PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910860

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910860

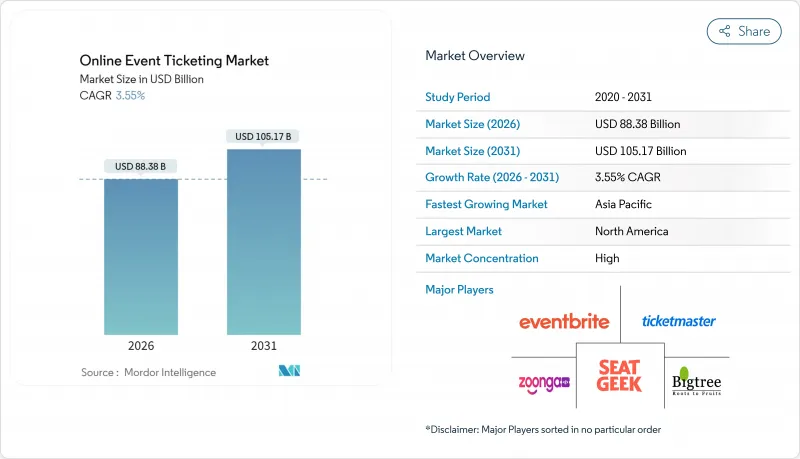

Online Event Ticketing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

Online event ticketing market size in 2026 is estimated at USD 88.38 billion, growing from 2025 value of USD 85.35 billion with 2031 projections showing USD 105.17 billion, growing at 3.55% CAGR over 2026-2031.

This expansion occurs in a digital ecosystem where mobile-first shopping, premium add-ons, and AI-driven pricing anchor revenue streams, while antitrust scrutiny and fee-transparency mandates restrain margin upside. Mobile devices already account for 58.95% of total transactions, and their 4.65% CAGR underscores how 5G coverage, digital wallets, and social discovery reinforce friction-free purchases. Music concerts and festivals regained momentum after pandemic disruption and now command 36.73% of 2024 revenue, bolstered by international tours and fans' willingness to pay for immersive experiences. North America maintains the largest regional presence at 38.76% 2024 share, yet Asia Pacific generates the fastest trajectory at 3.99% CAGR, due to widespread smartphone adoption and real-time payment rails. Competitive intensity rises as SeatGeek and regional specialists deploy AI pricing, NFT authentication, and vertically integrated offerings to chip away at incumbency advantages held by Ticketmaster, CTS Eventim, and StubHub.

Global Online Event Ticketing Market Trends and Insights

Proliferation of High-Speed Mobile Internet and 5G Adoption

Expanding 5G networks make real-time bidding, location-based pricing, and instant confirmation possible, boosting conversion during peak sales windows. Affordable 5G handsets open untapped consumer strata, especially across Southeast Asia, where many users leapfrog desktops entirely. Global 5G connections hit 1.7 billion in 2024, with Asia Pacific supplying 61% of new lines.Faster speeds support richer multimedia listings that heighten user engagement and spur impulse buys. Event organizers overlay AI engines on live network data to micro-segment audiences and optimize seat pricing minute-by-minute. The linkage between high-bandwidth access and flexible payment APIs has already trimmed cart-abandon rates, strengthening platform ROI.

Rising Smartphone Penetration in Emerging Economies

Sub-USD 150 smartphones with in-built biometric security normalize mobile checkouts among first-time buyers in India, Indonesia, and Nigeria. India's Unified Payments Interface alone cleared 13.4 billion transfers worth USD 200 billion in March 2025, underscoring mobile payments' scale. Such ubiquity means users expect one-tap ticket purchases and social-media discovery rather than desktop browsing. Regional event promoters exploit this mobile primacy by marketing directly through messaging super-apps, skipping costly physical distribution. The smartphone wave thus broadens the total addressable base and pulls micro-events, college festivals, and local sports into formal ticket commerce.

Heightened Antitrust and Fee-Transparency Scrutiny

The FTC Junk Fees Rule, effective May 2025, obliges upfront disclosure of all ticket charges, erasing revenue once earned from surprise add-ons. Parallel DOJ litigation contests Live Nation's exclusivity pacts, while U.K. regulators probe secondary-market markup practices. Compliance requires revamped invoicing, user-interface redesign, and legal counsel, inflating overheads just as price ceilings firm. Smaller players initially gain competitive oxygen, but legal ambiguity still deters fresh entrants, tempering aggregate online event ticketing market expansion in the short run.

Other drivers and restraints analyzed in the detailed report include:

- Growth of Live Music and Sports Mega-Events Post-COVID

- Dynamic and AI-Driven Pricing Boosting Organiser ROI

- Cyber-Fraud and Bot Resale Activity

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Music concerts and festivals controlled 36.12% of 2025 revenue, the largest slice of the online event ticketing market size, and are projected to climb 3.92% CAGR to 2031. Season-ticket sports retain loyal bases, but arena capacity caps temper volume gains. Premium cinema formats offer differentiation against streaming, yet remain niche. Comedy, theater, and esports collectively widen demographic reach and bolster weekday seat utilization.

Sustained fan appetite propels pre-sales months ahead of show dates, assisting promoter cash flow. Younger cohorts aged 18-34 pay USD 70 more on average for live acts and attend 1.4 times more frequently than older patrons. Hybrid bundles that grant backstage virtual access or NFT collectibles further inflate yields. Consequently, online event ticketing market demand concentrates around music, even as new genres nurture incremental volume.

Mobile devices accounted for 58.40% of 2025 transactions, the dominant channel within the online event ticketing market size, and are forecast to rise 4.42% CAGR through 2031. Desktop usage contracts as Generation Z favors apps that enable thumbprint authentication and instant wallet pay. Smart-TV ticket buttons emerging inside Netflix or Apple TV trailers illustrate omnichannel convergence.

Real-time inventory alerts, social-media referrals, and geofenced discounts give mobile an engagement edge. Apple Wallet's richer pass features, from venue maps to loyalty stamps, improve entry flow and post-event upselling. Combined with BNPL and crypto acceptance, mobile channels unlock fresh cohorts, cementing their strategic centrality across the online event ticketing market.

The Online Event Ticketing Market Report is Segmented by Event Type (Sports, Music Concerts and Festivals, and More), Platform (Mobile Devices, Desktop/Laptop, and More), Revenue Model (Ticket Face-Value, Service and Convenience Fees, and More), End User (Individual Consumers, Corporate and MICE Clients, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America commanded 38.20% of 2025 global revenue, supported by dense venue networks and high disposable income. Yet saturation and antitrust probes clip upside, nudging platforms to innovate around loyalty ecosystems rather than sheer volume. Hybrid corporate gatherings that marry in-person concerts with virtual streaming gain traction, sustaining ticket flow despite regulatory friction.

Asia Pacific posts the quickest 3.84% CAGR as smartphone usage exceeds 80% in India, Indonesia, and Thailand. UPI alone processed USD 200 billion of March 2025 payments, exemplifying digital wallet maturity. Chinese super-apps integrate discovery, chat, and checkout, setting experiential benchmarks Western rivals strive to emulate. Rising middle-class incomes and government bets on sports tourism, such as Indonesia's MotoGP, extend inventory supply.

Europe maintains moderate gains due to cultural tourism and festival diversity. However, compliance costs climb as each nation tightens consumer protection and fee-disclosure policies. Post-Brexit frictions add foreign-exchange and settlement complexity for U.K.-EU cross-sales. Emerging regions such as Brazil and Saudi Arabia provide upside, contingent on stable macro backdrops and continued investment in broadband and transport links.

- Ticketmaster Entertainment LLC (Live Nation Entertainment Inc.)

- Eventbrite Inc.

- Zoonga

- SeatGeek Inc.

- StubHub Holdings Ltd.

- Viagogo Entertainment Inc.

- Bigtree Entertainment Pvt. Ltd

- TickPick LLC

- AXS (Ticketing)

- CTS Eventim AG and Co. KGaA

- See Tickets (Vivendi)

- TEG Ticketek Pty Ltd

- Vivid Seats Inc.

- Fandango Media LLC

- TicketSpice

- Ticket Tailor

- Cvent Holding Corp.

- Hopin / RingCentral Events

- Oveit (NFT ticketing)

- Tixr Inc.

- Humanitix Ltd.

- ShowClix (Leap Event Technology)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Proliferation of high-speed mobile internet and 5G adoption

- 4.2.2 Rising smartphone penetration in emerging economies

- 4.2.3 Growth of live music and sports mega-events post-COVID

- 4.2.4 Dynamic and AI-driven pricing boosting organiser ROI

- 4.2.5 Blockchain-based NFT tickets enhancing fan engagement

- 4.2.6 Corporate demand for hybrid employee-engagement events

- 4.3 Market Restraints

- 4.3.1 Heightened antitrust and fee-transparency scrutiny

- 4.3.2 Cyber-fraud and bot resale activity

- 4.3.3 Venue exclusivity clauses limiting new entrants

- 4.3.4 Volatile event calendars amid macro shocks

- 4.4 Regulatory Landscape

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Investment and Funding Landscape

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Event Type

- 5.1.1 Sports

- 5.1.2 Music Concerts and Festivals

- 5.1.3 Movies and Cinematic Releases

- 5.1.4 Other Live Shows (Comedy, Theatre, Esports)

- 5.2 By Platform

- 5.2.1 Mobile Devices (Apps and Mobile Web)

- 5.2.2 Desktop / Laptop

- 5.2.3 Smart-TV and OTT Interfaces

- 5.3 By Revenue Model

- 5.3.1 Ticket Face-Value

- 5.3.2 Service and Convenience Fees

- 5.3.3 VIP and Premium Packages

- 5.3.4 Sponsorship-Bundled Passes

- 5.4 By End User

- 5.4.1 Individual Consumers

- 5.4.2 Corporate and MICE Clients

- 5.4.3 Event Organisers and Promoters

- 5.5 By Geography

- 5.5.1 North America

- 5.5.2 South America

- 5.5.3 Europe

- 5.5.4 Asia Pacific

- 5.5.5 Middle East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview...etc.)

- 6.4.1 Ticketmaster Entertainment LLC (Live Nation Entertainment Inc.)

- 6.4.2 Eventbrite Inc.

- 6.4.3 Zoonga

- 6.4.4 SeatGeek Inc.

- 6.4.5 StubHub Holdings Ltd.

- 6.4.6 Viagogo Entertainment Inc.

- 6.4.7 Bigtree Entertainment Pvt. Ltd

- 6.4.8 TickPick LLC

- 6.4.9 AXS (Ticketing)

- 6.4.10 CTS Eventim AG and Co. KGaA

- 6.4.11 See Tickets (Vivendi)

- 6.4.12 TEG Ticketek Pty Ltd

- 6.4.13 Vivid Seats Inc.

- 6.4.14 Fandango Media LLC

- 6.4.15 TicketSpice

- 6.4.16 Ticket Tailor

- 6.4.17 Cvent Holding Corp.

- 6.4.18 Hopin / RingCentral Events

- 6.4.19 Oveit (NFT ticketing)

- 6.4.20 Tixr Inc.

- 6.4.21 Humanitix Ltd.

- 6.4.22 ShowClix (Leap Event Technology)

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment