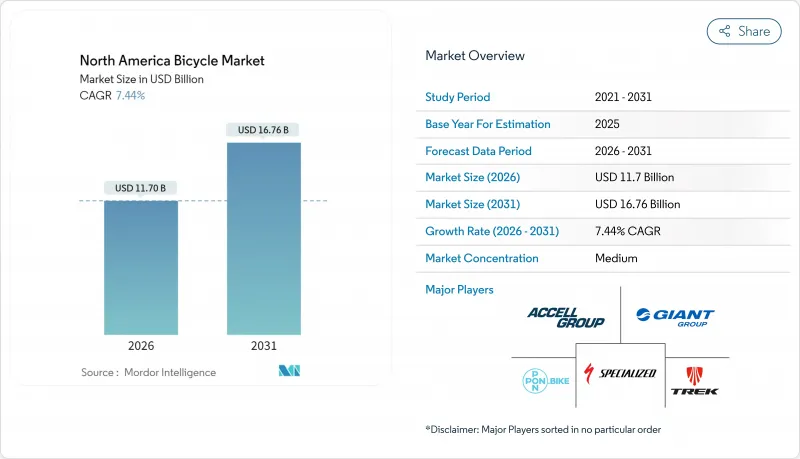

North America Bicycle - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

North American bicycle market size in 2026 is estimated at USD 11.7 billion, growing from 2025 value of USD 10.89 billion with 2031 projections showing USD 16.76 billion, growing at 7.44% CAGR over 2026-2031.

Public-sector investments, corporate ESG procurement, and supply-chain near-shoring are driving this optimistic outlook. In the U.S., a notable USD 44.5 million allocation for active transportation underscores the visibility of demand, supporting infrastructure development and encouraging the adoption of bicycles as a sustainable mode of transport. Companies adhering to science-based climate targets are increasingly adopting bicycle fleets to reduce Scope 3 emissions, which include indirect emissions from their supply chains and product use. This trend is significantly contributing to the growth of the North American bicycle market by adding institutional demand. Meanwhile, the rise of battery-as-a-service models is alleviating ownership costs by offering flexible subscription-based solutions for battery usage, making electric bicycles more accessible to consumers. This innovation is helping the North American bicycles market stay robust as the initial pandemic-driven enthusiasm for cycling normalizes. Additionally, assembly hubs in Mexico are shortening lead times and reducing tariff exposure, providing manufacturers with new cost advantages. These hubs not only enhance operational efficiency but also strengthen the region's position as a competitive manufacturing base, reinforcing long-term competitiveness in the market.

North America Bicycle Market Trends and Insights

Urban-mobility funding programs drive infrastructure-led demand

In North America, the bicycle market thrives not just on consumer enthusiasm but significantly on robust infrastructure grants. Under the U.S. Infrastructure Investment and Jobs Act, a notable USD 44.5 million is allocated for active-transportation projects in 2025, focusing on protected lanes, greenways, and shared-mobility hubs. These projects aim to enhance urban mobility, reduce traffic congestion, and promote environmentally sustainable transportation options. Canada bolsters this initiative with its USD 400 million Active Transportation Fund, designating USD 19 million specifically for British Columbia. This fund supports the development of bike-friendly infrastructure, including dedicated cycling paths and pedestrian-friendly zones, to encourage active commuting. States, too, play a pivotal role; for instance, California is channeling a substantial USD 930 million over four years into bike and pedestrian corridors. This investment is expected to significantly improve connectivity and safety for cyclists and pedestrians alike. Such comprehensive investments elevate bicycles to the status of quasi-infrastructure assets, with municipal agencies and corporate fleets acquiring them on a predictable basis. As these transportation networks evolve, the North American bicycle market sees consistent demand, driven by replacement programs, fleet expansions, and maintenance contracts, all synchronized with public budgeting timelines.

