PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910865

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910865

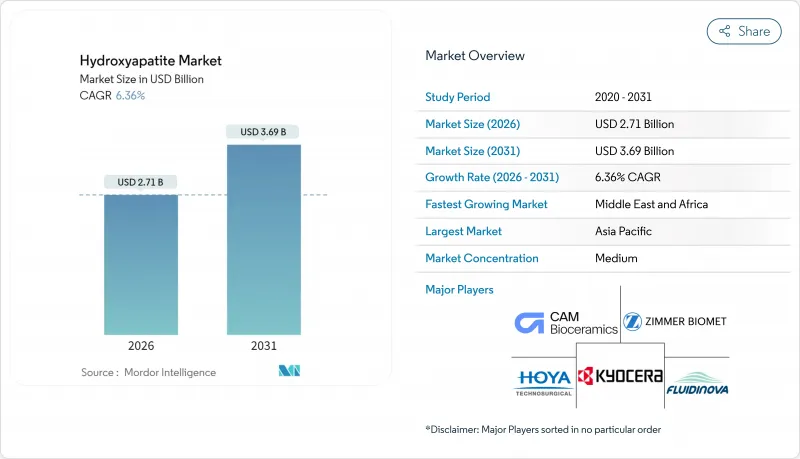

Hydroxyapatite - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

Hydroxyapatite market size in 2026 is estimated at USD 2.71 billion, growing from 2025 value of USD 2.55 billion with 2031 projections showing USD 3.69 billion, growing at 6.36% CAGR over 2026-2031.

This steady trajectory confirms the hydroxyapatite market as an expanding pillar of the broader biomaterials landscape, with growth powered by demographic aging, widening clinical adoption, and rapid gains in nano-scale manufacturing. Demand is reinforced by surgeons' preference for bioactive coatings that cut revision rates, oral-care brands pivoting toward fluoride-free remineralization, and regulators signaling a clear preference for ceramic implants that limit ion release. Competitive momentum intensifies as process innovation lowers production cost and extends material versatility into drug delivery, imaging, and specialty cosmetics. Although reimbursement headwinds and stringent device approvals temper near-term acceleration, the hydroxyapatite market's long-range outlook remains positive as companies align portfolios around personalized medicine and sustainability.

Global Hydroxyapatite Market Trends and Insights

Dental-Implant Boom in Ageing Economies

Age-associated tooth loss in OECD nations is expanding the patient pool for restorative dentistry, and insurers increasingly reimburse single-tooth implants that integrate faster with hydroxyapatite coatings. Clinical registries show 95-98% survival for coated fixtures versus 90-92% for uncoated titanium, a difference that directly lowers revision costs. Lower unit prices, chair-side digital workflows, and wider availability of training courses widen practitioner adoption. As a result, premium coating demand rises even in mid-income segments, supporting higher volumes for nano-enhanced powders used in abutment sprays and socket fillers. U.S. and EU regulators formalized guidance in 2025 that underscores the need for biocompatibility testing; hydroxyapatite consistently clears these hurdles, accelerating supplier contract awards in hospital networks.

Orthopedic Implant Volume Growth

Elective joint reconstruction rebounded in 2024 as outpatient surgery centers overcame pandemic backlogs. Broader use of partial knees, trauma plates, and spinal cages enlarges the overall implant base, and hydroxyapatite-coated surfaces shorten osseointegration time by 20-30% compared with bare titanium, cutting hospitalization days for bundled-payment episodes. APAC contract manufacturers leverage plasma-spray lines to supply global OEMs, creating scale economies. 3D-printed lattices incorporating hydroxyapatite paste further accelerate fixation, particularly in custom femoral stems for younger patients where long-term revision avoidance carries high value.

High Implant Procedure Cost

Premium hydroxyapatite coatings lift implant invoice prices by 15-25%, stretching hospital budgets in emerging markets that rely on out-of-pocket payments. While bundled care in the United States captures long-term savings from lower revision incidence, many payers in Southeast Asia still reimburse on a per-item basis, which limits surgeons' discretion in selecting coated hardware. Training and equipment requirements, such as high-energy plasma guns, add further upfront cost for local manufacturers. Cost headwinds may ease as centralized procurement frameworks incorporate life-cycle assessments that credit avoided revision surgeries, a trend gaining traction in France and Brazil.

Other drivers and restraints analyzed in the detailed report include:

- Biocompatibility Advantage Over Metallic Substitutes

- Government Push for Safer Biomaterials

- Stringent FDA & CE Approvals

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Although micro-sized powders retained 47.65% of the 2025 revenue, nano-grade materials registered a 7.09% CAGR as premium dental and drug-delivery products scaled. Nano-hydroxyapatite enhances protein adsorption, resulting in 35% higher enamel remineralization compared to micro-scale grades in split-mouth trials. Demand is concentrated in Japan, South Korea, and Western Europe, where consumers are willing to pay for functional oral-care claims. In drug delivery, superparamagnetic nano-HAp ferries chemotherapeutics to bone metastases, combining imaging and therapy in a single construct.

Scale-up remains challenging; primary particle aggregation jeopardizes rheology in toothpaste and injectable gels. Fluidinova's proprietary dispersants stabilize sub-100 nm crystals in aqueous media, allowing formulators to hit higher loading levels without viscosity spikes. The nano segment's premium pricing offsets the higher capital costs associated with controlled-atmosphere reactors. Micro-grades retain cost and availability advantages for bulk orthopedic cements, while macro particles continue to be used in load-bearing scaffolds, where mechanical strength takes precedence over surface reactivity.

Synthetic feedstock accounted for 71.85% of 2025 sales, anchored by wet-precipitation and hydrothermal routes that deliver consistent purity essential for implants. Nevertheless, the bio-derived sub-segment is experiencing a 6.83% CAGR driven by its circular-economy appeal. Eggshell and fish-scale precursors yield HAp with porous whisker morphologies that enhance osteoconduction. Coral-derived hydroxyapatite exhibits interconnected canals that facilitate vascular ingrowth, a property that has been documented to increase fusion success in spinal cages by 12 percentage points compared to dense synthetic pellets.

Process variability once deterred surgeons, but new calcination protocols homogenize mineral phases to a stoichiometry of greater than or equal to 99% Ca/P. Certification remains stricter; bio-routes must document trace element levels and zoonotic safety. Yet hospitals deploying green procurement metrics are beginning to prefer bio-sourced cements, particularly in Scandinavia and Canada. Synthetic routes keep dominance in coated knee tibial trays, where batch-to-batch uniformity, color control, and low endotoxin levels are mandatory.

The Hydroxyapatite Market Report is Segmented by Particle Size (Nano-Sized, Micro-Sized, Macro-Sized), Source (Synthetic, Bio-Derived), Form (Powder, Granules, Coatings and Pastes), Application (Dental Care, Orthopedics, Plastic and Cosmetic Surgery, Other Industrial Uses), and Geography (Asia-Pacific, North America, Europe, South America, Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific's leadership stems from a vertically integrated ecosystem that links phosphate mines in China's Hubei province to finishing plants in Shizuoka, Japan. Regional research programs produce steady patent output on nano-dispersion chemistries, underlining competitive superiority. Domestic consumption also rises; China performed nearly 600,000 hip and knee replacements in 2024, up 11% year on year, feeding local powder demand. Japan's aging demographic sustains high implant volumes and premium cosmetic filler uptake, while ASEAN nations ease tariff barriers to import CE-marked dental products.

North American suppliers defend share through FDA classifications that build clinician confidence. U.S. start-ups exploit NIH funding to refine magnetic nano-hydroxyapatite for site-directed oncologic therapies, a frontier application likely to spin off specialized contract manufacturers.

European vendors navigate MDR's clinical-evidence hurdles by forming post-market surveillance consortia to aggregate long-term data. This environment moderates new-entrant pace yet enriches margins for compliant players.

Middle East and Africa outpaces in growth as oil-exporting nations diversify into health tourism. High-spec orthopedic centers in Abu Dhabi import Swiss and U.S. prosthetics, spurring regional distributors to stock consistent powder lots. Turkish private hospitals leverage cost advantage and geographic proximity to Europe, marketing hydroxyapatite-coated spinal systems as a differentiator in medical-tour packages. South American markets adopt hydroxyapatite more cautiously, slowed by currency volatility, though Brazil's ANVISA streamlined device approvals in 2025, unclogging a pipeline of coated dental implants.

- Berkeley Advanced Biomaterials

- Bio-Rad Laboratories

- CAM Bioceramics

- Cerabone (Botiss)

- CGbio

- Clarion Pharmaceutical Co.

- Fluidinova

- Hoya Technosurgical Corporation (HOYA Corporation)

- KYOCERA Corporation

- Medtronic

- Merz North America Inc. (Merz Biomaterials)

- Regenity

- Reneuco Berhad (Granulab Malaysia SDN.BHD)

- SANGI Co. Ltd

- SigmaGraft Biomaterials

- Taihei Chemical Industrial Co. Ltd

- Tomita Pharmaceutical Co. Ltd

- Zimmer Biomet

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Dental-implant boom in ageing economies

- 4.2.2 Orthopedic implant volume growth

- 4.2.3 Biocompatibility advantage over metallic substitutes

- 4.2.4 Government push for safer biomaterials

- 4.2.5 Nano-HAp in premium toothpaste and cosmetics

- 4.3 Market Restraints

- 4.3.1 High implant procedure cost

- 4.3.2 Stringent FDA and CE approvals

- 4.3.3 Competing bio-ceramics (B-TCP, zirconia)

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Intensity of Rivalry

5 Market Size and Growth Forecasts (Value)

- 5.1 By Particle Size

- 5.1.1 Nano-sized

- 5.1.2 Micro-sized

- 5.1.3 Macro-sized (greater than 1 µm)

- 5.2 By Source

- 5.2.1 Synthetic (wet, sol-gel, hydrothermal)

- 5.2.2 Bio-derived (egg-shell, coral, bovine, fish-scale)

- 5.3 By Form

- 5.3.1 Powder

- 5.3.2 Granules

- 5.3.3 Coatings and Pastes

- 5.4 By Application

- 5.4.1 Dental Care

- 5.4.2 Orthopedics

- 5.4.3 Plastic and Cosmetic Surgery

- 5.4.4 Other Industrial Uses (catalysts, chromatography, water-treatment)

- 5.5 By Geography

- 5.5.1 Asia-Pacific

- 5.5.1.1 China

- 5.5.1.2 India

- 5.5.1.3 Japan

- 5.5.1.4 South Korea

- 5.5.1.5 ASEAN Countries

- 5.5.1.6 Rest of Asia-Pacific

- 5.5.2 North America

- 5.5.2.1 United States

- 5.5.2.2 Canada

- 5.5.2.3 Mexico

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Spain

- 5.5.3.5 Italy

- 5.5.3.6 Russia

- 5.5.3.7 Rest of Europe

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 United Arab Emirates

- 5.5.5.3 South Africa

- 5.5.5.4 Rest of Middle-East and Africa

- 5.5.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share**/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Berkeley Advanced Biomaterials

- 6.4.2 Bio-Rad Laboratories

- 6.4.3 CAM Bioceramics

- 6.4.4 Cerabone (Botiss)

- 6.4.5 CGbio

- 6.4.6 Clarion Pharmaceutical Co.

- 6.4.7 Fluidinova

- 6.4.8 Hoya Technosurgical Corporation (HOYA Corporation)

- 6.4.9 KYOCERA Corporation

- 6.4.10 Medtronic

- 6.4.11 Merz North America Inc. (Merz Biomaterials)

- 6.4.12 Regenity

- 6.4.13 Reneuco Berhad (Granulab Malaysia SDN.BHD)

- 6.4.14 SANGI Co. Ltd

- 6.4.15 SigmaGraft Biomaterials

- 6.4.16 Taihei Chemical Industrial Co. Ltd

- 6.4.17 Tomita Pharmaceutical Co. Ltd

- 6.4.18 Zimmer Biomet

7 Market Opportunities and Future Outlook

- 7.1 White-space and unmet-need assessment