Micro-mobility subscription platforms reshape urban transportation

Subscription services are making premium hardware more accessible and generating steady revenue streams. These services lower the financial barrier for consumers, enabling them to access high-quality products without significant upfront costs. In major U.S. cities, micromobility operators are now logging over 150 million annual rides, a clear sign of mainstream acceptance and growing reliance on shared mobility solutions. Cities are increasingly incorporating e-bike sharing into their strategies to combat congestion and reduce emissions, steering commuters away from single-occupancy vehicles and promoting sustainable urban transportation. This shift allows bicycle manufacturers to transition from unpredictable one-time sales to stable multi-year leasing contracts, bolstering their cash flow and creating predictable revenue models. As a result, there's a consistent influx of refurbished units into well-managed second-life channels, not only extending product life but also bolstering sustainability narratives that appeal to ESG investors. These second-life channels ensure that refurbished products are efficiently utilized, reducing waste and aligning with environmental goals.

Bike-theft insurance gaps undermine urban adoption

Active riders face annual theft rates of about 4.2%, leading to losses of USD 1.4 billion. Coverage for these losses is inconsistent; many property insurers exclude bicycles valued over USD 1,000, unless policyholders opt for expensive riders. This lack of coverage disproportionately impacts lower-income neighborhoods, where higher theft risks create significant barriers to bicycle ownership and use. These barriers prevent public agencies from effectively serving key demographics, limiting the potential for equitable market growth. The challenge is particularly severe in the electric bicycle segment, where retail prices start at USD 2,000, making them even less accessible to vulnerable groups. Without broader insurance offerings or city investments in secure parking infrastructure, theft concerns will continue to undermine consumer confidence and hinder the growth of North America's bicycle market.

Other drivers and restraints analyzed in the detailed report include:

- OEM manufacturing investments in Mexico create supply-chain alternatives

- ESG-driven corporate fleet procurement institutionalizes demand

- Component supply-chain fragility creates production bottlenecks

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

In 2025, mountain and all-terrain bikes command a 35.02% share of the North American bicycle market, fueled by a surge in consumer enthusiasm for outdoor escapades and off-road cycling. Bolstered by trail-building grants and investments, this segment has broadened accessible riding zones, amplifying mountain biking's allure across diverse demographics. Enthusiasts, drawn to the rugged versatility and durability of these bikes, prioritize performance on challenging terrains. As riders increasingly seek premium frames, advanced suspension systems, and specialized trail accessories, discretionary spending on mountain bikes remains strong. Manufacturers are fine-tuning product lines, emphasizing a balance between strength and weight to align with shifting rider demands. While other categories gain traction, mountain bikes retain a devoted following, solidifying their status as a primary revenue source for leading bicycle brands.

Hybrid bicycles are set to outstrip all other categories, boasting a projected CAGR of 7.62%, positioning them as North America's fastest-growing segment. This surge is driven by a rising tide of commuters and leisure riders gravitating towards versatile bikes adept on both paved and unpaved surfaces. Infrastructure advancements, like the melding of protected lanes with gravel connectors, empower hybrid riders to navigate diverse terrains without the hassle of switching bikes. With their blend of comfort, durability, and adaptability, hybrids cater perfectly to urban riders prioritizing practicality. In response, top manufacturers are refining product ranges and channeling research and development into crafting frames that strike a balance between sturdiness and lightweight design. As hybrids cement their status as the market's utility cornerstone, their ascent underscores a broader consumer shift towards versatile mobility and active living.

In 2025, regular bike frames command a dominant 92.05% share of total shipments. Their established diamond geometries ensure consistent ride comfort and easy maintenance. These traditional designs, favored in both leisure and sports cycling, boast straightforward constructions. This simplicity translates to affordability, making regular frames particularly attractive to first-time buyers, families, and casual riders. Manufacturers are honing in on the delicate balance of durability, weight, and cost, ensuring these bikes remain widely accessible. The ready availability of spare parts and familiar repair processes further bolsters their popularity across diverse markets. In essence, regular frame bikes stand as the cornerstone of the North American bicycle market, celebrated for their versatility in both recreational and sporting arenas.

Folding bikes are emerging as the market's fastest-growing segment, boasting a robust projected CAGR of 9.86%. This surge is largely fueled by urban centers grappling with space constraints. Their compact, portable design caters perfectly to apartment dwellers and those navigating multi-modal commutes in bustling cities. Major metropolitan transit authorities, including those in New York, Toronto, and Vancouver, have relaxed restrictions on carrying folding bikes during peak hours, further bolstering their appeal in public transport. While they currently hold a modest slice of the North American market, folding bikes are witnessing a notable uptick as urban residents hunt for convenient mobility solutions. A notable trend sees weekday commuters opting for folding bikes for practical travel, then transitioning to regular or electric bikes for leisurely weekend rides, highlighting a growing trend of dual ownership. This adaptability accentuates folding bikes' pivotal role in navigating urban mobility challenges and aligning with modern lifestyle preferences.

The North America Bicycle Market Report Segments the Industry Into Type (Road Bicycles, Hybrid Bicycles, All-Terrain/Mountain Bicycles, E-Bicycles, Other Types), Distribution Channel (Offline Retail Stores, Online Retail Stores), and Geography (United States, Canada, Mexico, Rest of North America). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Trek Bicycle Corporation

- Specialized Bicycle Components

- Giant Manufacturing Co.

- Accell Group (Raleigh, Haibike)

- Cannondale (Cycling Sports Group)

- Pon Bike (Santa Cruz, Gazelle)

- Schwinn (Pacific Cycle)

- Rad Power Bikes

- Lectric eBikes

- Aventon

- Mongoose

- Diamondback

- Marin Bikes

- Salsa Cycles

- QuietKat

- Serial 1 (Harley-Davidson)

- Propella

- Ride1Up

- Juiced Bikes

- Brompton Bicycle

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Urban-mobility funding programs drive infrastructure-led demand

- 4.2.2 Micro-mobility subscription platforms reshape urban transportation

- 4.2.3 OEM manufacturing investments in Mexico create supply-chain alternatives

- 4.2.4 ESG-driven corporate fleet procurement institutionalizes demand

- 4.2.5 Battery-as-a-service models lowering e-bike TCO

- 4.2.6 Fitness trends increase the popularity of cycling activities

- 4.3 Market Restraints

- 4.3.1 Bike-theft insurance gaps undermine urban adoption

- 4.3.2 Component supply-chain fragility creates production bottlenecks

- 4.3.3 Rising anti-dumping duties on Chinese imports

- 4.3.4 Growing second-hand marketplace cannibalisation

- 4.4 Value/Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Product Type

- 5.1.1 Road/City

- 5.1.2 Mountain/All-Terrain

- 5.1.3 Hybrid

- 5.1.4 E-Bicycle

- 5.1.5 Other Types

- 5.2 By Design

- 5.2.1 Regular

- 5.2.2 Folding

- 5.3 By End User

- 5.3.1 Men

- 5.3.2 Women

- 5.3.3 Kids

- 5.4 By Distribution Channel

- 5.4.1 Online Retail Stores

- 5.4.2 Offline Retail Stores

- 5.5 By Geography

- 5.5.1 United States

- 5.5.2 Canada

- 5.5.3 Mexico

- 5.5.4 Rest of North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Trek Bicycle Corporation

- 6.4.2 Specialized Bicycle Components

- 6.4.3 Giant Manufacturing Co.

- 6.4.4 Accell Group (Raleigh, Haibike)

- 6.4.5 Cannondale (Cycling Sports Group)

- 6.4.6 Pon Bike (Santa Cruz, Gazelle)

- 6.4.7 Schwinn (Pacific Cycle)

- 6.4.8 Rad Power Bikes

- 6.4.9 Lectric eBikes

- 6.4.10 Aventon

- 6.4.11 Mongoose

- 6.4.12 Diamondback

- 6.4.13 Marin Bikes

- 6.4.14 Salsa Cycles

- 6.4.15 QuietKat

- 6.4.16 Serial 1 (Harley-Davidson)

- 6.4.17 Propella

- 6.4.18 Ride1Up

- 6.4.19 Juiced Bikes

- 6.4.20 Brompton Bicycle

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK